Horizons ETFs Management (Canada) Inc. has launched two new exchange-traded funds (ETFs) that offer investors a monthly income backed by the creditworthiness of the Canadian and U.S. federal governments. The Horizons 0-3 Month T-Bill ETF (“CBIL”) and the Horizons 0-3 Month U.S. T-Bill ETF (“UBIL.U”) are the first ETFs in Canada to provide exclusive exposure to Canadian and U.S. short-term federal Treasury Bills: federal government securities with maturities of one year or less.

Across the fixed-income spectrum, T-Bills are generally considered to be amongst the lowest-risk investments available to investors, given that they are short-term securities backed by the creditworthiness of large federal governments.

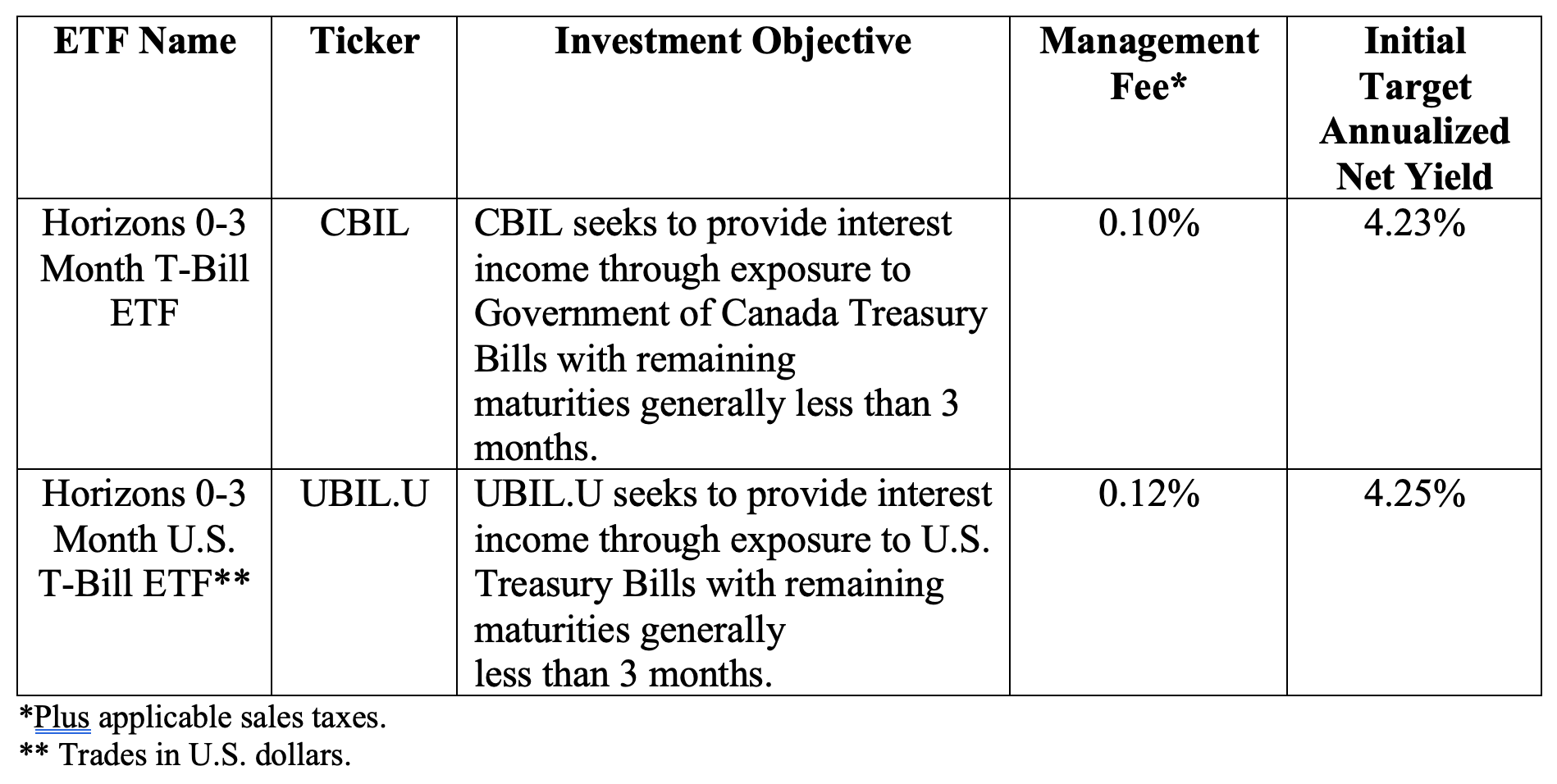

The ETFs will distribute the net income they generate from their T-Bill holdings to unitholders on a monthly basis, with an initial target annualized net yield at launch of 4.23% for CBIL and 4.25% for UBIL.U.

“Short-term treasuries, like the ones held in CBIL and UBIL.U, can offer investors consistent monthly income, backed by the creditworthiness of the Canadian and U.S. federal governments,” said Jasmit Bhandal, Interim President and CEO of Horizons ETFs. “During volatile markets, factors like credit risk and term-to-maturity can be crucial considerations when building a resilient portfolio.”

While T-Bills are available for public purchase, direct investment can potentially result in additional costs, like commissions, as well as requiring additional management to roll and purchase new T-Bills to maintain a desired exposure. With CBIL and UBIL.U, investors do not need to undertake any manual management, as the ETFs handle these processes while maintaining their respective maturity exposures between 0 to 3 months.

“Increasingly, investors are seeking ways to hold cash in their portfolio, while taking advantage of higher interest rates to generate higher levels of income,” said Jasmit Bhandal. “In our view, CBIL and UBIL.U provide exposure to very low-risk assets that provide investors with viable Canadian and U.S. dollar cash alternatives that offer both safety and an attractive monthly income.”

Unlike other savings vehicles, like Guaranteed Investment Certificates (“GICs”) or High-Interest Savings Accounts, which typically have minimum holding periods or investment amounts, CBIL and UBIL.U can be purchased or sold anytime throughout the trading day.

While CBIL and UBIL.U are not covered by the Canada Deposit Insurance Corporation or the Federal Deposit Insurance Corporation in the U.S., T-Bills are respectively backed by the Government of Canada and the U.S. Government, both of which have never defaulted on their debt obligations.

The ETFs closed their initial offering of units to their designated broker at the close of business on April 12, 2023, and began trading on the Toronto Stock Exchange when the market opened on April 13, 2023.

The launch of these ETFs comes at a time when many investors are looking for safe-haven investments that offer a reliable income stream. With CBIL and UBIL.U, investors can gain exposure to short-term T-Bills without the hassle and additional costs of direct investment. These ETFs provide an attractive alternative to traditional savings vehicles, offering a comparable yield with the added flexibility of being able to buy or sell units anytime during trading hours. Overall, the launch of CBIL and UBIL.U marks an important milestone for Canadian investors seeking low-risk, income-generating investment options. With these ETFs, investors can gain exposure to short-term T-Bills without the hassle and additional costs of direct investment, while still enjoying a reliable monthly income stream.

*****

Horizons ETFs Management (Canada) Inc. is an innovative financial services company that offers one of the largest suites of ETFs in Canada. With over $25 billion in assets under management and 108 ETFs listed on major Canadian stock exchanges, the company provides investors with a broad range of solutions to meet their investment objectives. As a wholly owned subsidiary of the Mirae Asset Financial Group, which manages approximately $710 billion of assets across 13 countries around the world, Horizons ETFs is well positioned to offer investors a range of innovative investment solutions that meet their evolving needs.