by Cherie Tan, CFA, Eugene Smit, CFA, & Christopher Mason, AllianceBernstein

Income-seeking investors are accustomed to casting wide nets after years of low yields. Many choose to tap more income from their equity allocations through high-dividend stocks. But it isn’t enough to simply stretch for yield—portfolio design matters. We think a systematic approach may produce a more diversified strategy that results in more core-like equity exposure.

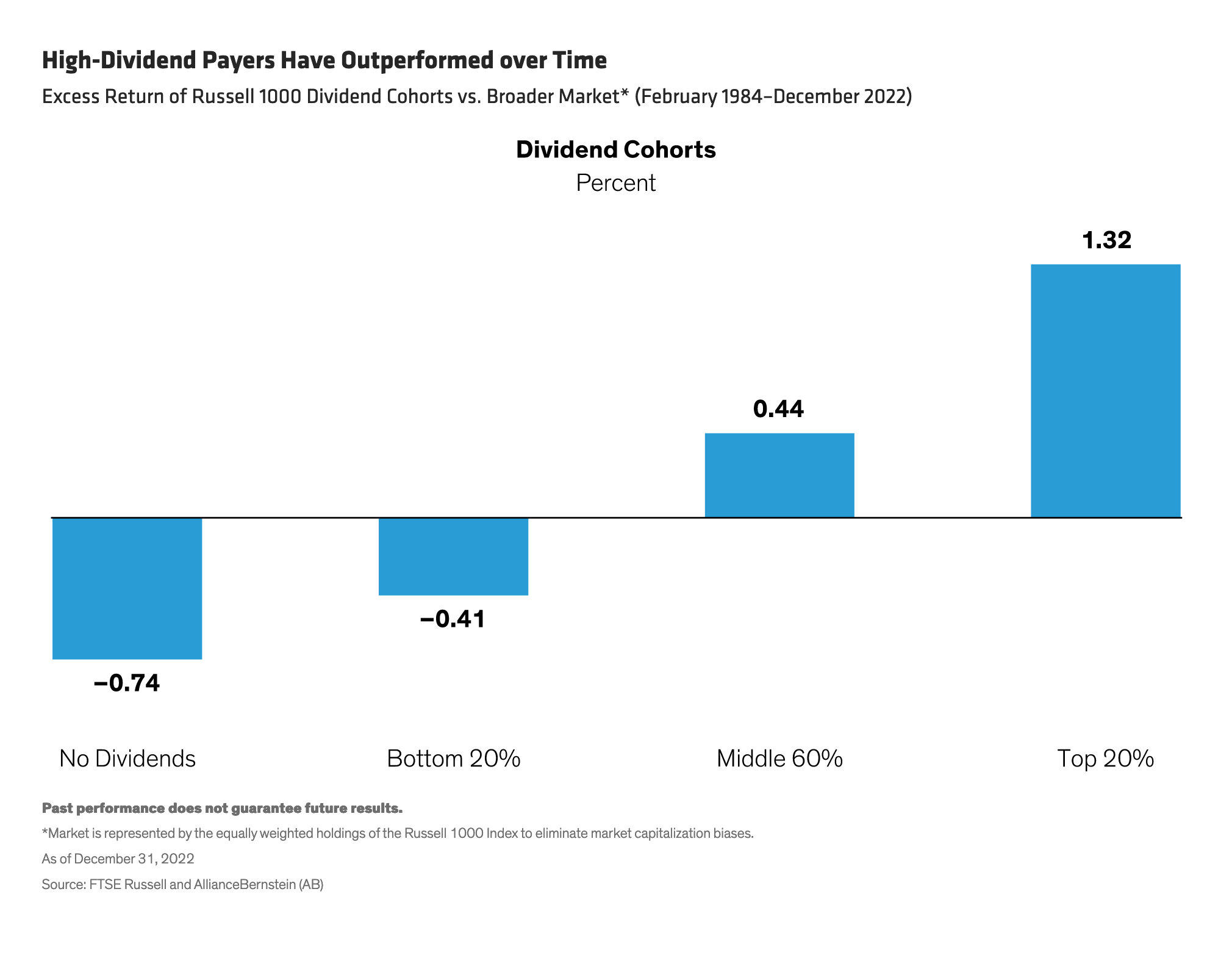

High-Dividend Stocks Have Been an Effective Building Block

Stocks paying higher dividends showed their mettle during a challenging 2022: the S&P 500 High Dividend Index declined only a modest –1.1% even as the S&P 500 tumbled –18.1%. Historically speaking, stocks paying the most dividends have outperformed the broader market while low or no dividend stocks have trailed (Display).

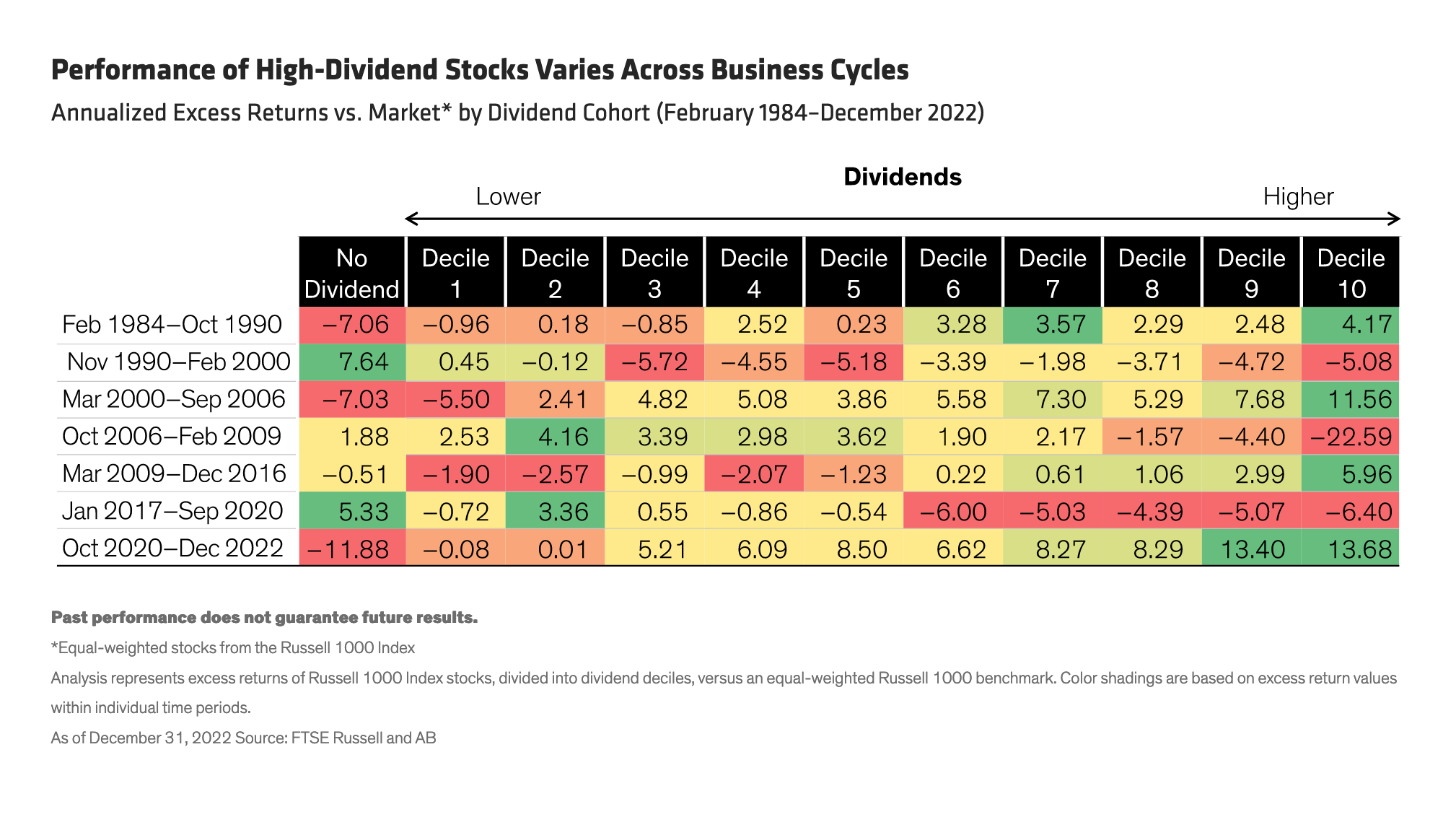

Of course, high-dividend stocks aren’t always in favor, even if they’ve outperformed over the long run. From March 2000 through September 2006, the highest 10% of dividend payers beat an equal-weighted Russell 1000 Index by 11.56%, based on annualized returns (Display). But sometimes favoring the highest dividend payers hasn’t worked: from October 2006 to February 2009, they underperformed by 22.59% while lower-dividend stocks outperformed.

Because high-dividend stocks tend to have value traits, they can trail in growth-driven markets such as 2017 through September 2020, when the top 10% of dividend payers lagged by nearly –6.4% even as no-dividend companies outperformed by about 5.3%. Since late 2020, this relationship has reversed, with high payers leading and low payers lagging. As these examples demonstrate, simply reaching for the highest dividends can lead to pain in unfavorable market environments.

Strategy Design Choices Can Introduce Unintended Biases

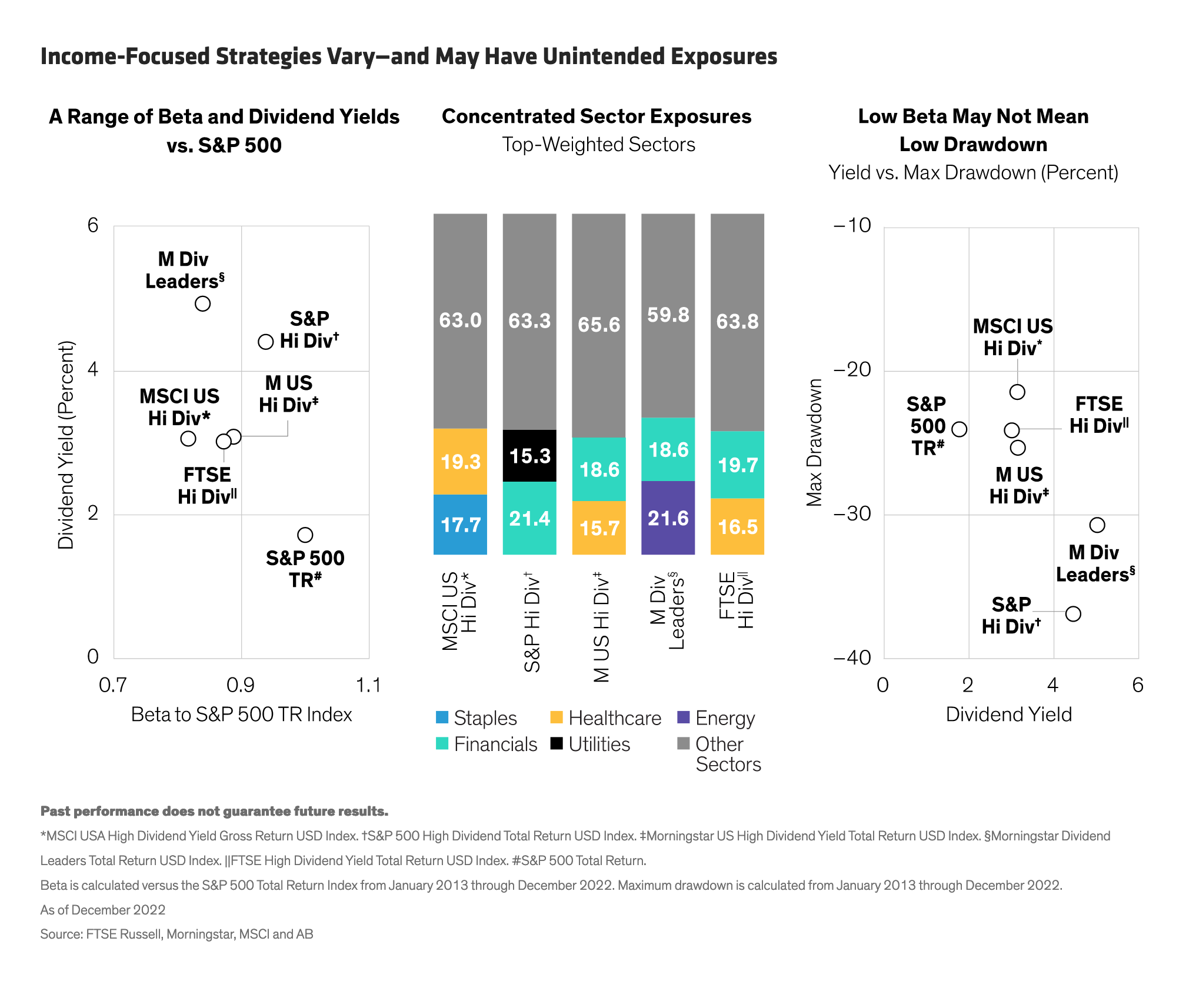

In our view, much of the volatility in high-dividend strategies, broadly speaking, comes down to portfolio design choices, which can create very different characteristics (Display, left).

A basic collection of the highest-dividend stocks results in natural tilts toward industries where robust dividends are most common—such as utilities, energy, healthcare and consumer staples (Display, center). They also tend to be relatively light in exposure to high-growth companies that reinvest profits instead of distributing them.

The higher the dividend yield investors are after, the bigger the portfolio tilts needed to reach it—and the greater the chances of sizable performance differences from the broad market. When the MSCI USA High-Dividend Yield Index underperformed the S&P 500 from 2017 through late 2020, it averaged a 10% underweight to the technology sector. That bias translated into a sizable missed opportunity, as tech clobbered the S&P 500 by 90%.

Some high-dividend approaches go so far as to explicitly exclude any stocks that don’t pay a dividend. Because these stocks are a significant share of the S&P 500’s market cap (19% at the end of 2022), this decision can lead to significant tracking error versus the broader index.

Sector and style tilts can introduce a related risk—less market participation. Many popular high-dividend indices have betas between 0.80 and 0.95 to the S&P 500. That may help cushion against market sell-offs, but sizable sector biases might have the opposite effect—producing heavier drawdowns than the market (Display, right), depending on which sectors are under pressure. And the flip side of lower beta is a potential sacrifice in long-run growth potential.

A Systematic Hand May Tame Unintended Tilts While Harvesting High Dividends

Given the pitfalls of stretching too aggressively for income in equity exposure, what can investors do to access more yield in a disciplined way? As we see it, an active approach to choosing stocks and assembling a portfolio can help tame the inherent biases of simple high-dividend exposure.

We believe one effective path to tackling the challenge is to apply a systematic approach. Start with the objective of producing a market-like beta that will enable investors to maintain a higher level of broad-market participation. Coupling this with a targeted yield above that of the market, and managing risks around sector tilts, beta exposures and tracking error versus a broad equity allocation may create a formula for less risky high-dividend exposure.

We also think it makes sense to broaden the investment universe, looking beyond high-dividend payers to stocks with attractive thematic exposures—including value, quality, momentum and earnings revisions—that complement dividend yield. These exposures may also enhance long-term returns, playing an important role when the high-dividend-yield theme is under pressure.

The Big Picture: Pursuing Income Advantages…with Fewer Surprises

To sum things up, high-dividend equities are playing a growing role as a diversified income source for equity allocations, and they’ve historically outperformed broad equity indices. But a thoughtful, systematic portfolio construction is critical in avoiding the inherent risks of stretching for yield.

After all, investors’ goal should be to boost income while warding off unwanted performance surprises.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

*****About the Authors Cherie Tian, CFA

Cherie Tian, CFA

Cherie Tian is a Portfolio Manager on the Systematic Equity team within the Multi-Asset and Hedge Fund Solutions Group, where she focuses on managing equity portfolios and conducting stock selection signaling and portfolio research. Prior to joining the team in 2019, Tian was a senior research associate on the US Quantitative Research team with Bernstein Research since 2015, where her responsibilities included conducting and publishing quantitative research, developing multivariate stock-selection models and working with institutional clients to implement customized quantitative solutions. Tian holds an MS in operations research with a concentration in financial engineering from Columbia University, and a BS in mathematics and a BA in economics from Wuhan University in China. She is a CFA charterholder. Location: New York

Eugene Smit is a Portfolio Analyst and Manager on the AB Hedge Fund Solutions (HFS) team within Multi-Asset. In this role, he conducts research on alpha and portfolio construction, and builds systems for portfolio management and monitoring. Smit has been the primary quantitative analyst for Merger Arbitrage and a member of the portfolio management team since its inception in 2018. Prior to that, he worked on the Equity Factor team, managing multiple global mandates. Smit joined AB as a member of the Technology Group in 2010, responsible for supporting equity quantitative research and the firm’s Investment Risk Oversight Group. He joined Multi-Asset in 2013 as the lead technologist supporting the Equity Factor team. Smit transitioned to quant research and portfolio management shortly thereafter. Prior to joining AB, he ran an e-learning start-up. Smit holds a BS in business from the University of Cape Town and is a CFA charterholder. Location: New York

Christopher Mason is a Vice President and Product Manager for AB’s Multi-Asset Solutions team. His primary responsibilities include portfolio strategy and communications for AB’s Multi-Asset income thematic strategies. Prior to joining AB in 2019, Mason served as an investment analyst at Wellington Management with product management responsibilities for core and emerging-market equity strategies. Prior to Wellington, he served as a senior analyst at Cerulli Associates, focusing on industry trends in the institutional asset management industry. Mason holds a BS in management from Boston College with concentrations in finance and accounting and is a CFA charterholder. Location: Nashville

Copyright © AllianceBernstein