A new study from Fidelity Investments shows that advisors could be hurting the future of their business by not connecting with younger investors. The younger generations, called “Gen YZ,” are those born between 1981 and 2012, and they are set to inherit 57 percent of existing client assets by 2045. However, Fidelity found that advisors are missing out on Gen YZ because they only reached out to 13 percent of their adult clients' children. More than 70 percent of heirs are likely to change or fire their financial advisors after inheriting wealth from their parents, so advisors may lose a significant amount of business by not engaging with the younger generation.

The study also discovered that while the majority of Millennial and Gen Z investors feel that they need a financial advisor, only one in five advisors has an asset-weighted client age under 60. This gap suggests a missed opportunity for advisors, as Millennials alone are expected to inherit $27.4 trillion and Gen Z is set to inherit $11.5 trillion over the next 25 years.

Fidelity’s research found a correlation between a firm’s asset-weighted client age and its average organic growth rate. For instance, firms with an asset-weighted client age lower than 62 have an average organic growth rate of 10 percent. But firms with an asset-weighted client age of 69 only have an organic growth rate of 1 percent, with as much as 78 percent of assets at risk. In comparison, only 37 percent of assets are at risk for firms with an asset-weighted age lower than 62.

Anand Sekhar, vice president of practice management and consulting at Fidelity Institutional, said that “advisors who don’t adapt to this shift also risk the overall longevity and valuation of their firm.”

To attract younger generations, advisors may need to change the way they communicate, the products they offer, and how they structure their fees. Young investors surveyed by Fidelity have an expectation of their advisor to provide more than financial advice and investment management guidance. For example, 67 percent of young investors expect advisors to offer services beyond financial advice and investment management, while 63 percent believe advisors should provide access to sophisticated investment strategies like alternatives. Additionally, 55 percent of young investors believe that aligning investments to their values is more important than getting maximum returns.

“Our industry is approaching a transfer of wealth tipping point as younger investors look for an advice model that is different from what worked for their parents and grandparents,” says Sekhar.

Sekhar suggests that advisors should focus on the next generation of their existing clients, evolve their offerings, and think about how to innovate. For example, they could create YouTube content or think about a niche to attract younger clients.

Source: Fidelity Investments

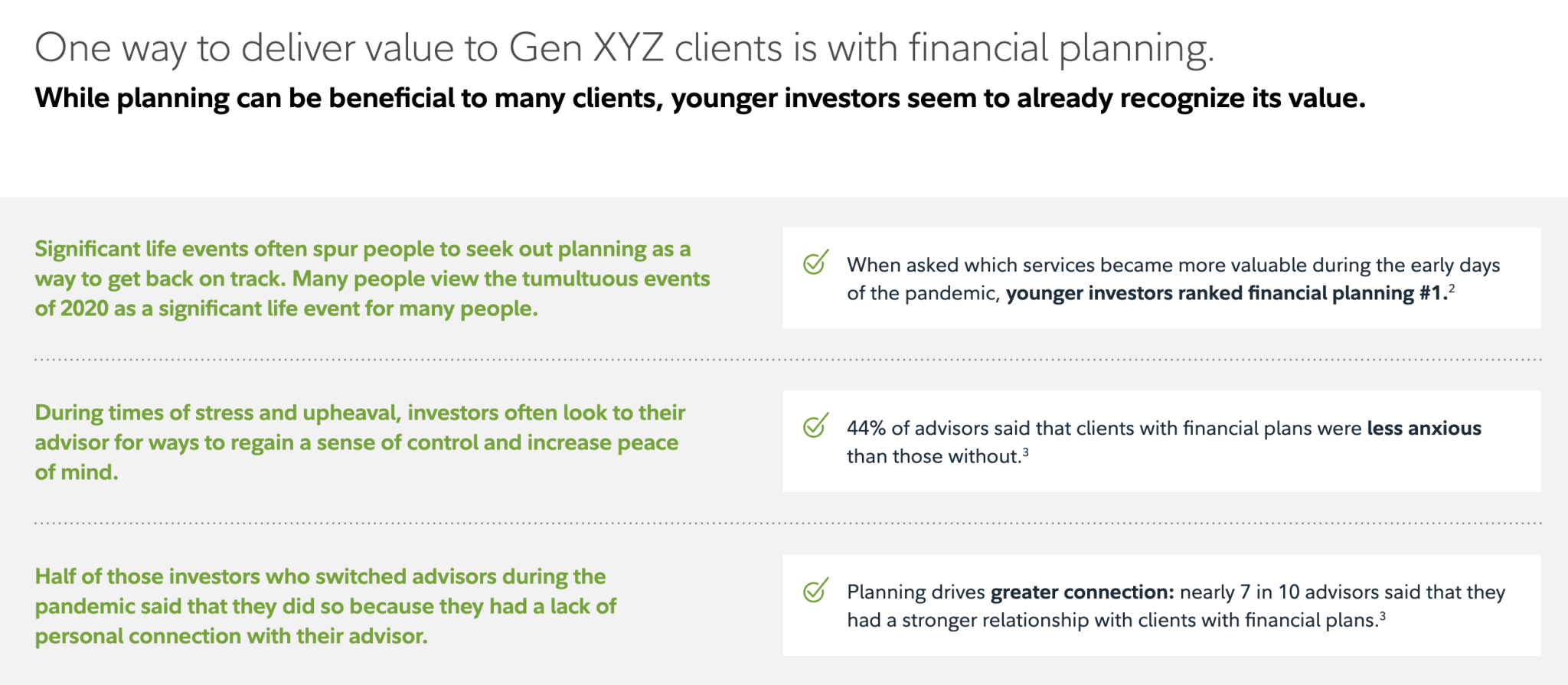

Despite the challenges that some advisors need to overcome, younger investors are keen on getting professional financial help.2 Fidelity reports that 63 percent of Gen YZ investors believe that working with an advisor is key to achieving financial success, and 60 percent feel a heightened need to engage a financial advisor due to economic uncertainty.

As the demographics of wealth ownership change, advisors need to meet these new investors where they are or hire younger and more diverse advisors to meet their needs. Women control more than a third of total U.S household financial assets, and by 2030, they are expected to control much of the $30 trillion in financial assets belonging to baby boomers. Meeting the needs of younger investors and women is critical for the future success of advisory firms.

Footnote:

1 Adapted from source: Deaton, Holly. "Advisors Still Missing an Opportunity With Younger Potential Clients." RIA Intel, 1 Feb. 2023, www.riaintel.com/article/2b7sy4x22fkf47grvwy68/practice-management/advisors-still-missing-an-opportunity-with-younger-potential-clients.

2 "Fidelity® Research Spotlights Significant Growth Opportunity for Advisors With Young Investors." 24 Jan. 2023, www.businesswire.com/news/home/20230124005076/en/Fidelity%C2%AE-Research-Spotlights-Significant-Growth-Opportunity-for-Advisors-With-Young-Investors.