Financial markets worldwide are in for a wild ride as rates are predicted to soar, and inflationary pressures are gaining momentum. It was all sunshine and rainbows in December and January when the world believed that inflation was on the way down, and the central banks could finally sit back and relax. However, fast forward to February, and the same indicators have changed, painting a completely different picture.

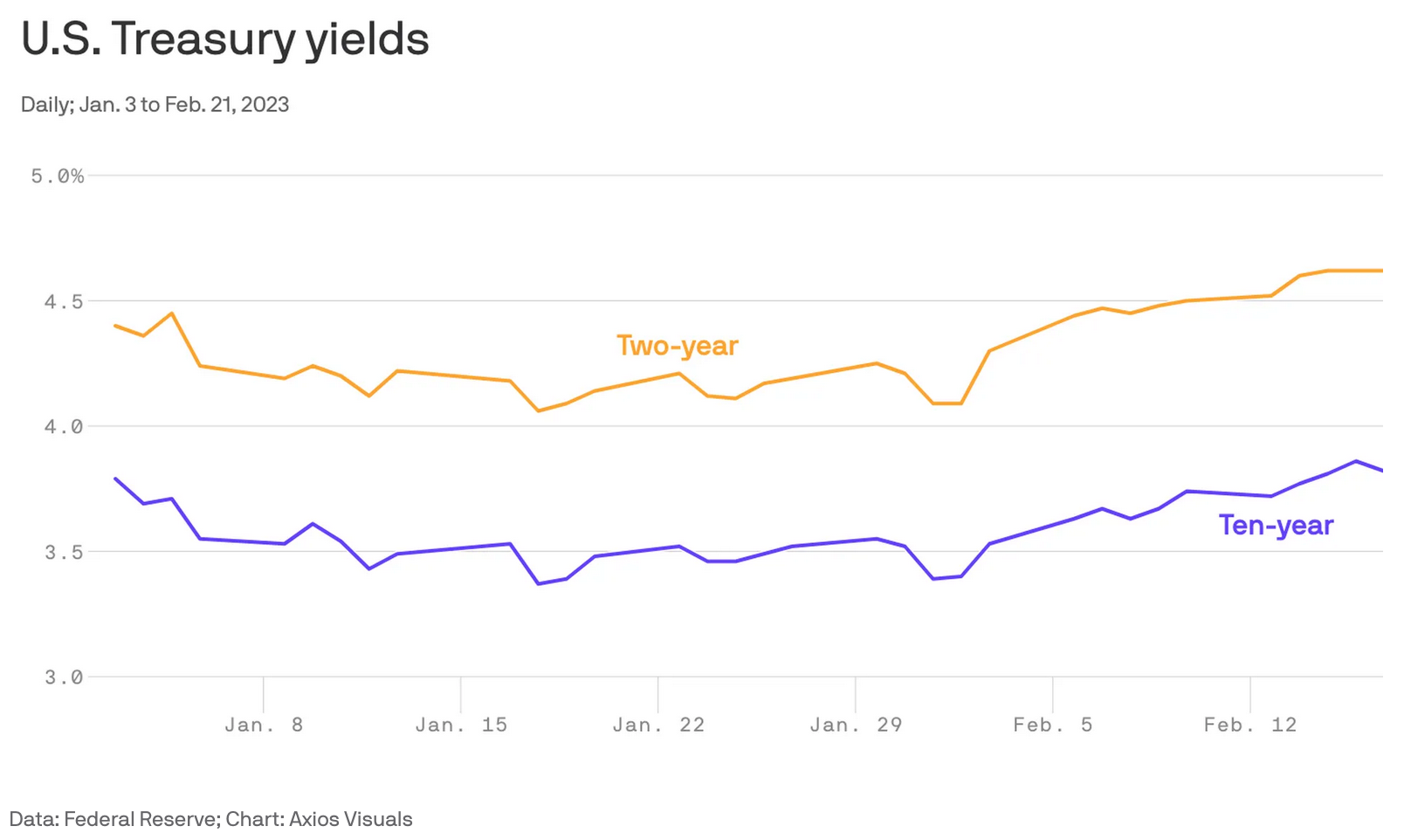

As of yesterday, the ten-year US Treasury yields are up by 0.08 percentage points to 3.91%, a significant increase from the 3.4% on February 1. German bond yields are also up 0.45 percentage points from their recent low of February 2. Furthermore, the British 10-year rate has increased by 0.6 percentage points in the same period.

The rapid surge in rates is a warning that the major central banks worldwide may increase the rates to curtail price pressures. Investors in the stock market are already feeling the pinch, as prices for stocks and other risky investments fall as a result of higher borrowing costs. At yesterday's close, stock indexes closed down by: Dow -2.06%, S&P -2%, Nasdaq -2.5%, opening and trading mostly flat late morning today (2/22).

Last year, the financial markets adjusted to the possibility of tighter monetary policies, and both the stock and bond prices moved in the same direction. The recent surge in rates has marked a return to this pattern, and it is anything but a welcome development. It remains to be seen how much the world's financial markets will be affected, but it's safe to say that it's not going to be pretty. So, buckle up and hold on tight as we brace ourselves for this bumpy ride.

Footnotes:

1 Adapted from source: Neil Irwin, Courtenay Brown. "Axios." Axios, 21 Feb. 2023, www.axios.com/2023/02/21/bond-yields-keep-on-rising.