Technical Notes

Dow Jones Industrial Average dropped below its 20 and 50 day moving averages.

Israel iShares $EIS moved below $55.01 extending an intermediate downtrend.

First Trust Natural Gas ETF $FCG moved below $22.70 extending an intermediate downtrend.

Berkshire Hathaway $BRK.B an S&P 100 stock moved below $303.86 setting an intermediate downtrend.

Abbot Labs $ABT an S&P 100 stock moved below intermediate support at $105.14.

American Tower $AMT an S&P 100 stock moved below $204.25 setting an intermediate downtrend.

Canadian “gassy” stocks were under technical pressure. ARC Resources $ARX.TO moved below $14.67 extending an intermediate downtrend. Advantage Energy $AAV.TO moved below $7.85 extending an intermediate downtrend.

Trader’s Corner

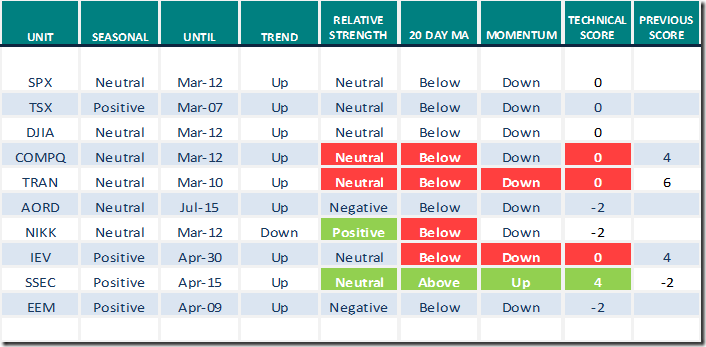

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.21st 2023

Green: Increase from previous day

Red: Decrease from previous day

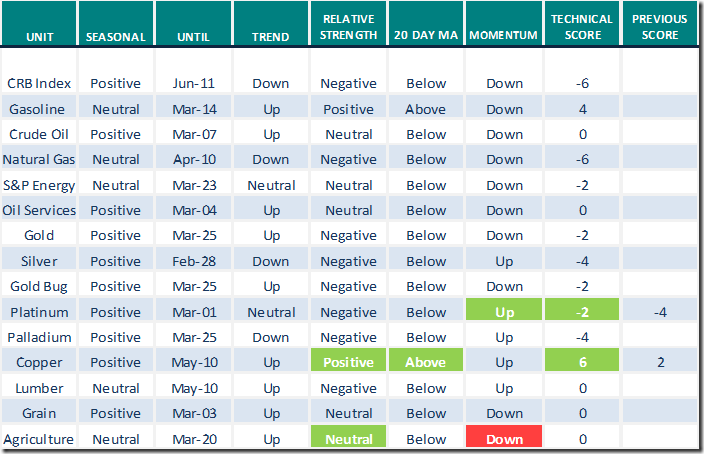

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.21st 2023

Green: Increase from previous day

Red: Decrease from previous day

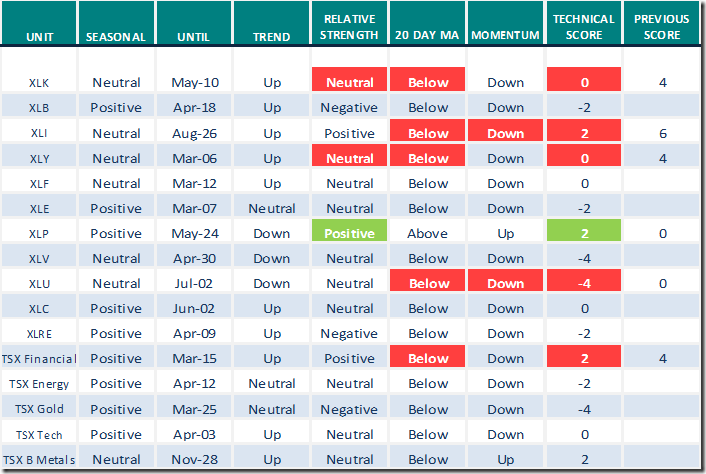

Sectors

Daily Seasonal/Technical Sector Trends for Feb.21st 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

It’s Time To Be Cautious | Tom Bowley | Trading Places (02.21.23)

Editor’s Note: Interesting seasonality studies on Specialty Finance and Utilities

https://www.youtube.com/watch?v=tMoqZsTl2dw

Risk Off Mode as SPX Breaks 4000 | David Keller, CMT | The Final Bar (02.21.23)

Editor’s Note: Includes a bearish comment on XLY

Risk Off Mode as SPX Breaks 4000 | David Keller, CMT | The Final Bar (02.21.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 15.20 to 49.40. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

The long term Barometer dropped 5.80 to 63.00. It remains Overbought. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer plunged 13.98 to 49.58. It changed from Overbought to Neutral. Trend is down.

The long term Barometer dropped 2.97 to 59.32. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed