The Bottom Line

Focus this week is on the January core PCE Price Index released on Friday. January CPI and PPI reports released last week were “hotter” than hoped by the Federal Reserve. Selected member of the FOMC hinted that the Fed Fund Rate could increase another 50 basis points at its next meeting on March 21/March 22. North American equity markets will remain “choppy” between now and the next meeting.

Consensus for Earnings and Revenues for S&P 500 Companies

Analysts increased fourth quarter earnings and revenue estimates slightly from our last report on February 13th. Eighty two percent of S&P 500 companies have reported quarterly results to date. According to www.factset.com fourth quarter earnings are expected to decrease 4.7% (versus previous decrease of 4.9%) but revenues are expected to increase 5.1% (versus previous increase of 4.6%).

Preliminary estimates for 2023 continue to move lower. According to www.factset.com first quarter 2023 earnings are expected to decrease 5.4% (versus previous decrease of 5.1%) but revenues are expected to increase 1.9%. Second quarter 2023 earnings are expected to decrease 3.4% (versus previous decrease at 3.3%) and revenues are expected to decrease 0.1%. Third quarter earnings are expected to increase 3.3% (versus a previous increase of 3.4%) and revenues are expected to increase 1.4% (versus previous increase of 1.3%). Fourth quarter earnings are expected to increase 9.7% (versus previous increase of 10.1%) and revenues are expected to increase 3.4% (versus previous increase of 3.7%). For all of 2023, earnings are expected to increase 2.3% (versus previous increase of 2.5%) and revenues are expected to increase 2.3% (versus previous increase of 2.4%)

Economic News This Week

January Canadian Consumer Price Index released at 8:30 AM EST on Tuesday is expected to drop 0.7% versus a drop of 0.6% in December. On a year-over-year basis January CPI is expected to increase 6.1% versus 6.3% in December.

December Canadian Retail Sales released at 8:30 AM EST on Tuesday is expected to drop 0.5% versus a drop of 0.1% in November. Excluding auto sales, December Canadian Retail Sales are expected to drop 0.4% versus a drop of 0.6% in November.

January U.S. Existing Home Sales released at 10:00 AM EST on Tuesday are expected to increase to 4.10 million units from 4.02 million units in December.

FOMC Meeting Minutes are released at 2:00 PM EST on Wednesday

Next estimate of fourth quarter U.S. GDP released at 8:30 AM EST on Thursday is expected to remain unchanged at an annual rate of 2.9%.

January Personal Savings released at 8:30 AM EST on Friday is expected to increase 0.9% versus a gain of 0.2% in December. January Personal Spending is expected to increase 1.3% versus a drop of 0.2% in December.

January Core PCE Price Index released at 8:30 AM EST on Friday is expected to increase 0.4% versus a gain of 0.3% in December. On a year-over-year basis, January Core PCE Price Index is expected to increase 4.3% versus a gain of 4.4% in December.

February Michigan Consumer Sentiment released at 10:00 AM EST on Friday is expected to remain unchanged from January at66.4

January New Home Sales released at 10:00 AM EST on Friday is expected to increase to 620,000 units 616,000 units in December.

Selected Earnings News This Week

Another 61 S&P 500 companies are scheduled to report quarterly results this week (including two Dow Jones Industrial Average companies: Wal-mart and Home Depot).

Four TSX 60 companies are scheduled to report: Teck Corp, Pembina Pipeline, Bausch Health and Commerce Bank.

Trader’s Corner

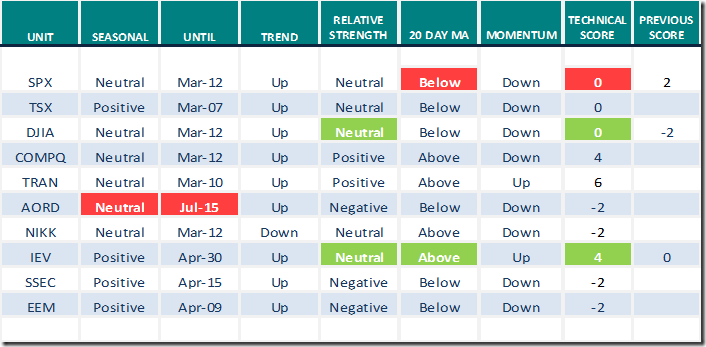

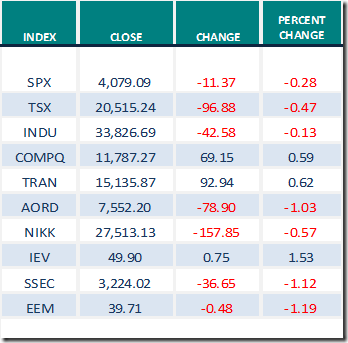

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.17th 2023

Green: Increase from previous day

Red: Decrease from previous day

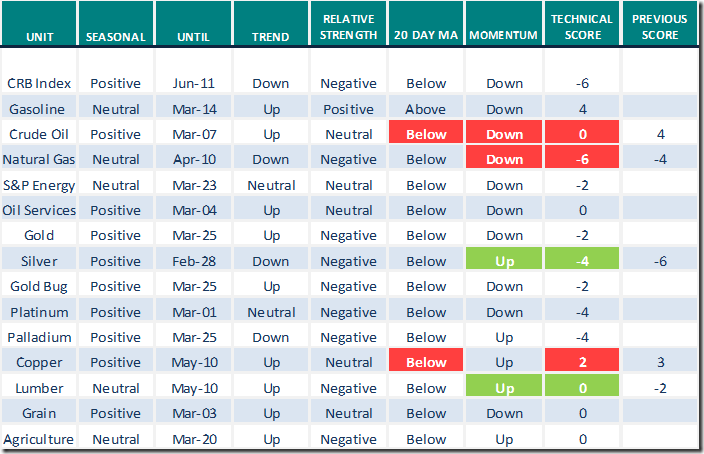

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.17th 2023

Green: Increase from previous day

Red: Decrease from previous day

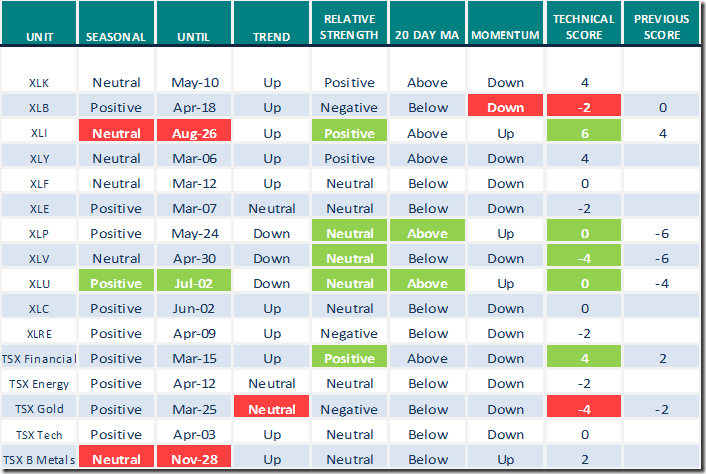

Sectors

Daily Seasonal/Technical Sector Trends for Feb.17th 2023

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Links offered by valued providers

Greg Schell asks “The Bull Market should be doing what”?

This Bull Market Should Be Doing What? | The Canadian Technician | StockCharts.com

Mike’s Money Talks for February 18th

Michael Campbell’s MoneyTalks – Complete Show (mikesmoneytalks.ca)

David Keller discusses ‘The bullish case for gold”.

The Bullish Case for Gold | The Mindful Investor | StockCharts.com

Accumulation Points To Higher Prices | Tom Bowley | Trading Places (02.16.23)

Accumulation Points To Higher Prices | Tom Bowley | Trading Places (02.16.23) – YouTube

Risk Off Feel Before Holiday Weekend | David Keller, CMT | The Final Bar (02.17.23)

Risk Off Feel Before Holiday Weekend | David Keller, CMT | The Final Bar (02.17.23) – YouTube

Markets Stuck Amid Fed Comments | Mary Ellen McGonagle | The MEM Edge (02.17.23)

Markets Stuck Amid Fed Comments | Mary Ellen McGonagle | The MEM Edge (02.17.23) – YouTube

Larger Pullback Could be Forming | TG Watkins | Moxie Indicator Minutes (02.17.23)

Larger Pullback Could be Forming | TG Watkins | Moxie Indicator Minutes (02.17.23) – YouTube

Rosenberg Research’s David Rosenberg calls ‘no landing’ a nice fairy tale: Feb.17th

Rosenberg Research’s David Rosenberg calls ‘no landing’ a nice fairy tale – YouTube

Mark Leibovit: February 16, 2023 | US Stock Markets, Gold, The Fed, Digital Currency

US Stock Markets, Gold, The Fed, Digital Currency – HoweStreet

Bob Hoye: February 17, 2023 | Gold, Interest Rates, Recession, Junk Bonds

Gold, Interest Rates, Recession, Junk Bonds – HoweStreet

Victor Adair | Trading Desk Notes For February 18, 2023

Trading Desk Notes For February 18, 2023 – HoweStreet

Links offered by Mark Bunting and www.uncommonsenseinvestor.com

Top Five Ranked Warren Buffett Stocks – Uncommon Sense Investor

Microsoft & Google’s AI Not Ready for Primetime – Uncommon Sense Investor

INFL_Annual-Letter_2022_Final-Approved.pdf (horizonkinetics.com)

7 Long-Term Stocks to Buy to Bet on Nuclear Fusion (yahoo.com)

Technical Scoop from David Chapman and www.EnrichedInvesting.com

Technical Notes for Friday

Junior Gold ETF $GDXJ moved below intermediate support at $33.89

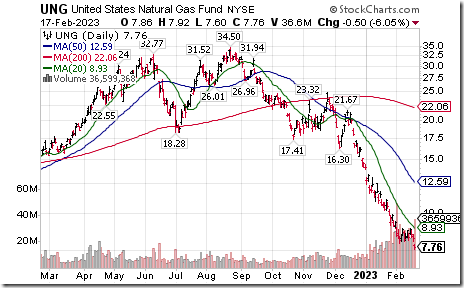

Natural gas ETN $UNG moved below $8.00 extending an intermediate downtrend.

Pfizer $PFE a Dow Jones Industrial Average stock moved below $42.70 extending an intermediate downtrend.

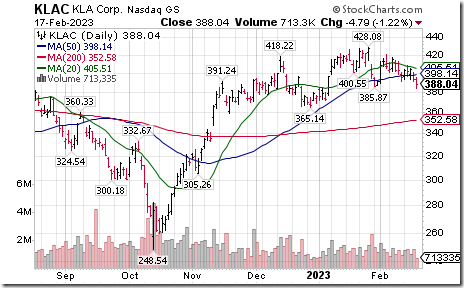

KLA Corp $KLAC a NASDAQ 100 stock moved below $385,87 setting an intermediate downtrend.

O’Reilly Automotive $ORLY a NASDAQ 100 stock moved above $870.92 to an all-time high extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate term Barometer was unchanged on Friday and down 1.00 last week to 64.60. It remains Overbought. Trend is down.

The long term Barometer was unchanged on Friday and 2.00 last week to 68.80. It remains Overbought. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer slipped 1.27 on Friday and added 1.36 last week to 63.56. It remains Overbought. Trend is down.

The long term Barometer dropped 3.39 on Friday and 4.24 last week to 62.29. It remains Overbought. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed