by Larry Adam, Chief Investment Strategist, Raymond James

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Wage growth would keep inflation from quickly easing

- Consumer strength defies the Fed’s intent to cool demand

- Growing probability that a recession could be avoided

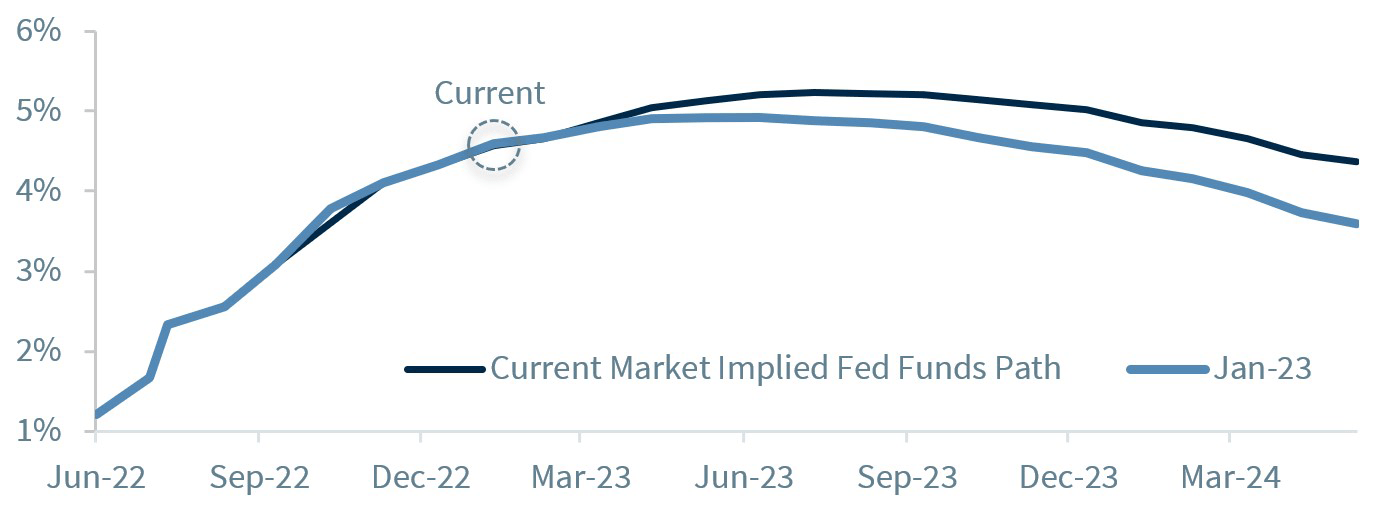

'Good news is bad news, and bad news is good news.' Have you heard this in recent weeks? More likely than not – you have. Especially if you’ve been closely monitoring the equity markets’ daily moves. As economic data is released, many market pundits have been assessing whether each data point signals a weaker or stronger economy – and in turn, its impact on whether the Fed will soon pause or be more aggressive raising rates. Recently, the list of evidence in favor of the latter has grown, reflected by the futures market pricing in an additional 40 basis points of hikes over the last month. While there is some truth to this 'good versus bad' narrative in terms of how high the terminal rate may go, we’d argue that some of the 'good news' truly is 'good news' for the economy and markets over the longer term.

- Understanding the market’s mindset – all about the Fed | For over a year, the market has been fixated on the Fed. While there have been interim distractions (e.g., earnings seasons), the focus has been on the path of inflation and interest rates. With this in mind, it is understandable that the market is analyzing every development in these two dynamics within the framework of what it means for the Fed. As such, the following recent 'good news' was not as warmly welcomed as it would have been in the past:

- Labor market | It is hard to imagine the equity market disappointed by a 517k monthly job gain. But that is what happened with the January jobs report. And this is just one example of the labor market’s health that includes 11 million job openings and historically low jobless claims. Then why is it viewed as ‘bad’? Because the longer the labor market remains resilient, the stronger consumer spending and potential for elevated wage growth, causing inflation to ease at a slower than desired pace.

- Consumer spending | The January retail sales report surprised to the upside – rising 3% month-over-month to notch the fifth strongest month of spending over the last 20 years. The strength in spending was broad-based, as sales for all major categories increased, led by department stores (+17.5%) and restaurants (+7.2%). Similarly, real-time data suggests consumer strength as well. For example, the number of commercial flights just recovered to pre-COVID levels for the first time (suggesting airlines are expanding offerings to meet increased demand) and weekly consumer spending continues to rise to record highs. Then why is it viewed as ‘bad’? Because ongoing strength defies the Fed’s intent to cool demand and reduce some of the pricing pressures, particularly for services, and may lead to more aggressive interest rate hikes.

- Housing market | The housing market was quick to cool as interest rates increased, but some recent data points are starting to revert. For one, mortgage applications are up ~13% from the lows. Home builder confidence posted its largest monthly increase since June 2013 (ex. COVID). This is in part due to the level of prospective buyers rising to the highest level in five months. Then why is it ‘bad’? While some of this data doesn’t reflect the sharp increase in yields the last two weeks, it is not evidence in support of shelter costs – a critical component of inflation – rolling over which could keep inflation elevated.

- But is this narrative defying logic? | The above data makes the case that recent economic strength will not only prolong the tightening cycle but also lift the peak in interest rates this cycle. The potential for more aggressive Fed action is not necessarily a good thing for the equity market. However, it is important to assess economic data beyond the immediate impact to the Fed’s next decision. In doing so, long-term investors may conclude that the recent 'good news' is indeed 'good news' for the economy and markets, especially if the Fed does not ‘overtighten.' We still expect only two more 0.25% increases (last in May) in this cycle.

- Revisiting the prospects of a soft landing | The Atlanta Fed 1Q23 GDP Now estimate has risen to 2.5%. If this forecast comes to fruition, it would be far from the challenging start to the year that many expected and impressive given that recession calls have been lingering for some time. While the full impact of the Fed’s actions are yet to be felt, our economist believes that the economic resiliency has increased the probability of avoiding a recession to 30%. The last time the Fed hiked rates without a recession? 1994 – which resulted in positive forward returns for both equity and fixed income markets.

- Better than expected corporate earnings | A few analysts on Wall Street still have forecasted sub $200 earnings for the S&P 500, which could make our forecast of $215 seem like a pipedream. However, the recent economic data makes us more confident in this call. Why? From a top line perspective, a stronger than expected economy and consumer should support sales growth and lead to upside risk to our earnings forecast and put our 4,400 year-end target well within reach.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Copyright © Raymond James