Pre-opening Comments for Wednesday February 15th

U.S. equity index futures were lower this morning. S&P 500 futures were down 18 points in pre-opening trade.

U.S. equity index futures were unchanged following release of January Retail Sales at 8:30 AM EST. Consensus was an increase of 2.0% versus a drop of 1.1% in December. Actual was.an increase of 3.0%. Excluding auto sales, consensus was an increase of 0.9% versus a drop of 1.1% in December. Actual was an increase of 2.3%.

Analog Devices added $0.41 to $182.95 after the company raised its quarterly dividend by 13% to $0.86.

Taiwan Semiconductor dropped $4.06 to $93.90 after Berkshire Hathaway reduced its position in the stock from 60 million shares to 8.6 million shares.

Bank of New York Mellon dropped $0.29 to $51.42 after Berkshire Hathaway reduced its position from 62.2 million shares to 25 million shares.

Devon Energy dropped $3.44 to $60.50 after reporting less than consensus fourth quarter earnings. The company also lowered guidance for first quarter production.

EquityClock’s Daily Comment

Headline reads “Consumer prices jump in the first read of 2023, indicating that the inflation problem that the Fed has been pushing back against has yet to go away”.

http://www.equityclock.com/2023/02/14/stock-market-outlook-for-february-15-2023/

Technical Notes

Frontier 100 iShares $FM moved below intermediate support at $25.27.

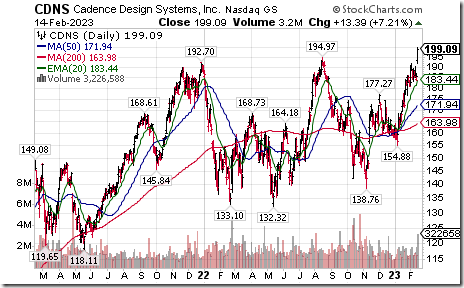

Cadence Design Systems $CDNS a NASDAQ 100 stock moved above $194.97 to an all-time high extending an intermediate uptrend.

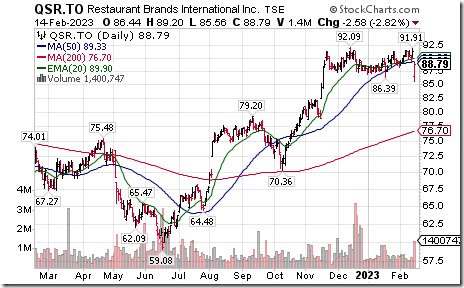

Restaurant Brands International $QSR.TO a TSX 60 stock moved below Cdn$86.39 completing a double top pattern. The company released less than consensus quarterly earnings.

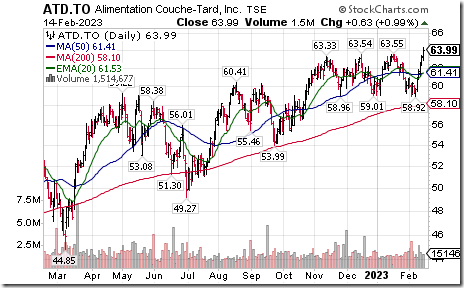

Couche-Tard $ATD.TO a TSX 60 stock moved above Cdn$63.55 to an all-time high extending an intermediate uptrend.

Kinross Gold $K.TO a TSX 60 stock moved below intermediate support at $5.48.

Trader’s Corner

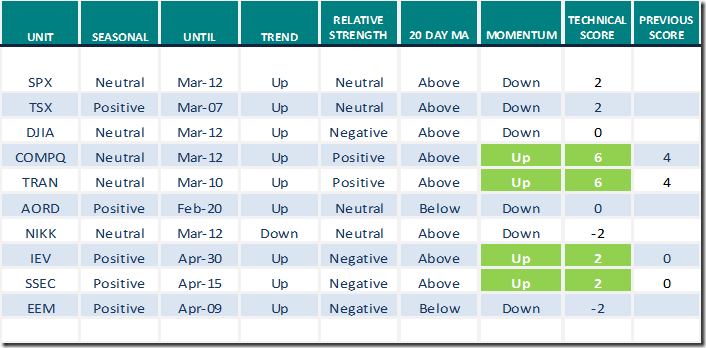

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.14th 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.14th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for Feb.14th 2023

Green: Increase from previous day

Red: Decrease from previous day

Notes offered by valued providers

FAANG Sectors Launch Higher | David Keller, CMT | The Final Bar (02.13.23)

https://www.youtube.com/watch?v=o5YOEGgbk-U

The peak of this market rally is almost here, says JPMorgan. Time to ditch U.S. stocks, and buy these instead, says Wall Street giant.

Finding The Best Reward-to-Risk Stocks | Tom Bowley | Trading Places (02.14.23)

(Note screen that identifies attractive Biotech and Oil Services stocks)

Finding The Best Reward-to-Risk Stocks | Tom Bowley | Trading Places (02.14.23) – YouTube

Barkin Sees Case for Leaving Fed Rates Higher for Longer

Barkin Sees Case for Leaving Fed Rates Higher for Longer – YouTube

Wharton Professor Jeremy Siegel now sees a stronger economy post-CPI

Wharton Professor Jeremy Siegel now sees a stronger economy post-CPI – YouTube

Bad news: It looks like inflation is stubborn and the Fed will have to react

by Zachary Halaschak, Economics Reporter |

February 14, 2023 12:29 PM

Bad news: It looks like inflation is stubborn and the Fed will have to react | Washington Examiner

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 2.80 to 69.20. It remains Overbought.

The long term Barometer slipped 0.40 to 71.80. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 0.42 to 67.37. It remains Overbought.

The long term Barometer added 1.69 to 68.22. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed