The Bottom Line

U.S. equity indices struggled last week despite moderately encouraging fourth quarter results released by S&P 500 companies. Focus is on news from the next FOMC meeting released on February 1st. Last major data point prior to February 1st is the December Core PCE Price Index released at 8:30 AM EDT on Friday.

Far East equity markets continue to lead world equity markets. Equity indices are responding to an expected revival of the Chinese economy following removal of COVID 19 restrictions. Asia iShares advanced another 14.8% from their close on December 31st

Consensus for Earnings and Revenues for S&P 500 Companies

Analysts lowered fourth quarter earnings and revenue estimates since our last report on January 16th. According to www.factset.com fourth quarter earnings are expected to decrease 4.6% (versus previous decrease of 3.9%) but revenues are expected to increase 3.7% (versus previous increase of 3.9%). For all of 2022 earnings are expected to increase 4.6% (versus previous increase of 4.8%) and revenues are expected to increase 10.3%.

Preliminary estimates for 2023 continued moving lower. According to www.factset.com first quarter 2023 earnings are expected to decrease 1.1% (versus previous decrease of 0.6%) but revenues are expected to increase 2.7% (versus previous increase of 3.1%). Second quarter 2023 earnings are expected to decrease 1.2% (versus previous decrease at 0.7%) but revenues are expected to increase 0.3% (versus previous increase at 0.7%). Third quarter earnings are expected to increase 4.6% and revenues are expected to increase 1.5%. Fourth quarter earnings are expected to increase 10.5% and revenues are expected to increase 4.6%. For all of 2023, earnings are expected to increase 4.2% (versus previous increase of 4.6%) and revenues are expected to increase 2.9% (versus previous increase of 3.2%)

Economic News This Week

December Leading Economic Indicators released at 10:00 AM EST on Monday are expected to decline 0.7% versus a decline of 1.0% in November.

Bank of Canada announces its interest rate for major Canadian banks at 10:00 AM EST on Wednesday. Consensus calls for an increase from 4.25% to 4.50%. Press conference is offered at 11:00 AM EST

December Durable Goods Orders released at 8:30 AM EST on Thursday are expected to increase 2.5% versus a drop of 2.5% in November. Excluding Transportation Orders, December Durable Goods Orders are expected to slip 0.1% versus a gain of 0.1% in November.

Next estimate of U.S. fourth quarter GDP released at 8:30 AM EST on Thursday is expected to show growth at an annualized rate of 2.6% versus a previous estimated growth rate of 3.2%.

December New Home Sales released at 10:00 AM EST on Thursday are expected to slip to 615,000 units from 640,000 units in November.

December Core PCE Price Index released at 8:30 AM EDT on Friday is expected to increase 0.3% versus a gain of 0.2% in November. On a year-over-year basis December core PCE Price Index is expected to increase 4.4% versus a gain of 4.7% in November.

December Personal Income released at 8:30 AM EST on Friday is expected to increase 0.2% versus a gain of 0.4% in November. December Personal Spending is expected to decline 0.1% versus a gain of 0.1% in November.

January Michigan Consumer Sentiment released at 10:00 AM EST on Friday is expected to remain unchanged from December at 64.6.

Selected Earnings News This Week

Quarterly reports released by S&P 500 companies have been encouraging: 55 companies have reported to date with 67% reporting higher than consensus earnings and 64% reporting higher than consensus revenues. Another 93 S&P 500 companies are scheduled to report this week (including 12 Dow Jones Industrial Average companies)

Trader’s Corner

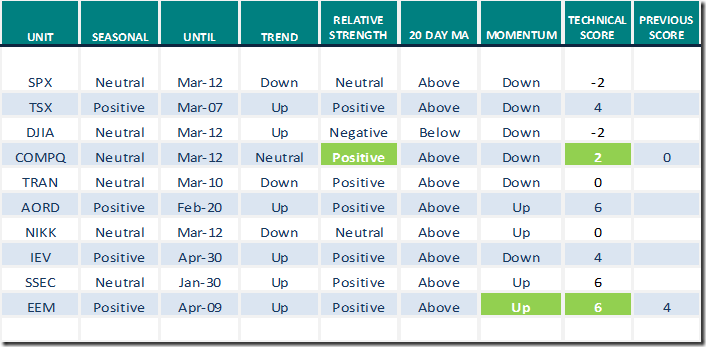

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

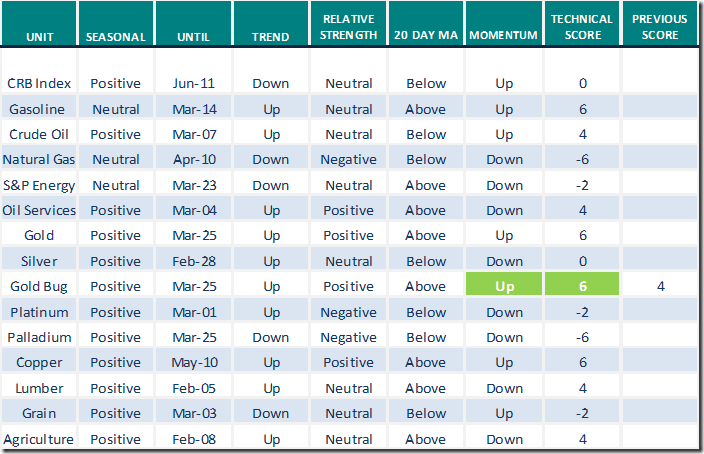

Commodities

Daily Seasonal/Technical Commodities Trends for January 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

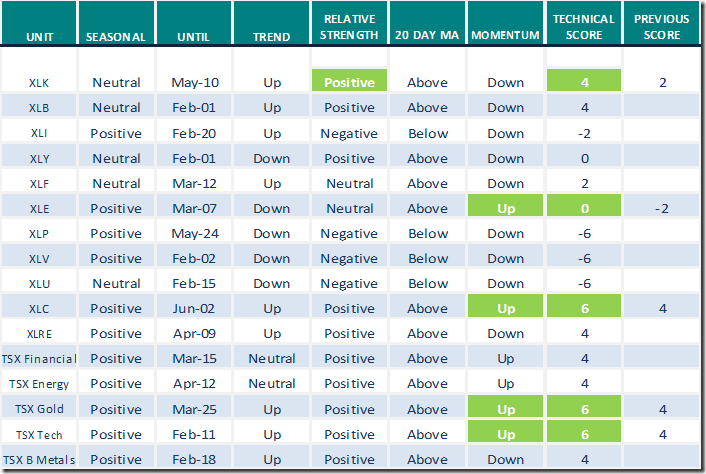

Sectors

Daily Seasonal/Technical Sector Trends for January 20th 2023

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Notes for “Wolf on Bay Street: January 21st 2023” Interview

The following comments were drafted prior to Don Vialoux’s radio interview on Saturday:

Outlook for the TSX 60 Index

Historically, strongest period during the year to own the TSX 60 Index and its related ETFs (XIU and XIC) has been from December 19th to March 3rd. On average during the past 20 years, units have gained 4.0% per period. Two major events occur during this period: Investors receive year-end bonuses and funds frequently are invested into equity markets through annual TSFA and RRSP contributions. This year, the deadline for contributions into RRSPs is March 1st

Outlook for major U.S. equity indices.

Historically, broadly based U.S. equity indices have recorded mixed returns in the first quarter of each year. During the past 20 periods from January 1st to March 15th, the S&P 500 Index has recorded an average return per period of 0% and the Dow Jones Industrial Average has recorded an average return per period of -1.0%.

Beyond March 15th, broadly based U.S. equity indices have a history of moving significantly higher, particularly during the third year of the four year U.S. President Election cycle. Indeed, the third year of the U.S. Presidential Election cycle has recorded the highest gain in the four year cycle. On average the Dow Jones Industrial Average during the past 23 periods since 1930 has gained an average of 14.0% per period.

Outlook for major equity indices outside of North America

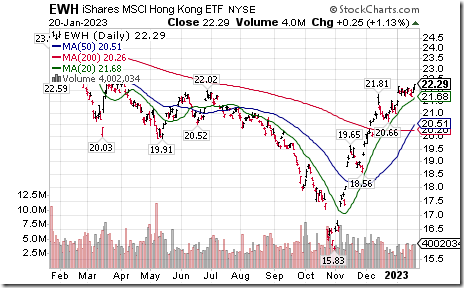

Economies outside of North America have started to recover after experiencing COVID 19 shutdowns. Notable has been a recovery in Far East equity markets. Last week the Shanghai Composite Index and the Hang Seng Index broke out to six month highs. Seasonally, both indices have a history of reaching an important low near Chinese New Year for a seasonal trade lasting until mid-April. This year, Chinese New Year is held on January 22nd.

A continuing recovery by Far East equity markets is positive for North American companies that supply commodities and services for the Far East market, notably companies and their share prices that benefit from growing demand for base metals and grains.

Outlook for precious metals and precious metal equities.

Seasonal strength in gold, silver, platinum, palladium and related equities/ETFs is greatest from mid-December to the end of February. On average during the past 18 years, the U.S. gold bullion ETN (Symbol:GLD) has advance 7.0% per period. Since December 14th, GLD already has already has advance 4.9%. Gold prices could be helped in the short term by purchases of gold to be offered for gifts during the Chinese New Year.

Technical Notes for Friday

Hong Kong iShares $EWH moved above $22.21 extending an intermediate uptrend.

Vietnam ETF $VNM moved above $13.01 completing a base building pattern.

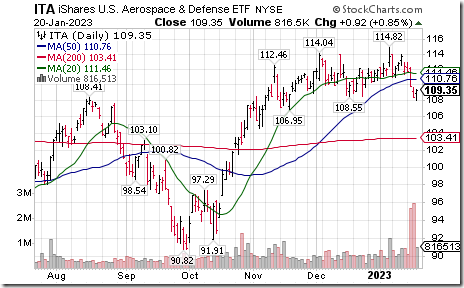

Aerospace & Defense iShares $ITA moved below intermediate support at $108.55.

Home Depot $HD a Dow Jones Industrial Average stock moved below $309.00 completing a double top pattern

MMM $MMM a Dow Jones Industrial Average stock moved below $117.80 completing a double top pattern.

Goldman Sachs $GS a Dow Jones Industrial Average stock moved below $339.30 completing a double top pattern.

American International Group $AIG an S&P 100 stock moved below intermediate support at $61.28.

Cisco $CSCO an S&P 100 stock moved below $46.31 completing a double top pattern.

Cameco $CCJ a TSX 60 stock moved above US$25.81 and Cdn$35.01 resuming an intermediate uptrend.

Links Offered By Valued Providers

Mark Leibovit’s weekly interview

Energy Security, World Economic Forum – HoweStreet

Is The Bear Market Over For Some? | TG Watkins | Your Daily Five (01.20.23)

https://www.youtube.com/watch?v=sLefNcBpyr4

Greg Schnell reveals “Five stocks to save the planet”

5 Stocks To Save The Planet | The Canadian Technician | StockCharts.com

Michael Campbell’s Money Talks for September 21st

https://mikesmoneytalks.ca/category/mikes-content/complete-show/?mc_cid=bd6c6d007a&mc_eid=592546b4b5

Bob Hoye says “GOP Wants End to Income Tax and Extra Auditors”

GOP Wants End to Income Tax and Extra Auditors – HoweStreet

Ross Clark – Stock Markets, Oil, Gold, USD, Canadian Dollar, Gasoline

This Week in Money – HoweStreet

Victor Adair’s Trading Notes for January 21st

Trading Desk Notes For January 21, 2023 – HoweStreet

Links from Mark Bunting and www.uncommonsenseinvestor.com

Three Outlier Stocks with as Much as 78% Upside – Uncommon Sense Investor

David Rosenberg: Permabear to turn into a bull sooner than you think (yahoo.com)

Two Dividend Stock Picks for 2023 | Morningstar

Technical Scoop from David Chapman and www.EnrichedInvesting.com

S&P 500 Momentum Barometers

The intermediate term Barometer added 13.80 on Friday, but dropped 14.20 last week. It remains Overbought.

The long term Barometer added 5.40 on Friday, but dropped 4.00 last week. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 6.78 on Friday and gained 2.97 last week. It remains Overbought.

The long term Barometer added 1.27 on Friday and gained 2.31 last week. It remain Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed