by Doug Drabik, Fixed Income, Raymond James

Investors may be able to lock in higher yield levels notes Doug Drabik, Managing Director, Fixed Income Research and Nick Goetze, Managing Director, Fixed Income Solutions.

To read the full article, see the Investment Strategy Quarterly publication linked below.

Key takeaways:

- Income and cash flow investors are presented with an opportunity to lock in higher yield levels.

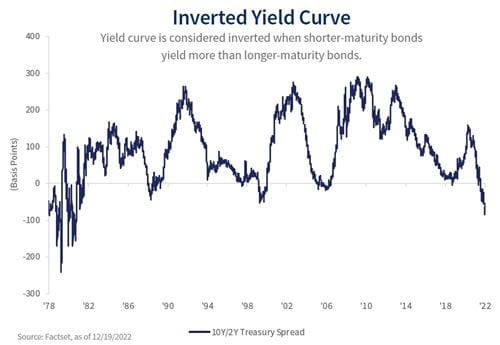

- The inverted yield curve is thought to precede a recession but is also an indicator of lower future rates. In our view, value lies in the intermediate part of the curves.

- Locking in these rates may give investors strong income benefits to work alongside individual bonds' protective asset qualities.

- Whether you are an investor seeking total return or just earning income, there appears to be a window of opportunity in fixed income.

Persistent volatility accosted the bond market in 2022, creating prevalent investor uncertainty which could be attributed to various economic circumstances, including: inflation, geopolitical events and recessionary fears. The general trend of interest rates throughout the year moved the 10-year Treasury yield in a range from 1.52% to 4.25%. As you may already know, there is an inverse relationship between bond rates and bond prices. The longer the maturity, the greater the price impact associated with large rate swings.

2022 underscored the distinction between two investor types: those seeking total return and those needing/wanting income. The price plunge decreases total returns (because of decreasing prices), yet the rate increase provides investors an opportunity to increase income. It has been a long time since investors had the opportunity to lock in these income levels. For this specific investment asset, locking in higher income can be achieved when purchasing individual bonds with stated maturity dates, allowing investors to receive purchased yields for a predetermined period of time (up to the maturity) that is not affected by interim price/rate moves.

Different investors, different opportunities

Market forces will likely continue to move the yield needle in a distorted pattern in 2023, yet investors seeking income and cash flow may relish in the current attainable yield levels. High quality (investment grade) taxable and municipal tax-equivalent yields are well above 5% in modest duration investments. Historically, procuring income at a plus 5% level in an asset that primarily protects principal bodes well. As a relative benchmark for dedicated growth assets, the S&P Index since the turn of the century (~22 years from 12/31/99—12/16/22) experienced a total return of 6.29%.

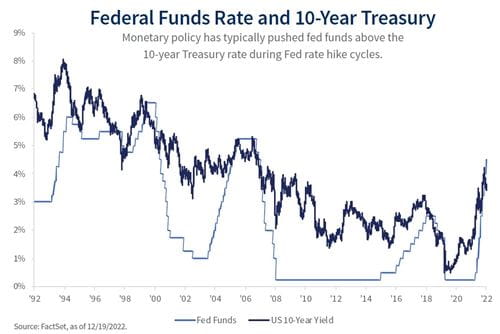

Yet, the potential fixed income benefits for 2023 may provide multiple benefits rewarding both total return investors as well as income/cash flow investors. Several interest rate curve behaviors might support this prospect. The Treasury yield curve behavior has been influenced by two economic notions: the Federal Reserve's (Fed) handling of inflation through monetary policy and the uncertainty of a recession, present or near future. Fed Chairman Jerome Powell has suggested, even in the face of economic pain, that the Federal Open Market Committee will fight inflation at any cost. As the bond market often leads policy change, the 10-year Treasury yield begins falling prior to a program reversal when the Fed begins lowering the fed funds rate. The last several recessions occurred when core CPI (inflation) was sitting at 2.5% or lower. Core CPI peaked in September at 6.6% and sits at 6.0%. If the Fed holds true to fighting this still high inflationary figure, Treasury rates, particularly on the short end, may still climb.

Analyzing the inverted yield curve

Of particular note: the yield curve is already inverted. This means that short-term maturity rates are higher than long-term maturity rates. As of December 19, the 3-month Treasury bill was ~4.30% while the 10-year Treasury note was ~3.50%. With potentially more fed fund hikes, this inversion may spread wider. In the last 80 years, each recession was preceded by a yield curve inversion. Uncertainty swells with data divergence. Will the Fed’s tenacious push to suppress inflation prove to be the catalyst for a future economic slowdown as high interest rates foster a costly business environment?

The takeaway is that the inverted curve is an indication or an anticipation of future lower rates. In the interim, investors have a window to lock in high yields. Although short-term Treasury yields are higher versus intermediate to long-term Treasury rates, locking in for longer holds the potential for a longer-term benefit by lowering reinvestment risk. In other words, adding some duration to individual bond purchases may provide better long-term benefits.

In our view, the real value lies in the intermediate part of the curves. High quality investment-grade taxable bonds may provide 5.25% to 5.50% yields in the three- to seven-year maturity ranges where the corporate curve reflects an upward slope contrary to the Treasury’s inverted slope. The municipal yield curve, hampered by too much short-term demand, reflects positive slope throughout the entire curve.

Total return investors may also have the dual benefit of income plus price appreciation. As the economic cycle turns and high interest rates end economic expansion, monetary policy often shifts back to easing or bringing interest rates back down from their peak. As interest rates begin to fall, prices will rise, thus potentially giving total return buyers an opportunity to see positive returns through price appreciation. Whether you are an investor seeking total return or just earning income, there appears to be a window of opportunity in fixed income.

Read the full

Investment Strategy Quarterly

All expressions of opinion reflect the judgment of the Chief Investment Office, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against loss. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Investing in small cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. If bonds are sold prior to maturity, the proceeds may be more or less than original cost. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revisions, suspension, reduction or withdrawal at any time by the assigning rating agency. Investing in REITs can be subject to declines in the value of real estate. Economic conditions, property taxes, tax laws and interest rates all present potential risks to real estate investments. The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence.