by Turgut Kisinbay, Director, Fixed Income Research, & Robert Waldner, Chief Strategist and Head of Macro, Research, Invesco Fixed Income, Invesco

Key takeaways

November CPIThe latest U.S. Consumer Price Index (CPI) report revealed that inflation slowed more in November than markets expected. |

Encouraging newsWe're encouraged by this inflation report as well as broader macro data. Inflation appears to be moderating and the details are in line with our expectations. |

Fed tighteningEasing inflationary pressure takes some urgency off the U.S. Federal Reserve (Fed) and may allow it to slow the tightening of financial conditions. |

The latest U.S. inflation report was encouraging, in our view, and likely eases the pressure on the U.S. Federal Reserve (Fed). We believe it will remain cautious and somewhat hawkish in the near term — which we saw in action at Wednesday’s Federal Open Market Committee Meeting when the FOMC hiked rates by 50 basis points — but if inflation pressure continues to ease, we believe the Fed is likely close to the end of this rate hiking cycle.

What does the latest CPI report tell us?

The latest U.S. Consumer Price Index (CPI) report revealed that inflation slowed more in November than markets expected. Annual inflation fell from 7.7% in October to 7.1% in November, which is significantly below June’s peak level of 9.1%.1 Core inflation, which strips out volatile items such as food and energy, also dropped, measuring 6.0%, after peaking at a 40-year high in September at 6.6%.2

Monthly numbers matter the most for markets, and the November print was promising for the inflation outlook, in our view, as it suggested we could see ongoing disinflation without a sharp slowdown in the U.S. economy. The composition of the CPI was also promising, with core goods prices falling in recent months, and shelter inflation and other services inflation stabilizing. There was help from the global environment as declining energy and food prices helped the disinflation process.

Core goods prices have been declining

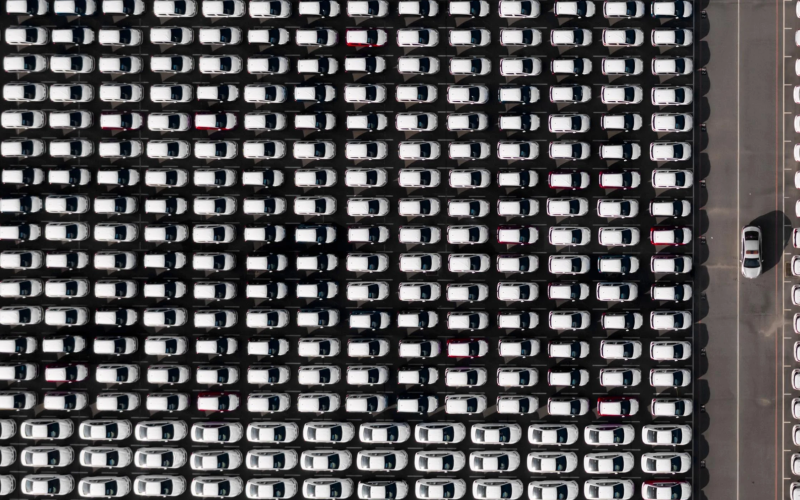

The much-awaited decline in goods prices finally showed up in November, as goods prices declined faster than expected. This was due to a rebalancing of demand away from goods to services and an improvement in global supply-side bottlenecks. The main contributor was car prices; used car prices declined, and new car prices were roughly unchanged. Other categories, such as recreation, commodities, and information technology goods, helped disinflation.

Shelter inflation is high, but market rents moved back to trend

While goods prices have been declining, the real battle for the Fed is the services side of the economy. Those prices are believed to be “stickier” and more sensitive to a tight labour market. While November core services inflation was not higher than expected , the evidence is mixed, and we believe there is more wood for the Fed to chop.

Importantly, a key component of inflation — owners’ equivalent rent and rent components — was up in November and remained at elevated levels. However, there is room for optimism. It is now well-known that CPI shelter inflation is slow to incorporate new market rents, as contracts are renewed gradually. Much of the increase in the CPI reflects past increases in market rents, but current rent data from private companies show that rent inflation is back to historical trends. As the CPI measures catch up with market rents, we anticipate that shelter inflation should moderate toward the historical trend as well.

What about non-shelter core services?

Non-shelter core services is the remaining part of the inflation puzzle. Fed Chair Jerome Powell talked about this recently as the key area to watch, since these items are sensitive to wage growth. There was no bad news in November regarding these items. Medical care services costs declined notably, although those numbers may be unsustainably low. Hotels and airfare prices were down in November, a trend that has persisted for a few months. But there is probably still pent-up demand for travel after two years of a pandemic, so travel-related inflation may pick up next spring and afterward.

What does this mean for the Fed?

We’re encouraged by this inflation report as well as broader macro data. Inflation appears to be moderating and the details are in line with our expectations. The labour market is still tight, but it is slowing from very hot levels last winter. The adjustment toward more sustainable growth will likely take time. While the economy is moving in the direction the Fed would probably like to see, we believe it will remain cautious and somewhat hawkish in the near term.

Indeed, the Fed announced another 50 basis point rate hike at Wednesday’s meeting and expressed caution about easing financial conditions anytime soon. Powell acknowledged the good news from the monthly CPI data but indicated that the Fed needs to see further improvement and easing of the tight labour market before turning more dovish. The “dot plot” indicates that the Fed is expecting to hike another 75 basis points in this cycle. Whether they deliver on this expectation will be dependent on upcoming inflation data in our view.

In short, we believe the Fed will likely continue to raise rates for the next couple of meetings for risk management purposes, but if inflation pressure continues to ease, it is likely close to the end of this rate hiking cycle.

Implications for the markets?

Easing inflationary pressure, as we see in the most recent data, takes some pressure off. The Fed has acknowledged that its policy impacts the real economy with a delay, and slowing inflation pressure reduces the urgency it is likely to feel. The aggressive tightening of financial conditions so far this year has been a key driver of markets and had kept market volatility high. Easing inflationary pressure should allow this volatility to ease.

Markets are now likely to turn to the 2023 growth outlook for direction. A soft landing would likely be supportive of equities and credit, but there is a significant risk of a recession, which would likely be negative for earnings and risky assets, such as credit and equities. Recent inflation news is good for the bond market, in our view. Declining inflation pressure and a more dovish Fed should cap yields, and bond yields are likely to decline if growth slows toward recessionary conditions.

Implications for portfolios?

We believe an overweight to investment grade credit is warranted as companies are in good financial shape and the economy is slowing but still in relatively good shape, in our view. Interest rate volatility should decline, which would be a positive for agency mortgages as well. Investors have wanted higher yields but had concerns that inflation would become unhinged and the Fed would need to be even more aggressive, driving the terminal rate above 5%. Now that it appears the Fed may be nearing the end of its hiking cycle, and yields are still elevated on a recent historical basis, we expect that technicals should be positive for higher quality fixed income in 2023, driving credit spreads tighter. We think there will be opportunities in high yield, but we would favour the BB or higher rated portion of high yield as the lower rated CCC’s may struggle into a slowing economy.

With contributions by Matt Brill