Technical Notes

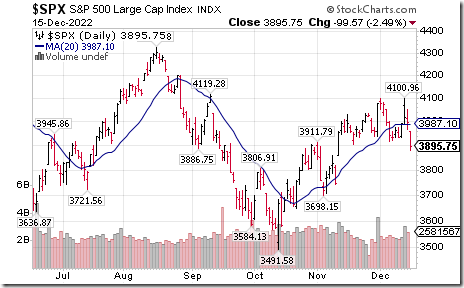

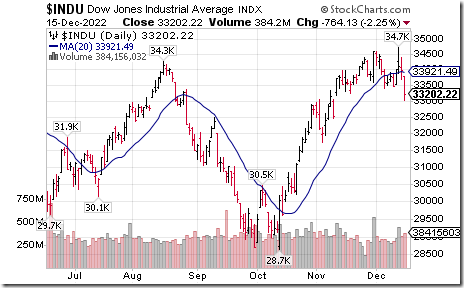

Broadly based U.S. equity indices, notably the S&P 500 Index and Dow Jones Industrial Average) dropped below their 20 day moving average mainly in response to the lower than consensus November Retail Sales report released at 8:30 AM EST.

Agribusiness ETF $COW.TO moved below Cdn$70.94 setting an intermediate downtrend.

Timber and Forest iShares $WOOD moved below intermediate support at $74.28

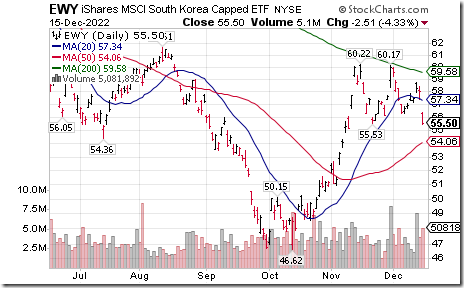

South Korea iShares $EWY moved below $55.53 completing a double top pattern.

Palladium ETN $PALL moved below $165.86 extending an intermediate downtrend.

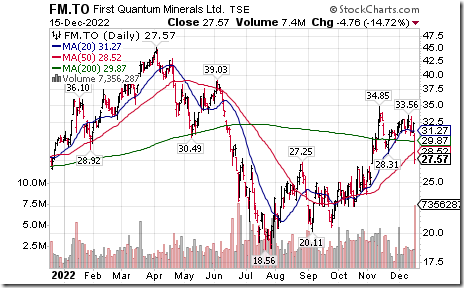

First Quantum Minerals $FM.TO a TSX 60 stock moved below $28.31 completing a double top pattern. The company is negotiating payments to the Panamanian government.

AT&T $T an S&P 100 stock moved below intermediate support at $18.52.

First Majestic Silver $FR.TO moved below Cdn$11.65 completing a double top pattern.

Trader’s Corner

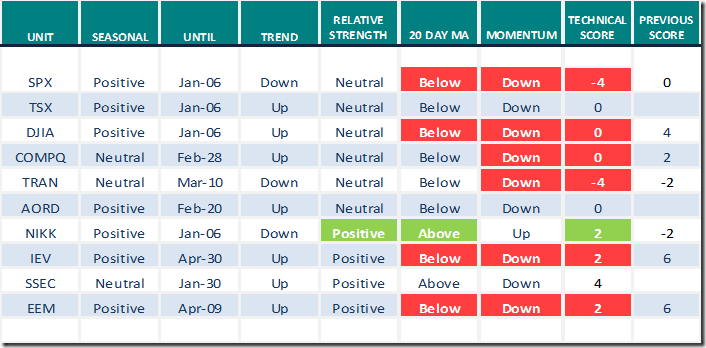

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

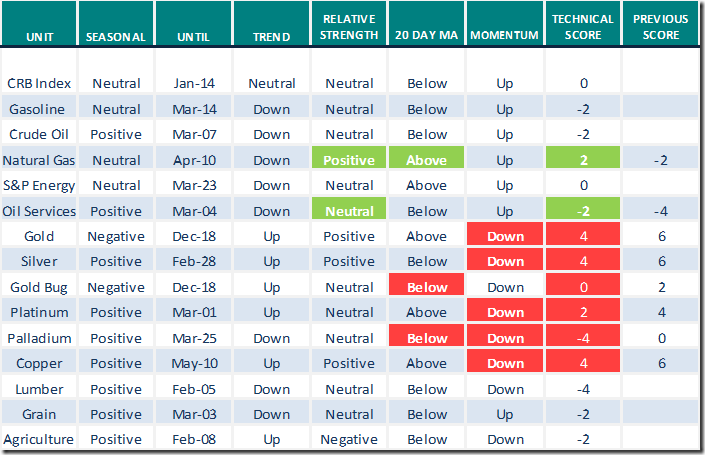

Commodities

Daily Seasonal/Technical Commodities Trends for December 15th 2022

Green: Increase from previous day

Red: Decrease from previous day

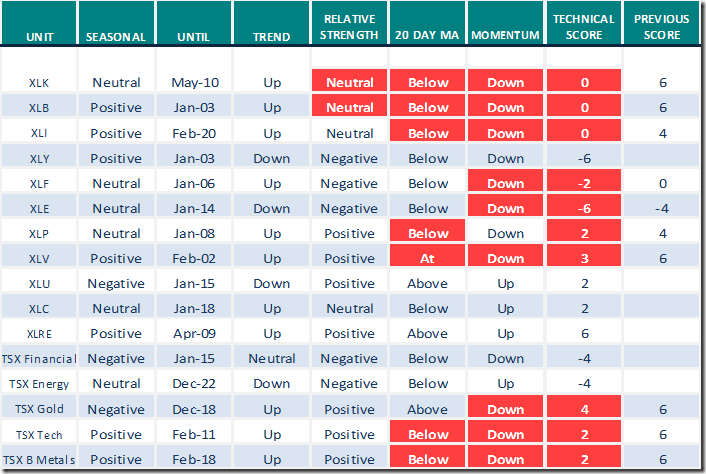

Sectors

Daily Seasonal/Technical Sector Trends for December 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by a valued provider

Tom Bowley and other StockChart.com analysts are offering an “Outlook for 2023” presentation on January 7th. Register at Fed Disappoints As Selling Kicks In | Tom Bowley | Trading Places (12.15.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 12.20 to 67.20. It remains Overbought. Trend is down.

The long term Barometer dropped 7.80 to 53.00. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer dropped 6.61 to 59.07. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

The long term Barometer dropped 6.12 to 43.46. It remains Neutral. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed