Technical Notes for yesterday

Long term U.S. Treasury ETF $TLT moved above $119.07 extending an intermediate uptrend.

Aerospace and Defense ETF $PPA moved above $74.76 extending an intermediate uptrend.

Coca Cola $KO a Dow Jones Industrial Average stock moved above $64.45 resuming an intermediate uptrend.

Pepsico $PEP a NASDAQ 100 stock moved above $176.39 to an all-time high extending an intermediate uptrend.

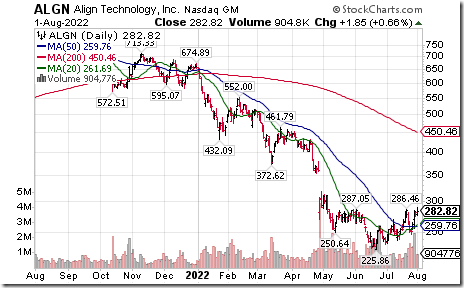

Align Technology $ALGN a NASDAQ 100 stock completed a reverse Head & Shoulders pattern on a move above $287.05.

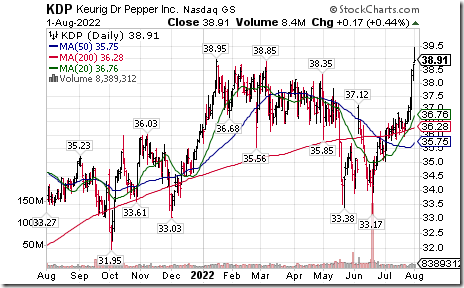

Keurig Dr. Pepper $KDP a NASDAQ 100 stock moved above $38.95 to an all-time high extending an intermediate uptrend.

Palladium ETN $PALL moved above $202.88 completing a double bottom pattern.

Check Point $CHKP a NASDAQ 100 stock moved below $117.44 extending an intermediate downtrend.

Trader’s Corner

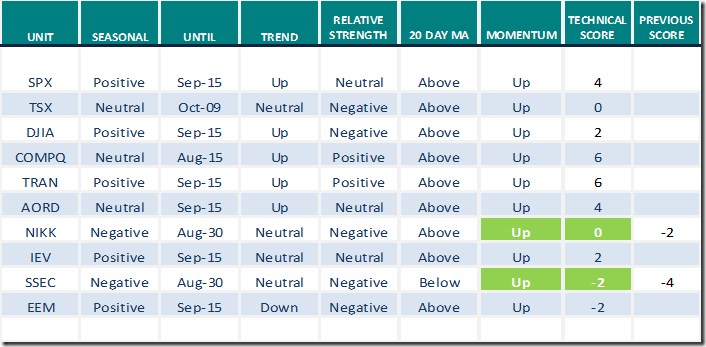

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

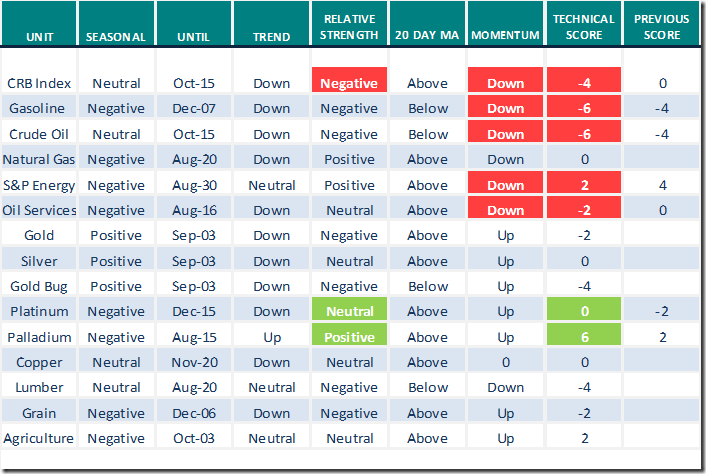

Commodities

Daily Seasonal/Technical Commodities Trends for August 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

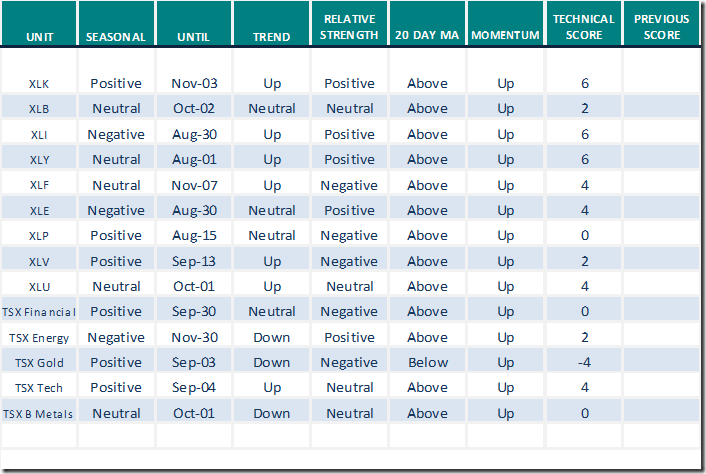

Daily Seasonal/Technical Sector Trends for August 1st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Technical Scoop from David Chapman and www.EnrichedInvesting.com

Larry Williams says “Get ready to rock and roll”

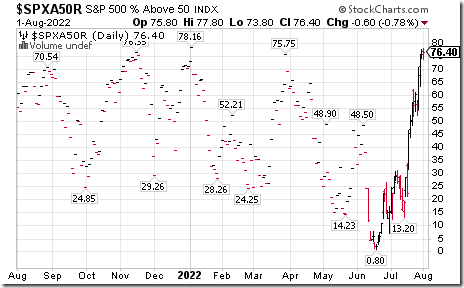

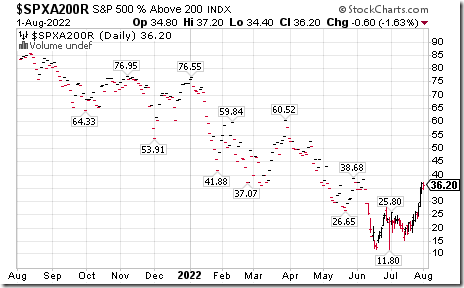

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.60 to 76.40 yesterday. It remains Overbought.

The long term Barometer eased 0.60 to 36.20 yesterday. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed