by Will Smith, CFA, Director—US High Yield & Gershon M. Distenfeld, CFA, Co-Head—Fixed Income; Director—Credit, AllianceBernstein

Looking for a tactical way to de-risk your portfolio? You might consider rotating a portion of your equity allocation into high-yield bonds.

Yes, you read that right. It may take a minute to process, since buying high yield is usually thought of as a way to add risk. And with risk assets bearing the brunt of the recent market sell-off, adding risk is the last thing many investors want to do right now.

Here’s what you may not realize: when combined with stocks, high yield can reduce overall risk without sacrificing much return.

Want Lower Volatility? Consider High Yield

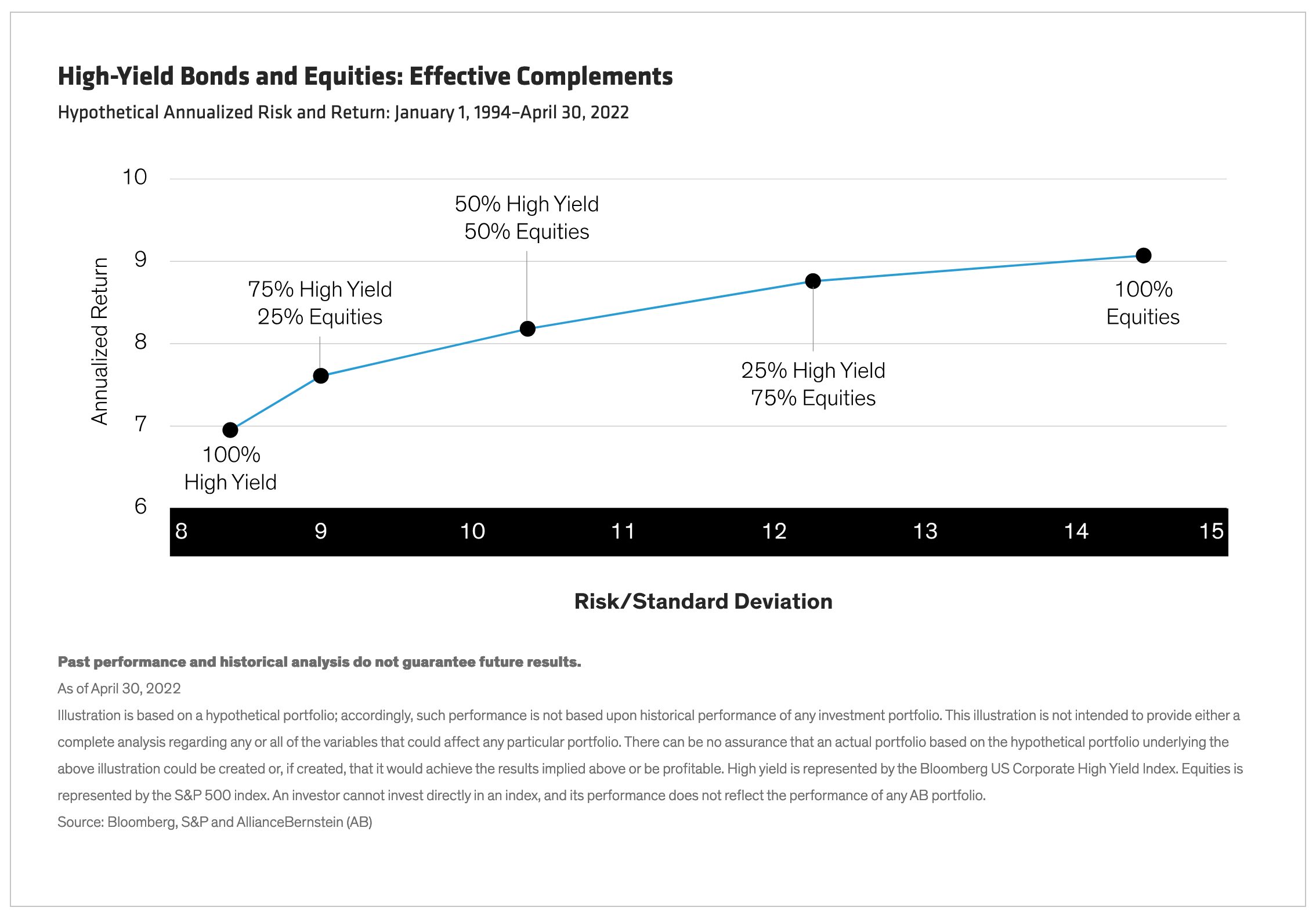

In fact, by shifting a modest allocation away from US equities and into US high yield, investors can actually boost risk-adjusted return potential (Display).

How is this possible?

First, high-yield bonds provide investors with a consistent income stream that few other assets can match. This income—distributed semiannually as coupon payments—is constant. It gets paid in bull markets and bear markets alike. It’s the main reason high-yield investors have historically looked at starting yield as a remarkably reliable indicator of future returns over the next five years—no matter how volatile the environment.

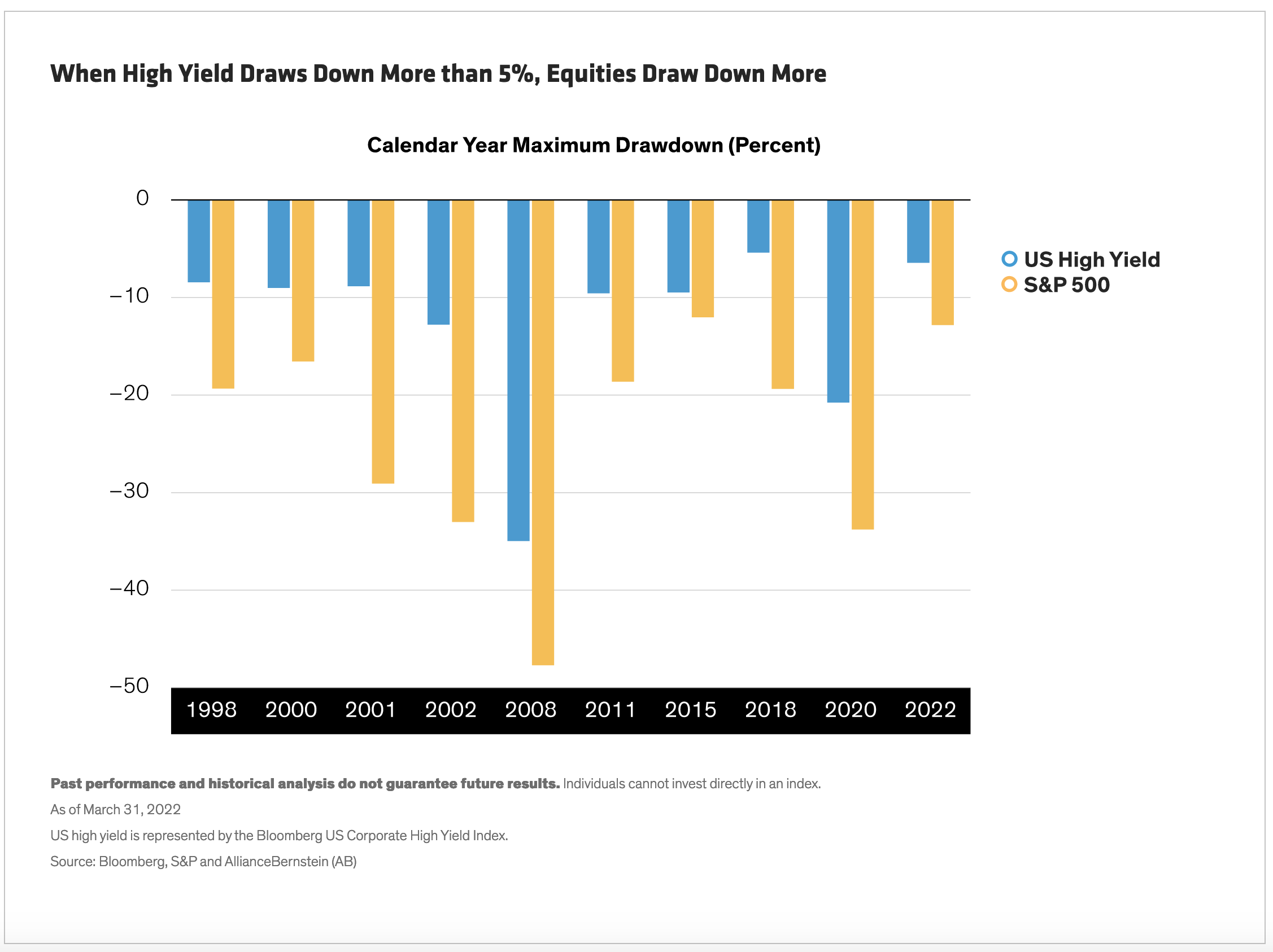

Second, along with these payments, high-yield bonds also have a known terminal value that investors can count on. As long as the issuer doesn’t go bankrupt, investors get their money back when the bond matures. All this helps to offset stocks’ higher level of volatility—and provide better downside protection in bear markets (Display).

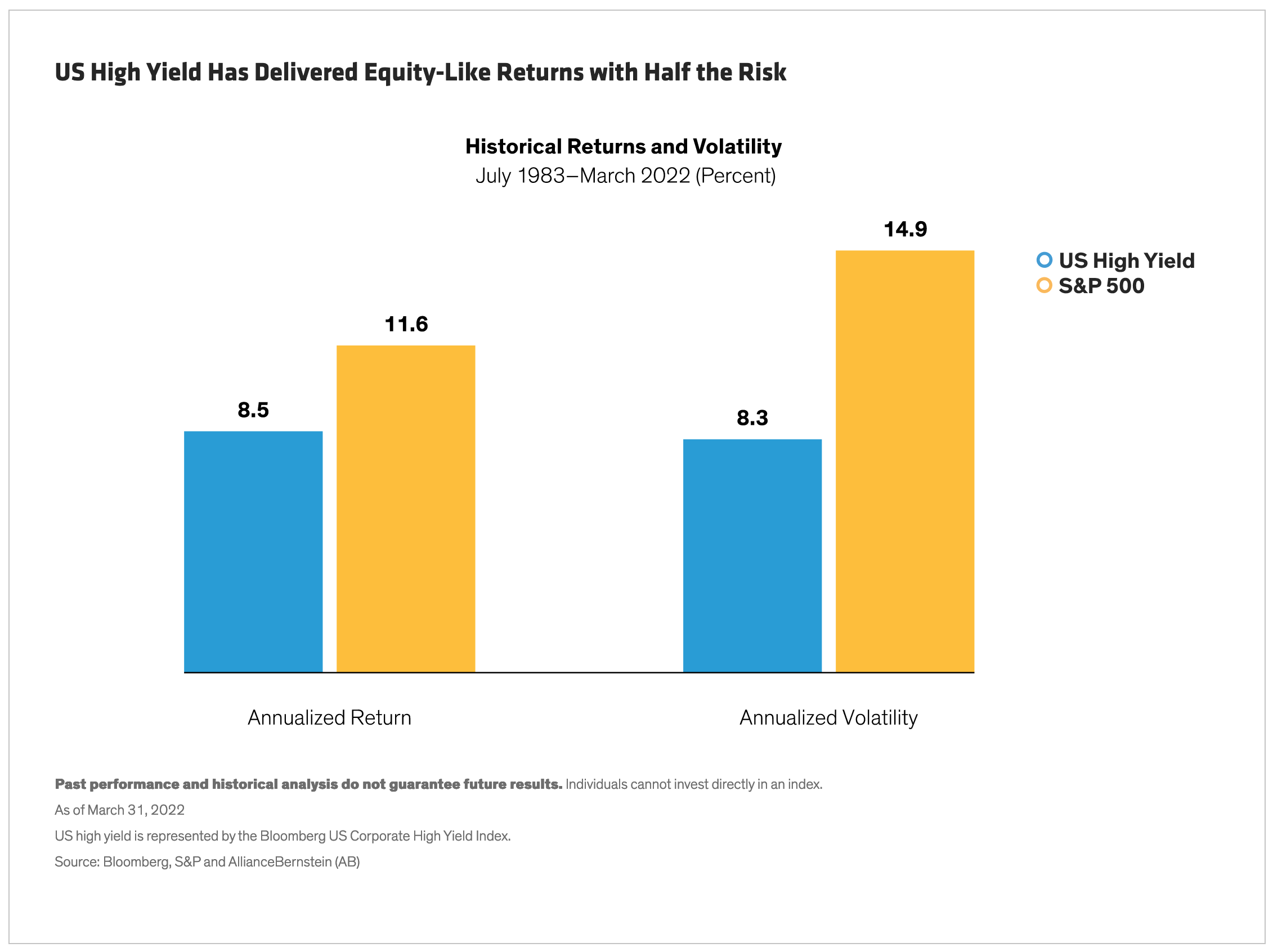

Average annualized returns for the Bloomberg US Corporate High Yield Index and the S&P 500 between July 1983 and March 2022 were 8.5% and 11.6%, respectively. But the average drawdown for high yield over that period was 8.3%, around half of stocks’ tally of 14.9% (Display).

Recovering Losses Quickly

A more typical approach to moderating equity volatility is to reallocate assets to more stable options, such as investment-grade bonds or even cash. But this can exact a heavy cost in sacrificed return potential—especially now that high-yield spreads (the extra yield the bonds offer over comparable Treasury debt) are at their widest since the onset of the pandemic.

As spreads widen, high-yield bonds’ income-generating potential grows, and investors can reinvest their proceeds at higher yields. If volatility eases and spreads start to tighten, that will boost potential returns. If spreads widen further, investors can take comfort knowing that high yield tends to make up its losses more quickly than stocks do.

For instance, over the last 20 years, when the high-yield market suffered a peak-to-trough loss greater than 5%, investors recovered their losses from those drawdowns in just five months on average—and sometimes in as few as two. Meanwhile, stock markets have seen much larger losses and have taken longer to recover from drawdowns.

Of course, it’s still critical to choose your exposures carefully. But over the long run, we’ve seen that adding a dash of high-yield debt to an equity portfolio can tamp down volatility without sacrificing too much return potential. When markets are volatile, that’s a reassuring thought.