by Don Vialoux, EquityClock.com

Technical Notes from yesterday

Coca Cola $KO a Dow Jones Industrial Average stock moved below $62.58 completing a double top pattern.

Pepsico $PEP a NASDAQ 100 stock moved below $165.27 completing a double top pattern.

CVS Health $CVS an S&P 100 stock moved below $95.02 extending an intermediate downtrend.

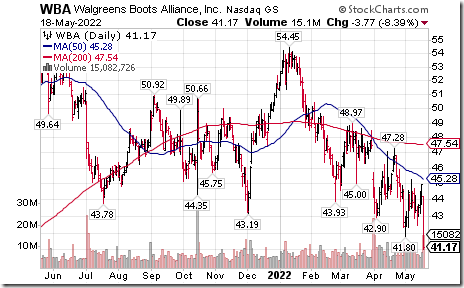

Walgreens Boots $WBA a Dow Jones Industrial Average stock moved below $41.80 extending an intermediate downtrend.

Target $TGT an S&P 100 stock moved below $183.24 extending an intermediate downtrend. The company issued lower than consensus first quarter results.

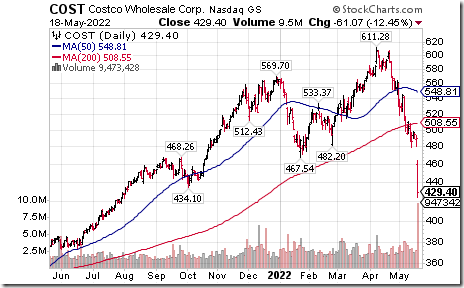

Costco $COST an S&P100 stock moved below $467.54 extending an intermediate downtrend.

Lululemon $LULU a NASDAQ 100 stock moved below $278.00 extending an intermediate downtrend.

PACCAR $PCAR a NASDAQ 100 stock moved below $81.47 extending an intermediate downtrend.

Trader’s Corner

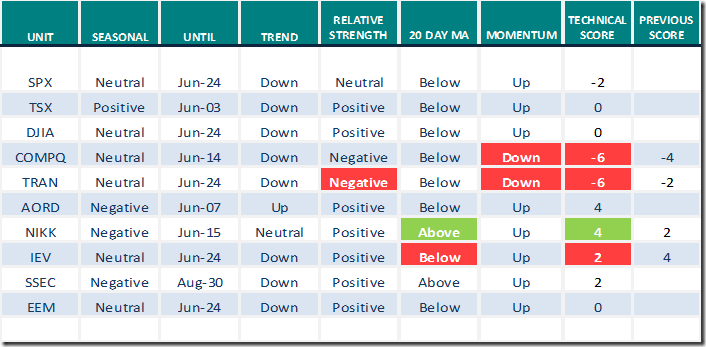

Equity Indices and Related ETFs

Green: Increase from previous day

Red: Decrease from previous day

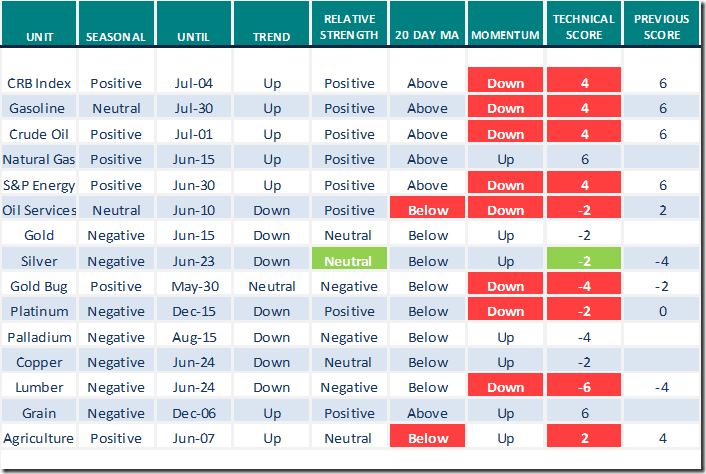

Commodities

Daily Seasonal/Technical Commodities Trends for May 18th 2022

Green: Increase from previous day

Red: Decrease from previous day

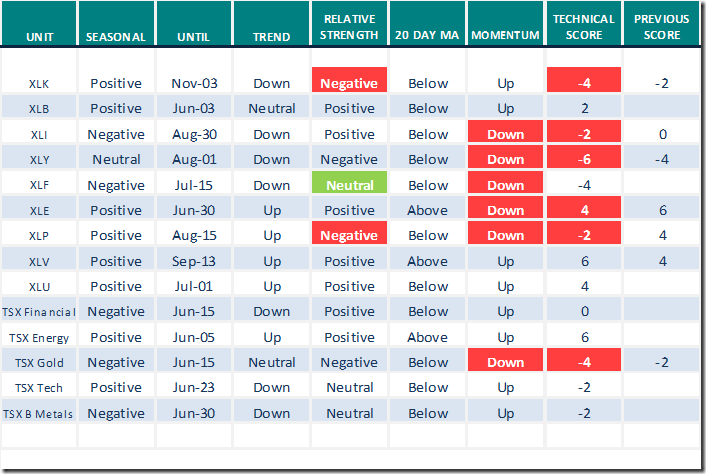

Sectors

Daily Seasonal/Technical Sector Trends for May 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from Valued Providers

Ari Wald, Technical Analyst from Oppenheimer says “The bottom has not yet arrived”.

https://www.youtube.com/watch?v=46lzi82kezw

Mark Bunting and www.uncommonsenseinvestor.com notes in an interview with John O’Connell “Investors need to know this one key thing”

https://www.youtube.com/watch?v=46lzi82kezw

Mark Bunting and www.uncommonsenseinvestor.com asks “Is Elon Musk repeating the mistakes of Henry Ford”?

Is Elon Musk Repeating the Mistakes of Henry Ford? – Uncommon Sense Investor

Greg Schnell comments on “How to discover a new rally”.

How to Discover a New Rally | Greg Schnell, CMT | Market Buzz (05.18.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 15.63 to 16.63 yesterday. It remains Oversold. Confirmation of a bottom has yet to arrive.

The long term Barometer dropped 7.82 to a new recent low at 28.26. It remains Oversold. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer dropped 5.80 to 22.71 yesterday. It remains Oversold. Confirmation of a bottom has yet to arrive.

The long term Barometer fell 3.22 to 34.06 yesterday. It remains Oversold. Confirmation of a bottom has yet to arrive.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.