by Russ Koesterich, CFA, Portfolio Manager, Blackrock

Russ Koesterich, Managing Director and Portfolio Manager of the Global Allocation team, discusses the case for the cheaper segments of growth stocks.

By Russ Koesterich, CFA, JD

While equities are up from the March lows, actual gains have proved elusive except for energy stocks. The conflict in Ukraine appears frozen, oil remains above $100/barrel, inflation continues to accelerate, and Federal Reserve rhetoric has grown more hawkish. As a result, global stocks are still down 7-10% this year, with Europe, China and growth names faring worse. With a lack of viable hedges, a sensible strategy is to moderate equity exposure and focus on tilting the portfolio towards resiliency. To the extent recession fears are now competing with inflation for investor mindshare, look to add beaten-up GARP (“growth at a reasonable price”) names.

Energy & defensive

Outside of a few niche markets, including the UK and Australia, few stock markets are up year-to-date. Instead, the best way to insulate portfolios has been to get the style and sector call right. With oil prices spiking and investors avoiding volatile names, only a few themes have worked: energy and defensive stocks.

Going forward, I would continue to maintain exposure to energy stocks, arguably the simplest hedge should inflation remain sticky. Outside of leaning into energy and other natural resource names, investors should give a second look to some of the highly profitable growth names, particularly those that are now trading at more reasonable valuations. With economic growth likely to slow and earnings growth harder to come by, companies able to grow earnings should garner renewed interest. Specifically, I would focus on the cheaper segment of growth, otherwise known as GARP.

Back in mid-January I discussed the case for GARP names. The major argument was that at this point in the cycle investors want to avoid the extremes of both growth and value, which tend to be the most volatile. Avoiding volatility has been a winning strategy, but with interest rates surging growth stocks have continued to struggle. GARP names have performed in-line with the market, outperforming momentum, quality, and pure growth but trailing value.

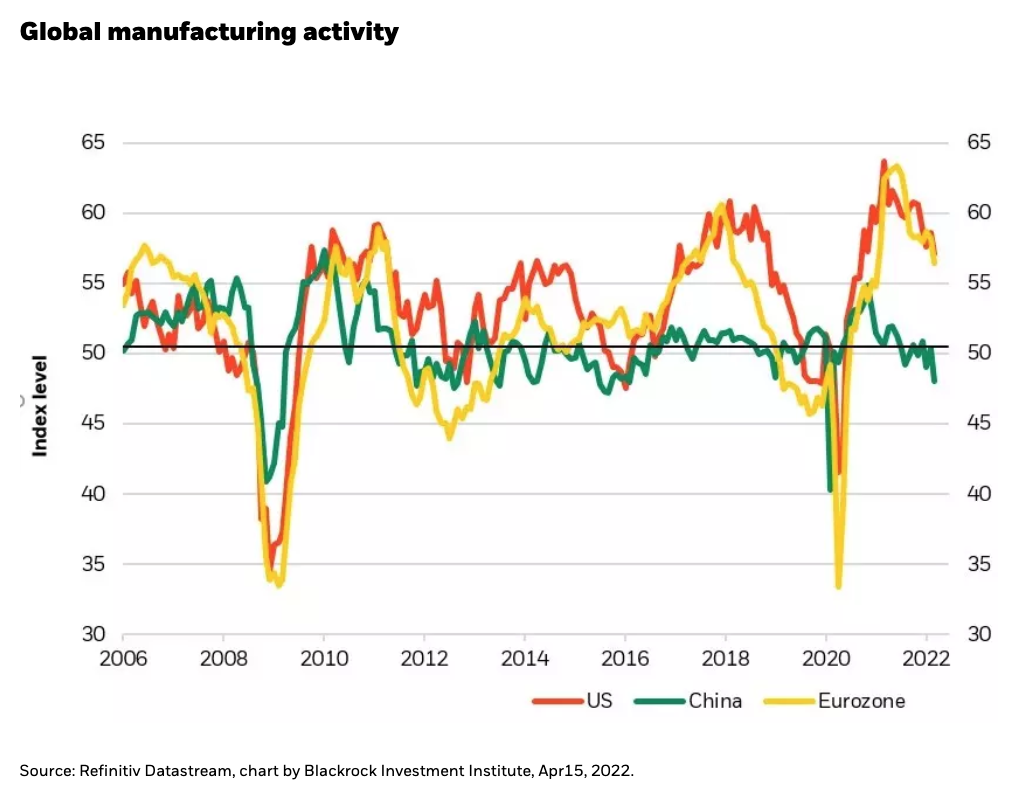

This largely fits the historical pattern. As I discussed several months ago, while GARP is an effective “all-weather” style, it can struggle when inflation is accelerating. However, the environment is shifting again. Headline inflation continues to accelerate and may not peak for several months. That said, core inflation may already be decelerating, and investors are becoming more concerned with growth given an increasingly aggressive Fed. My view is that a U.S. recession is not imminent or pre-ordained, but there is little doubt that forward-looking measures of growth are slowing (see Chart 1).

As economic growth slows, consistent earnings are harder to come by and the growth premium may start to rise again. While investors have understandably eschewed overpriced growth names, growth’s unusually high pandemic premium versus value has dissipated. Going forward, investors should revisit profitable growth stocks where valuations are more reasonable.

Copyright © Blackrock