by Lance Roberts, RIA

A bull market in bonds is set to return with a vengeance as the Fed once again makes a policy mistake.

I recently discussed the surge in bond yields noting that such events have previously led to more unwelcome market and economic outcomes.

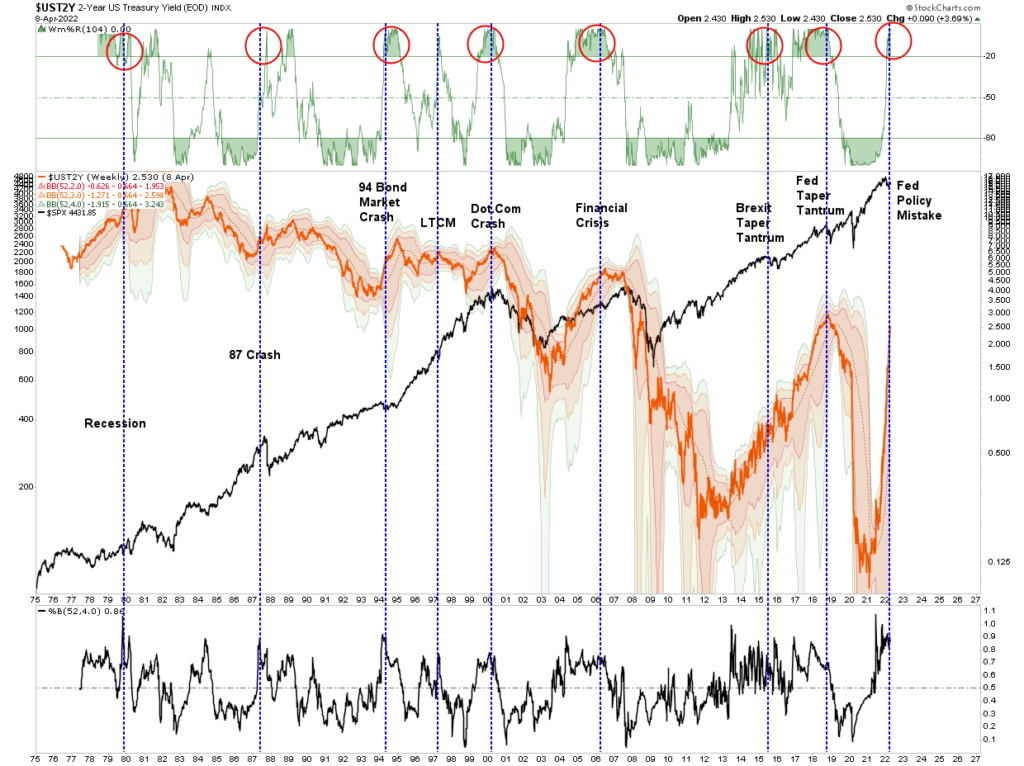

“As shown below, the surge in 2-year bond yields is unprecedented. Historically, such a surge in short-term yields coincides with either recessions or market events. With yields now 4-standard deviations above their 52-week moving average, such has traditionally denoted peaks in yields previously.”

The chart is updated to current yield levels.

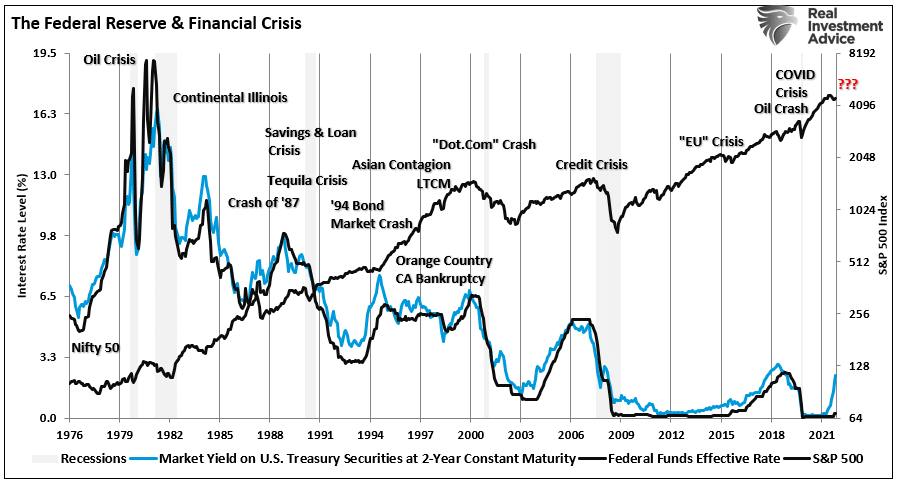

What is important about the 2-year treasury yield is that it maintains a very high correlation to the Fed funds rates. As shown below, the current surge in the 2-year yield is leading the Federal Reserve rate suggesting the Central Bank is very far behind the curve on rate hikes.

The importance of these two charts should not be quickly dismissed.

The Federal Reserve has only just begun its rate hiking campaign to tighten monetary policy. However, the bond market is already rapidly tightening policy which will slow consumption through higher borrowing costs. As noted previously:

“People don’t buy houses or cars. They buy payments. Payments are a function of interest rates, and when interest rates rise, loan activity falls as payments rise above affordability. In an economy where 70% of Americans have little savings, higher payments significantly impact family budgets. Such is a critical point. Higher interest rates create “demand destruction.”

Such is a crucial point.

Long-Term Yields At Critical Levels

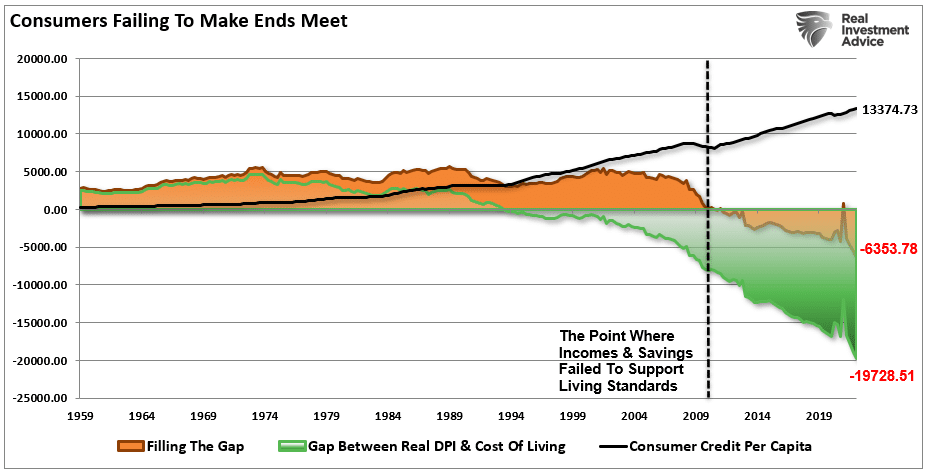

The U.S. economy is more heavily levered today than at any other point in human history. Since 1980, debt levels continue to increase to fill the gap between incomes and the desired standard of living. Bigger houses, televisions, computers, etc. all required ever cheaper debt to finance it all.

The chart below shows the inflation-adjusted median living standard, and the difference between real disposable incomes (DPI) and the required debt to support it. Beginning in 1990, the gap between DPI and the cost of living went negative leading to a surge in debt usage. In 2009, DPI alone could no longer support the standard of living without using debt. Today, it requires almost $6400 a year in debt to maintain the current standard of living.

Such is why, with the heavy requirement of cheap debt to support the standard of living, sharp rate increases have an almost immediate impact on economic activity.

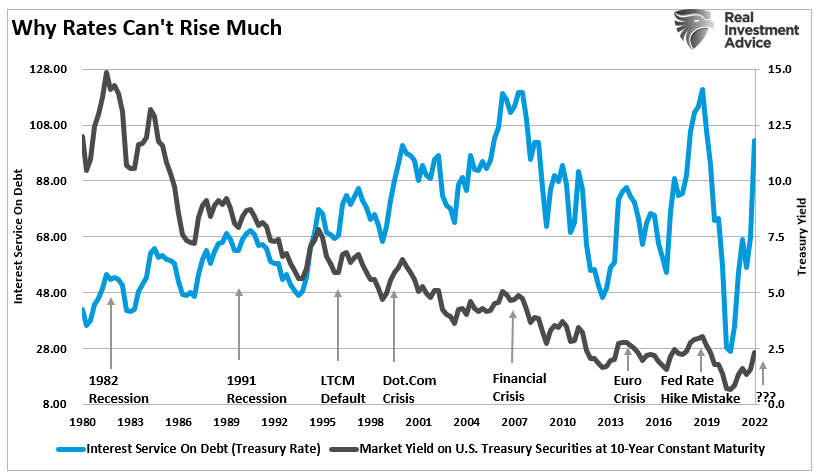

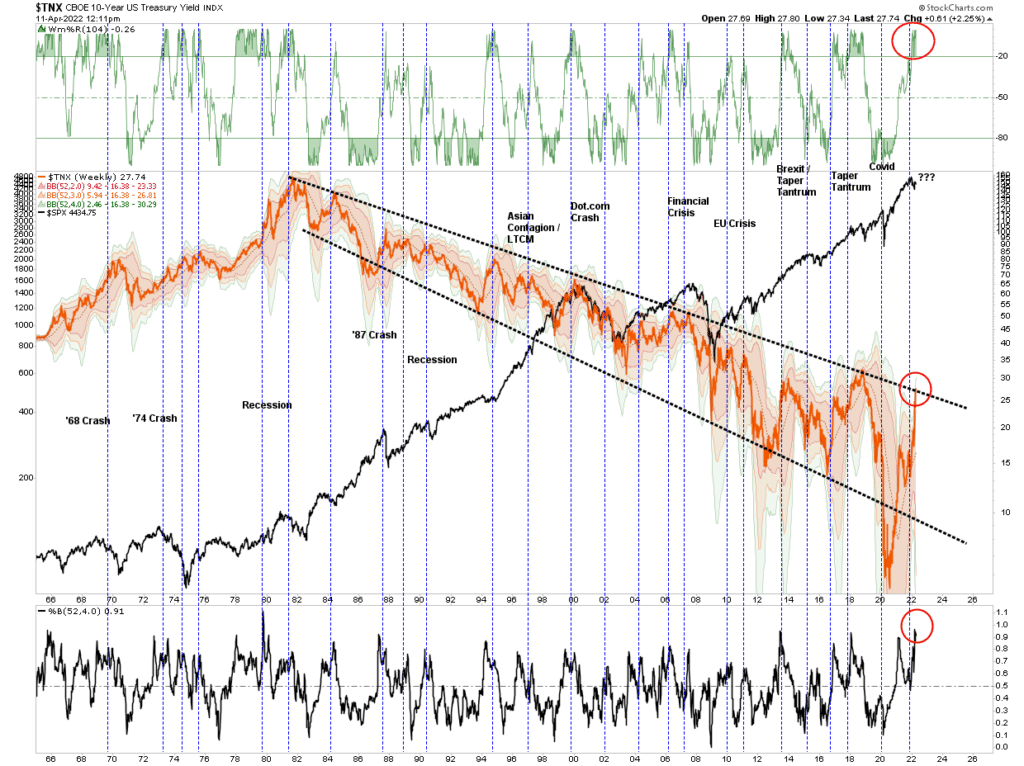

From a technical perspective, we can analyze levels where previous rate increases impacted economic activity. The current surge in bond yields has taken the 10-year yields to extreme overbought levels. As with the 2-year rate, the 10-year rate is now 4-standard deviations above its 52-week moving average. It is also approaching the top of the long-term downtrend channel from 1980.

At 2.5%-3% on the 10-ten year treasury yield, the economy will begin to suffer the effects of reduced consumption.

While it is possible for rates to temporarily move higher, there is a point where “something breaks,” economically speaking, and deflationary pressures will reassert themselves.

Nobody Wants To Buy Stuff In A Bear Market

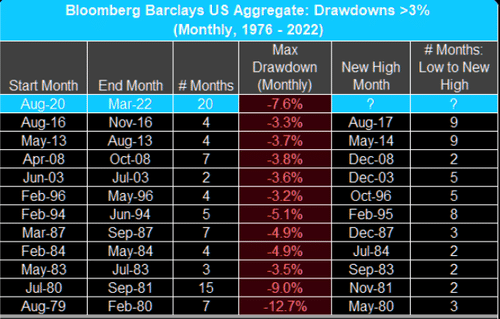

Currently, the bond “bear market” is in full swing. Interestingly, just as it is with a bear market in stocks when asset prices are extremely beaten up, no one wants to own them. However, such is historically exactly the time you want to buy assets.

Of course, the absolute hardest thing to do in the financial markets is to buy “when there is blood in the streets.”

As shown in the table below, the current “bear market in bonds” is one of the longest and deepest draws on record.

Of course, we must remember that following each of those previous “bear markets” was a “bull market” in bonds as the cycle reversed.

This time most likely will be no different.

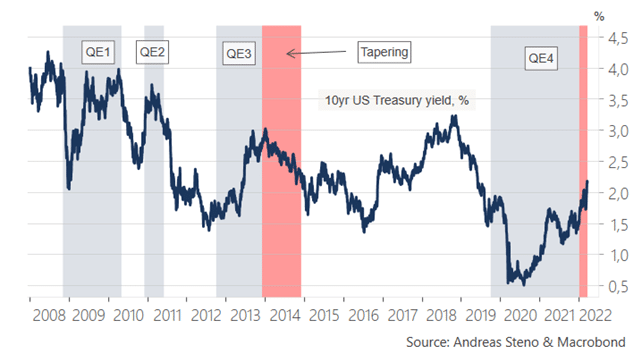

As the Fed hikes rates and reduces their monetary support for the financial markets, money will eventually begin to see out the safety of the highest quality collateral – which is Treasury bonds. As we noted previously:

“Empirically, long bond yields have faded every time we approached the end of a QE program. Will this time be different? I doubt it.” – Andreas Steno Larsen

The reason is that when the Fed removes liquidity from the markets (QE), market participants shift from “risk-on” positioning to “risk-off.” Such is because the reversal of QE is coincident with weaker equity markets.

While buying bonds today may still have some “pain” in them, we are likely closer to a significant buying opportunity than not.

More importantly, if we are correct, the coming bull market in bonds will likely outperform stocks and inflation-related trades over the next 12-months.

Such an outcome would not be the first time that happened.

Of course, buying bonds when no one else wants them is a tough thing to do.

Copyright © RIA