by Howard Marks, Chairman, Oaktree Capital

As regular readers of my memos and books know, I’m strongly interested in – you might say obsessed with – the concept of the pendulum. The following is only a partial list of my writings on the subject:

-

My second memo, written in April 1991, was creatively titled First Quarter Performance. It talked about the oscillation in securities markets between euphoria and depression; between celebrating positive developments and obsessing over negatives; and thus between overpriced and underpriced assets.

-

On Regulation, written in March 2011, discussed the outlook for rulemaking stemming from the Global Financial Crisis. I said future developments were likely to be driven by the long-term pendulum-like swing in attitudes on that subject. Over time, those attitudes tend to fluctuate between “the markets best serve the country when they’re unfettered by rules” to “we need the government to protect us from participants’ misbehavior.”

-

In The Role of Confidence, from August 2013, I discussed the way shifts in fundamentals are translated into market volatility by often-excessive swings in investor confidence.

-

And in my 2018 book, Mastering the Market Cycle, I interrupted my discussion of the various cycles – in the economy, corporate profits, credit availability, etc. – to use the metaphor of a pendulum, not a cycle, to describe the swings of investor psychology.

Because psychology swings so often toward one extreme or the other – and spends relatively little time at the “happy medium” – I believe the pendulum is the best metaphor for understanding trends in anything affected by psychology. . . not just investing.

People frequently ask what caused me to start writing memos in 1990. My very first memo, The Route to Performance, resulted from two events I witnessed in short order, the juxtaposition of which led to what I thought was an important observation. Over the years, many memos have been prompted by connections I sensed between ostensibly unconnected events.

At a recent meeting of the Brookfield Asset Management board, a discussion of Ukraine triggered an association with another aspect of international affairs – offshoring – which I first discussed in the memo Economic Reality (May 2016). Thus the inspiration for this memo.

Background

The first item on the agenda for Brookfield’s board meeting was, naturally, the tragic situation in Ukraine. We talked about the many facets of the problem, ranging from human to economic to military to geopolitical. In my view, energy is one of the aspects worth pondering. The desire to punish Russia for its unconscionable behavior is complicated enormously by Europe’s heavy dependence on Russia to meet its energy needs; Russia supplies roughly one-third of Europe’s oil, 45% of its imported gas, and nearly half its coal.

Since it can be hard to arrange for alternative sources of energy on short notice, sanctioning Russia by prohibiting energy exports would cause a significant dislocation in Europe’s energy supply. Curtailing this supply would be difficult at any time, but particularly so at this time of year, when people need to heat their homes. That means Russia’s biggest export – and largest source of hard currency ($20 billion a month is the figure I see) – is the hardest one to sanction, as doing so would cause serious hardship for our allies. Thus, the sanctions on Russia include an exception for sales of energy commodities. This greatly complicates the process of bringing economic and social pressure to bear on Vladimir Putin. In effect, we’re determined to influence Russia through sanctions . . . just not the potentially most effective one, because it would require substantial sacrifice in Europe. More on this later.

The other subject I focused on, offshoring, is quite different from Europe’s energy dependence. One of the major trends impacting the U.S. economy over the last year or so – and a factor receiving much of the blame for today’s inflation – relates to our global supply chains, the weaknesses of which have recently been on display. Thus, many companies are seeking to shorten their supply lines and make them more dependable, primarily by bringing production back on shore.

Over recent decades, as we all know, many industries moved a significant percentage of their production offshore – primarily to Asia – bringing down costs by utilizing cheaper labor. This process boosted economic growth in the emerging nations where the work was done, increased savings and competitiveness for manufacturers and importers, and provided low-priced goods to consumers. But the supply-chain disruption that resulted from the Covid-19 pandemic, combined with the shutdown of much of the world’s productive capacity, has shown the downside of that trend, as supply has been unable to keep pace with elevated demand in our highly stimulated economy.

At first glance, these two items – Europe’s energy dependence and supply-chain disruption – may seem to have little in common other than the fact that they both involve international considerations. But I think juxtaposing them is informative . . . and worthy of a memo.

Russian Energy

In 2019, Russia’s top four exports were crude petroleum, refined petroleum, petroleum gas, and coal briquettes. These totaled $223 billion, or 55% of Russia’s total exports of $407 billion, according to the Observatory of Economic Complexity.

As shown in the following table, Russia is exceptionally well positioned to wield influence over Europe through exports of energy commodities.

Europe

Russia

ProducesConsumesNet

ProducesConsumesNetOil (bbl/day)3.6 mm15.0 mm(11.4 mm)

11.0 mm3.4 mm7.6 mmGas (cu met/year)230 bn560 bn(330 bn)

700 bn400 bn300 bnCoal (tons/year)475 mm950 mm(475 mm)

800 mm300 mm500 mm

Source: “The West’s Green Delusions Empowered Putin,” Michael Shellenberger, Common Sense with Bari Weiss, March 1, 2022. Some data is approximate or rounded. (Common Sense is probably as tendentious as other media outlets, but I have no reason to believe the data is inaccurate.)

The implications are clear. Europe uses far more energy than it produces and makes up the difference through imports. Russia, on the other hand, uses far less than it produces, leaving the remainder to generate economic and strategic gains.

How did things get this way? According to Shellenberger (see source above):

While Putin expanded Russia’s oil production, expanded natural gas production, and then doubled nuclear energy production to allow more exports of its precious gas, Europe, led by Germany, shut down its nuclear power plants, closed gas fields, and refused to develop more through advanced methods like fracking.

The numbers tell the story best. In 2016, 30 percent of the natural gas consumed by the European Union came from Russia. In 2018, that figure jumped to 40 percent. By 2020, it was nearly 44 percent, and by early 2021, it was nearly 47 percent.

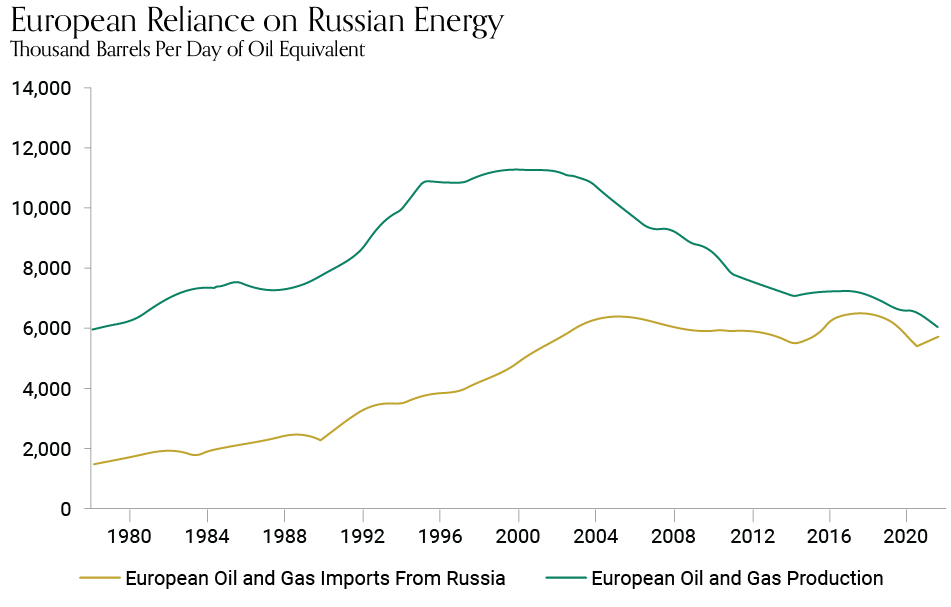

The following chart makes the situation clear. In 1980, imports from Russia represented less than one-third of Europe’s oil and gas production. European production peaked about 20 years ago and has almost halved since then, ending up near where it was in 1980. In the same roughly 40-year period, imports from Russia have tripled, meaning they’re now roughly equal to Europe’s production.

Source: BP, Gazprom, Eurostat, Perovic et al., Russia Federal Customs Service. Journal of Policy Analysis and Management calculations, 2021.

Shellenberger asserts – and it seems credible – that Europe allowed its dependence on imports of energy commodities, especially from Russia, to increase so dramatically because it wanted to be more ecologically responsible at home. In addition to limiting their production of oil and gas, some nations (especially Germany) reduced their use of nuclear power generation – which could arguably offer the best energy option by providing large-scale power production without emitting greenhouse gases – in a concession to those who consider nuclear power unsafe or environmentally unfriendly. As Shellenberger puts it:

At the turn of the millennium, Germany’s electricity was around 30 percent nuclear-powered. But Germany has been sacking its reliable, inexpensive nuclear plants. . . . By 2020, Germany had reduced its nuclear share from 30 percent to 11 percent. Then, on the last day of 2021, Germany shut down half of its remaining six nuclear reactors. The other three are slated for shutdown at the end of this year.

During a briefing earlier this month, a U.S. senator told the nonpartisan political organization No Labels, “The energy issue regarding ‘Putin’s war’ has four components: energy, climate, security, and economics (both national and at the household level).” Security doesn’t seem to have received much consideration in the deliberations that led to Germany’s energy dependency on Russia. Just one of the four factors – climate – appears to have motivated the decision. Choosing to count on a hostile neighbor for essential goods is like building a bank vault and contracting with the mob to supply it with guards. But that’s what happened.

Foreign Sourcing

The downside of Europe’s dependence on Russian oil and gas has made its way into the consciousness of many people only recently, as a result of the invasion of Ukraine. But the shift to sourcing and manufacturing overseas is something that’s been on people’s minds for decades.

If you think back a few hundred years, limitations on transportation required that production take place near the point of consumption. But after the advent of the railroad, it became possible to separate the locations of production and consumption by hundreds – or even thousands – of miles. This must have been an important element in the creation of national champions that eventually supplied whole countries with goods such as food and building materials that previously had to be manufactured near the local customers. This enabled goods to be produced in places where labor was most readily available or where benefits from specialization could be maximized. It was inevitable that these forces would affect countries around the world and – with the emergence of airfreight and containerization – result in rapidly growing cross-border trade.

Shortly after World War II, cheap labor and skill in assembling products permitted Japan to rapidly become a major exporter of electronic goods and automobiles. The products were highly cost-competitive and initially of low quality, but Japan soon developed some of the world’s most desired brands. In the late 1950s, Japanese auto companies exported just a few hundred cars a year to the U.S., the main selling point of which was low price. But quality rose even as prices remained attractive, and by the early 1980s, the Reagan administration, in an attempt to protect the U.S. auto industry, asked Japanese manufacturers to “voluntarily” limit exports to the U.S. to 1.68 million cars per year.

The lure of low manufacturing costs caused producers to shift operations from Japan to other parts of Asia over time. A large-scale shift to China began in earnest around 1995. Subsequently, the production of low-value-added goods such as T-shirts and jeans shifted to Vietnam, Bangladesh and Pakistan. As each country benefited from the growth of manufacturing, the supply of labor got tighter, and workers became able to demand higher wages. Per-capita incomes and standards of living rose, expanding the middle class and strengthening domestic consumption. Higher wages in one country caused the mantle of lowest-cost manufacturer to pass to others. Wages may have risen locally, but as a consequence, the search for low-margin, low-skill work moved on to new low-cost venues.

Asia’s ability to produce goods inexpensively soon led U.S. companies to capitalize on Asia’s advantages by (a) building factories abroad and (b) hiring Asian contractors to do manufacturing for them. The reasons are clear: vastly lower wages and fewer protections for workers, which permitted long days and poor labor conditions that wouldn’t be tolerated in the U.S. The result was more jobs for non-U.S. workers, economic growth for the countries where the manufacturing was done, increased competitiveness for U.S. importers, and bargain-priced goods for American consumers.

In addition, offshoring undoubtedly contributed substantially to the low level of inflation experienced in the U.S. over the last 40 years. One popular gauge of inflation, the Personal Consumption Expenditures (PCE) deflator, rose by only 1.8% per year from 1995 (importantly, the blast-off point for Chinese exports to the U.S.) through 2020. Inflation was considered tame at that level, and, in fact, many in business and government wished it were a bit higher. But a look inside the numbers is instructive:

Personal Consumption ExpendituresAnnual InflationShare of PCE

All 1.8%

Non-Durables1.6 25-30%Durables(2.0)10-15Services2.655-60

Source: Federal Reserve Bank of St. Louis FRED database; AmosWEB

It’s startling to note that the prices of durables fell by almost 40% over the 25 years in question. The availability of ever-cheaper goods like cars, appliances and furniture produced abroad was a major contributor to the benign U.S. inflation picture in this quarter-century. Likewise, although prices of non-durables didn’t actually come down, cheap imports of items like clothing helped keep the lid on prices overall. This was an important benefit of globalization for the net-importing nations.

On the other hand, offshoring also led to the elimination of millions of U.S. jobs, the hollowing out of the manufacturing regions and middle class of our country, and most likely the weakening of private-sector labor unions.

Ford, for example, reported in 1992 that 53 percent of its employees worked in the U.S. and Canada. By 2009, its North American workforce (by then Ford had expanded to Mexico) made up only 37 percent of total payroll. (The Week, January 11, 2015)

Capitalism is based on the desire to maximize income. Globalization allows production to be performed where the costs are lowest. The combination of these two powerful forces has had a profound influence on the world over the last half-century.

Semiconductors present an outstanding example of this trend. Many of the most important early developments in electronics – transistors, integrated circuits, and semiconductors – took place at U.S. companies such as Bell Labs and Fairchild Semiconductor. In 1990, the U.S. and Europe were responsible for over 80% of global semiconductor production. By 2020, their share was estimated to be only around 20% (data from Boston Consulting Group and the Semiconductor Industry Association). Taiwan (led by Taiwan Semiconductor Manufacturing Company (TSMC)) and South Korea (essentially Samsung) have taken the place of the U.S. and Europe as the largest producers of semiconductors. Today, “TSMC and Samsung are the only companies capable of producing today’s most advanced 5-nanometer chips that go into iPhones.” (Visual Capitalist) The upshot is well known:

While pandemic-induced shutdowns have hampered supply, the demand for chips has continued surging with reopening economies. The resulting chip shortage has rattled several industries with lead times – the gap between when a semiconductor is ordered and when it is delivered is at a record high of 22 weeks.

The chip shortage is a boon to semiconductor companies, but downstream firms are struggling. Global automakers are set to make 7.7 million fewer cars in 2021, which translates into a $210 billion hit to their revenues. Consumer electronics have taken a blow as well, with popular products like the PlayStation 5 console in short supply. (Visual Capitalist)

The Common Thread

So, what’s the connection? U.S. companies’ foreign sourcing, in particular with regard to semiconductors, differs from Europe’s energy emergency in many ways. But both are marked by inadequate supply of an essential good demanded by countries or companies that permitted themselves to become reliant on others. And considering how critical electronics are to U.S. national security – what today in terms of surveillance, communications, analysis and transportation isn’t reliant on electronics? – this vulnerability could, at some point, come back to bite the U.S. in the same way that dependence on Russian energy resources has the European Union.

How did the world get into this position? How did Europe become so dependent on Russian exports of energy commodities, and how did such a high percentage of semiconductors and other goods destined for the U.S. come to be manufactured abroad? Just as Europe allowed its energy dependence to increase due to its desire to be more green, U.S. businesses came to rely increasingly on materials, components, and finished goods from abroad to remain price-competitive and deliver greater profits.

Key geopolitical developments in recent decades included (a) the perception that the world was shrinking, due to improvements in transportation and communications, and (b) the relative peace of the world, stemming from:

-

the dismantling of the Berlin Wall;

-

the fall of the USSR;

-

the low perceived threat from nuclear arms (thanks to the realization that their use would assure mutual destruction);

-

the absence of conflicts that could escalate into a multi-national war; and

-

the shortness of memory, which permits people to believe benign conditions will remain so.

Together, these developments gave rise to a huge swing of the pendulum toward globalization and thus countries’ interdependence. Companies and countries found that massive benefits could be tapped by looking abroad for solutions, and it was easy to overlook or minimize potential pitfalls.

As a result, in recent decades, countries and companies have been able to opt for what seemed to be the cheapest and easiest solutions, and perhaps the greenest. Thus, the choices made included reliance on distant sources of supply and just-in-time ordering.

(As an aside, I acknowledge that in countries with less-well-developed economies, environmental protection, high safety and labor standards, and green behavior may sometimes be considered unaffordable luxuries. Thus offshoring may allow companies to engage in practices that wouldn’t be acceptable at home – low-cost manufacturing based on burning coal is a good example. In this way, offshoring may help a company’s or even a country’s domestic profile while being bad for the world as a whole.)

As I’ve written in the past, economics is the science of choice (the same seems true of geopolitics, although there’s even less science regarding that realm.) Few options in these fields offer only positives and no negatives. Most entail tradeoffs. However, the negatives often become apparent “only when the tide goes out,” as they have recently. The invasion of Ukraine has shown that Europe’s importation of oil and gas from Russia has left it vulnerable to a hostile, unprincipled nation (worse in this case – to such an individual) at the same time that winding down nuclear power generation has increased the region’s need for imported oil and gas. The practice of offshore procurement similarly makes countries and companies dependent on their positive relations with foreign nations and the efficacy of our transportation system.

The recognition of these negative aspects of globalization has now caused the pendulum to swing back toward local sourcing. Rather than the cheapest, easiest and greenest sources, there’ll probably be more of a premium put on the safest and surest. For example, both U.S. and non-U.S. companies have announced that they intend to build new foundries to produce semiconductors in the U.S. And I imagine many U.S. importers of materials, components and finished goods are looking for sources closer to home. Similarly, it’s now less likely that Germany will follow through on its plan to turn off its three remaining nuclear reactors on December 31 and more likely that it will reactivate the three it retired at the end of 2021 (and perhaps, with the rest of Europe, recalibrate the balance between energy imports and domestic energy production).

If the pendulum continues to move for a while in the direction I foresee, there will be ramifications for investors. Globalization has been a boon for worldwide GDP, the nations whose economies it has lifted, and the companies that reduced costs by buying abroad. The swing away will be less favorable in those regards, but it may (a) improve importers’ security, (b) increase the competitiveness of onshore producers and the number of domestic manufacturing jobs, and (c) create investment opportunities in the transition.

For how long will the pendulum swing away from globalization and toward onshoring? The answer depends in part on how the current situations are resolved and in part on which force wins: the need for dependability and security or the desire for cheap sourcing.

* * *

In complex fields like economics and geopolitics, there are few easy decisions – just choices, many of them very difficult. There are too many moving parts, too many unknowns, and too many pros and cons whose merits can’t be weighed quantitatively. What sits on either side of the scale doesn’t necessarily change much, but the pendulum swings radically in terms of how those things are viewed and weighted in the decision.

Here’s what I wrote in On Regulation concerning the swing of the pendulum toward and away from regulation of the financial markets:

It’s my belief that because both free markets and regulation are imperfect – and because of the strength of people’s political and philosophical biases – we will never settle permanently on either a completely free market or a thoroughly regulated system. Any position will prove merely temporary, and the pendulum will continue to swing toward one end of the spectrum and then back toward the other.

If you substitute the words “offshoring” and “domestic sourcing” for “free markets” and “regulation,” then this passage just as accurately describes the choice between the cheapest sourcing and the most secure sourcing. This absence of perfect, permanent solutions is characteristic of pendulums – it’s why they swing. And after many decades of globalization and cost minimization, I think we’re about to find investment opportunities in the swing toward reliable supply.

March 23, 2022

Legal Information and Disclosures

This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree Capital Management, L.P. (“Oaktree”) believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Oaktree.

©2022 Oaktree Capital Management, L.P.