by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

The trend of the US Dollar Index remains in a position of a headwind against risk assets and it could be a significant factor behind whether or not stocks realize the gains that are average for the month of April. equityclock.com/2022/03/23/… $USDX $USD $UUP #USD #USDollar

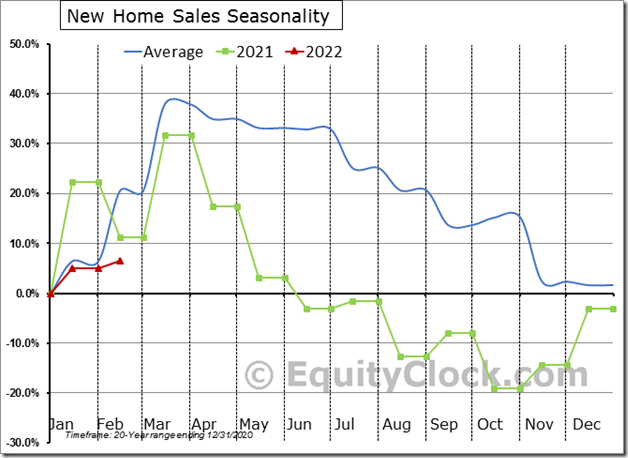

New Home Sales in the US are higher by 6.6% through the first two months of 2022, which is the weakest performance since 2011 as the housing market was still healing from the Great Financial Crisis. The average change in the run-up to the spring home buying season is a rise of 20.6%. $STUDY $MACRO $ITB $XHB $KBH $PHM $DHI $TOL

Aerospace & Defense iShares $ITA moved above $111.90 to extend an intermediate uptrend and Powershares Aerospace & Defense ETF $PPA moved above $78.65 to an all-time high extending an intermediate uptrend.

Materials SPDRs $XLB moved above intermediate resistance at $86.89.

U.S. Oil & Gas Exploration and Production SPDRs $XOP moved above $132.22 extending an intermediate uptrend. Seasonal influences are favourable to April 24th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/spdr-sp-oil-gas-exploration-production-etf-nysexop-seasonal-chart

Natural Gas ETN $HUN.CA moved above Cdn$4.82 extending an intermediate uptrend. Seasonal influences are favourable to May 24th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/horizons-natural-gas-etf-tsehun-to-seasonal-chart

One of the reasons for strength in Materials SPDRs $XLB is strength in copper stocks and related ETFs. Global copper equity ETF $COPX moved above $46.27 to an all-time high extending an intermediate uptrend.

BHP Group $BHP one of the world’s largest base metal producers moved above $73.68 to an all-time high extending an intermediate uptrend.

Union Pacific $UNP an S&P 100 stock moved above $270.14 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to June 5th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/union-pacific-corporation-nyseunp-seasonal-chart. One of several U.S. railway stocks recording nice gains this morning. See chart at $DJUSRR

CGI Group $GIB.A.CA, a TSX 60 stock moved below $99.26 extending an intermediate downtrend.

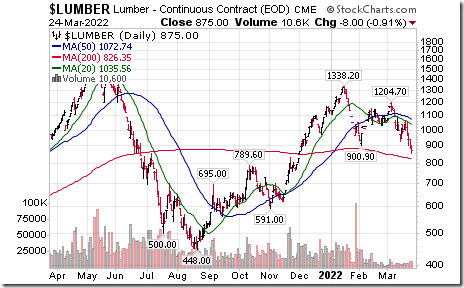

Forest product stocks and related ETFs $WOOD $CUT are responding to the breakdown by lumber prices below US$900 per TBT. West Fraser Timber $WFG.CA moved below Cdn$111.30 completing an intermediate topping pattern.

Trader’s Corner

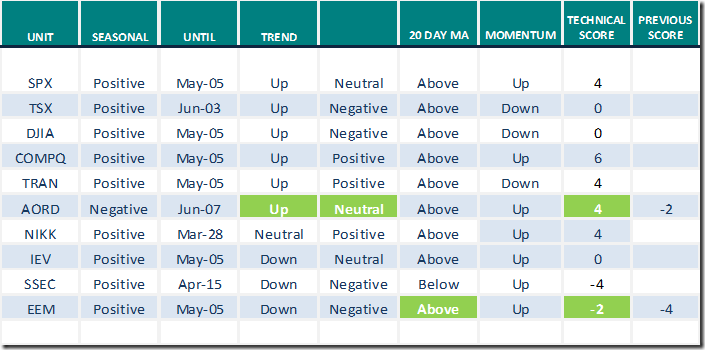

Equity Indices and Related ETFs

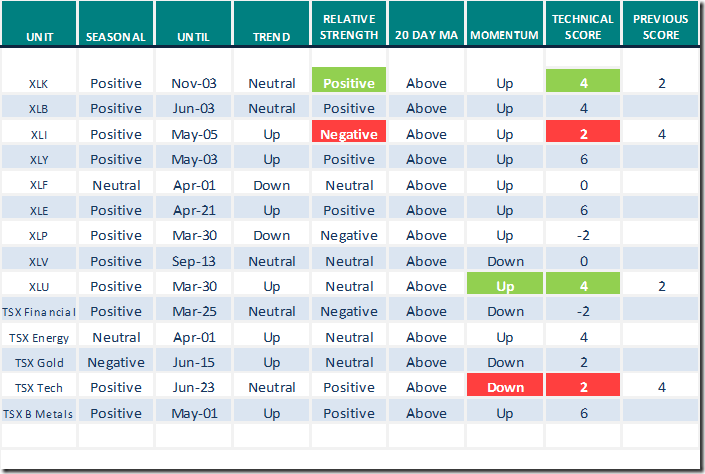

Daily Seasonal/Technical Equity Trends for March 24th 2022

Green: Increase from previous day

Red: Decrease from previous day

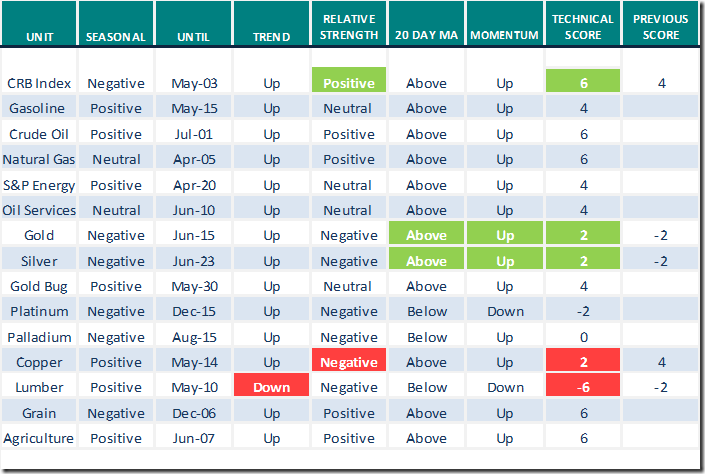

Commodities

Daily Seasonal/Technical Commodities Trends for March 24th 2022

Green: Increase from previous day

Red: Decrease from previous day

SECTORS

Daily Seasonal/Technical Sector Trends for March 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

The Canadian Technician

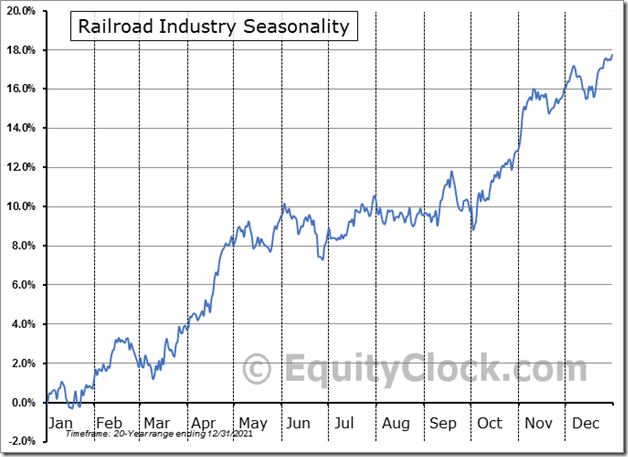

Greg Schnell discusses “Getting our trading back on the rails”. Focus is on the North American railway industry. Following is a link:

https://stockcharts.com/articles/canada/2022/03/getting-our-trading-back-on-th-825.html

Greg Schnell also is a participant in Chart Madness released by www.stockcharts.com yesterday where four technical analysts make their stock picks for the rest of 2022. Following is a link:

https://www.youtube.com/watch?v=sguSXHcOUlg

Seasonality Chart of the Day

Optimal favourable seasonal influences for the North American railway industry are positive on a real and relative basis (relative to the S&P 500 Index) between now and June 2nd.

Wolf on Bay Street

Don Vialoux is a guest on the “Wolf on Bay Street” radio show hosted by Wolfgang Klein and Jack Hardill. The show is broadcasted at 7:00 PM EDT on Saturday on Corus Radio 640. Discussion included comments on the Uranium, Infrastructure and Healthcare sectors.

S&P 500 Momentum Barometers

The S&P 500 momentum Barometer gained 8.82 to 57.72 yesterday. It remains Neutral.

The long term momentum Barometer added 4.01 to 51.70 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term momentum Barometer slipped 1.29 to 69.40 yesterday. It remains Overbought.

The long term Barometer eased 2.44 to 64.22 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.