by Wouter Sturkenboom, CFA, Chief Investment Strategist, EMEA and APAC, Northern Trust

Roiling market conditions are seeing equity investors shift from growth to value – what that means for their risk appetite.

2022 has consisted of headline-grabbing financial market volatility, higher interest rates, geopolitical uncertainty and surging energy prices. There has been a lot of intra-asset class movement, perhaps none more notable than the rotation from growth to value within equity markets. The rotation sends a key message regarding the risk appetite of equity investors and has implications for how to appropriately evaluate regional performance differentials.

THE EQUITY MARKET ROTATION

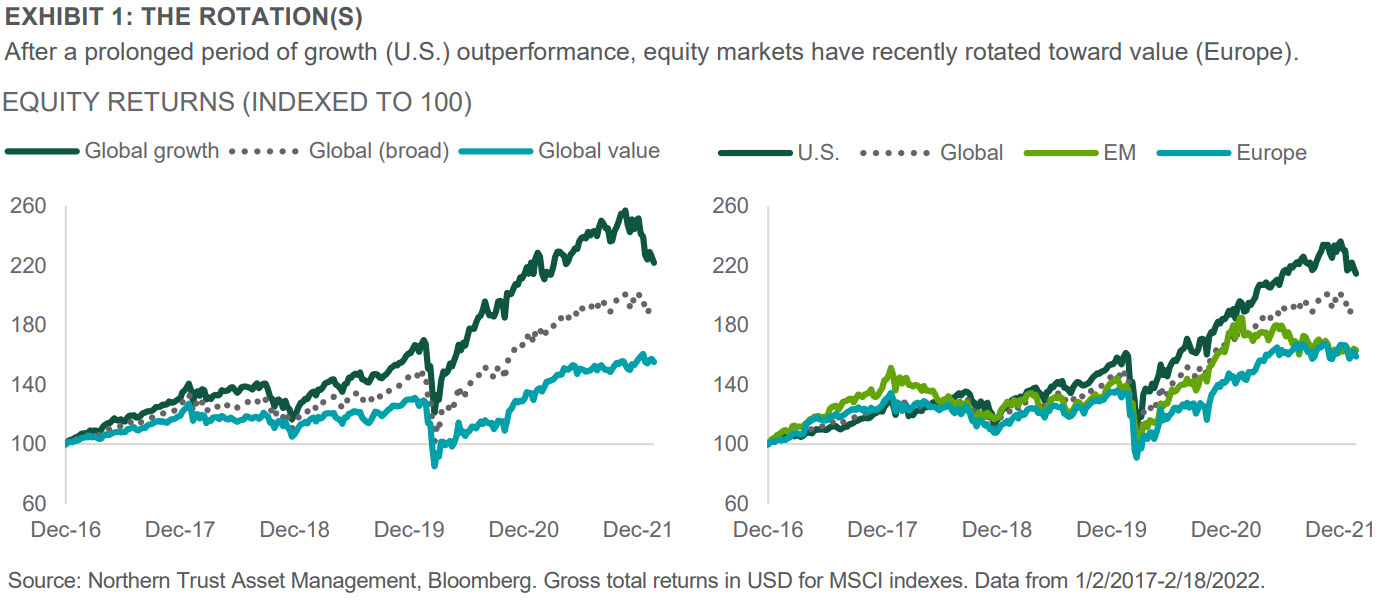

Global growth equities outperformed global value equities by nearly 70% over the past five years (Exhibit 1). Investors were attracted to strong corporate earnings growth in a muted economic growth environment, while low interest rates helped keep a lid on the discount rate of future profitability (a hallmark of growth companies). At the same time, traditional value sectors such as Financials and Energy faced significant headwinds. Expectedly, this trend impacted relative regional equity performance through each region’s differing exposure to growth versus value. The U.S. outperformed Europe and emerging markets (EM) by over 50%. However, a notable rotation took place during the recent equity market pullback. During the 7.1% decline in global equities from January 4 through February 18, growth equities declined 11.6% and value equities lost 2.6%. Regional equity performance followed a similar pattern: U.S. equities declined 9.5% and Europe equities lost a lesser 5.7% (Exhibit 1).

THE CONNECTION TO REGIONAL PERFORMANCE

Value tends to be far more heavily weighted toward cyclical industries such as Financials and Energy, which have benefited from higher interest rates and commodity prices, while growth indexes are heavily weighted toward Technology and adjacent industries. This same observation can be also made when comparing the U.S. and Europe. The U.S. market is heavily weighted toward Technology-oriented companies, while Europe is more old-economy cyclicals. Financials, Industrials, Energy and Materials stocks make up 26% of the U.S. market, but constitute 46% of the market in Europe. Meanwhile, those sectors account for 40% of the U.S. value market (Exhibit 2). Consequently, U.S. value performance has closely resembled that of the broader Europe market over the past several years (Exhibit 2). Regionally, comparing the U.S. to Europe is much like comparing growth to value, with support coming from both valuations and relative performance.

CONCLUSION: ROTATION REFLECTS INCREASED UNCERTAINTY

Inflation is elevated, interest rates have moved up and the number of expected Fed rate hikes in 2022 has increased to 6 from 3 year-to-date. The investor response to favor less interest-rate sensitive value stocks, to some degree, reflects a drop in risk appetite when faced with risks to corporate profitability, higher interest rates and elevated uncertainty regarding the future path of monetary policy.

The significance of the rotation should not be overstated at this stage of the cycle. We believe the global economy has a decent runway for growth and we expect corporate profits to be resilient in the face of higher interest rates and input costs. While it is understandable that investors would lower their risk appetite toward interest-rate sensitive growth stocks in the face of a more hawkish Fed, we think monetary policy will remain accommodative by historical standards. Knowing that equity investors are sending a consistent message across sectors and regions gives us comfort that our current preference for developed market equities over EM, combined with a natural resources overweight for protection against inflation and Russia-Ukraine risks, is the best combination for the time being. Moreover, we appreciate that a global portfolio provides not only geographic diversification, but also exposure to cyclical industries currently offering greater protection from inflation and monetary policy uncertainty.

Wouter Sturkenboom, CFA, Chief Investment Strategist, EMEA and APAC

Wouter Sturkenboom, CFA, Chief Investment Strategist, EMEA and APAC

Wouter Sturkenboom, CFA, CAIA, is chief investment strategist for EMEA and APAC at Northern Trust. He is also a member of the Interest Rate Strategy Committee and Investment Policy Committee.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.

IMPORTANT INFORMATION. For Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. Information is subject to change based on market or other conditions.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Copyright © Northern Trust