by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Editor’s Note: U.S. equity indices recorded s stunning reversal yesterday. The S&P 500 realized a 6.8% gain from its opening low to its high at the close.

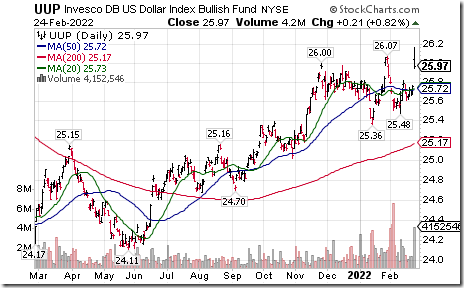

U.S. Dollar Index ETN $UUP moved above $26.07 extending an intermediate uptrend.

Canadian Dollar $CDW moved below intermediate support at US78.15 cents.

Major benchmarks are breaking levels of significant support, risking an expansion of the downfall of the equity market to areas beyond the technology sector. equityclock.com/2022/02/23/… $RSP $SPXEW $NYA $SPX $SPY $ES_F

Euro $XEU moved below 111.25 extending an intermediate downtrend.

Gold SPDRs $GLD moved above $178.85 extending an intermediate uptrend.

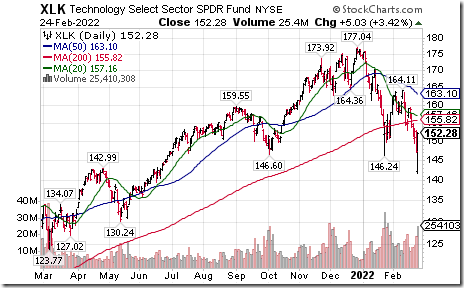

Sector SPDRs that broke support setting an intermediate downtrend included $XLK $XLB $XLP $XLV

Editor’s Note: All reversed by the end of the day.

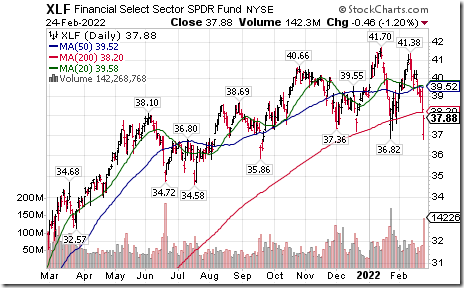

U.S. financial service equities and related ETFs are the hardest hit sector. Financial SPDRs $XLF moved below $36.82 completing a Head & Shoulders pattern.

Industry ETFs breaking support setting intermediate downtrends included $IHF$TAN $IHI $CARZ $WOOD

Editor’s Note: All reversed by end of the trading day, notably TAN

International equity ETFs trading in U.S. Dollars moving below support setting intermediate downtrends included: $EWI $EWY $EEM $FXI $IEV $EWT $EIS $PIN

Editor’s Note: International equity indices and related ETFs also recovered but their recovery was less impressive.

Trader’s Corner

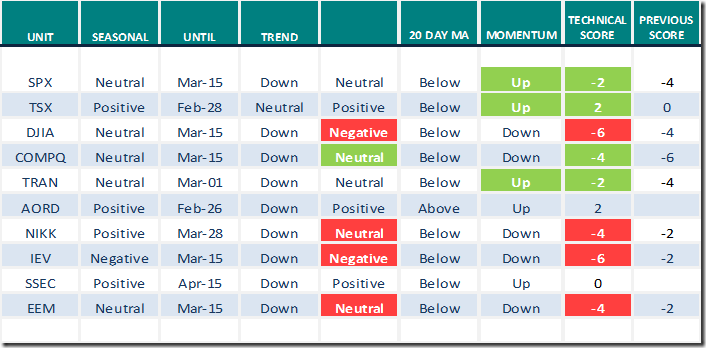

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.24th 2022

Green: Increase from previous day

Red: Decrease from previous day

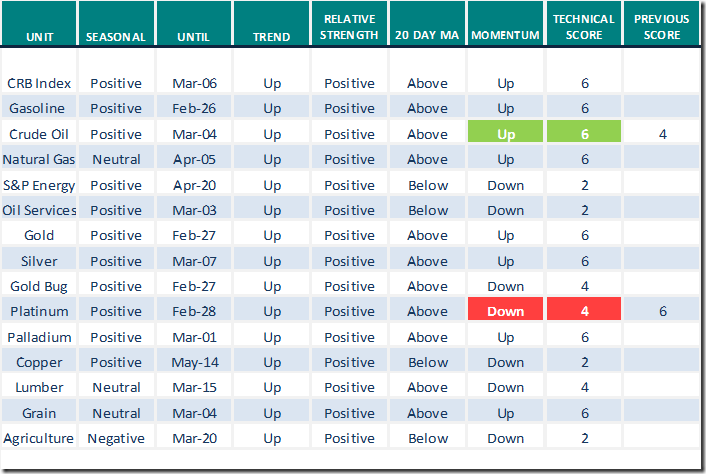

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.24th 2022

Green: Increase from previous day

Red: Decrease from previous day

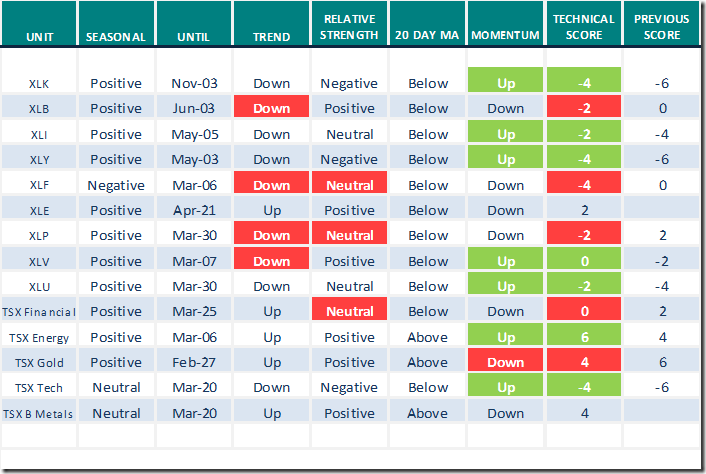

Sectors

Daily Seasonal/Technical Sector Trends for Feb.24th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by Valued Providers

Links from Mark Bunting and www.uncommonsenseinvestor.com

Four Companies with Pricing Power – YouTube

Volatility & Lower Prices Present Opportunity for Long-Term Investors – Uncommon Sense Investor

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 1.80 to 24.25 yesterday. It remains Oversold, but has yet to show signs of bottoming.

The long term Barometer added 0.20 to 37.27 yesterday. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer added 2.45 to 50.66 yesterday. It remains Neutral.

The long term Barometer added 0.18 to 53.30 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.