by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

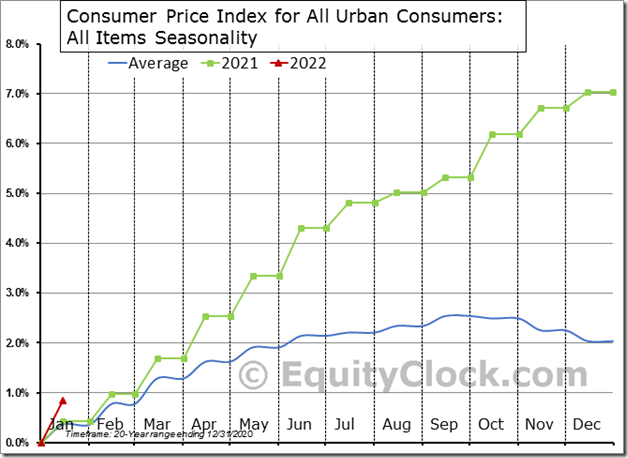

Consumer Prices in the US jumped by 0.8% (NSA) in January, which is double the 0.4% increase that is average of the first month of the year. This is the strongest January increase since 1990! $MACRO $STUDY #Economy #CPI

S&P/TSX 60 ETF breaking out of a multi-month consolidation range as resource centric stocks continue to attract attention. equityclock.com/2022/02/09/… $XIU.CA $EWC $TSX.CA

Canada iShares $EWC moved above US$39.58 and US$39.60 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable until at least early March. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/ishares-msci-canada-etf-nyseewc-seasonal-chart

More technical signs of a recovery by Far East equity markets! Hong Kong iShares $EWH moved above $24.62 completing a classic reverse Head & Shoulders pattern.

Copper equity ETF $COPX moved above $41.39 extending an intermediate uptrend.

Metals and Minerals SPDRs $XME moved above $48.23 to a 10 year high extending an intermediate uptrend. Seasonal influences are favourable to early May and frequently to early June. If a subscriber to EquityClock, see seasonality chart at charts.equityclock.com/spdr…

BHP Billiton $BHP one of the largest base metal producers in the world moved above $69.56 extending an intermediate uptrend. Seasonal influences are favourable to mid-April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/bhp-billiton-limited-adr-nysebhp-seasonal-chart

Rio Tinto $RIO one of the world’s largest base metal producers moved above $78.76 extending an intermediate uptrend. Seasonal influences are favourable to mid-April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/rio-tinto-plc-adr-nyserio-seasonal-chart

First Quantum Minerals $FM.CA a TSX 60 stock moved above $36.32 to an all-time high extending an intermediate uptrend Seasonal influences are favourable to early May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/first-quantum-minerals-limited-tsefm-seasonal-chart

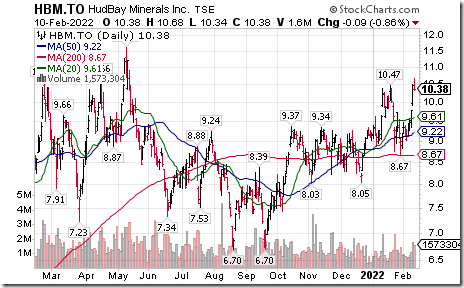

HudBay Minerals $HBM.CA a major base metal producer moved above $10.47 extending an intermediate uptrend. Seasonal influences are favourable to the end of April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/hudbay-minerals-inc-tsehbm-seasonal-chart

Fox $FOXA a NASDAQ 100 stock moved above $44.51 extending an intermediate uptrend.

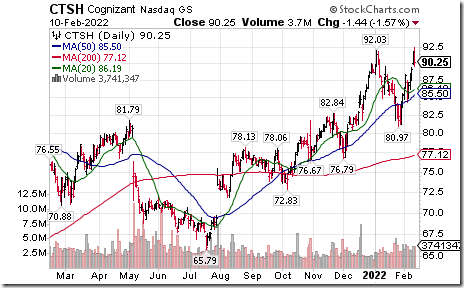

Cognizant $CTSH a NASDAQ 100 stock moved above $92.03 to an all-time high extending an intermediate uptrend.

Seagen $SGEN a NASDAQ 100 stock moved below $120.99 extending an intermediate downtrend.

Citigroup $C an S&P 100 stock moved above $68.11 resuming an intermediate uptrend.

Brookfield Asset Management $BAM.A.CA a TSX 60 stock moved above $78.67 to an all-time high extending an intermediate uptrend.

Trader’s Corner

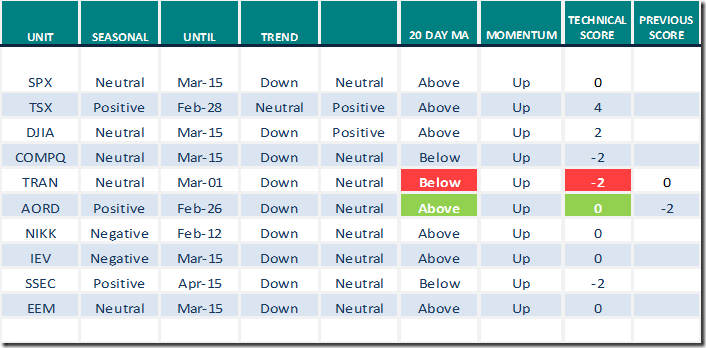

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.10th 2022

Green: Increase from previous day

Red: Decrease from previous day

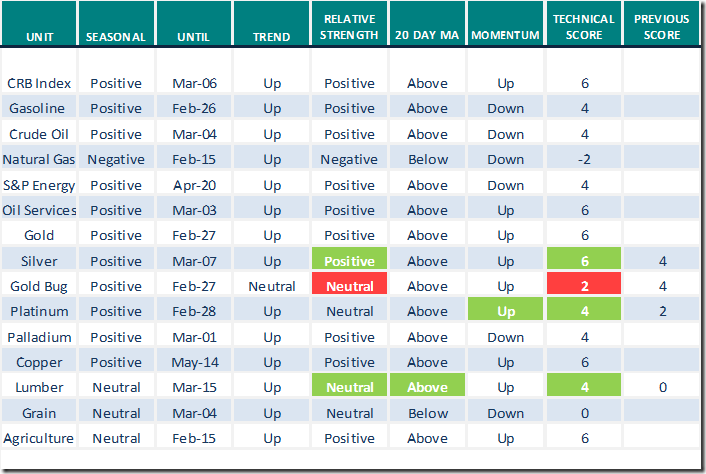

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.10th 2022

Green: Increase from previous day

Red: Decrease from previous day

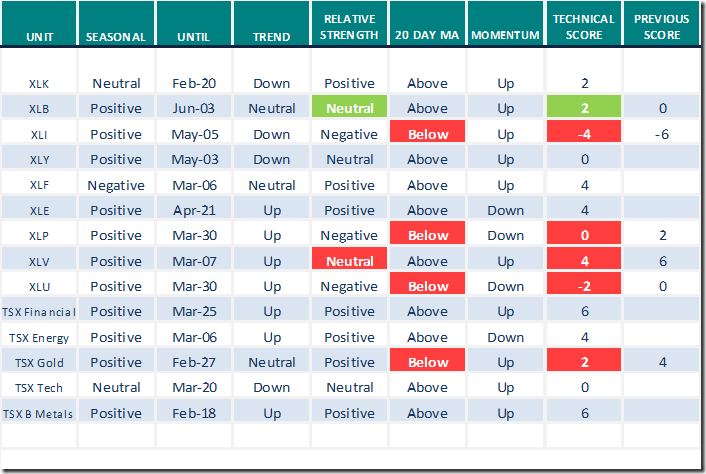

Sectors

Daily Seasonal/Technical Sector Trends for Feb.10th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from Valued Providers

Greg Schnell asks “Can large cap tech break out”? Following is the link:

Can Large Cap Tech Break Out? | The Canadian Technician | StockCharts.com

Greg Schnell says “Bankers enjoy the rate rise”. Following is a link:

Bankers Enjoy The Rate Rise | Greg Schnell, CMT | Market Buzz (02.09.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 9.46 to 42.77 yesterday. It remains Neutral.

The long term Barometer dropped 6.43 to 53.41 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 4.13 to 61.95 yesterday. It remains Overbought.

The long term Barometer eased 2.40 to 56.19 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.