by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

UnitedHealth Group $UNH a Dow Jones Industrial Average company moved above $464.48 to an all-time high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to early February. If a subscriber to EquityClock see:

https://charts.equityclock.com/unitedhealth-group-inc-nyseunh-seasonal-chart

IBM $IBM a Dow Jones Industrial Average stock moved above intermediate resistance at $123.14. Seasonal influences are favourable until mid-February. If an EquityClock subscriber, see:

https://charts.equityclock.com/international-business-machines-corp-nyseibm-seasonal-chart

Interesting Chart

The U.S. Dollar Index and its related ETN UUP moved below their 20 day moving average yesterday. Daily momentum indicators (Stochastics, MACD, RSI) have rolled over from Overbought levels.

U.S. Dollar Index is closely following its seasonal pattern for this time of year. The Index normally peaks in the third week in November and moves sharply lower to the end of the year. If a subscriber to EquityClock, see: https://charts.equityclock.com/us-dollar-index-futures-seasonal-chart Weakness is related to year-end transaction completed by major international companies before the end of the year.

Trader’s Corner

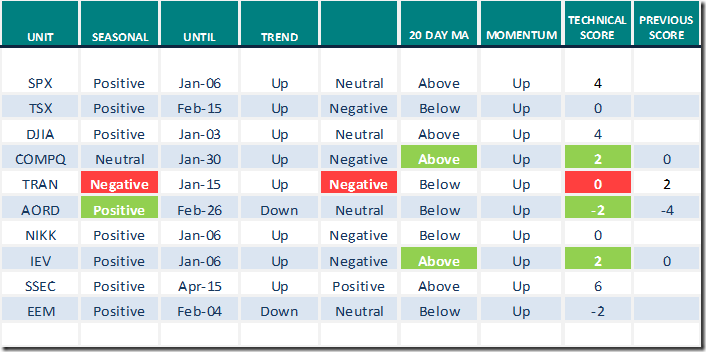

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.8th 2021

Green: Increase from previous day

Red: Decrease from previous day

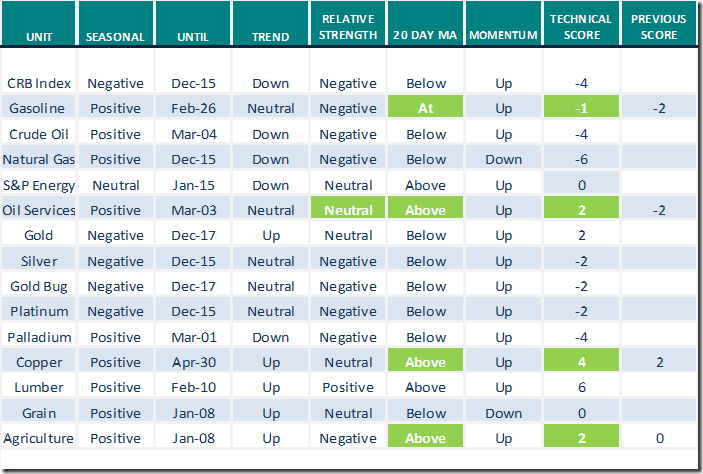

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.8th 2021

Green: Increase from previous day

Red: Decrease from previous day

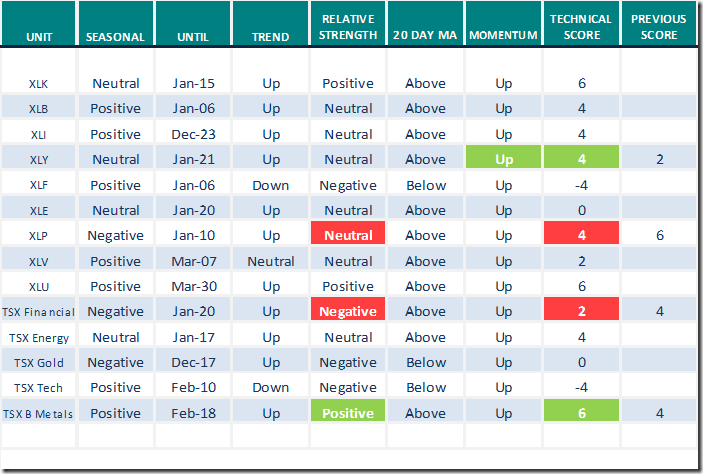

Sectors

Daily Seasonal/Technical Sector Trends for Dec.8th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Links from Valued Providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following links:

Six Stocks For a Housing Boom That Could Last a Decade – Uncommon Sense Investor

How Money Manager & 100-Bagger Author Chris Mayer Deals with Volatility – Uncommon Sense Investor

Market Buzz by Greg Schnell

Greg asks “Will These Be Hot Commodities in 2022”?

Will These Be Hot Commodities in 2022? | Greg Schnell, CMT | Market Buzz (12.08.21) – YouTube

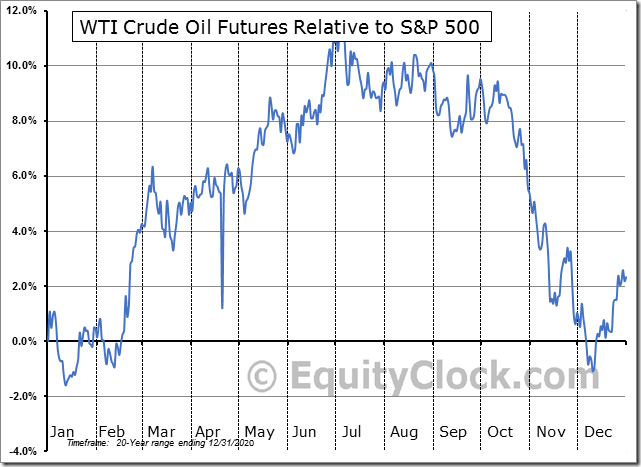

Editor’s Note: Check out Greg’s call on crude oil and the energy sector.

Looking back and planning ahead for 2022: Andrew Cardwell

https://www.youtube.com/watch?v=b51iyX5Z9c0

Editor’s Note: Andrew also is bullish on the outlook for crude oil.

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences on a real and relative basis for crude oil turn positive this week for a seasonal trade lasting at least until early March and frequently to the end of June.

Crude oil remains in a long term uptrend. Nice recovery above its 200 day moving average! Short term momentum indicators (daily Stochastics, RSI, MACD) just turned positive. Energy equities and related ETFs are outperforming crude oil, a favourable sign prior to a seasonal trade

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.60 to 63.73 yesterday. It remains Overbought and trending higher

The long term Barometer added 0.60 to 70.54 yesterday. It remains Overbought and trending higher.

TSX Momentum Barometers

The intermediate term Barometer slipped 2.76 to 41.01 yesterday. It remains Neutral.

The long term Barometer eased 1.38 to 57.14 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.