by Carl Tannenbaum, Executive Vice President, and Chief Economist, Ryan Boyle, and Vaibhav Tandon, Northern Trust

The Northern Trust Economics team shares its outlook for the U.S. economy.

Just one year ago, COVID-19 vaccines were not yet approved, gatherings were restricted amid surging cases, many schools and offices remained closed, and thoughts of moving past the pandemic seemed as realistic as visions of sugar plums. The transformation seen in 2021 has been historic, and the year is not ending quietly.

Inflation remains above target while economic data shows continued, robust growth. As a result, Fed officials surprised some observers with hints that they will normalize policy much more rapidly. We now expect a first interest rate increase from the Fed in mid-2022.

The year brought other challenges that our wondering eyes did not foresee, from new virus variants to persistent supply chain bottlenecks. Our economy’s ability to continue recovering despite those setbacks gives us confidence in another year of growth to come.

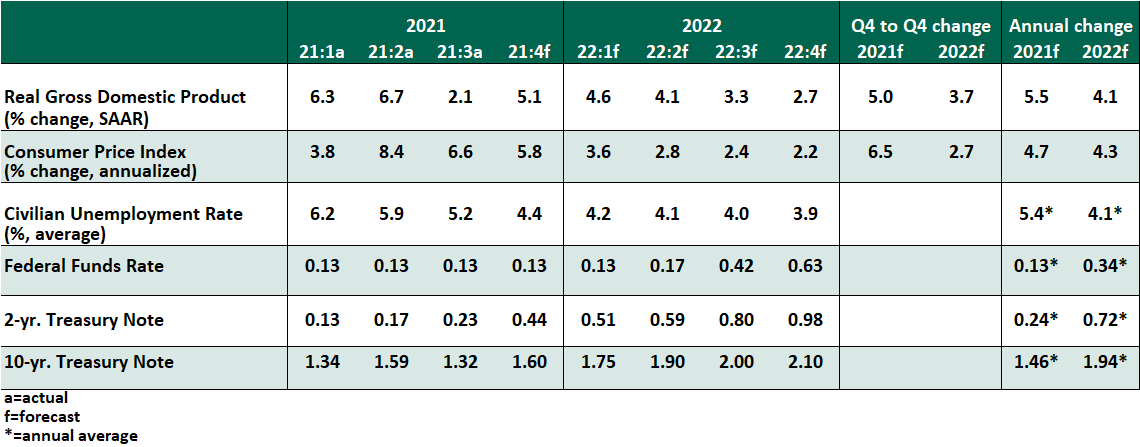

Key Economic Indicators

Influences on the Forecast

- Inflation continues its hot streak. In testimony before Congress, Fed Chair Jerome Powell suggested it is time to retire the word “transitory” in describing the current state of elevated prices.

- The October reading of the price index on personal consumption expenditures grew 5.1% year over year, or 4.1% on a core basis (excluding food and energy), far exceeding the Fed’s 2% target.

- Evidence is emerging that many prices have peaked. Gasoline is retreating slightly after inching higher most of the year, while natural gas futures suggest heating costs may not reach a worst-case scenario this winter. Inflation readings will stay elevated for the moment but are likely to retreat in the year ahead.

- Despite higher prices, personal consumption is growing in a balanced manner. Consumers’ inflation-adjusted purchases of goods grew 7.3% year over year in October, while services grew by 6.3%; the lockdown-driven shift toward consumption of goods is reverting. The personal saving rate fell to 7.3%, returning to its pre-pandemic norms.

- The second estimate of third quarter gross domestic product revealed corporate profits grew 21% year over year, continuing a year of gains. Productivity-enhancing investments, thinner payrolls, and higher prices are driving better profitability for many firms.

- November’s Employment Situation Summary showed further recovery, with the unemployment rate falling to 4.2%. The two component surveys diverged, with the household survey indicating a gain of over 1.1 million jobs, while the establishment survey showed only 210,000. Whatever the measure, the return to work is ongoing: the employment-population ratio for prime-age (25-54) workers climbed by 0.5% to 78.8%, continuing progress toward its pre-pandemic range of over 80%. With weekly unemployment claims returning to low levels, we expect the employment gains to persist.

- High inflation, growing employment, and robust economic activity are the recipe for rate hikes. The Fed has signaled it may accelerate its taper of asset purchases, and we expect an announcement to follow the December 15 meeting of the Federal Open Market Committee. Ending the taper clears the way for a rate increase, which we now expect in June 2022, with one additional hike to follow later in the year.

- Sentiment surveys reflect discontent. The Conference Board Consumer Confidence and National Federation of Independent Business Small Business Optimism indices have declined steadily from their June peaks, while the University of Michigan Consumer Sentiment index fell even lower than its COVID-19 trough in 2020. While inflation and lingering virus concerns are understandable, these very low perceptions are difficult to reconcile with rapid hiring, wage gains, elevated quits, asset market highs, strong spending and high profits. Confidence is an incomplete indicator of real outcomes.

- Congress’ extension of government funding into February 2022 removes the near-term risk of a shutdown. Running into the debt ceiling is a growing risk this month, and progress toward a more sustainable increase is welcome.

- The Omicron variant of COVID-19 rattled markets and has cast a shadow of uncertainty for all forecasters. We have not adjusted our forecast, but we will watch the variant’s progress closely. After surviving Delta, we believe the economy can work through similar new variants. Omicron’s greatest risk will be further shutdowns in exporting nations that add to the current challenges in supply chains.

Copyright © Northern Trust