by Schwab Center for Financial Research

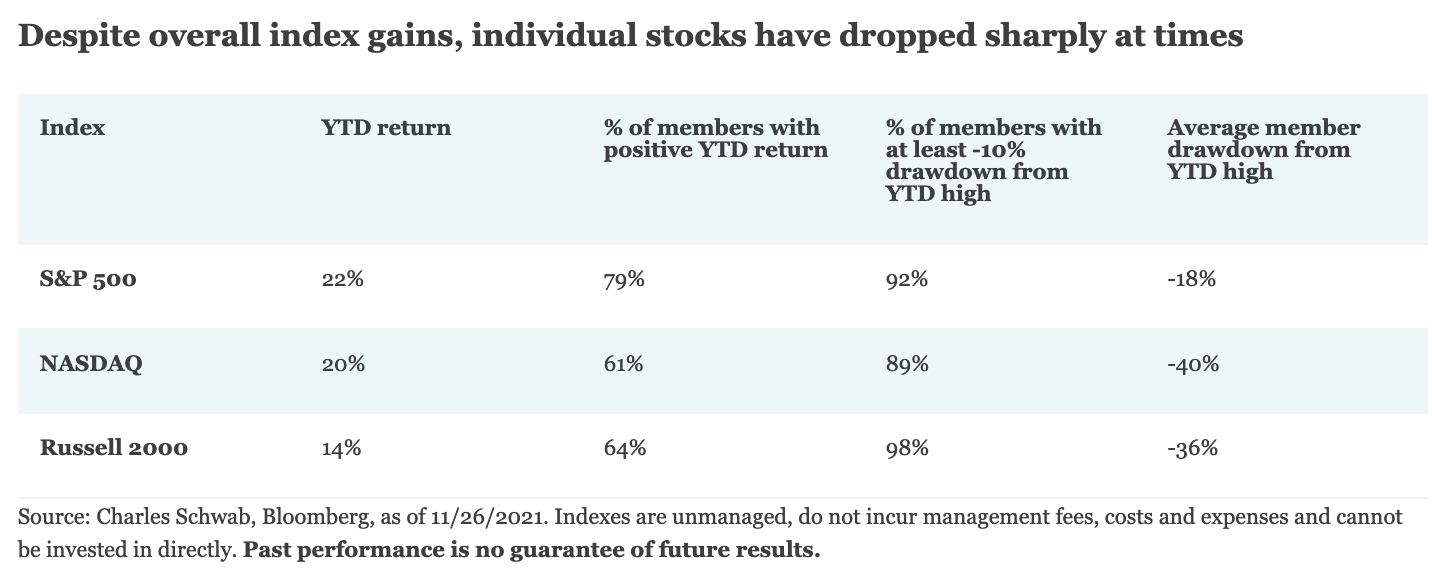

The S&P 500 index is up more than 20% so far this year, but more than 90% of its member stocks have had “correction” level drawdowns—more than 10% from a peak—at some point this year. In short, while overall stock market performance has been strong, there has been a lot of churn beneath the surface.

Will U.S. stock indices begin to reflect more of that weakness in 2022? It’s possible, especially as the world’s major central banks begin to drain the liquidity that has supported financial markets since the start of the COVID-19 pandemic in March 2020. But major uncertainties remain, including the pace of inflation, how central banks will react to it, and the direction of the virus.

Illustration by Charlos Gary. © 2021 Charles Schwab & Co., Inc.

U.S. stocks and economy: Under pressure

The 2020 pandemic-sparked recession was sharp and short at only two months. The rebound in economic activity also has been sharp, but uneven, as the services sector faced rolling social-distancing restrictions while demand for goods and materials surged. The question heading into 2022 is where the economy goes from here.

Illustration by Charlos Gary. © 2021 Charles Schwab & Co., Inc.

COVID-19 remains a risk. At the moment, it’s unknown whether its latest variant, omicron, will respond to current vaccines and treatments, and ultimately how disruptive it will be. What we’ve learned since the pandemic began, however, is that it’s the societal restrictions and/or lockdowns imposed that cause the most economic damage—and countries have had vastly different reactions in this regard. The pandemic also has exposed instability in complex global supply chains, possibly heralding a long-term environment of pervasive supply shocks, rather than the demand shocks that were more commonplace for much of the past two decades.

In terms of the U.S. stock market, for all the talk of its resiliency, there has been a significant amount of churn beneath the surface. Although major stock indices were up strongly year-to-date (as of Nov. 26th), most of their member stocks had undergone a drop of 10% at some point during the time period (since we published our U.S. market outlook on Nov. 26th, the average drawdowns have gotten a little worse because of recent market volatility).

Although these rotational corrections are preferable to watching the bottom fall out all at once, there is a risk that the major stock indices at some point will reflect more of the weakness that has persisted under the surface. Macroeconomic backdrops that include slower growth and tightening monetary policy tend to usher in higher intra-market correlations—that is, the potential for securities to rise and fall in tandem—as well as greater “tail risk,” i.e., the probability that an investment will move more than three standard deviations beyond its historical mean.

However, we’re in no way suggesting that investors should “get out” of the stock market. Neither getting in nor getting out is an investing strategy; they simply represent gambling on moments in time, whereas investing should always be a disciplined process over time.

This discipline should involve diversification—across and within asset classes—and periodic rebalancing (that is, trimming positions or asset classes that have appreciated and become overweight in relation to the rest of your portfolio, and moving the proceeds to assets that have become underweight). We also recommend focusing on high-quality stocks, those of companies that have characteristics such as strong balance sheets, healthy free-cash flow, and stable-to-improving earnings trends.

Global stocks and economy: Slowing but not slow

A high tide of growth, aided by a sea change in fiscal policy, is likely to help float the global economy safely over the rocks of risks in 2022, despite waves of worry emanating from COVID-19, inflation, materials shortages, and rate hikes.

Illustration by Charlos Gary. © 2021 Charles Schwab & Co., Inc.

New COVID variants (e.g., omicron) present risks to the global economic outlook, but the economic and market impact will likely depend on policymaker responses. Based on what we know now, those responses don’t appear likely to derail global growth. Prior COVID waves tended to be buying opportunities. Yet, markets could remain volatile as more information on variants becomes available.

Global gross domestic product (GDP) has surpassed its pre-pandemic level in 2021 and completed the transition from recovery to expansion, aided by strong policy support, the deployment of effective vaccines and the resumption of economic activities. In 2022, global GDP is anticipated to grow around 5%, forming the strongest back-to-back years for the world economy since the early 1970s.

The likelihood of additional fiscal support in Europe, Japan, and the United States combined with the spending of pent-up savings by consumers and businesses supports global growth prospects. China’s policies in 2022 may offer targeted support for favored industries, allowing economic growth to slow only modestly. Although monetary policy may begin to tighten, the slow pace of withdrawal from pandemic-era policies may limit any negative impact on stock valuations. Inflation pressures are likely to ease over the course of the year; some of 2021’s shortages may turn into gluts by the second half of 2022.

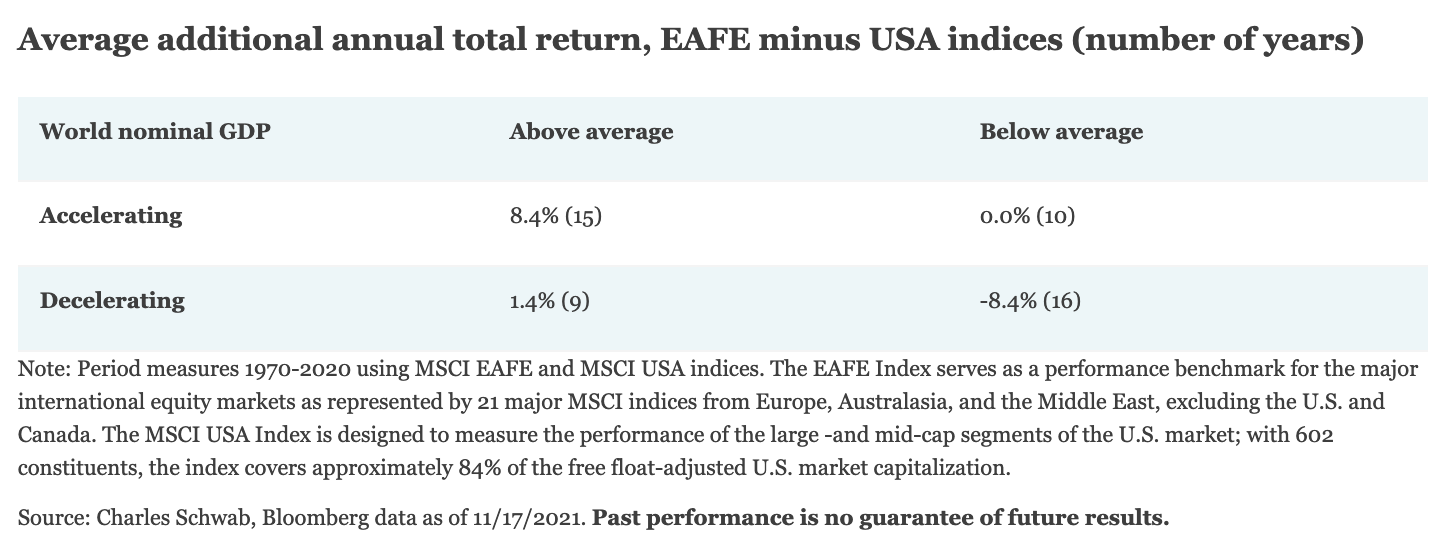

Historically, when global growth is above average, international stocks have tended to performed well, even when that growth rate is slowing, due to a high weighting in economically sensitive sectors, as you can see in the chart below.

Source: Charles Schwab, Bloomberg data as of 11/17/2021. Past performance is no guarantee of future results.

For investors, this underscores the importance of global diversification—making sure your portfolio includes an appropriate allocation to international as well as U.S. stocks, based on your goals, investing timeline and risk tolerance.

Fixed Income: Rough waters

It wasn’t exactly smooth sailing for fixed income investors in 2021. The faster-than-expected reopening of the economy from COVID-19 shutdowns early in the year led to a surge in yields during the first quarter, only to be followed by a plunge in the summer as virus cases rebounded. Inflation expectations have risen, but mostly for shorter time horizons.

We see more rough waters ahead in 2022, but also more potential opportunities for bond investors looking for income. Yields will likely move higher for all maturities with more volatility as the support from easy monetary policy ebbs.

Illustration by Charlos Gary. © 2021 Charles Schwab & Co., Inc.

The one trend that’s clear for 2022 is that the ultra-loose monetary policies pursued by central banks since the onset of the pandemic are ending. Less easy money circulating should mean higher interest rates and a decline in the relative value of risk assets, but the effects depend on the pace and magnitude of the policy shift.

When central banks tighten policy quickly, the yield curve—that is, the difference between short-term and longer-term yields—tends to flatten on expectations that a reduction in credit flowing to the economy will slow growth. When central banks are slow to tighten policy, the yield curve tends to steepen as it allows inflation pressures to build. For riskier segments of the fixed income markets, like high-yield corporate bonds, a series of fast rate hikes would likely cause a sharper decline in prices than a slow pace since it would signal the potential for a sharper slowdown in growth.

The Federal Reserve has signaled that it will taper its bond purchases, but it’s still unclear when it will pivot to rate hikes. Currently, the market is pricing in a series of rate hikes over the next two years. That’s well ahead of the Fed’s most recent estimates, which indicate a slower path of rate hikes. However, the market’s estimate of the peak in the federal funds rate (the terminal rate) is lower than the Fed’s estimate, implying a less pessimistic view of inflation long-term.

The Fed’s view of the path of rate hikes vs. the market’s view

Note: The 12/15/2027 eurodollar futures rate was used for the Longer-Run market rate.

Source: Bloomberg. Fed estimate as of 9/22/2021. The market estimate of the federal funds rate using eurodollar futures (EDSF). As of 11/10/2021.

As the tide moves out on the ultra-easy monetary policies of central banks in 2022, we suggest looking for potential opportunities to add to intermediate- and long-term bond holdings as yields move higher. While there may be periods when the yield curve steepens, long-term demand for low-risk bonds remains strong, as aging populations around the globe are driving up savings and the demand for safe yields. Bond ladders or barbells can be effective strategies for averaging into higher yields over time.

We also suggest a more careful approach to the riskier segments of the fixed income markets, such as high-yield corporate and emerging-market bonds. While current conditions are still positive, valuations appear stretched and vulnerable to a shift in the outlook for the economy.

Copyright © Schwab.com