by Don Vialoux, EquityClock.com

Wolf on Bay Street

Don Vialoux is a guest on Wolf’s weekly radio show released at 7:00 PM EST tomorrow (Saturday). Connect to HiFi Radio on Global News Radio 640 Toronto

Technical Notes released yesterday at

Short-term trend of the S&P 500 showing a declining megaphone pattern. equityclock.com/2021/12/01/… $SPX $SPY $ES_F $STUDY

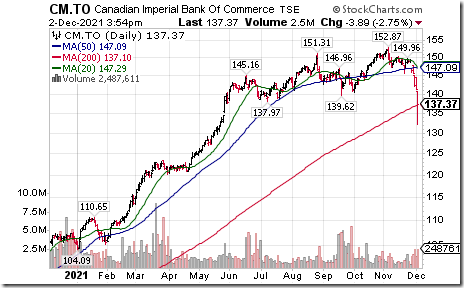

Commerce Bank $CM.CA a TSX 60 stock moved below $139.62 and $137.97 setting an intermediate downtrend.

Idexx Labs $IDXX a NASDAQ 100 stock moved below $597.84 extending an intermediate downtrend

Kirkland Lake $KL.CA a TSX 60 stock moved below $47.89 extending an intermediate downtrend

Another silvers stock breakdown! Hecla Mining $HL moved below $5.08 extending an intermediate downtrend. Tax loss selling pressures in the sector?

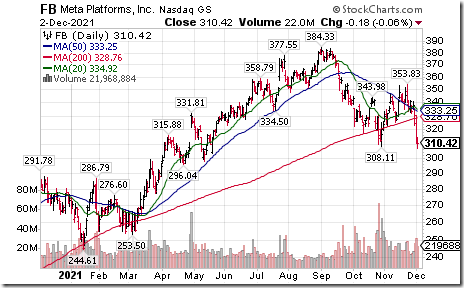

Facebook $FB an S&P 100 stock moved below $308.11 extending an intermediate downtrend.

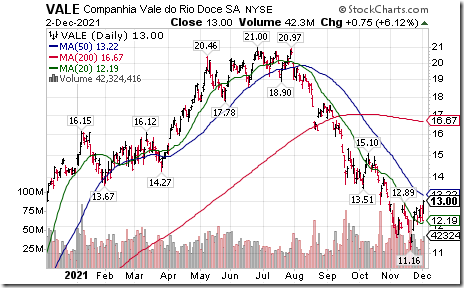

VALE $VALE one of the largest base metals producers in the world moved above intermediate resistance at US$12.89. Responding to rising demand for base metals under Biden’s "Build Back Better" program.

Trader’s Corner

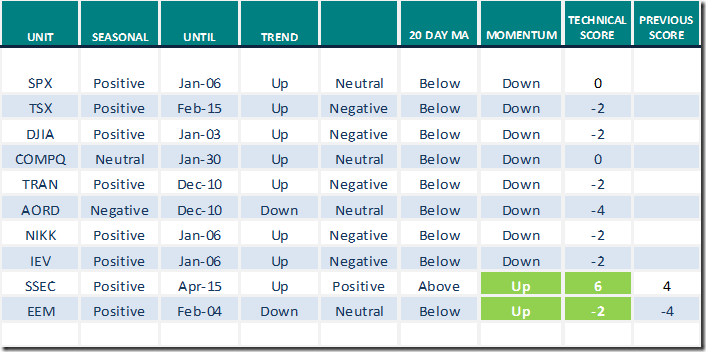

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.2nd 2021

Green: Increase from previous day

Red: Decrease from previous day

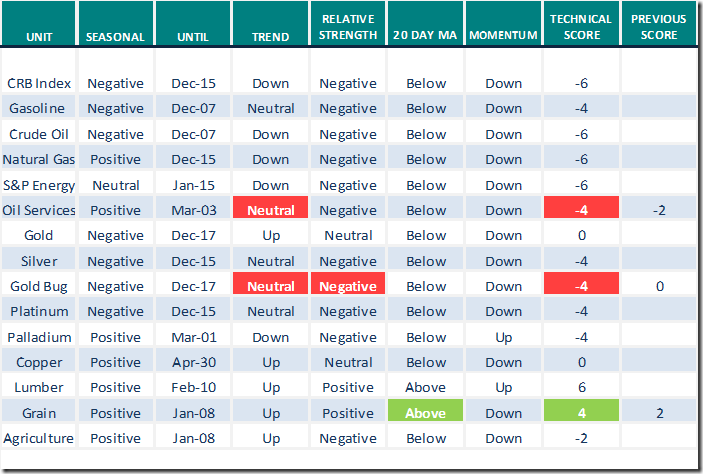

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.2nd 2021

Green: Increase from previous day

Red: Decrease from previous day

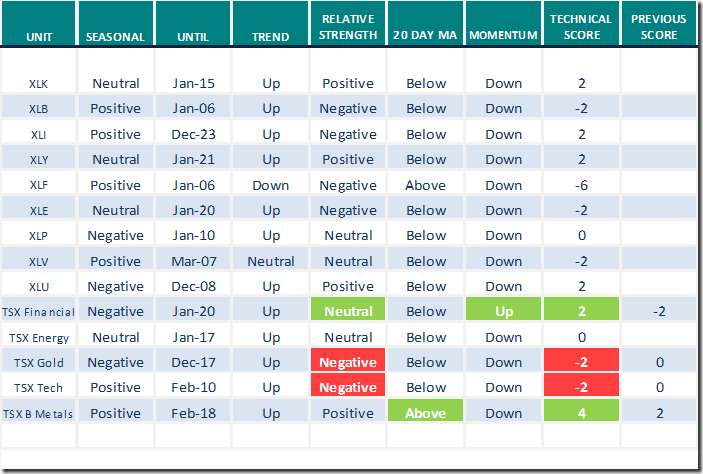

Sectors

Daily Seasonal/Technical Sector Trends for Dec.2nd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Market Buzz

Greg Schnell takes the journey to stock exchanges around the world demonstrating that the recent chart weakness in America might have some peers. Following is a link:

https://www.youtube.com/watch?v=LgS-iLx5U3w

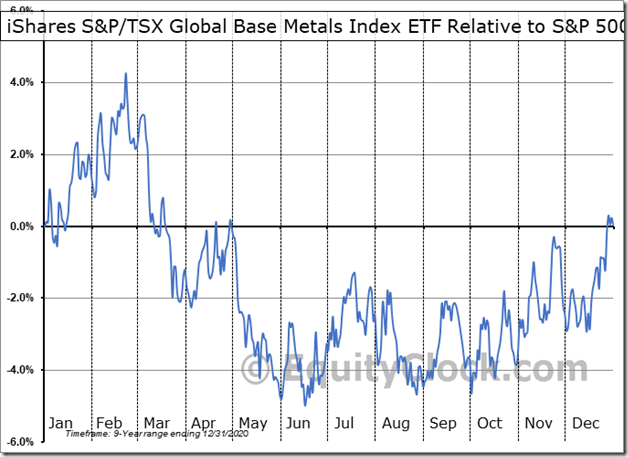

Seasonality chart of the day from www.EquityClock.com

Seasonal influences on a real and relative basis for base metal stocks and related ETFs (e.g. XBM.TO, PICK, COPX) are favourable between now and the third week in February.

Technicals for XBM are improving. Intermediate trend is up. Strength relative to the S&P 500 Index has just turned positive. Shares recently moved above their 20, 50 and 200 moving averages. The sector is a major beneficiary of Biden’s “Build Back Better” program.

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 14.03 to 43.29 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer added 7.82 to 61.52 yesterday. It changed from Neutral to Overbought on a return above 60.00.

TSX Momentum Barometers

The intermediate term Barometer added 7.83 to 29.95 yesterday. It remains Oversold.

The long term Barometer added 5.99 to 53.00 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.