By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

You’ve probably heard this already, but if you haven’t started your Christmas shopping, it might be a good idea to do so as soon as this weekend. Shipping bottlenecks are expected to persist well into 2022, driven by slow capacity growth, a shortage of containers and truckers and the ongoing semiconductor chip crunch, which has limited new truck production for last mile delivery.

These “perfect storm” disruptions have created numerous headaches for shipping and logistics companies. But as is often the case, bad news is good news, especially for investors who have seen shares of container lines surge in the 18 months since the pandemic began.

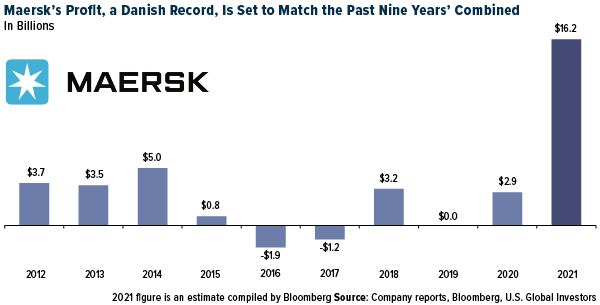

A.P. Moller-Maersk, the world’s largest carrier, has sailed up close to 190% in Copenhagen trading. Last month, Bloomberg analysts forecast that Maersk’s 2021 net income will end up somewhere in the neighborhood of $16 billion, which would be a record for not just the company but for any Denmark-listed company. (Danish pharmaceutical company Novo Nordisk holds the current record after having reported over $6.5 billion in profits in 2020.)

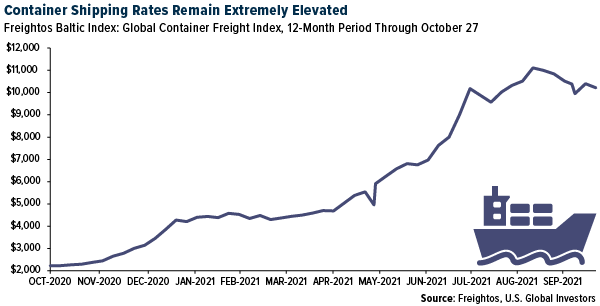

This is all thanks, of course, to unheard-of shipping rates. The Freightos Baltic Index, which measures global container prices, currently stands at an average $10,321 per 40-foot container. A year ago, the same container cost exporters only $2,231, or about four-and-a-half times less, to ship. To send just one container from Shanghai to Los Angeles, companies must now cough up a jaw-dropping $17,478, according to Freightos.

Looking at the chart above, you probably notice that rates are rolling over, and so you may infer that the market is in the process of normalizing. As much as that would provide consumers with some relief, we could be looking at several more months of global supply chain disruptions.

Morgan Stanley: Higher for Longer

That’s according to research by Morgan Stanley, which writes in a report this week that “the market may stay peaked for longer.” The investment bank expects shipping revenues to stay elevated at least through the second quarter of 2022. Quarterly earnings, then, may not have peaked yet, leaving plenty of upside potential for investors who seek to participate.

And then there’s the chip shortage. Like nearly everything manufactured today, new trucks don’t work without chips. This has hampered production.

President Joe Biden recently brokered a deal with ports in Los Angeles and Long Beach to remain operating 24 hours a day to help alleviate the shipping bottleneck, but if there aren’t enough trucks and truck drivers to move containers, then it doesn’t matter how late the ports stay open. At one point in the past week, as many as 100 ships—an all-time record—were waiting to unload their cargo outside LA and Long Beach, which together account for 40% of all containers entering the U.S.

Long story short, supply chain disruptions may be the new normal for at least the next six to 12 months.

This will cause logistics companies all sorts of headaches, but it could end up being very profitable for investors.

Shipping Is a Long-Term Growth Story

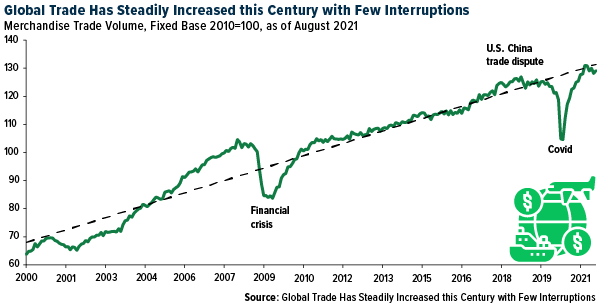

It’s important for investors to be aware, though, that everything I’ve said up to this point deals strictly with the short-term. Global trade and shipping are part of a long-term secular story, at the center of which is the global middle class. So far this century, trade has steadily increased with few interruptions as the number of people classified as middle class has continued to expand, particularly in China and India. Although the pandemic has stalled household income growth in some regions, an incredible 1 billion Asians are forecast to join the middle class by 2030, according to the World Data Lab. Most of these 1 billion people will seek a middle class lifestyle filled with middle class furniture, appliances, gadgets and more, all of which should support shipping and logistics companies years into the future.

Air Cargo Up Nearly 8% in August Compared to Pre-Pandemic Levels

It’s not just ocean freight that looks attractive right now. Air cargo companies are also benefiting from increased consumer demand, with cargo volumes up 7.7% in August compared to the same month in 2019, according to the International Air Transport Association (IATA). This is down slightly from 8.8% growth in July, but still a very solid report.

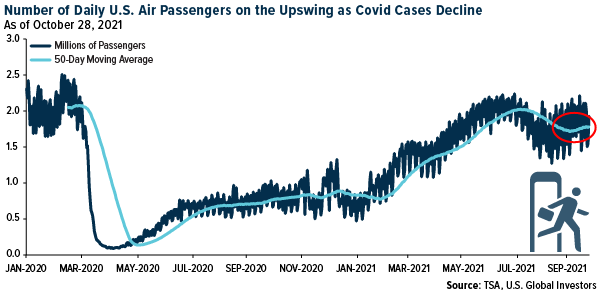

As for commercial air passenger volume, I’m pleased to see daily traffic as reported by the Transportation Security Administration (TSA) begin to recover following the Delta-impacted summer months. We’re still down some half a million daily passengers from 2019 levels, but the 50-day moving average suggests we’re in a growth stage.

We believe the next catalyst for growth will be November 8. That’s when certain restrictions will be lifted for travelers from China, India and most of Europe. These restrictions have been in place since the beginning of the pandemic in 2020, so it wouldn’t surprise me to see a huge influx of people who have been eager to visit the U.S.

Explore the 10 largest cargo planes in the world by clicking here!

Index Summary

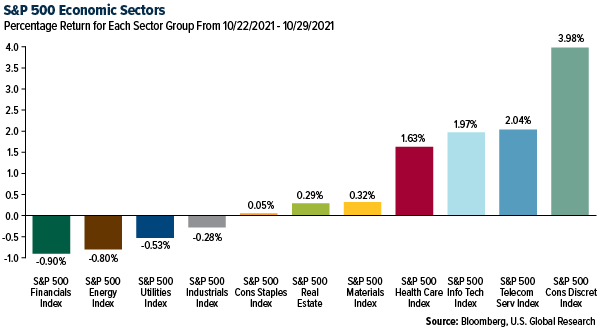

- The major market indices finished up this week. The Dow Jones Industrial Average gained 0.40%. The S&P 500 Stock Index rose 1.24%, while the Nasdaq Composite rose 2.71%. The Russell 2000 small capitalization index gained 0.33% this week.

- The Hang Seng Composite lost 3.11% this week; while Taiwan was up 0.58% and the KOSPI fell 1.18%.

- The 10-year Treasury bond yield fell 8 basis points to 1.55%.

Airline Sector

Strengths

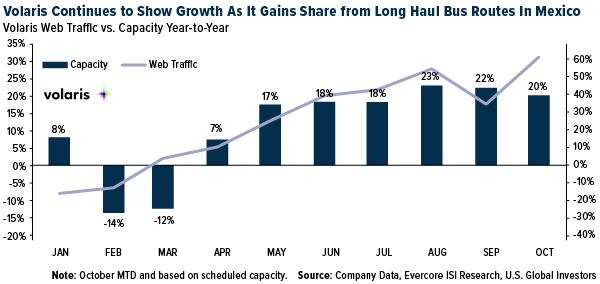

- The best performing airline stock for the week was Finnair, up 6.6%. Volaris continues to be one of the best performing airlines, driven by a shift from long-haul bus travel to airlines in Mexico. During the third quarter, Volaris unit revenue increased 11% versus total unit cost growth of 3% (on capacity growth of 21%) leading to an operating margin of 24%. Web traffic is indicating that bookings growth has accelerated into the fourth quarter.

- Overall fare trends for the scheduled domestic U.S. airlines were up this week as average close-in (one-week out) fares increased 10.1% (versus 15.5% last week) and the leisure (four-week out) fares gained 6.8% this week. Importantly, the fare trends are consistent with the recent industry commentary of improving demand from the lows of Delta variant-related weakness in mid-September with momentum gaining in recent weeks, (both in business and leisure).

- European airline bookings continued to trend upwards this week after a big step-up last week, with an increase in both international and domestic net sales as a proportion of 2019 levels. Intra-Europe net sales increased by 4 points to -23% versus 2019 levels (versus -27% in the prior week). This led to a 4-point increase in system-wide net sales for flights booked in Europe to -43% (versus -47% in the prior week). Both volumes and pricing improved, with intra-Europe prices remaining at just 3% below 2019 levels.

Weaknesses

- The worst performing airline stock for the week was SAS, down 17.5%. According to Goldman Sachs, JetBlue is expecting fourth quarter cost per available seat mile (CASM) ex-fuel to be up 14% to 16% versus 2019 levels, which is worse than the 12.7% it was in the third quarter as JetBlue's capacity cut will be steeper versus 2019 levels. Transitory cost headwinds will persist through year-end with higher jet-fuel prices, rents/landings fees, and ramp-up labor costs. “We view 2022 as a recovery year and expect investors will be focused on steady state earnings in 2023 and beyond,” they said.

- Hawaiian Air’s leisure seasonality, a pause in bookings around the COVID-19 Delta variant, and various state restrictions led to a weaker fourth quarter revenue outlook than expected at -37% (versus 2019 levels and compared to -33% in the third quarter). Fourth quarter operating expense, ex-specials and fuel, is guided to be down 7% to 11% versus 2019, which results in unit costs up 12.8% at the midpoint of the guidance range. Going forward, the company called out cost headwinds tied to rebuild costs related to the resumption of international travel, investments in technology, maintenance/the onboarding of a new fleet type (Boeing 787), and contractual wage increases.

- Allegiant Air is pointing to fourth quarter revenue being up 0.5% to 4.0%, worse than the third quarter’s 5.3% (partially due to lower capacity, but also lower revenue per available seat mile (RASM)). Fourth quarter CASM-ex fuel is expected to be higher than 6.3 cents reflecting lower capacity, elevated hiring/training and increased costs from the maintenance technician deal.

Opportunities

- For American Airlines, small business appears to account for 60% of its domestic business revenue, which has shown a faster recovery than large corporates. As such, American’s revenue recovery continues to outpace peers by 5 to 10 points going into the fourth quarter. American noted that July business revenue was driven by an 83% and 35% recovery in the small and large corporate segments respectively, implying a 60/40% mix.

- Daily website visits for E.U. airlines were up by 5 points to -11% versus 2019 in the week (versus -16% in the prior week). British Airways and Iberia showed the highest growth, at 17 points and 10 points respectively, although this is likely related to marketing activity.

- According to Bank of America, system net sales improved for the third straight week to down 46.5% versus 2019 for the week (versus last week's level of -50.9%). Domestic leisure (e.g., bookings through online channels) remained above 2019 levels at 6.0% versus 2019 (versus 4.4% last week). In the most recent data, international tickets improved to down 33.9% versus 2019 (compared to down 38.0% last week), which is the best level since the pandemic started. In their view, these bookings are likely useful for upcoming holiday travel and perhaps some planning for spring/summer 2022.

Threats

- According to Raymond James, for the second earnings call in a row, Southwest spooked investors with a disappointing cost outlook. Notably, transitionary cost pressure driven by inefficiencies and lower productivity is likely to take well over a year to reverse due to the time it will take to restore the core network following the opportunistic pull forward of growth into new airports. To return to historic productivity levels (for airports/airplanes), Southwest will need to restore much of the core network, which will take well over a year.

- According to Credit Suisse, state shareholding agency APE has no plans to reduce 29% holding in Air France-KLM over the coming years. This implies continued state ownership with the French stake doubling this year, making labor restructuring more challenging.

- Spirit introduced fourth quarter guidance, with adjusted EBITDA margins expected to be break-even to -5%, sequentially worse than the third quarter’s 1%. Assuming the midpoint of the rest of the company's fourth quarter guidance and D&A flat quarter-over-quarter implies fourth quarter revenue down 1%. This revenue outlook is worse than consensus, driven partially by lower capacity, but also worse RASM.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was Turkey, gaining 2.9%. The best performing country in Asia this week was Taiwan, gaining 0.82%.

- The Hungarian forint was the best performing currency in emerging Europe this week, gaining 0.33%. The Pakistani rupee was the best performing currency in Asia this week, gaining 1.4%.

- Economic confidence in the euro-area unexpectedly rose to 118.6 in October from 117.8 in September. Optimism in services made up for the concern in industry that a global supply squeeze will dampen production.

Weaknesses

- The worst performing country in emerging Europe for the week was Hungary, losing 1.9%. The worst performing country in Asia this week was Hong Kong, losing 3.4%.

- The Polish zloty was the worst performing currency in emerging Europe this week, losing 1.1%. The Chinese yuan was the worst performing currency in Asia this week, losing 0.32%.

- Chinese borrowers have defaulted on about $9 billion of offshore bonds this year, with the real estate industry accounting for one-third of that amount. Credit-rating downgrades of Chinese developers have accelerated further in October, hitting a record high for a second straight month.

Opportunities

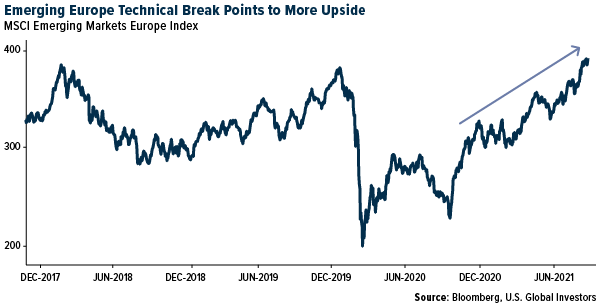

- Emerging European equities, as measured by MSCI Emerging Market Europe Index (MXMU), had a technical breakout this week pointing to more upside. Stocks recently passed above the pre-pandemic level last seen in mid-January of 2020. Russian equities have been outpacing other central emerging markets driven by higher oil and gas prices.

- PMIs in Europe most likely will remain at a strong level, well above the 50 mark that separates growth from contraction. It is likely that the Service PMI may slightly decrease, but the manufacturing activity in the euro-area should remain unchanged. The latest PMI data will be released on Monday.

- President Xi of China will participate and deliver a speech at the G20 leader’s summit via video link in Rome this weekend (October 30th and 31st). He will most likely not attend the climate summit (COP26), but China formalized its commitment to raising the share of renewable, non-fossil fuels in its primary energy consumption to 25% by 2030, higher than a previous pledge of 20%, and increasing wind and solar power capacity. The G20 meeting and the climate summit in Europe will present opportunity for global leaders to discuss ways to strengthen economic growth, overcome political tensions, and solidify action plans to combat climate change.

Threats

- A CLSA broker, who specializes in Asia, believes that the newly proposed pilot property tax program in China will be an enhanced version with more cities, higher rates, broader tax objects, and stricter implementation compared to the current property tax pilot in Shanghai and Chongqing. It is likely to discourage investment demand and lead to more secondary market supply from homeowners with multiple units. Together with the unsolved Evergrande liquidity issue, the pilot property tax could potentially deepen the property market downturn.

- Winter is approaching and some regions of the world are seeing spikes in COVID-19 cases. Russia and the Czech Republic are reporting a higher number of infections. China this week placed the city of Lanzhou in lockdown. It has a population of around 4.3 million and it is home to an oil refinery, industrial metals plants and petrochemical complexes. China’s zero tolerance strategy for COVID-19 cases and a recent increase in restrictions will further slow economic growth during the fourth quarter.

- Turkey's central bank raised its year-end inflation projection to 18.4%, from a previous forecast of 14.1%. It predicted a slowdown to 11.8% by the end of 2022, but that's an upward revision from 7.8%.

Energy and Natural Resources Market

Strengths

- The best performing commodity for the week was corn, up 5.76%, on ethanol surge and harvest delays. Chinese purchases are running higher than last year while rains are slowing the harvest in the U.S. Inflation in the U.S. shale patch is “money in the bank” for fracking companies. Prices for drilling services are rising faster than the cost of labor and raw materials, Richard Hubbell, chief executive officer at pressure pumper RPC Inc., said Wednesday in an earnings statement. He echoed similar comments last week from Halliburton Co., the world’s biggest fracking provider. As a rally in crude and natural gas prices boosts explorers’ cash flow after a disastrous 2020, oilfield service providers are trying to win back pricing power.

- Cushing crude oil inventories are at risk of reaching tank bottoms within weeks given continued draws. Cushing stocks have declined by in excess of 4 million barrels over the past two weeks to 31 million barrels, with further draws potentially causing inventories to test the 20-million-barrel level generally understood as necessary to maintain normal operations (levels last reached in July 2014). The tightness in supply represents a sharp reversal from the storage glut at Cushing last year in the depth of the Covid crisis that briefly drove prices to negative territory. Demand for U.S. light sweet crude continues to be high globally, particularly given lower sulfur content than certain other grades that require hydrocracker refining reliant on hydrogen.

- Chemical and fertilizer prices are continuing to increase. U.S. Midwest potash prices surged $25 per ton this week to $802 per ton and Brazilian prices rose $10 per ton this week to $775 per ton. U.S. DAP/MAP prices also rose $40 per ton this week to $715 per ton. U.S. export PVC prices increased $45 per ton this week to $2,050 per ton, an all-time high. Export prices are $200 over domestic markets, supporting a November contract price increase.

Weaknesses

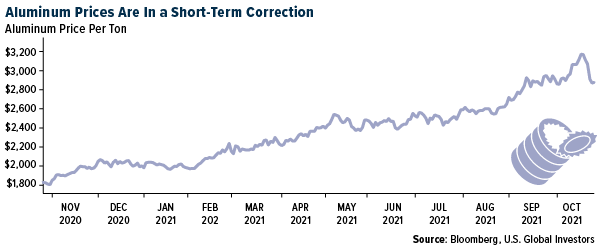

- The worst performing commodity was lumber, down 15.11% for the week as the world’s biggest lumber producer, West Fraser Lumber Co. Ltd. said it has begun to increase production. Aluminum fell to the lowest in more than three weeks, with most metals retreating on concerns about slowing Chinese demand. After hitting a record high earlier this month, metals prices slumped last week as worries mounted that an energy crunch may hurt manufacturing demand, along with concerns about a debt crisis in China’s property market.

- China’s September crude output declined for the fifth consecutive month, down 11.4% month-to-month to 73.8 million tons. Daily crude steel output dipped 8.4% to about 2.46 million tons. Steel industry PMI in North China’s Hebei province, retreated for the second consecutive month, down 4.3 points this month to a 19-month low of 43. China steel mills’ utilization rate eased by 0.6 points this week to 80.5%.

- World steel output fell 3.3% this month due to lower Chinese output. European Union prices fell 5-7% this month and U.S. prices finally fell 3% this month from record levels, due to automotive weakness and rising import pressure. Chinese prices fell 2-3% this month due to weaker demand.

Opportunities

- Sibanye Stillwater said it is in talks to acquire the Santa Rita nickel and Serrote copper mines in Brazil as the South African platinum giant seeks to bolster its position in battery metals. A deal would further Chief Executive Officer Neal Froneman’s goal of building a presence in the metals that are key to powering electric vehicles and the wider green revolution. Sibanye has already acquired lithium assets in Europe and the U.S. this year and a nickel processing facility in France.

- According to Morgan Stanley, LNG demand is set to rise at 2X the rate of supply through 2025. While prices likely moderate from current levels, they should average 60% higher over the next five years. Since the start of 2020, the group’s forecast for total supply has fallen by an average of 5% through 2025, while their demand estimates over the same period have trended the other way, up 5%. On top of that, capacity outages, low inventories and tightness across alternative fuels markets have helped push global prices higher, setting all-time highs in recent weeks.

- Aluminum continues to have a bright outlook. The market is extremely strong and there’s a tightness that “we have not seen since 1987,” Norsk Hydro CFO Pal Kildemo said in a Bloomberg TV interview. He cited short-term issues such as supply chain problems, as well as longer term ones such as the auto industry using more aluminum. Aluminum prices have rallied more than 50% in the past year.

Threats

- Statements by Russia's President Vladimir Putin late last week suggest Russian gas exports to Europe might increase from current levels despite the low Yamal capacity booking announced for November. These statements, along with Germany's Economy Ministry analysis released earlier this week saying Nord Stream 2 certification would not pose a risk to the EU’s security of supply, have driven a $3 per mmBTU sell-off in gas prices over the past week, to $29 per mmBTU.

- Exxon Mobil Corp. is weighing salary increases as it tries to halt employee attrition across its business divisions after sweeping job and benefit cuts. Chief Executive Officer Darren Woods told employees at a town hall-style meeting that they should be “encouraged” by the ongoing salary-review process, according to a recording of the event. “The policies we’re putting in place will get us back to where people can begin to see a different path going forward than what we came out of in 2020,” he said at the gathering in suburban Houston.

- Cracks are emerging in the global solar industry, threatening to flatten its growth trajectory just as the world needs clean power more than ever. The sector is being slammed by a barrage of obstacles, with rising materials costs, forced labor accusations and a worsening trade war all hitting at once. As a result, panel prices are rising for the first time in years, and some manufacturers have asked buyers to delay purchases if they can.

Domestic Economy and Equities

Strengths

- October Chicago PMI data was reported higher by 3.7 points month-over-month, spiking to 68.4 and beating consensus for 63.7. It was the first increase in three months. Final October Michigan Consumer Sentiment was reported higher by 0.3 points reaching 71.7. And the final October expectations and conditions indexes were revised up from the preliminary prints.

- Initial jobless claims were reported at 281,000 for the latest week beating 290,000 consensus and the prior week's upwardly revised 291,000. It was a fresh pandemic low and the third consecutive week of claims below 300,000. Continuing jobless claims were reported at 2,243,000, below consensus for 2,350,000 and last week's downwardly revised 2,480,000.

- Enphase Energy, a solar panel producer, was the best performing S&P 500 stock for the week, increasing 31.05%. Shares gained after the company announced strong third quarter results.

Weaknesses

- Gross domestic product in the third quarter was released at 2.0% versus 2.6% expected, weaker than the second quarter which recorded a growth of 6.7%.

- Heavy-weighted technology companies reported earnings misses this week. Apple missed on revenue (for the first time since 2017) and the company flagged a $6 billion headwind from supply constraints and expectations for an even bigger drag in the month of December. Amazon missed as well; the company’s growth was hit by the labor crunch and rising costs. Facebook reported weaker earnings per share as well.

- Twitter was the worst performing S&P 500 stock for the week, losing 13.98%. Twitter Inc. tumbled 11% on Wednesday, the biggest drop in six months, after the social-media company’s third-quarter revenue and fourth-quarter sales outlook trailed Wall Street projections.

Opportunities

- President Biden announced a deal on a $1.75 trillion framework investment package to be spent over the span of 10 years. The framework includes $400 billion to help provide subsidized childcare for more than 6 million children and tuition-free preschool for 3- and 4-year-olds, along with $555 billion for clean energy initiatives, including a $320 billion in tax credits over 10 years to help Americans pay for environmentally friendly home improvements and to help corporations transition to clean-energy manufacturing. President Biden is confident the package will have support of all 50 Democratic senators and that it will pass in the House.

- Bloomberg economists predict ISI manufacturing PMI to remain strong in October at 60.3, slightly lower than the 61.1 reported in September. The Manufacturing PMI will come out November 1 and the Service and Composite PMIs will be released November 3.

- Initial jobless claims will most likely continue to decline next week. Nonfarm payrolls and private payrolls are expected to increase. Bloomberg economists are expecting the unemployment rate to decline by 0.1% to 4.7% in October from 4.8% in September.

Threats

- The Bank of Canada ended its bond buying program and accelerated the potential timing of rate increases amid inflation concerns. Brazil delivered its biggest hike in nearly two decades to 7.75%. Some countries in emerging Europe started to hike rates as well, with Russia being the most aggressive. The Federal Reserve may soon announce its strategy on how to combat rising inflation in the United States.

- A Fed meeting will take place next week. The rates will stay unchanged, but we may hear more policymakers talking about pulling some pandemic stimulus money out of the system. The big question remains when will the Federal Reserve start reducing its $120 billion in monthly asset purchases to stimulate the economy? FactSet reported that the Fed is expected to announce that it will begin tapering, likely in mid-November, and likely at a pace of $15 billion a month.

- Many businesses are raising wages and offering more flexible working conditions as they struggle to hire and retain staff, according to a UBS survey. Over 80% of respondents to the survey said they are having problems with both recruitment and retention of staff. It found 74% of firms globally are offering more flexible hours, 71% on more choice in work locations and 66% have increased base wage pay as a method to solving the labor problem.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Aigang (AIX), rising 66,384.61%.

- The Wharton School of business at the University of Pennsylvania, one of the nation’s premier business schools, plans to accept cryptocurrency as tuition payment for its online blockchain and digital assets program. The Ivy League’s program will accept digital coins such as Bitcoin as a method of payment for the $3,800 course, according to Bloomberg.

- Cryptocurrency miners are hoarding Bitcoin, writes Kraken, creating supply shocks that help boost prices even further. An indicator called the 0-hop supply, that determines whether miners are holding onto coins they’ve mined, has risen about 50% since September, said Kraken. The supply shock and demand is putting Bitcoin in a strong position to potentially trend higher.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Wolf Safe Poor (WSPP), down 99.98%.

- Coinbase and Robinhood shares fell drastically this week after Robinhood reported earnings and cryptocurrency transactions plunged from the preceding period. The popular app for stock trading, Robinhood revealed a big revenue miss for the third quarter, owing to a big fall in Bitcoin trading.

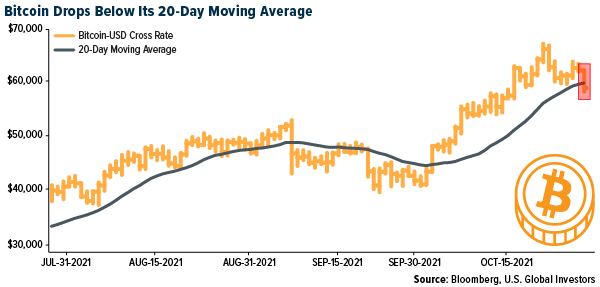

- Bitcoin slid below $60,000 this week as euphoria over the first U.S crypto futures ETF dissipated and traders took profits following a record-breaking rally, writes Bloomberg. Bitcoins broke its 20-day moving average which could invite more selling.

Opportunities

- A $100 billion Vanguard crypto market ETF is possible, reads one Bloomberg headline this week. After the launch of the first Bitcoin futures ETF last week, the momentum could lead to a total-market cryptocurrency ETF that’s physically backed, cheap and highly liquid. Vanguard could issue such a product, or one of its rivals will, writes Bloomberg ETF analysts Eric Balchunas and James Seyffart.

- The U.S seems to be taking the Bitcoin mining crown after China’s crackdown on the digital currency market. According to an article published by the Wall Street Journal, more than one-third of global computing power dedicated to mining Bitcoin is now drawn from machines in the U.S., which is up from less than one-fifth since last spring. Samir Tabar, Bit Digitals CEO, called China’s crackdown “an unintentional gift to the U.S.”

- Ethereum soared to a record level above $4,400 on Friday following bullish sentiment surrounding an upgrade on the Ethereum network. The popular cryptocurrency has outperformed Bitcoin throughout 2021 with a sixfold increase thanks to retail and institutional interest in the space, writes Bloomberg.

Threats

- China’s technology giants are playing down their links to non-fungible tokens amid concerns that this area of the crypto universe may be the next target for regulators. The move could be speculation that another possible crackdown is coming from the CCP, writes Bloomberg.

- In an interview on CNBC, Nassim Nicholas Taleb, the author of “The Black Swan,” states that crypto doesn’t hedge anything, “not inflation, not the stock market, nothing.” He calls it a “grandiose scam” and adds that crypto makes the Nasdaq from 2000 look rational, writes Bloomberg.

- The Financial Action Task Force, an international body that coordinates government policy on illicit finance, released new guidelines that could force cryptocurrency firms to take greater steps to combat money laundering. A representative of the crypto industry criticized the guidelines saying they would undermine privacy and innovation, writes Bloomberg.

Gold Market

This week spot gold closed the week at $1,783.38, down $9.27 per ounce, or 0.52%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.75%. The S&P/TSX Venture Index fared better with a gain of 0.17%. The U.S. Trade-Weighted Dollar rose 0.51%.

DateEventSurveyActualPrior

Oct-26Hong Kong Exports20.6%16.5%25.9%Oct-26New Home Sales756k800k702kOct-26Conf. Board Consumer Confidence108.0113.8109.8Oct-27Durable Goods Orders-1.0%-0.4%1.3%Oct-28ECB Main Refinancing Rate0.000%0.000%0.000%Oct-28Germany CPI YoY4.4%4.5%4.1%Oct-28Initial Jobless Claims288k281k291kOct-28GDP Annualized QoQ2.6%2.0%6.7%Oct-29CPI Core YoY1.9%2.1%1.9%Oct-31Caixin China PMI Mfg50.0--50.0Nov-1ISM Manufacturing60.3--61.1Nov-3ADP Employment Change400k--568kNov-3Durable Goods Orders-----0.4%Nov-3FOMC Rate Decision (Upper Bound)0.25%--1.9%Nov-4Initial Jobless Claims278k--1.9%Nov-5Change in Nonfarm Payrolls400k--1.9%

Strengths

- The best performing precious metal for the week was gold, but still off 0.52%. Gold remained range bound as traders weighed concerns over the world’s economic recovery, which is supporting demand for haven assets, against prospects of tighter monetary policy. The collapse in the global sovereign-debt yield curve is accelerating, sending a foreboding signal to central banks that a withdrawal of stimulus risks triggering a slowdown in economic growth.

- Funds raised by junior and intermediate companies totaled $5.5 billion in 2020, the most since 2012 and a clear sign of heightened investor confidence in the yellow metal. This has allowed the junior sector, which had been on a general downtrend in terms of exploration since 2012, to fund its exploration plans. Additionally, the late field start for many companies in 2020 due to pandemic-related lockdowns caused some planned spending to run over into 2021. There are more than 200 additional companies exploring for gold in 2021 than in 2020. At 1,328 companies, that’s the most since 2012.

- Gold exploration budgets have increased 43% year-over-year to a total of $6.2 billion in 2021, outpacing the 35% increase in the global nonferrous exploration budget. Gold's surge has been driven by multiple factors, including a strong price performance, higher junior company financings and exploration plans carried over from 2020. Although the gold price has since retreated somewhat, it has averaged $1,800 an ounce in 2021, holding the interest of explorers and producers alike in exploration for the precious metal.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.09% despite bullish positioning in the futures market rising to a 19-week high. Newmont reported disappointing earnings. Revenues of $2.90 billion were 8% below consensus. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) of $1.32 billion was 18% below consensus. Adjusted earnings per share (EPS) of $0.60 per share was also below consensus of $0.74. Attributable gold production was 1.45 million ounces, below consensus of 1.61 million ounces, mainly on lower throughput at Boddington, Nevada Gold Mines and Tanami.

- Reuters reported that a Iamgold convoy was attacked in Burkina Faso and that several people could be missing, pushing the share price off more than 5% for the day. The assailants lit the buses on fire before leaving.

- Mine safety, as measured by fatalities, has deteriorated in South Africa according to the Minerals Council lobbying group. Since the start of the year, the number of deaths has risen to 55 versus 43 in the same period last year. This means that safety trends are set to deteriorate for a second year after 60 workers died in accidents last year. The lowest year on record for fatalities was 2019, with just 51.

Opportunities

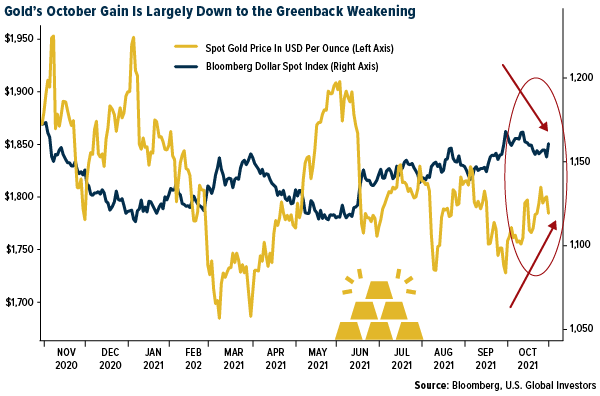

- Gold broke a two-month losing streak in October thanks in part to the dollar weakening, which largely offset monetary tightening sooner than thought theme. Gold may hit a fresh record high in the next 12 months as investors seek haven from a buildup of inflationary pressures. That’s the view of Agnico-Eagle Mines CEO Sean Boyd, who expects bullion to surpass the current record of $2,075.47 an ounce reached in August last year. “Inflation is not transitory,” Boyd said in a phone interview, noting that costs pressures are “more sticky” than three months ago. “We’ll see higher inflation as we move down the road, which is generally a very favorable environment for gold.”

- Transactions are picking up. Calibre Mining and Fiore Gold announced that they have entered into a definitive arrangement agreement whereby Calibre will acquire all of the issued and outstanding common shares of Fiore. West African Resources has struck a deal to acquire the Volta asset from B2Gold in a stagged cash and stock transaction.

- K92 Mining announced that the strike extension for the J1 Vein at 3.9 meter thick was extended in total for another 211 meters in strike with an average grade of 21.69 grams per tonne. At the Northern extension over 97 meters were added and on the Southern extension over 114 meters extended in strike. The development drives continue to encounter solid geotechnical competency with the development work. Long hole drilling has commenced at the Judd Vein System with the first production stope targeted for production in the fourth quarter. The Judd Vein represent an entirely new ore source for the mill, increasing flexibility in the mine plan.

Threats

- At least one person was killed during protests against evictions near Barrick Gold’s Kibali gold mine in northeast Democratic Republic of Congo last week, the local governor’s office said on Monday. Two villages near the mine, where residents had previously been resettled from, have been occupied by local people in recent months, “in violation of the rights of the company Kibali goldmines,” the Haut Uele governor’s office said in a statement. “Shots were fired and at least one death and several wounded have been confirmed,” the governor’s office said, referring to Friday’s confrontation between settlers and police.

- Silver’s on a slippery slope as the unwinding of pandemic-era stimulus and industrial disruptions from the global energy crisis threaten recent gains. The metal is poised for the first monthly advance since May, alongside gains in gold, on concerns that power shortages and supply-chain snarls will keep inflation persistently high. Whether or not China has a soft landing from its current energy crisis will also be crucial to silver’s price outlook as the metal is more leveraged to manufacturing activities there, according to Aakash Doshi, an analyst at Citigroup In.

- Next week’s Federal Open Markey Committee (FOMC) meeting will likely be a focus point for investors to draw lines in charts, as if were sand, to mark their trigger points. Unsurprisingly, trade directions get pushed on gold until the other side yields. Heightened gold volatility around timing of the Fed announcement consistently draws a statement as if to be settling an argument. Better to be patient and buy the dips, if they come, as the path of least resistance is likely higher given the current balance sheet of the government.

Leaders and Laggards

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2021):

Amazon.com Inc

Apple Inc

American Airlines Group Inc

Allegiant Travel Co.

Hawaiian Holdings Inc

JetBlue Airways Corp.

Southwest Airlines Co.

Spirit Airlines Inc

Halliburton

Sibanye Stillwater

AP Moller-Maersk A/S

West Fraser Timber Co. Ltd.

IAMGOLD Corp.

Calibre Mining Corp.

Fiore Gold Ltd.

K92 Mining Inc.

Barrick Gold Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

EBITDA stands for a company's earnings before interest, taxes, depreciation, and amortization. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The University of Michigan Confidence Index is a survey of consumer confidence conducted by the University of Michigan. The report, released on the tenth of each month, gives a snapshot of whether or not consumers are willing to spend money. The Freightos Baltic Daily Index measures the daily price movements of 40-foot containers in 12 major maritime lanes. It is expressed as an average price per 40-foot container. The Bloomberg Dollar Spot Index (BBDXY) tracks the performance of a basket of 10 leading global currencies versus the U.S. Dollar.

Copyright © U.S. Global Investors