by Don Vialoux, EquityClock.com

The Bottom Line

Most North American equity indices moved lower last week. Equity indices moved sharply lower early last week, but recovered most of the losses by the end of the week. Greatest influences on North American equity markets remain evidence of a possible third wave of the coronavirus (negative) and continued expansion of distribution of a vaccine (positive).

Observations

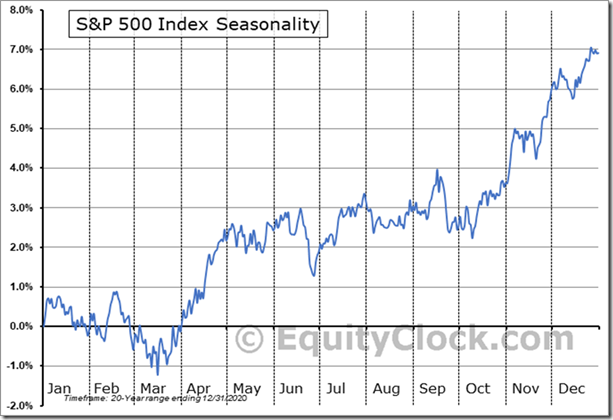

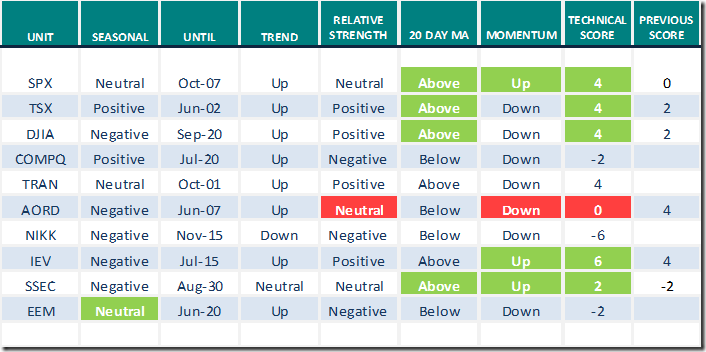

The S&P 500 Index is following its historic seasonal pattern for this time of year, a mixed, choppy period between early May and the second week in October. Average return during this period is close to zero. Positive returns are possible by selecting sector investments that outperform during the period.

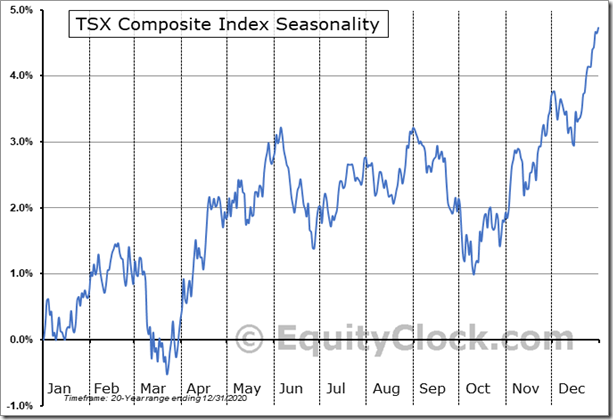

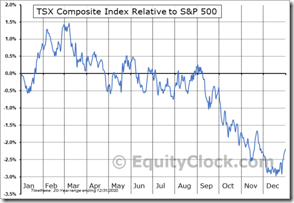

Last week, the TSX Composite Index followed its historic pattern by outperforming the S&P 500 Index on a relative basis until early June.

Short term short term indicators for U.S. equity indices, commodities and sectors (20 day moving averages, short term momentum indicators) moved slightly lower last week.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved lower last week. It changed from Extremely Overbought to Overbought. See Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average) moved slightly lower last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors moved lower last week.

Medium term technical indicator for Canadian equity markets moved lower last week. It remained Overbought. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) moved slightly lower last week. It remained Overbought. See Barometer chart at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase last week. Ninety one percent have reported results to date with 86% reporting higher than consensus earnings estimates and 76% reporting higher than consensus revenue estimates. According to www.FactSet.com earnings in the first quarter of 2021 on a year-over-year basis are expected to increase 50.3% (versus previous estimate at 49.4% last week) and revenues are expected to increase 10.1% (versus previous estimate at 10.0% last week). Earnings in the second quarter are expected to increase 59.3% (versus previous estimate at 59.5%) and revenues are expected to increase 18.6% (versus previous estimate at 18.7%). Earnings in the third quarter are expected to increase 22.1% (versus previous estimate at 22.7%) and revenues are expected to increase 11.5% (versus previous estimate at 11.4%). Earnings in the fourth quarter are expected to increase 16.8% (versus previous estimate at 16.7%) and revenues are expected to increase 8.6%.. Earnings for all of 2021 are expected to increase 33.2% (versus previous estimate at 32.9%) and revenues are expected to increase 11.6% (versus previous estimate at 11.5%)

Economic News This Week

April Canadian Housing Starts to be released at 8:15 AM EDT on Monday are expected to drop to 250,000 units from 335,200 units in March.

May Empire State Manufacturing Survey to be released at 8:30 AM EDT on Monday is expected to slip to 24.00 from 26.30 in April

April U.S. Housing Starts to be released at 8:30 AM EDT on Tuesday are expected to slip to 1.710 million units from 1.759 million units in March.

April Canadian Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.1% versus a gain of 0.5% in March.

May Philly Fed Index to be released at 8:30 AM EDT on Thursday is expected to slip to 44.0 from 50.2 in April.

April U.S. Leading Economic Indicators to be released at 10:00 AM EDT on Thursday are expected to increase 1.3% versus an increase of 1.2% in March.

March Canadian Retail Sales to be released at 8:30 AM EDT on Friday are expected to increase 3.7% versus a gain of 1.2% in February.

April U.S. Existing Home Sales to be released at 10:00 AM EDT on Friday are expected to increase to 6.08 million units from 6.01 million units in March.

Earnings News This Week

The first quarter reporting season is winding down for S&P 500 and TSX 60 companies. Another 18 S&P 500 are scheduled to report results this week (including three Dow Jones Industrial Average companies: Wal-Mart, Home Depot and Cisco).

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

Commodities

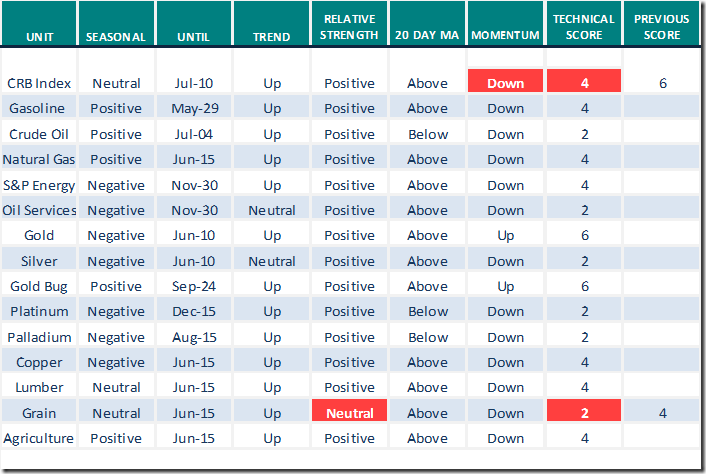

Daily Seasonal/Technical Commodities Trends for May 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

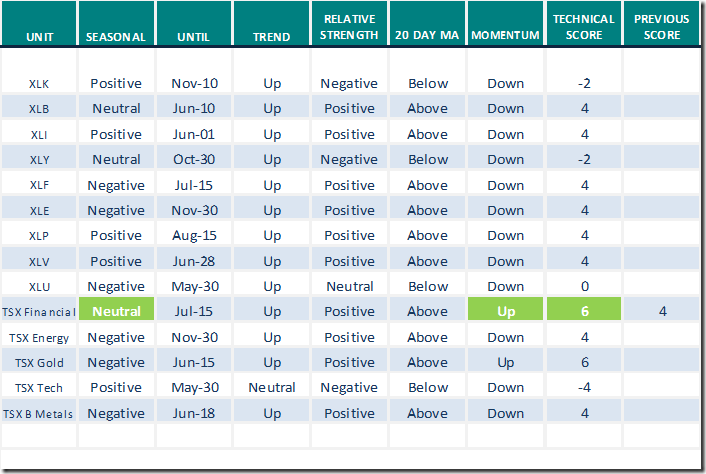

Daily Seasonal/Technical Sector Trends for May 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Changes in Seasonality Rating

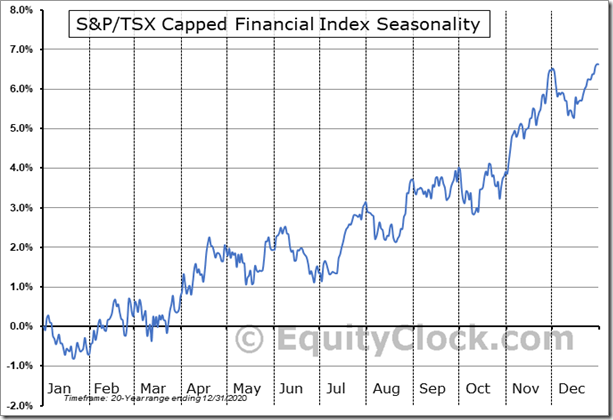

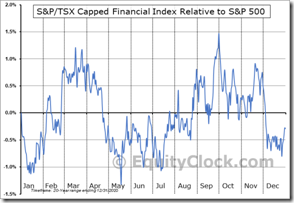

S&P/TSX Financial Index on a relative basis changes from Negative on May 15th to Neutral to July 12th. It also is Neutral on a real basis to mid-July. Thereafter, it turns Positive on a Real and Relative basis.

S&P/TSX Capped Financial Index ($SPTFS) Seasonal Chart

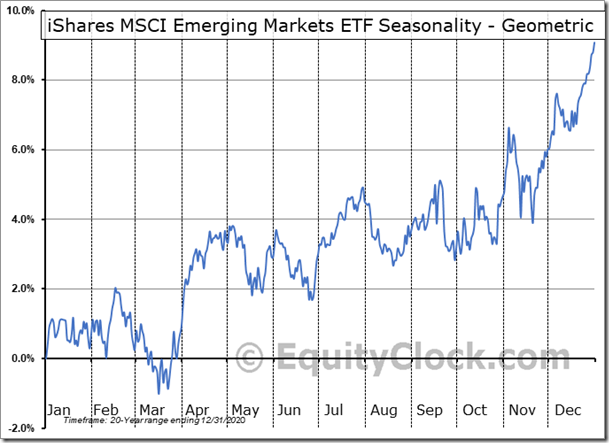

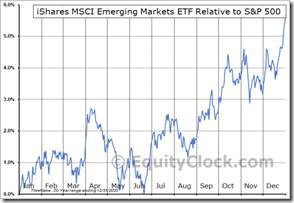

Emerging Markets on a relative basis change from Negative from mid-May to Neutral to June 20th, thereafter turns Positive. They currently are Neutral on a real basis, but also turn Positive near the end of June.

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes on Friday at StockTwits.com@EquityClock

How to play the breakout of the CRB commodity index above long-term declining trendline resistance. equityclock.com/2021/05/13/… $CRB $GLD $SLV $USO $UGA $GDX $GDXJ $DUST $NUGT $JNUG $JDST

SNC Lavalin $SNC.CA a TSX 60 stock moved above $29.70 extending an intermediate uptrend. Quarterly revenues and earnings reported on Friday were higher than consensus.

Brookfield Asset Management $BAM.A.CA a TSX 60 stock moved above Cdn$58.33 extending an intermediate upternd. Also, testing its all-time high at Cdn$60.13

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment:

The Canadian Technician

Greg Schnell asks “Does getting hit with a money cannon ever hurt”? Following is a link to his comments:

Does Getting Hit With A Money Cannon Ever Hurt? | The Canadian Technician | StockCharts.com

S&P 500 Momentum Barometers

The intermediate term Barometer added 6.41 on Friday, but dropped 7.42 last week. It changed from Extremely Overbought to Overbought last week on a move below 80.00

The long term Barometer added 1.80 on Friday, but slipped 1.01 last week. It remains Extremely Overbought by remaining above 80.00.

TSX Momentum Barometers

The intermediate term Barometer gained 4.20 on Friday, but dropped 10.68 last week. It remains Overbought and is trending down.

The long term Barometer added 2.06 on Friday, but slipped 0.32 last week. It remains Overbought and is trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.