by John Corcoran, Invesco Canada

Investors concerned about inflation may want to consider REITs, energy infrastructure, and global infrastructure.

Inflation hawks have been predicting a spike in inflation ever since the U.S. Federal Reserve (Fed) announced its first round of quantitative easing in 2008 — and they are still waiting. It turns out that the global financial crisis was massively deflationary, and despite at least five rounds of quantitative easing in the U.S. over the last 12 years, inflation has remained subdued. More recently, the global coronavirus outbreak and economic shutdowns were additional deflationary shocks. In response to the ensuing recessions and loss of jobs, governments have tried to stimulate their economies back to health, collectively using more than 3x the amount of stimulus employed to combat the global financial crisis.1 Not surprisingly, early warning signs of inflation have started to flash yellow. Fortunately for investors, three kinds of real assets can potentially help to minimize the adverse impact of rising inflation — REITs, midstream energy infrastructure, and global infrastructure.

U.S. inflation: Below average but returning to normal

U.S. inflation has averaged 2.0% over the last 20 years compared to 1.3% today, although many strategists expect it to turn higher in the near term as we lap the shock of the pandemic-induced shutdowns a year ago.2 Simply put, U.S. inflation is below average but returning to normal. What investors are facing now is merely a return to the long-run average. The interesting part comes next.

Inflation signals begin to flash yellow

Several inflation signals have recently started to flash a warning to the market. Right on cue, risk asset prices have started to wobble as investors have begun to discount expectations of rising inflation. In this regard, future inflation expectations (as measured by the U.S. five-year forward breakeven) have been climbing steadily from a low of 1.09% last March to 2.08% today.3 How high will they go? No one knows for sure, but they haven’t even reached their 20-year average of 2.28%.3

Rates are rising

Not surprisingly, interest rates are starting to respond to expectations of accelerating growth and higher inflation, and the recent rate of change in the 10-year Treasury yield has unsettled the capital markets. In particular, the benchmark yield has climbed from its all-time low of 0.51% in August 2020 to 1.53% today, a rise of more than 100 basis points with most of that move coming since January.3 As a result, the price of the 10-year Treasury note has fallen 5.7% this year.4 Properly understood, better-than-expected growth and rapid inoculation against the coronavirus have pulled forward the expected start of Fed rate hikes. Futures contracts now discount a Fed move in late 2023 instead of late 2024.4 Against this backdrop, some investors are growing more cautious because of the unprecedented amount of stimulus used to combat the pandemic, the Biden administration’s new $1.9 trillion USD rescue package, and the fact that the 10-year Treasury yield is still only half of its 20-year average of 3.28%.3

Real assets can help hedge against inflation

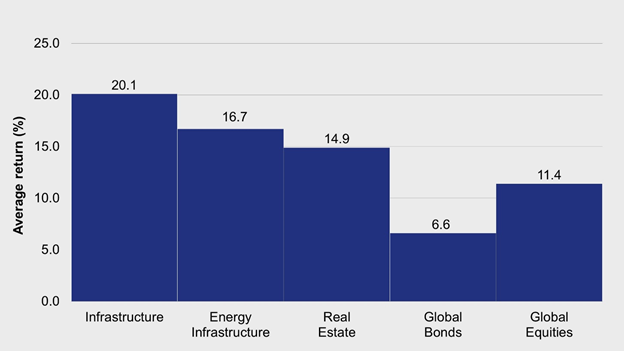

Real assets can offer a combination of attractive returns, diversification, inflation protection, and yield. The good news for investors is that REITs, energy infrastructure, and global infrastructure have historically offered an effective hedge against rising inflation, largely because of the pricing power of the underlying physical assets. During inflationary periods, inelastic demand from customers for many real assets means those customers must typically absorb subsequent price increases.5 As a result, listed real assets have historically outperformed global stocks and bonds during inflationary periods (see figure one). In particular, over the last 15+ years global infrastructure has outperformed global stock and bonds by 8.7% and 13.5%, respectively, during periods of rising inflation. Energy infrastructure has outperformed by 5.3% and 10.1%, respectively, and REITs have outperformed by 3.5% and 8.3%, respectively.

Figure one: Real asset performance during periods of rising inflation

Sources: Invesco Real Estate, S&P, MSCI, FTSE EPRA NAREIT, Dow Jones, Alerian MLP, and Bloomberg L.P. using data from Jan. 1, 2003 through Dec 31, 2020. Total returns shown in USD. Annual update with latest available data. Periods of world inflation acceleration include Jan. 1, 2004 through Dec. 31, 2004, Jan. 1, 2006 through Dec. 31, 2007, Jan. 1 2010 through Dec. 31, 2011, and Jan. 1, 2016 through Dec. 31, 2017. Note: Infrastructure represented by Dow Jones Brookfield Global Infrastructure Index; Energy Infrastructure represented by Alerian MLP Total Return Index; Real Estate represented by FTSE EPRA NAREIT Developed Index; Global Equities represented by MSCI World Index; Global Bonds represented by Bloomberg Barclays Global Aggregate Index. An investment cannot be made directly in an index. For illustrative purposes only. Past performance is not indicative of future results.

The linkages between real assets and inflation matter

Stepping back for a moment, the linkage between real assets and inflation can differ depending on the asset class. For example, some real assets can drive inflation through rising commodity, energy and raw materials prices, while others have intrinsic values that are tied to rising operating or replacement costs. Sometimes the owners of real assets have explicit contractual protection against inflation while others benefit from the economics underlying their business models.

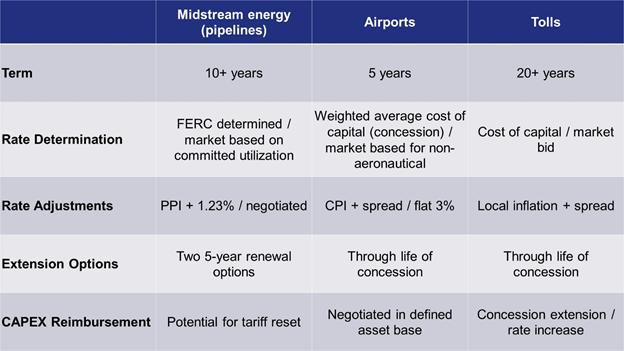

- Global infrastructure. Listed global infrastructure, which offers a return profile similar to defensive equities, can provide an effective hedge against inflation.6 In this regard, infrastructure providers often have longer-term contracts or regulated revenue models that include periodic escalators linked to inflation. That link can be to realized inflation, operating expense inflation, or both. These explicit contractual linkages are common in the energy infrastructure, airport, toll road, and utility sectors, among others (see figure two). In any case, as inflation rises, their revenues and cash flows do as well, thereby providing a built-in inflation hedge.

Figure two: Inflation pass-throughs for certain infrastructure sectors

Source: Invesco Real Estate as of Oct. 30, 2020. For illustrative purposes only.

- Energy infrastructure. Pipelines and other midstream assets typically have long useful lives that can span decades. Like other hard assets, midstream assets can provide a natural inflation hedge because their replacement value typically increases along with the rising costs of property acquisition, materials, and labour. This dynamic generally enables the owners of energy infrastructure to charge higher rates over time, just as landlords of commercial property can often increase rents over time. In addition, many midstream assets have direct inflation protection through linkage to the Federal Energy Regulatory Commission (FERC) Oil Pipeline Index. In general, pipelines that carry natural gas, crude oil, and refined products across state boundaries are subject to FERC regulation of the rates charged for their services, as well as other terms and conditions. The FERC annual rate adjustments are currently equal to the Producer Price Index for Finished Goods plus 1.23%.7 These automatic adjustments provide a direct and timely cash flow bump based on changes in the inflationary environment. Although this rate increase applies primarily to interstate pipelines deemed to be “non-competitive,” many midstream assets that are not regulated by FERC have terms and conditions that mimic FERC policies, including annual price adjustments linked to the index rate. Of course, the owners of energy infrastructure can enjoy margin expansion as their tariff rates increase over time.

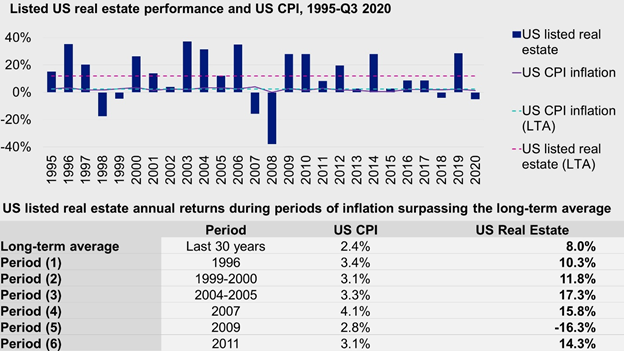

- Real estate. Listed real estate (including REITs) has historically provided an inflation hedge in part because in an inflationary environment, the rising cost of land, labour, materials, and borrowed capital can cause developers to increase the price of new properties. In addition, these rising costs can raise the economic threshold for new development, which in turn can limit the amount of new supply coming to market. This tightening of supply often gives landlords the pricing power needed to raise rents to tenants. Furthermore, many commercial leases (especially in the retail and office sectors) have rent escalators that are explicitly tied to inflation. This means that landlords can benefit from automatic rent increases, regardless of whether the inflation was expected or unexpected. Not surprisingly, listed real estate has historically delivered returns above the prevailing rate of inflation (see figure three).

Figure three: Listed real estate as a potential inflation hedge

Note: CPI reflects CPI-Urban Consumer, all Items indexed to 1982. Analysis relates to U.S. listed real estate performance, represented by the FTSE NAREIT All Equity Index and includes all property types. LTA=long-term average, 1990-2020. Source: Invesco Real Estate using data from the US Bureau of Labor Statistics, Moody’s Analytics, and FTSE Nareit as of January 2021. Past performance is not a guide to future returns. An investment cannot be made directly in an index.

Conclusion

Inflation in the U.S. has been subdued since the global financial crisis. Yet the Fed has recently adopted a more dovish approach that could allow inflation to run above target in the aftermath of persistent inflation shortfalls.8

If realized inflation exceeds current market expectations, the performance of traditional stocks and bonds could suffer. Investors who are concerned that the extreme monetary and fiscal stimulus employed in response to the pandemic could result in higher inflation over the next four years may want to consider a strategic allocation to REITs, energy infrastructure, and global infrastructure.

1 Source: Z. Cassim, et al., McKinsey & Company, “The $10 trillion rescue: How governments can deliver impact,” June 5, 2020

2 Inflation is represented by the US Consumer Price Index ex Food & Energy. Sources: Bloomberg L.P., March 10, 2021; A. Hunter, Capital Economics, “US Consumer Prices: Weakness in core inflation unlikely to last much longer,” March 10, 2021.

3 Source: Bloomberg L.P. as of March 20, 2021

4 Source: S. Shipley, Evercore ISI, “It Is More Than Just Inflation Expectations,” March 9, 2021

5 Source: B. Blue, et al., Morningstar, “In the Absence of Inflation, Some Real Assets are Down But Certainly Not Out,” Sep. 18, 2020

6 Source: Mercer, “The Role of Listed Real Assets,” January 2019

7 Source: Federal Energy Regulatory Commission, “Margin applicable for the period July 1, 2016 through July 2021”

8 Source: J. Powell, Board of Governors of the Federal Reserve System, “New Economic Challenges and the Fed’s Monetary Policy Review,” Aug. 27, 2020

This post was first published at the official blog of Invesco Canada.