by Walt Czaicki, AllianceBernstein

As US inflation expectations grow, many investors are concerned about the potential impact on stocks. Our research shows that US equities have delivered solid returns during periods of moderate inflation for more than seven decades.

Inflation hasn’t been on investors’ radar screens for a long time. But today, with a massive $1.9 trillion US stimulus program under way—and an infrastructure plan of at least $3 trillion under consideration— inflation is a real possibility.

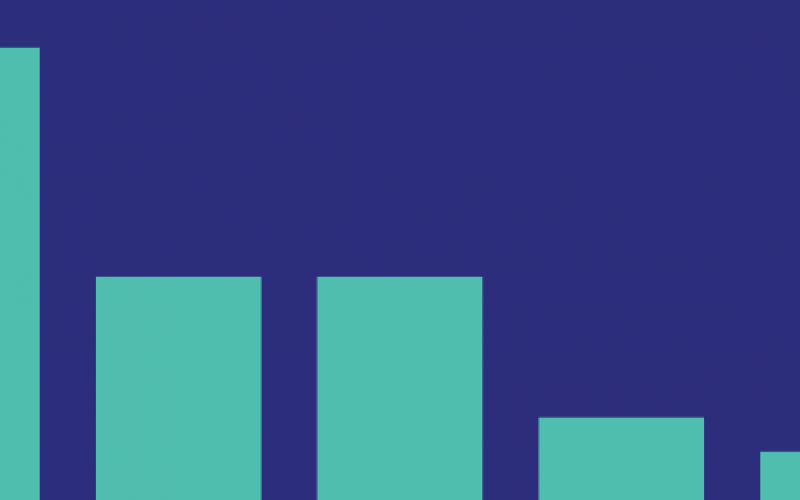

US Stocks Performed Well in Modest Inflationary Periods

Is inflation bad for stocks? Not necessarily. Since 1948, when inflation was within a 2%–4% range, US stocks posted quarterly returns of 2.7% on average, according to our research (Display). During the same period, inflation was within the 2%–4% range for 108 quarters. Our economists expect US inflation to reach 2.1% by the end of 2021 and to trend sideways thereafter.

Higher inflation can be a problem for equity returns, which fell to 1.0% on average when inflation exceeded 4%. Yet even with inflationary pressures building, that kind of dip in returns isn’t likely in the near future. Indeed, according to the Federal Reserve Bank of St. Louis, five-year forward inflation expectations reached 2.1% in late March, up from about 1.3% a year ago. While stocks performed better during periods of negative inflation, these performance patterns were skewed upwards by extraordinary early-stage recoveries from recession in the late 1940s and early 2009.

Consider Prudent Portfolio Adjustments

That doesn’t mean investors should be complacent. Rising inflation can erode the value of real investment returns and prompt an increase in interest rates. And rising rates boost the discount rate used to value stocks, which tends to reduce valuation multiples, particularly for growth stocks. But modest inflation can also help companies increase nominal earnings growth, which can offset a potential compression of stock multiples.

So, investors should check allocations within and across asset classes for inflation sensitivity. Different securities respond differently to inflation, both within equities and across asset classes. Consider expanding an allocation to value stocks that generally perform better when interest rates rise. Ensure that growth holdings have advantages such as pricing power, which could help support returns if multiples come under pressure. Making prudent adjustments to an allocation can help position portfolios for a changing environment. But, based on historical performance trends, there’s no need to fear that stocks are inherently vulnerable to a return of moderate inflation.

Walt Czaicki is a Senior Investment Strategist for Equities at AB

David Wong is Senior Investment Strategist and Head—Asia Business Development, Equities; Co-Chair—Responsible Investing Steering Committee, Asia-Pacific.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..