by Kent Hargis, AllianceBernstein

Investing in businesses that strive for a better climate through decarbonization doesn’t necessarily assume a lower bar for performance. Just the opposite. Besides contributing to a healthier environment, low-carbon equity investing can also offer attractive return potential.

Myriad forces are driving a shift toward low-carbon investing, with governments, corporations and investors all contributing. As a global community bands to combat the problem, more capital flows toward efforts to address climate change. All this creates opportunities for investors to play their part, while doing it well within scope of their long-term financial goals. Investors may no longer need to choose between a better environment or competitive returns, because it’s increasingly possible to have both.

Governments Set the Tone, Companies Step Up

Sharper demand for low-carbon investing is partially linked to intensifying government efforts toward climate improvement. Nations are especially fixed on decarbonizing their economies, and nearly 200 of them support the Paris Agreement, designed to help manage global warming by 2050. Specifically, the accord’s central aim is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius and limiting the temperature increase even further to 1.5 degrees Celsius.

While governments stress urgency, many companies are already way ahead at shrinking their carbon-emissions output. From finance and fossil fuels to transportation and technology, forward-looking businesses see higher value in a lower carbon footprint. And it’s starting to make a difference.

Low-carbon investing covers a lot of ground and industries. Companies’ climate-resilience strategies, for instance, can shift strains and ensure continuity amid climate events. For example, Nestlé now sources core agricultural items like cocoa and sugar from regions less impacted by climate change. Likewise, Home Depot maintains a 24/7 command center to keep customers supplied during hurricanes and other extreme weather.

Low-carbon investing also works hand-in-glove with growth initiatives. For example, miner Rio Tinto is developing technology to produce carbon-neutral aluminum that meets the needs of important clients like Apple and Alcoa. Even some airlines are trailblazing, with Qantas Airways creating new and smarter travel routes and schedules that burn less fuel.

Whether among the highest emitters, like Royal Dutch Shell, or lower-emitting businesses such as Microsoft, low-carbon strategies are improving bottom lines and fundamentally changing how companies do business up and down their supply chains.

Strong Demand for Low Carbon Is Prevalent Among Large Investors

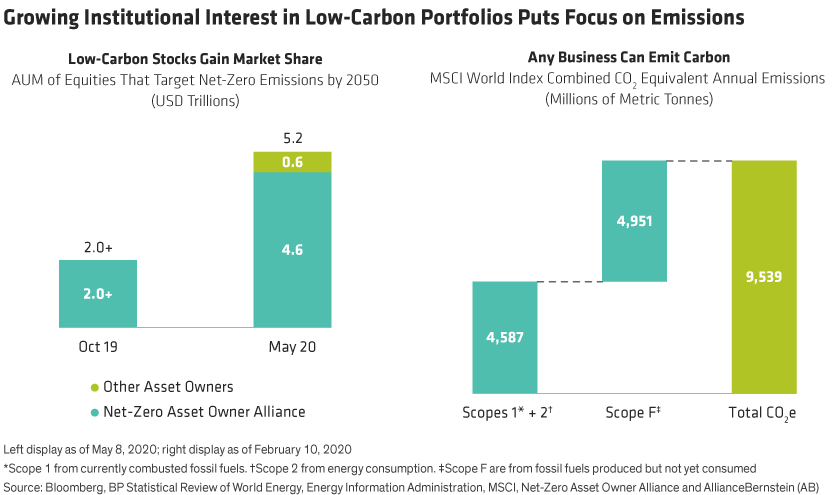

Portfolios that target low-carbon companies are gaining popularity as investors become increasingly climate aware. Demand is particularly strong among institutional asset owners, with many sharing best practices and comparing notes as the investment approach shifts from niche to mainstream. The Net-Zero Asset Owner Alliance, formed at the UN’s 2019 Climate Summit, will be a touchstone for standards and accountability for decades. Founding members Zurich, Allianz, CalPERS and SwissRe, with others, already account for the greatest share—some $2 trillion—of assets under management that target net-zero emissions by 2050 (Display left).

“Price on Carbon” Is a Game Changer

Practically every business model is linked to carbon emissions, whether as a producer or consumer of energy, or even indirectly via their supply chain. Emissions are measured in metric tonnes of CO2 equivalents (CO2e) per annum and the combined annual CO2e emissions for the MSCI World Index is 9.5 billion tonnes, as of February 10, 2020. That’s 210 tonnes for every US$1 million in market capitalization, including Scope F emissions, from fossil fuels that have been produced but not yet consumed (Display right).

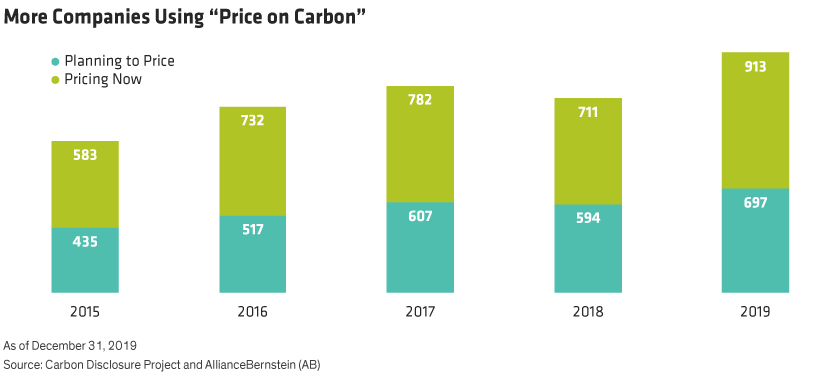

With carbon emission levels widely varied across companies, factoring their cost implications up front offers an insightful apples-to-apples comparison across the investment universe. This “price on carbon” priority is a dynamic factor that can dramatically change a company’s forecast in an instant. The World Bank calls it one of the “strongest levers we have to shift financing toward climate action.” Price on carbon is a rapidly growing internal gauge as companies form strategies as well as a powerful tool for low-carbon investors to assess them more accurately (Display). As more companies incorporate a price on carbon when making decisions, investment analysts should also, so they can build more accurate forecasts to identify attractive opportunities.

A price on carbon can also help catch tangential but related fundamentals that impact a company’s bottom line, like potential regulation (carbon taxes) and complying with standards (costly upgrades). These are typically found across several different CO2e emission “scopes” that should all get equal scrutiny. Whether CO2e emissions are from current fossil fuel combustion and consumption or potential future releases from fuels not yet consumed, we believe investors should weigh them all to fully grasp their impact on a company’s value. From there, further research would drill down to other telling characteristics of quality, stability and price.

Can Decarbonizing Help Long-Term Performance?

Lowering carbon output should lead to better climate outcomes, but its return potential still has skeptics. In our view, low-carbon investing can help improve alpha over time, especially when lower returns have been seen among higher-emitting stocks. For the five years ending in 2019, our research suggests that the highest carbon-emitting companies underperformed, even as oil prices rose. And when comprised of an optimal mix of actively selected, high-quality, stable companies with reasonable valuations, we believe a low-carbon portfolio can be well positioned to mitigate risk in down markets and participate in the upside over time.

Since the 2015 Paris Agreement, the world suffered its five hottest years on record. With renewed urgency, governments and businesses strive for climate improvements. Meanwhile, more investors are expressing their desire for greener approaches to profitability and returns.

We think all of these can work together to make a better world while generating a smoother pattern of competitive returns. The future looks bright, and perhaps less warm, with the help of low-carbon investment strategies.

Kent Hargis is Co-Chief Investment Officer—Strategic Core Equities at AllianceBernstein (AB)

Roy Maslen is Chief Investment Officer—Australian Equities at AB

Sammy Suzuki is Co-Chief Investment Officer—Strategic Core Equities at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..