by Talley Léger, Invesco Canada

In mid-June, we began cautioning that the high-velocity, v-shaped recovery in stocks from their March lows was producing tactically overbought conditions, raising the likelihood of a near-term pullback.1 Fast-forward to early-September and the S&P 500 Index began what now appears to be an abrupt risk-shedding event, centered on the high-flying growth and technology stocks.

Admittedly, our short-term timing indicators, including the put/call ratio†, tend to work better near lows than they do around highs in the stock market.2 As such, all we can really do is warn of overbought extremes, and offer a handful of negative catalysts that stocks may be more vulnerable to at the time. Still, a two-and-a-half-month lag is pretty good in our book.

Gauging the downside

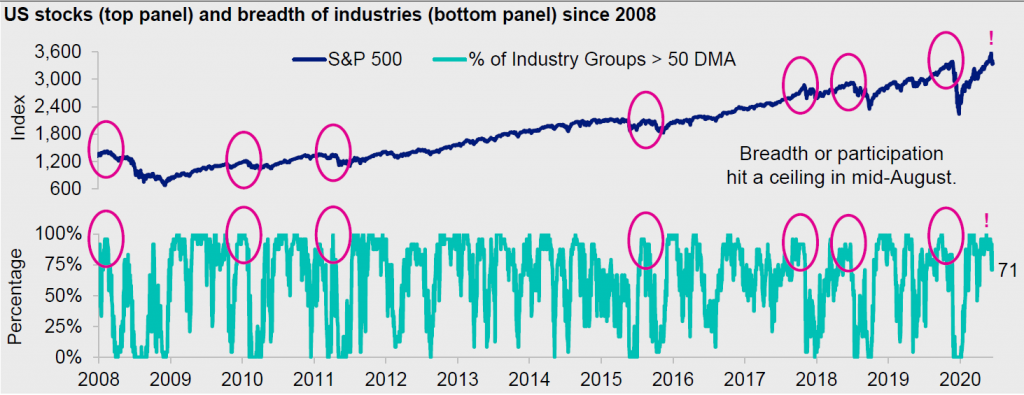

We don’t pretend to know for certain whether the selloff is over, it’ll continue or how much additional downside is in store. However, we developed a new breadth indicator – the percentage of S&P 500 industry groups above their respective 50-day moving averages – that in our view, seems to be a reliable tool for gauging technical extremes in stocks.

For example, all 24 of the industry groups within the S&P 500 Index fell below their near-term averages in late-February.3 Such bad breadth and an extremely oversold condition proved to be a contrarian buy signal for stocks, which ultimately bottomed in late-March.

True, only 46% of industry groups fell below their short-term trends during the June pullback in stocks.4 Nonetheless, the current reading of 71% remains comparatively elevated, suggesting the selloff isn’t over and further drawdowns may be in store.

What was the catalyst for the recent turbulence? More importantly, should investors sell everything and wait to re-invest until after the US presidential election?

Figure 1. Stocks remain technically overbought and further drawdowns may be in store

Source: Bloomberg L.P., Standard & Poor’s, Invesco, 09/11/20. Notes: 50 DMA = 50 day moving average. An investment cannot be made in an index. Past performance does not guarantee future results.

A change of trend or a buying opportunity?

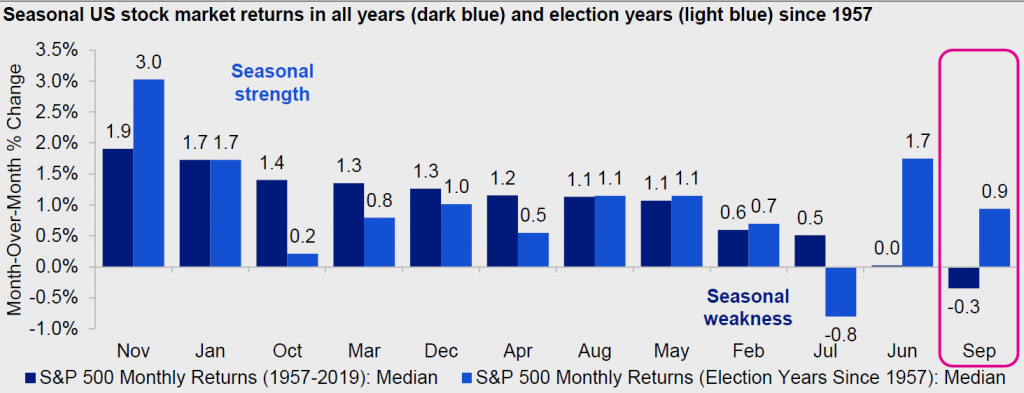

It seems reasonable to conclude that tactically overbought conditions collided with a month that’s widely recognized for its seasonal weakness. Since 1957, when the S&P 500 Index was created, its median price return has been -0.3% in September.5

However, when we analyze seasonal performance patterns in US presidential election years since 1957, the month of September looks quite different with a median price return of 0.9%.6 Why?

Perhaps the fiscal pump priming and campaign promises of the candidates stokes the hopes and dreams of voters, with positive knock-on effects for sentiment, spending and the economy. If that’s correct, investors may consider leaning into the current weakness and adding to their positions in stocks.

Understandably, U.S. politics and the election are popular topics right now, but should they dominate our investment decision-making processes? Are there any macroeconomic forces that matter more for long-term stock market returns?

Figure 2. In an election year, investors should consider buying the dips

Source: Bloomberg L.P., Standard & Poor’s, Invesco, 09/11/20. Notes: Price returns. An investment cannot be made in an index. Past performance does not guarantee future results.

Beyond politics, take advantage of low interest rates

In his Jackson Hole speech, Federal Reserve (Fed) Chairman Jerome Powell announced two major changes to the Fed’s monetary policy framework that will likely keep interest rates low for longer.

First, the Fed will no longer tighten monetary policy simply because of a low unemployment rate. That’s a notable departure from the broken Phillips curve, a simple yet flawed framework developed by William Phillips, which states that a falling unemployment rate should produce faster inflation. Second, the Fed will allow inflation to overshoot its 2% target.7

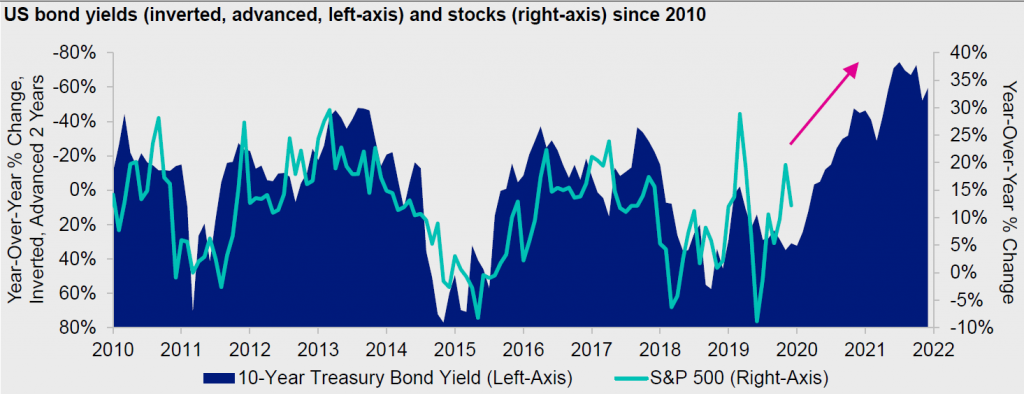

In our view, these significant policy changes mean the Fed’s less likely to repeat past mistakes (e.g., the 2015-2018 tightening cycle) by raising interest rates amidst persistent inflation undershoots, with calamitous stock market outcomes similar to 2018.

Rather, the Fed has renewed its commitment to keeping interest rates low for longer, thereby defending this fledgling economic recovery, while allowing the US dollar to weaken, inflation expectations to rise, and the bull market in stocks to continue.

We acknowledge some intentional, near-term reflationary pressures from policymakers and view a little bit of inflation as a good thing, meaning deflation‡ risks are subsiding.

That said, long-term disinflationary pressures remain in place where interest rates could stay pinned by the Fed, a global savings glut, an aging population, productivity-enhancing technological innovation and the “Amazonification” effect which refers to consumers’ present ability to get lower prices from online retailers like Amazon.

The bottom line is low interest rates for longer are the starting point for the “recovery trade” we’ve been embracing, which includes a modestly positively-sloped yield curve*, weaker US dollar, stronger commodity prices, corporate bond outperformance relative to government bonds, and stock market outperformance relative to government bonds.

Figure 3. Lower bond yields today (read: discount rates) usually mean higher stock prices tomorrow

Source: Bloomberg L.P., FRED, Invesco, 09/11/20. Notes: The year-over-year % change in US government bond yields has been inverted and advanced by 2 years. A lower discount rate in the present points to higher corporate cash flows in the future. An investment cannot be made in an index. Past performance does not guarantee future results.

This post was first published at the official blog of Invesco Canada.