by Frank Caruso, CIO, US Growth Equities, AllianceBernstein

Investors don’t often pay much attention to corporate culture when evaluating business and return potential. But cultural norms can make the difference between success and failure, especially for growth companies, which thrive on innovation and must be flexible to adapt to changing business trends.

Company reports don’t say much about culture. Unlike the profit and loss statement, balance sheet and business updates that dominate a quarterly report, a company’s internal behavioral features don’t usually move stocks. Yet we believe culture is actually the secret sauce for sustainable growth, because in a knowledge-based economy, cultivating human capital is essential for building a business with staying power. And for investors focused on environmental, social and governance issues, this awareness is key to engaging with management and stakeholders more effectively and integrating research on a company’s culture with its business outlook.

Top Growth Companies Have Dynamic Cultures

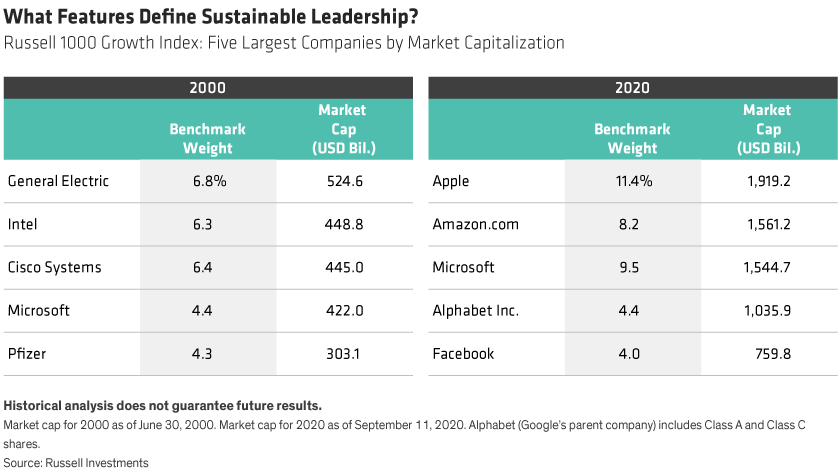

Just look at the top companies in the Russell 1000 Growth Index. Facebook, one of the five largest companies today by market capitalization, didn’t exist in 2000, while Google and Amazon were basically still start-ups. Apple, Microsoft and Amazon.com—which existed in 2000—constantly reinvented themselves to stay on top. All five built exceptional businesses based on new ideas and a willingness to take calculated risks. In contrast, the top US growth companies in 2000 had significantly more resources at the time, but, excluding Microsoft, they couldn’t keep up the pace of growth and were ultimately overtaken (Display).

Key Features of a Healthy Culture

What defines corporate culture? A healthy culture values learning, discovery, experimentation, and above all, trust and accountability. Cultures that prize relentless evaluation can avoid falling into the groupthink trap, when strongly held views and practices are blindly defended. We believe these three building blocks create a flourishing growth culture:

-

- Visionary Management—senior leadership sets the tone for day-to-day behavior and long-term goal setting. It’s no surprise that corporate-culture icons tend to be charismatic, influential and visionary CEOs.

-

- Team-Oriented flexibility—high-achieving growth cultures are team oriented but flexible. Jeff Bezos famously coined the term “the two-pizza team”—if a team couldn’t be fed with two pizzas, it was too big. Working groups must be small, diverse and transparent. They’re comfortable giving and receiving honest feedback, and they understand that their contribution must constantly change to fuel innovation.

-

- Motivational Incentives—as every investor knows, past performance doesn’t guarantee future results. Similarly, compensation for past achievements is less effective than incentivizing employees for future development, which provides motivation for success.

Many companies fall short in these areas. They make incremental, reactive changes to existing market conditions, while minimizing short-term risk to meet earnings expectations and increasing the risk of letting short-term incentive compensation influence performance. And all too often, companies fail to unleash the full creativity of their people.

Five Questions to Ask

When creativity is stifled, companies default to sustaining the status quo instead of thinking ahead about how the world is changing. Companies that fail to innovate, improve efficiency or cultivate the right talent are unable to sustain margins and returns. So how can investors distinguish between companies that have a dynamic culture and those that don’t? These five questions are a good starting point to help identify the companies that might become market leaders in 2040.

1. What type of innovation is being funded? Most firms invest in innovation, but often these efforts are just investments in “me-too” products. Look closely at where the money is going.

2. Does cost control cover up a lack of creativity? Cutting costs is a relatively easy way to prop up profitability, at least for a while. It requires less creativity—and typically less risk—than investing in a speculative new idea. Ongoing cost cuts may signal that a company doesn’t have the vision or courage to identify and invest in promising new business opportunities.

3. How deep is the pipeline? When management raises the bar on funding new ideas, it narrows the funnel of new products or services. Don’t be fooled by solid profitability when organic growth is weak. Fewer ideas mean the cost of failure is higher if a company makes the wrong bets.

4. Is a company making too many acquisitions? Beware of companies making important technology acquisitions directly in their core business. It’s frequently a sign of prior underinvestment and a weak growth culture.

5. What can we learn from employee sentiment and incentivization? The mood in the middle can be just as important as the tone at the top in monitoring cultural health. The size and structure of compensation, engagement and development, diversity of backgrounds, team orientation, attrition rates and satisfaction—all can and should be monitored. By engaging companies and stakeholders, or using tools like third-party sites such as Glassdoor or LinkedIn, investors can get a glimpse of how people inside a company think and feel.

Maintaining Motivation Through a Crisis

Regardless of company size, those with the right cultural attributes have a better chance of successfully navigating crises like the coronavirus pandemic. Firms that trust their employees are better equipped to shift comfortably to a remote working environment. Keeping staff motivated through a crisis is much easier when a company values employees’ well-being during good times and bad. In our view, COVID-19 is providing a real test, in which companies with truly innovative cultures will have a strong advantage in getting through the crisis.

Even in good times, finding true growth potential isn’t easy. Many companies pursuing new ideas haven’t achieved enough scale to be comfortably profitable. But companies with a culture that balances short-term flexibility with long-term strategic objectives are, in our view, often well-equipped to deliver sustainable growth. By looking at culture as an integral part of fundamental research, and engaging with management regularly, investors can gain insight into promising growth businesses before their potential is reflected in stock valuations.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

Frank Caruso is Chief Investment Officer of US Growth Equities at AB

Chris Kotowicz is Senior Research Analyst of US Growth Equities at AB

Ryan Oden is Research Analyst of Equities at AB

This post was first published at the official blog of AllianceBernstein..