by Brad McMillan, CIO, Commonwealth Financial Network

The past week has seen continued improvement, with the case growth rate down to new lows and case growth below 30,000 per day for the first time since June 21. The pandemic remains under control, and things are still getting better. The control measures are working.

At the national level, as of September 10, the daily spread rate is 0.5 percent per day, close to a new low and down over the previous two weeks. The seven-day average of the daily number of new cases was just over 37,000, down from just over 42,000 last week. The continued improvement in both the case growth rate and new cases is a positive.

The testing news was mixed. The number of tests bounced around over the past two weeks, but it was generally steady at around 700,000 per day. This testing level is likely insufficient. But with the drop in new and active cases, the positive testing rate has continued to decline and is now around the recommended 5 percent. This is a metric that will need to improve; nonetheless, signs are it may be sufficient at the moment to keep the virus under control.

Beyond the headline numbers, state-level data is generally good, although concerns remain about states in the Midwest. Overall, the national risks remain under control.

With the medical news better, the economic recovery remains on track, albeit with some areas of concern. One worth watching is consumer confidence and spending, with signs of weakness. Financial markets continue to move higher in response to the positive medical developments. But here, too, recent turbulence may be a sign of future weakness. Let’s take a look at the details.

Pandemic Growth Rate Still at Low Levels

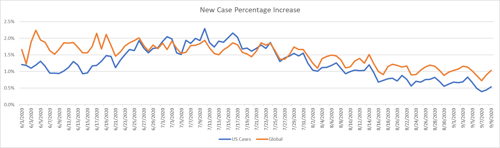

Growth rate. The daily case growth rate has continued to trend down. It reached a pandemic low last week and ended the reporting period at 0.5 percent per day, down from 0.7 percent per day the previous week. The dropping spread rate is a positive sign, leading directly to dropping daily new case counts even as the total number of cases continues to grow. At this rate, the case-doubling period is up to over 20 weeks, leaving the infection curve flat at a national level and leaving the risk to health care systems at a low level.

Source: Data from worldometer.com

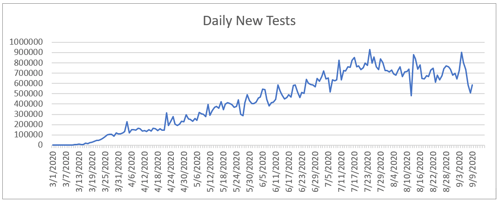

Daily testing rate. As infections have dropped, testing remains steady although variable, and it has stayed in the range of around 700,000 per day. This appears to be below the level of testing needed to develop a full understanding of the pandemic, despite the recent improvements in the spread rate.

Source: Data from the COVID Tracking Project

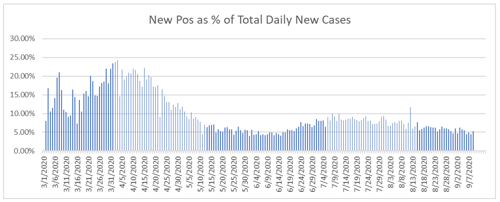

Positive test results. That said, the positive rate on tests has continued trending down and is approaching an acceptable level. If we look at the percentage of each day’s tests that are positive, lower numbers are better, as we want to be testing everyone and not just those who are obviously sick. The World Health Organization recommends a target of 5 percent or lower, which we are getting close to achieving again. The pandemic spread may be approaching the level where current testing is adequate.

Source: Data from the COVID Tracking Project

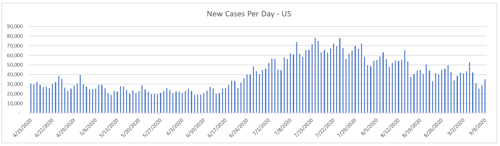

New cases per day. The most obvious metric for tracking the virus is daily new cases. With increased control measures in place, especially in the outbreak states, the seven-day average number of new cases per day has dropped from around 42,000 per day last week to just over 37,000 per day. This is an acceleration of the improvement seen in previous weeks.

Source: Data from worldometer.com

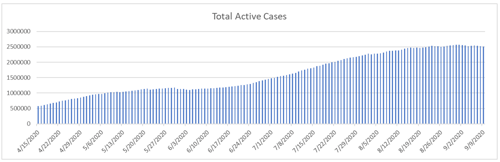

Total active cases. Another positive development is that as the number of new cases has slowed, the number of active cases has stabilized and even shown signs of declining. If case growth continues to decline, new infections will continue to lag recoveries, and the number of active cases would continue to decline, which would be a very positive sign.

Source: Data from worldometer.com

Overall, the pandemic is under control at the national level, and it continues to improve, although at a slower rate. At the state level, the health emergencies have largely passed, although concerns remain in some states. The good news here is that policy and behavioral changes have taken effect, as they did in the first wave, and that we have largely contained the virus as we did then.

Looking forward, the question is whether the improvement will continue into the fall. The trends are positive. But given the recent Labor Day holiday gatherings, combined with the ongoing reopening of school districts and universities, the risks remain material. These will be something we need to watch.

Economic Recovery May Be Slowing

Jobs market. The economic news is also good, with the recovery continuing, but there are signs of slowing. The most recent initial jobless claims report shows slightly higher layoffs. The continuing unemployment claims have also risen, showing that fewer people have returned to work in the most recent weeks. Improvement in the jobs market has been a relative bright spot, but that trend may be slowing.

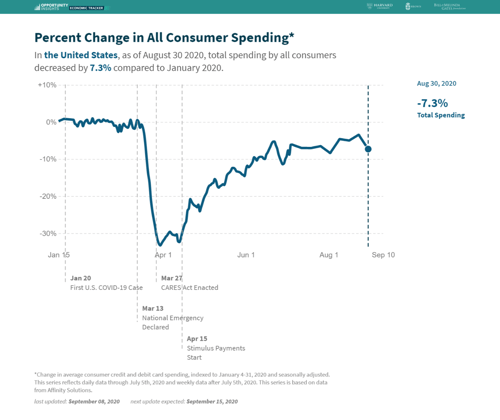

Consumer spending. Consumer spending has also weakened. In the past week, spending dropped from within 3.2 percent of the pre-pandemic level to 7.3 percent below, and consumer confidence has declined. Much of the decline in both confidence and spending appears to come from lower-income workers, where the jobs recovery has been particularly weak and who are most affected by the expiration of federal income support payments. This metric remains something to watch.

Source: https://tracktherecovery.org/

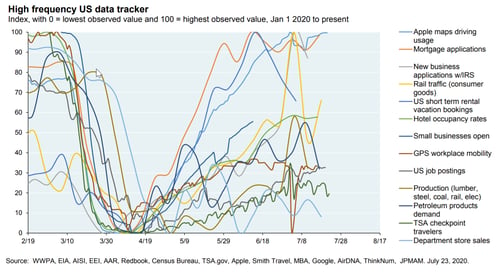

Business sector. Even as there are signs of weakness in the consumer economy, however, the business sector continues to do well. Business confidence and investment are largely back to pre-pandemic levels, and specific higher-frequency indicators are showing improvement in many cases, as we can see in this composite of many indicators from J. P. Morgan.

Source: J. P. Morgan

The big picture is that the recovery is still on track but that signs of weakness bear watching. The medical risks have improved significantly, but the economic risks are still real.

Financial Markets Hit New Highs Then Stumble

Financial markets dropped last week after hitting new highs. The new highs were in response to the positive medical news, including improvement in the new case count and encouraging news on vaccine development. The drop seemed to be due to worries about just how durable the economic recovery was. Given the data we reviewed above, those doubts seem reasonable, which suggests we might see more volatility ahead. That said, the positive medical news should provide some support for the markets through any such volatility.

Risks Are Real, But So Are Opportunities

The real news this week is that the pandemic is under control and that the medical risks are now contained. While there are real risks here, around the Labor Day holiday exposures and school reopenings, so far at least the news is as good as or better than we have seen in the pandemic so far.

The economic risks are also real, and we do see some slowing in the recovery so far. That will need to be watched. But, at the moment, the recovery continues, and there is a real possibility it will accelerate again if the medical risks remain constrained or, especially, if another federal income support program is passed. The risks are real, but so are the opportunities.

Finally, while markets pulled back last week on rising perception of the risks and while more volatility is quite possible, the fact that the medical risks remain contained and that the economic recovery continues should provide support.

Given all of this, over the next couple of weeks, the most likely case appears to be continued slow improvement on both the medical and economic fronts. There are certainly risks, and we need to watch them. But for the moment, the news remains good.

Copyright © Commonwealth Financial Network