by Donald Huber, Franklin Templeton Investments

As the global economy continues to grapple with the COVID-19 pandemic, there are still opportunities for investors, says Franklin Equity Group Portfolio Manager Don Huber. He has an eye on international companies able to navigate the crisis period—particularly those in regions where recovery is happening faster.

People have been spending much more time at home these days. For investors, however, we believe looking for long-term opportunities outside one’s home market is more important than ever. Many investors—whether consciously or subconsciously—tie a country’s economic growth to growth of companies based there. And in light of today’s greater economic uncertainties, that bias may prove detrimental. Certainly, there are plenty of companies that are growing their profits, sales and cash flow much faster than the gross domestic product growth rate in the country in which they are based. And many of these international companies are truly global in nature and not tied to the fundamentals of their domestic economy.

We have found opportunities in technology, e-commerce, semiconductor and health care across the globe, and also in companies that are leaders in niche industries. For example, one of the leading suppliers of cathode materials for rechargeable batteries used in hybrid and electric cars is a Belgian company. One of the leading global suppliers of implants for people with severe and profound hearing loss is Australian.

When people think about e-commerce, they tend to think about companies like Amazon or some of the Chinese titans, but e-commerce is growing rapidly around the world. We see good potential in Latin America, where e-commerce is growing off a much lower base than than the United States or China and therefore offering compelling investment opportunities.

COVID-19 Pandemic and Recovery

From an international investment lens, what we think has become more important during the COVID-19 pandemic is understanding where companies operate, and less so where they are headquartered. Different regions of the world are recovering from the COVID-19 pandemic at different paces. Many Asian countries have had experience dealing with past epidemics, including SARS, and they have thus tended to recover more quickly than the rest of the world. And at this point, Europe looks to be recovering faster than many parts of the United States.

The extent that Asia and Europe recover more quickly than the United States may shift the focus away from companies with a strong presence in the United States to those with businesses in regions that are recovering more rapidly. We would expect that companies focused on these regions to generate more revenue than those whose markets are constrained by lockdowns.

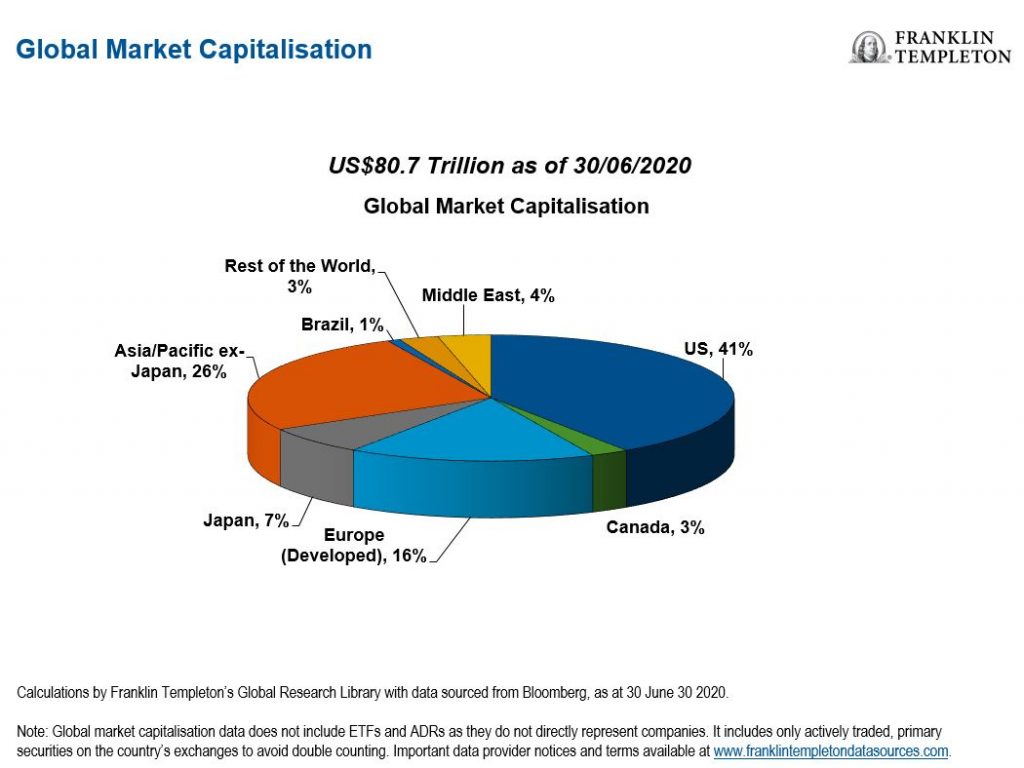

With the pandemic causing this greater disparity in growth rates in the near term, we believe it is an opportune time for US investors to look international for opportunities that may have gone overlooked previously. While the US market has underpinned global equity market returns in recent years and still accounts for roughly 40% of the total global stock market capitalisation, more than half the potential investment opportunities lie elsewhere.

We certainly didn’t go into 2020 expecting a global pandemic, but from an investment standpoint, our portfolio has been supported by the characteristics we look for in our holdings, including free cash flow, balance sheet strength, a seasoned management team, a strong business model and leading competitive position. Quite a few non-US companies can emerge from the current crisis in much stronger positions. Some have already accessed the capital markets to raise money to either expand their addressable market or buy out weaker competitors to better position themselves for the opportunities they see arising over the next few years.

A Focus on Mid- and Large-Capitalisation (Cap) Stocks

Diligent fundamental research is crucial in uncovering potential opportunities, particularly given the current public health and economic uncertainties. We tend to invest in international companies with a clear focus that operate only a handful of business lines. That allows us to gain better visibility into the underlying business, including where they derive their sales and earnings, as compared to large conglomerates. Often, this approach leads us down the market-cap spectrum to mid-cap companies that tend to be a bit earlier in their growth cycles. These companies have proven businesses with years of growth ahead of them, in our view. We believe the quality of the business model, financial strength and management are more important than domicile or market capitalisation in driving returns over the longer term.

We also strive to limit the overlap of underlying economic drivers to manage risk, so our portfolio does not have too much exposure to companies with a common revenue or expense driver. For example, the travel and leisure industry has been hit hard and will take longer to recover than e-commerce, gaming or online education, which have been booming during the pandemic.

In sum, our process is focused on identifying great growth companies that have staying power regardless of the economic environment and put them together in a portfolio that is concentrated, yet at the same time, diversified. Finding these stocks may mean leaving the home market for lesser-known international opportunities.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Diversification does not guarantee profit or protect against the risk of loss.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Any companies and case studies shown herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the US by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com-Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

This post was first published at the official blog of Franklin Templeton Investments.