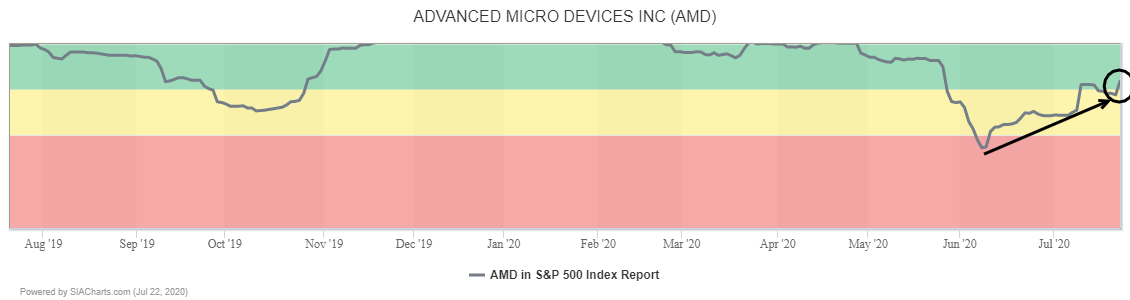

Advanced Micro Devices (AMD) has returned to the Green Favored Zone of the SIA S&P 500 Index Report for the first time since May after climbing 37 spots yesterday.

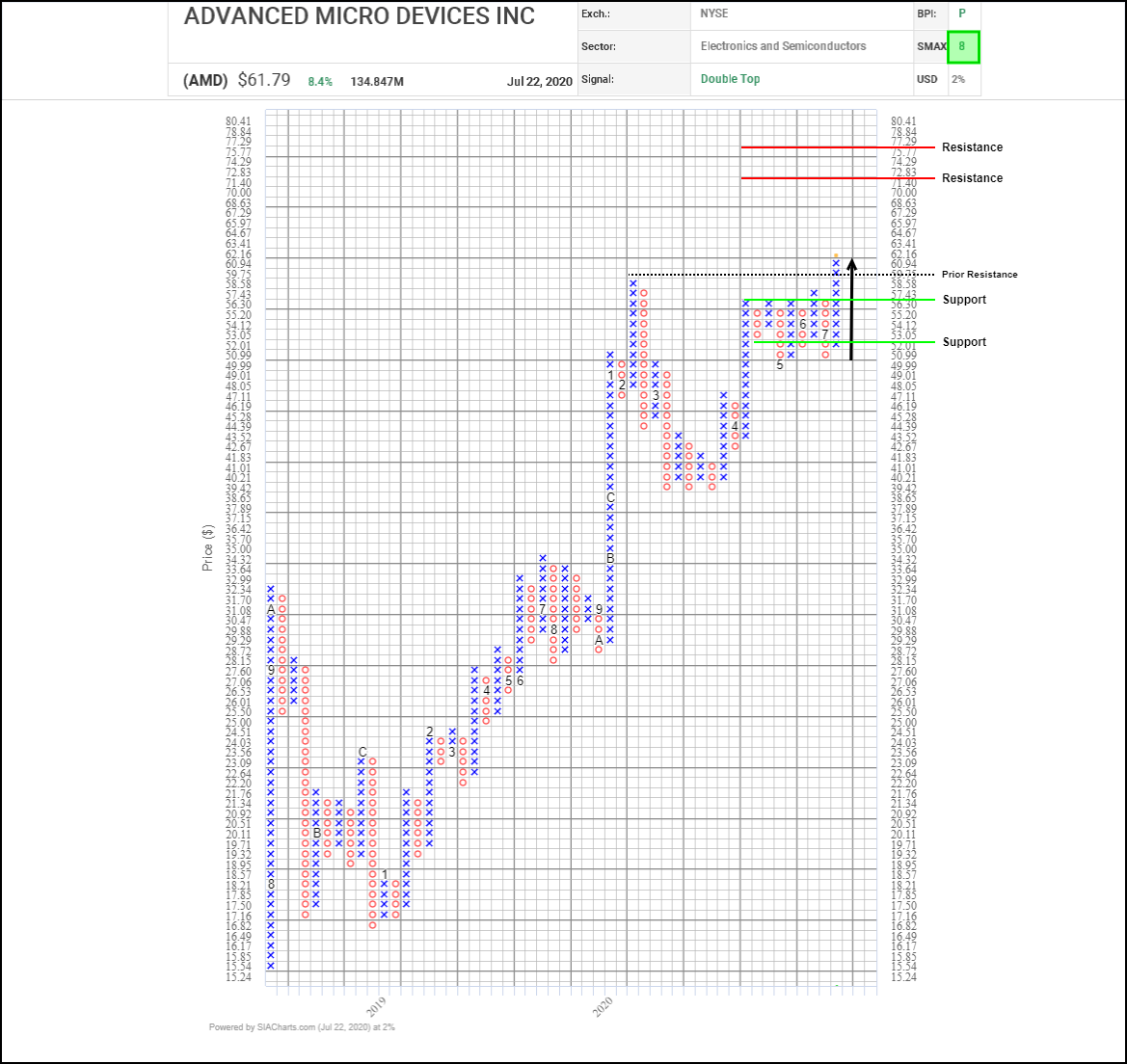

A major breakout is underway in Advanced Micro Devices (AMD) this week with the shares blasting through the top of a $48.00 to $60.00 trading range to a new all-time high, signaling the start of a new advance. A spike in volume on the breakout confirms increased investor interest Next potential upside resistance tests on trend appear near $66.00 then $72.00 based on measured moves. Initial support moves up toward $58.00 from the 50-day average near $54.00.

Since completing an initial recovery rally back in March-April, AMD shares have been consolidating in the $49.00 to $57.50 range. Back in June the shares completed a bullish Quadruple Top which fizzled but this week they have attracted renewed interest breaking through $60.00 to a new all-time high. Next potential upside resistance on trend appears in the $72.80 to $77.30 range where several of vertical and horizontal counts cluster. Initial support appears near $56.30 based on a 3-box reversal.

With its bullish SMAX score increasing to 8, AMD is exhibiting near-term strength against the asset classes.