by Don Vialoux, EquityClock.com

Technical Notes for Tuesday July 21st

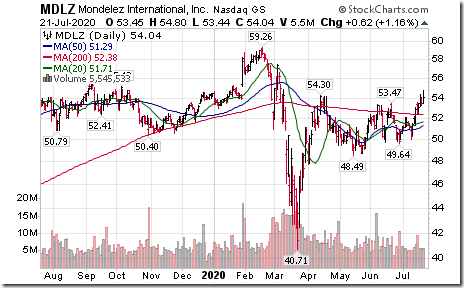

Mondelez (MDLZ), an S&P 100 stock moved above $54.30 resuming an intermediate uptrend.

Lululemon (LULU), a NASDAQ 100 stock moved above $324.76 to an all-time high extending an intermediate uptrend.

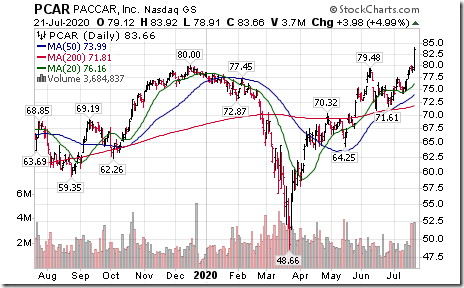

Paccar (PCAR), a NASDAQ 100 stock moved above $79.38 and $80.00 extending an intermediate uptrend.

Skyworks Solutions (SWKS), a NASDAQ 100 stock moved above $138.22 to an all-time high extending an intermediate uptrend.

Willis Towers Watson (WLTW), a NASDAQ 100 stock moved above 209.20 extending an intermediate uptrend.

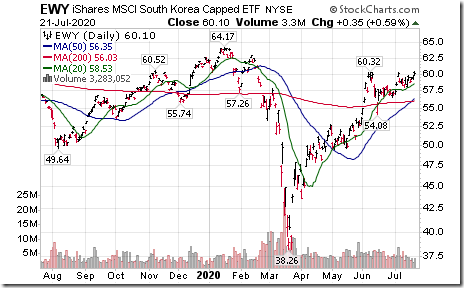

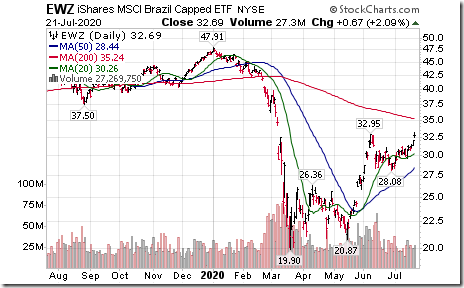

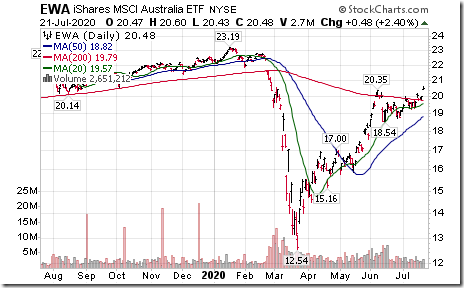

The U.S. Dollar Index and its related ETN virtually collapsed yesterday. Weakness triggered strength in commodities price in U.S. Dollars and related commodity equity prices. Weakness also added strength to ETFs that track equity indices of other countries (e.g. Korea, Brazil, Australia, Russia).

Korea iShares (EWY) moved above $60.32 extending an intermediate uptrend.

Brazil iShares (EWZ) moved above $32.95 extending an intermediate uptrend.

Australia iShares (EWA) moved above $20.35 extending an intermediate uptrend.

Russia ETF (RSX) moved above $21.88 extending an intermediate uptrend.

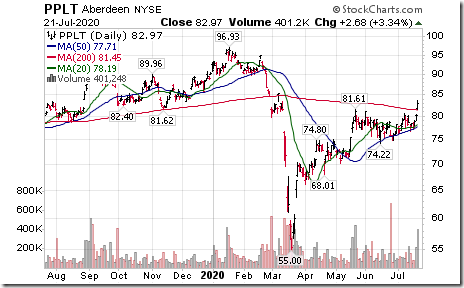

The CRB Index and its related ETN soared to a five month high triggered by U.S. Dollar weakness. It completing a modified reverse head & shoulders pattern.

Platinum also soared with U.S. Dollar weakness. Platinum ETN (PPLT) moved above $81.61 extending an intermediate uptrend.

Agnico-Eagle (AEM AEM.TO), a TSX 60 stock moved above $US69.44 to an all-time high extending an intermediate uptrend.

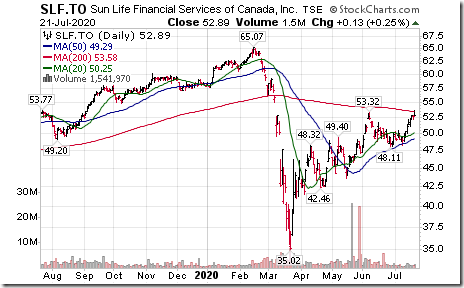

Sun Life (SLF), a TSX 60 stock moved above $53.32 extending an intermediate uptrend.

Trader’s Corner

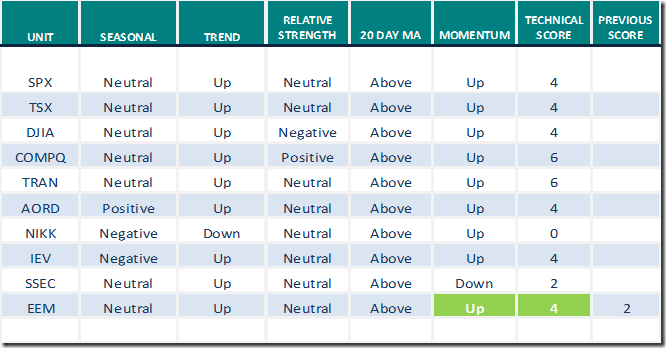

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for July 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

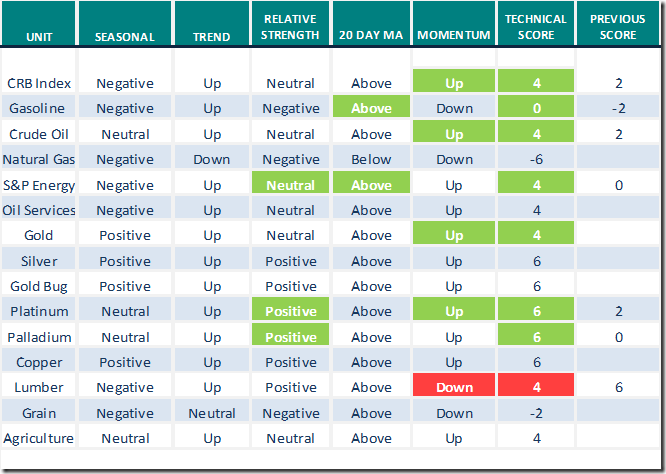

Commodities

Seasonal/Technical Commodities Trends for July 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

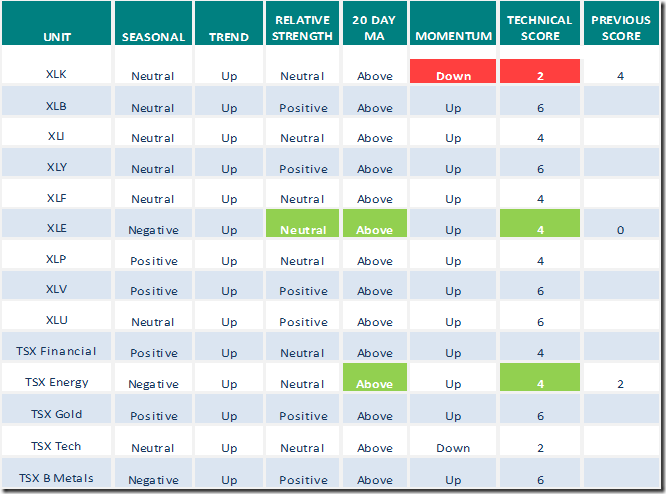

Sectors

Daily Seasonal/Technical Sector Trends for July 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer added 6.61 to 79.96 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer added 4.73 to 83.57 yesterday. It changed from intermediate overbought to extremely intermediate overbought on a move above 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.