by Derek Benedet, Craig Basinger, Chris Kerlow, Alexander Tjiang, Richardson GMP

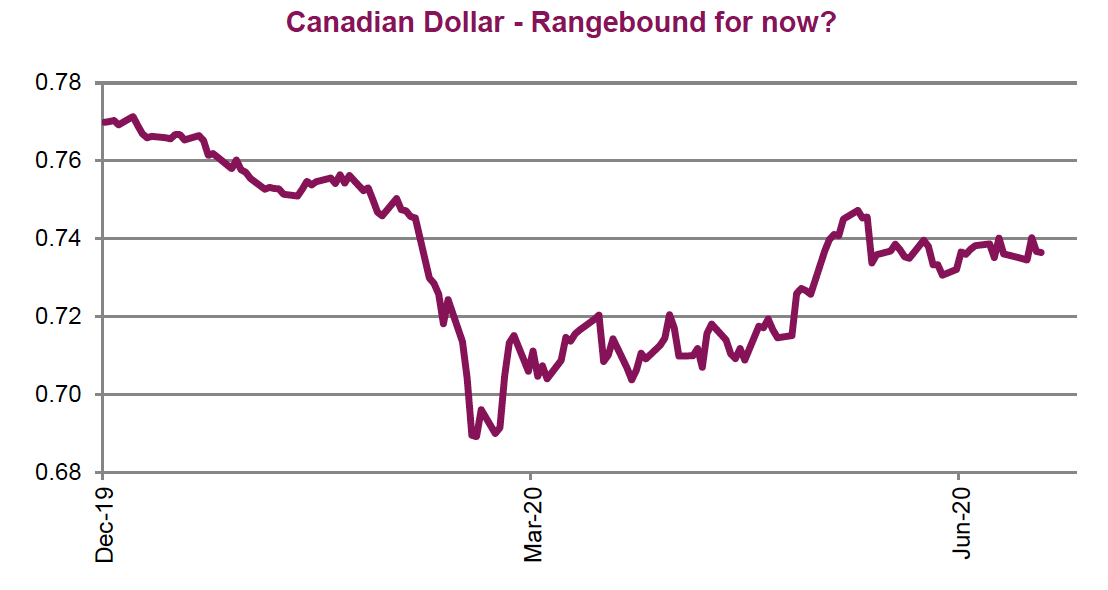

Last week was busy for watchers of Canada’s economic data, with the main event being the Bank of Canada (BoC) rate announcement. Not surprisingly, the bank left rates unchanged. It also released its Monetary Policy Report, which is always an interesting read. The good news is that Canada’s economy has fared better than the BoC’s worst-case scenarios and, in general, new bank Governor Tiff Macklem’s comments were somewhat more upbeat than expected. This was evident from the Canadian dollar’s immediate move upward.

The BoC expects to see a burst of activity in the coming quarters, but the road to full recovery will be long and bumpy. Looking ahead, the BoC expects GDP to contract 7.8% in 2020, but sees a slower recover with only a 5.1% gain in 2021 and 3.7% gain in 2022. So, while the trough wasn’t quite as deep as expected, it will take a long time to traverse. The recovery will also be uneven across regions and sectors, with some of the hardest hit facing ongoing challenges, especially restaurants and leisure companies. Lots of uncertainties remain, the biggest being the path of the virus. Forecasting is never a perfect science, but it is now highly conditional on the path of the virus more so than the economic models that typically place every variable within tight constraints. The BoC’s base case is that the virus has run its course by the middle of 2022. The outlook is highly uncertain, as nobody can predict the path of the virus or the timing, eventually, of a medical vaccine.

Canadian dollar

Currency moves, especially the CAD/USD cross are a critical but often unpredictable variable for Canadian investors. A weaker loonie boosts foreign investment returns, while a stronger loonie detracts (if unhedged). This is especially so now that we are in an even lower yielding paradigm than years past as currency moves can increase the risk exposure for foreign bonds especially. A one percent move for the loonie is not uncommon, and if it moves in the wrong direction it can easily wipe out a year or more of returns. Besides

T he residential real estate market is a risk, one that has been on our radar for some time. However, we don’t see signs that the market is under any undue pressure. Home sales increased in June, defying the standard recession playbook, but this isn’t your typical recession in many ways. The fiscal and monetary response has been incredibly quick. Canada recently announced an unprecedented budget deficit of $345 billion and has recently been downgraded by Fitch Ratings to AA+ from AAA, citing the massive spending outlays. It’s worth noting that Canada remains AAA rated by the other two major credit agencies, Moody’s and S&P.

he residential real estate market is a risk, one that has been on our radar for some time. However, we don’t see signs that the market is under any undue pressure. Home sales increased in June, defying the standard recession playbook, but this isn’t your typical recession in many ways. The fiscal and monetary response has been incredibly quick. Canada recently announced an unprecedented budget deficit of $345 billion and has recently been downgraded by Fitch Ratings to AA+ from AAA, citing the massive spending outlays. It’s worth noting that Canada remains AAA rated by the other two major credit agencies, Moody’s and S&P.

If Canada was acting as a lone wolf, this would wreak havoc on the loonie; however the U.S. has also opened its pocketbook and Europe is still deciding how much fiscal stimulus they want to pump into the system. Central banks have been busy stabilizing credit markets and increasing balance sheets in the process. What’s interesting is that the BoC has had a larger proportional response compared to the U.S. Federal Reserve. Pre-pandemic, the Fed’s balance sheet was roughly 35x as large as the BoC. Chart 2 shows that this ratio has actually declined to 13x thanks to the BoC increasing its balance sheet nearly fivefold. With every government spending as if every dollar they borrow won’t ever have to be paid back, the deficit’s longer-term impact is still unknown, but perhaps a wash in a relative sense.

Looking at long-term charts is a great way to gauge the lay of the land. Both from a historical perspective (Chart 3) and in terms of purchasing power parity, the loonie is undervalued. Chart 4 confirms that the loonie is nearly 20% undervalued to the U.S. dollar and near a critical junction that marked historical low points for the loonie.

Rate differentials also argue for a stronger loonie (Chart 5).The correlation has broken down over the past year, and we’re not so sure that these will move all that much in the coming quarters as central banks have indicated little likelihood of any movement. Central bank policy, for better or worse, pegged government bond yields within fairly tight bands. The longer end of the curve has more freedom, but currencies are most tightly correlated to rate differentials on the short end of the curve as seen in Chart 6.

Rate differentials also argue for a stronger loonie (Chart 5).The correlation has broken down over the past year, and we’re not so sure that these will move all that much in the coming quarters as central banks have indicated little likelihood of any movement. Central bank policy, for better or worse, pegged government bond yields within fairly tight bands. The longer end of the curve has more freedom, but currencies are most tightly correlated to rate differentials on the short end of the curve as seen in Chart 6.

Risk on/off sentiment will be a large, if not the largest, driver near-term. Unfortunately, that’s also the hardest to forecast. YTD the Canadian dollar has high beta to risky assets across G10 USD pairs (Chart 7). When risk sentiment is on the rise, the Canadian dollar is one of the largest beneficiaries in currency land. The U.S. dollar benefited materially during big selloff, but has been paring those gains and is under increasing pressure as long as risk sentiment rises. Traders in the futures market are boosting bets against the greenback with net long USD positioning falling, while net position for the loonie has only begun to rise off of a low bottom, which could act as a tail wind. On balance, most markets point to more upside risks than downside risks for the loonie longer term. Shorter term, markets are still at risk of further bouts of volatility – whether it’s the virus, economic missteps or earnings that act as the catalyst we can’t predict, but we do know that U.S. dollars will act as a solid portfolio diversifier. The Canadian dollar has had a nice run off of the March lows and we’ve been using the strength to increase U.S. equity exposure.

Beyond picking which currency will be the biggest winner, real assets could be a real winner. With yields so low and perhaps moving even lower, gold has been a great diversifier and is a logical winner with a potential future devaluation of fiat currency.

USD/CAD has been moving sideways inside a trading range since early June. The price is moving between 1.37 and 1.34 and there is no clear direction for the last couple of months. This is not necessarily a bad thing because when the price breaks out of the trading range, we will have an important signal of the direction of the future trend. For now, the best course of action is to simply be patient and wait. The chart below is longer term, and reveals the currency is sitting on a key long-term trend line with multiple levels of resistance overhead. While too early to say with conviction, technically we remain biased lower with the next key test of support coming from where the loonie was at the beginning of the year, around $1.30. Momentum has been weakening and the Moving Average Convergence Divergence (MACD) – a trend-following momentum indicator that shows the relationship between two moving averages of a security's price – has just had a negative crossover. This reinforces our view of a test and perhaps breaks through the longer-term trend line. The turning point for a new long-term cycle may very well be close at hand.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Insurance services are offered through Richardson GMP Insurance Services Limited in BC, AB, SK, MB, NWT, ON, QC, NB, NS, NL and PEI. Additional administrative support and policy management are provided by PPI Partners. Insurance products are not covered by the Canadian Investor Protection Fund.

Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.

Copyright © Richardson GMP