by Hubert Marleau, Market Economist, Palos Management

What Happened In the Week Ended July 17, 2020

The S&P 500 struggled to break above the key resistance point of 3200. The index increased 1.3% to settle at 3226. Most stocks kept on going with the S&P 500 now within striking distance of the all time high of 3386, brushing aside the current surge in Covid-19 infections.

The number of coronavirus cases is hitting new daily records. So far, it has not led to as many deaths as some public health experts feared. Thus, traders remained focused on economic indicators which kept on printing better data points than generally expected, with impressive gains in several measures of spending (retail sales up 7.5% m/o/m), of output (industrial production up 5.3% m/o/m), of prices (consumer prices up 0.6% m/o/m) and cost ( weekly earnings up 10.0% y/o/y).

The Citi Economic Surprise Index continues to reach new highs, giving comfort that the economy will eventually return to the level of business activity that was registered in the last quarter of 2019. The optimism index for small businesses increased 6.2 points to 100.6 in June---regaining three quarters of its plunge earlier this year.

The outlook for the market will depend on whether the apparent pause in the recovery process will turn into a protracted slowdown. I don't believe it will. Business sentiment related to economic conditions and investor confidence about market prospects should hold steady if the death toll does not reach an intolerable rate. There are a number of favorable factors on the horizon which could encourage traders to cling to their cautious but relatively optimistic view.

Firstly, thanks to $18.5 trillion in global stimulus, the global financial system is in relatively good shape. That is not to say that we did not have many bankruptcies and that more defaults aren’t coming. Many businesses have been badly affected by the economic collapse that accompanied lockdowns. But there is no “Lehman event” this time. Corporations have borrowed trillions of dollars in the debt markets in the last few months, giving them plenty of runway to fix their business.

Households were in a better shape heading into the pandemic than in the 2008-09 financial crisis. The percentage of personal debt (mortgages, credit cards, car loans) falling into delinquency, unexpectedly fell to 0.7% at the end of June from 1.5% in March even as millions lost their jobs. Additionally, the six big money center banks made colossal amounts of revenue in the June quarter via their trading desk. It has allowed them to take huge reserves totalling $35 billion, preserve capital and lower the value of risky assets used to calculate their key capital ratio. For example, JPMorgan’s reserves are now 3.0% of total loans compared to 1.76% last year.

They are braced for a possible wave of souring loans and prepared to weather their worst case scenarios. In the judgement of Citigroup, it had no other choices but to take precautions because the environment is completely unpredictable, as there are no models and no cycles to point to. What is interesting is that what is supposed to occur in a recession did not--- incomes are up and home prices are up.

Secondly, the U.S. government budget’s deficit for the month of June alone hit $864 billion--a record. The forecast for the fiscal year ending September stands at $3.7 trillion, more than double the high set in 2009. Congress is expected to pass another stimulus package by the 1st week of August. Given the deteriorating health conditions in several “red states” and resulting political impact on Republicans, the GOP will likely force the White House to accept a fiscal package in excess of $1.0 trillion that the House will surely pass. This year’s budgetary deficit could top $5.0 trillion.

The deficit will be financed in a MMT-ish fashion as the Fed will absorb an enormous part of the debt with all-time low interest rates. The exercise will suit their purpose because they want the rate of inflation to rise above the 2.0% target. In this respect, the Fed will hold the policy rate near zero, introduce yield curve control, keep QE for as long as needed and formally insist through forward guidance that they are resolved to get what it wants--- higher inflation and surreptitiously a lower dollar.

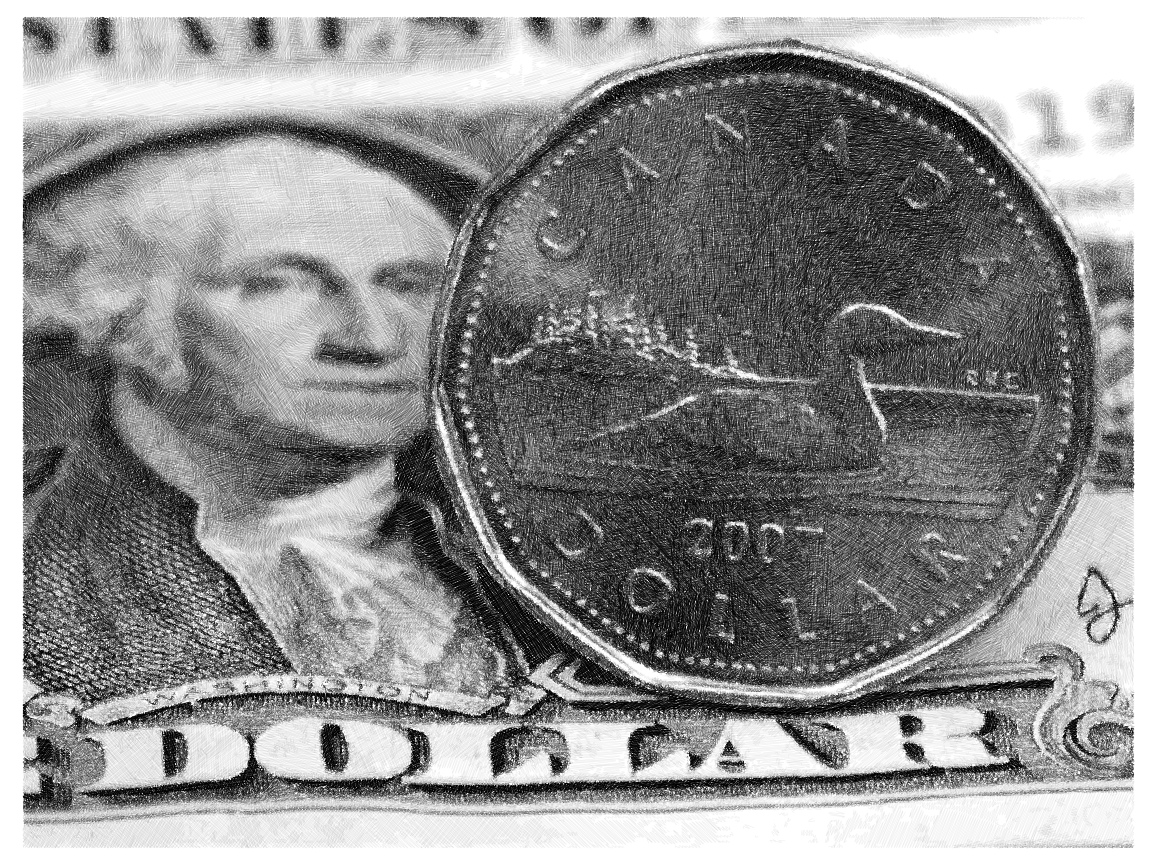

Thirdly, the ICE U.S. Dollar Index (DXY)--a gauge of the currency against the U.S.’s most important trading partners--has fallen 6.5% since March to 96.0. Over the past few months, numerous foreign exchange experts including the reputable Stephen Roach have indicated many fundemental factors--monetary, economic and geopolitical--have sufficiently changed to weaken its dominant role as a safe haven, an international store of value and transactional exchange currency.

The expectation among a survey of analysts compiled by Bloomberg is that the DXY will soon fall further to 94.0. It may not look like much but for a currency it’s a lot and enough to test a ten-year upward trendline that has climbed over 40% since 2011. Such an occurrence could be classified as a bear signal for the dollar and a bullish one for inflation.

Taking together all the aforementioned elements, I’m not surprised that there is a significant increase in inflation expectations in consumer surveys, industrial prices and bond yields. I hate to say it but “this time is different” because Chairman Powell is not even thinking about thinking about raising rates. History shows that when the price of money is low and stays low, expansions are usually durable even when inflation ticks up.

A viable inflation narrative is becoming a noticeable probability that could bring a constructive pro-cyclical rotation from growth to value stocks, high-grade to high-yield bonds and mega-cap to small-cap companies. Thus, I remain tactically bullish, keeping my present exposure in growth and big-cap stocks until a top coincides with a vaccine then putting new money into value and mid-cap stocks. Incidentally, I adjusted my trading range for the S&P 500 to 2950 to 3350.

Copyright © Palos Management