by Michael Hyman, Matt Brill and Steven Thomson, Invesco Canada

On March 23, the U.S. Federal Reserve (Fed) announced its intent to acquire investment grade corporate bonds. The purpose of the communication was to support a market in which sharp price declines were threatening to disrupt the normal functioning of primary (new issue) and secondary market activities. On April 9, the Fed announced an expanded definition of bonds eligible for purchase to include those with investment grade ratings as of March 23, even if they had since been downgraded to high yield, as long as they remain in the BB category.

Since the announcement, credit spreads have improved (declined) and the primary market has opened to companies seeking funds to withstand the coming months, and possibly years, of uncertainty. The Fed’s announcement proved to be so reassuring for the markets that the months of March and April – even before the Fed had purchased a bond – set records for the highest level of new issuance in the investment grade market’s history.1 Nevertheless, the Invesco Fixed Income† team expected the transition by the Fed from a verbal commitment to actual buying activity would be critical in the event of another selloff.

On May 12, the long-awaited acquisition of corporate bonds began, but instead of purchasing individual bonds, the Fed chose to acquire exchange traded funds (ETFs). Our belief is that the Fed is buying both investment grade and high yield corporate bond ETFs.

We expect larger ETFs to be involved and purchases to be distributed across the market. What matters more, in our view, is the size of purchases, which should become clearer in the coming days and weeks. This clarity should give us an idea of the potential impact of the Fed’s purchases on the market.

Purchasing ETFs rather than individual bonds was probably the quickest and most efficient way to accumulate bonds in a diversified manner. However, we believe the Fed will be prepared to acquire individual bonds, potentially by June. We anticipate the Fed’s purchasing activity to provide liquidity to the credit markets and be supportive of both investment grade and high yield bonds.

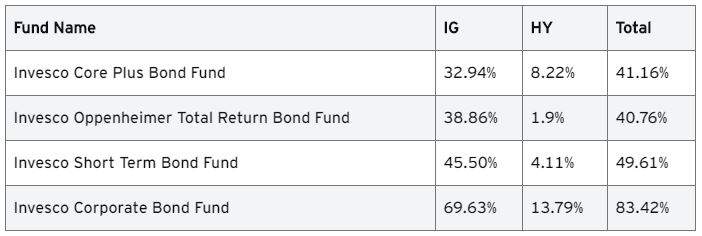

Figure 1: Invesco funds that could be impacted by the Federal Reserve’s bond purchasing program

Percentage of fund assets in the two asset classes where the Fed is purchasing bonds – investment grade (IG) and high yield (HY).

Source: Invesco, As of March 31, 2020. Please see the Invesco website for complete holdings information. Holdings are subject to change.

This post was first published at the official blog of Invesco Canada.