by Hubert Marleau, Market Economist, Palos Management

The Perfect Storm

This was the week when three key government men created a perfect storm that either put a stop to the bull run or forced a needed correction. An outside observer would think that Messer, Trump, Powell and Fauci willingly colluded to give investors a lesson on the danger of irrational exuberance. Their messages could not have been better timed, if that was the purpose. The market was already under some stressful technical conditions for moving too fast while valuations were believed to be out of whack with the current economic reality.

Unfortunately, opinions, even of reputable journalists and economists about what ought to be done on the monetary, economic and health issues have been politically interpreted, making cooperation, coordination and planification extremely difficult. Given the negative economic effect of the engineered lockdown on technical metrics and valuation measures, the market is understandably fragile. A dose of controversial opinions can easily upset investors. That is exactly what we had last week when Dr. Fauci, President Trump and Fed Chair Powell offered adversity rather than solace. Firstly, the blame game was on. President Trump accused China for the pandemic, augmenting geopolitical tensions over trade and investments. Secondly, Dr.Fauci cautioned the authorities that reopening the economy too wide and too fast could bring a second wave of viral infections which would lead to more deaths and a reintroduction of full-lockdowns. Thirdly, the Fed Chairman pushed back on the suggestion of negative rates and insisted that more fiscal spending is needed to prevent permanent economic damage. Not surprisingly, the week was a disaster and nerve racking, registering the worst session since March. The S&P 500 decreased 2.3% ending at 2863.70 on Friday.

The Current Economic Reality

As a matter of fact, the economic conjecture did change. A growing body of forecasters now believe that the economic future looks more like a swoosh shaped recovery than a V-shaped one. According to a monthly Wall Street Journal survey of economists, the U.S. unemployment rate is expected to hit 17% in June and the GDP to contract at the annual rate of 32% in the June quarter. Indeed big numbers. But they make complete sense, given what we are witnessing. The number of Americans seeking unemployment benefits remained in the millions for an eight straight week. For the week ended May 4, the Labor Department reported that initial jobless claims totaled 2.98 million compared to 3.18 million the prior week. The decline failed to meet the median estimate of 2.5 million. U.S retail sales fell 16.4% in April in part because of the March-panic buying but mostly because thousands of stores had black windows. The consensus forecast was a 12.0% decline--the range was comically wide (-25% to-6.5%). Grocery sales were up 13.2% and clothing stores saw their sales fall by 90%. Meanwhile, the Federal Reserve reported that the April industrial output fell 11.2%, pulling down production capacity to a record low 64.9%.

The Current Economic Outlook

Eighty-five percent of economists and strategists surveyed by the Wall Street Journal anticipate a recovery to start in the 2nd half of 2020, predicting an annualized growth rate of 9.1% in the September quarter followed by 6.9% in the final quarter of this year. The survey predicts that growth in 2021 and 2022 will increase 5.0% and 3.0% respectively. The weekly tally of economic prints has started showing pluses, suggesting that a recovery path may be underway.

Nevertheless, the output gap, the difference between actual GDP and potential, won't close until the end of 2022. In this regard. inflation and interest rates should remain relatively low because it will be a prolonged journey littered with potholes. In 2020, zero inflation is expected; but inflation-signals should arise in 2021. Cost push tension stemming from supply disruptions, de-globalization and demand pull pressure arising from the massive increase in the money supply will likely emerge, albeit slowly but gradually along the recovery path. The WSJ survey supports the prediction that the rate of inflation will rise to more than 2.0% as 2022 approaches. The University of Michigan sentiment survey was released on Friday. Not only did the index move up reflecting increased confidence but inflation expectations rose sharply.

In Round Numbers, The S&P 500 Is Stuck in a 300-Point Trading Range

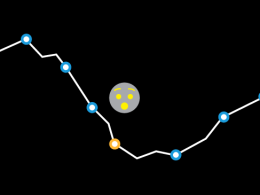

The current coronavirus episode is being fought on three levels—Finance, Health and the Economy— in an attempt to return the S&P 500 to the high of 3386 which was reached on February 19. If one is willing to accept in broad terms that the low point for the S&P 500 is 2237 (March 23), the spread between the high and the low is 1151. Assuming that each of the three aforementioned factors account for ⅓ of the lost ground, a rational conclusion can be made about what ought to be an hypothetical trading range.

Given that the Fed has done everything to avert a liquidity crisis, the monetary stimulus probably provided a lift of 375 points, suggesting that the low for the S&P 500 for the time being is around 2600.

As far as business is concerned, the crux of the narrative is that the government and the central bank will throw enough money at the economy to make sure it either becomes a Swoosh-up or V-up recovery. Well, it's happening. Green shoots are appearing as the U.S. is slowly reopening its economy. For example, car sales are bouncing back, retailers are open for curb-side pick-up, and restaurants with delivery services are busy. A daily survey conducted by Civics Analytics shows the pace of job losses is slowing. The bet is on a turnaround. The Bloomberg recession tracker has transitioned to a recovery tracker. High frequency indicators including Google searches and treasury revenues plus an assortment of small business data suggest that the worst is behind us. Nevertheless, the U.S. is not out of the woods, since there is a lot of work left to revive the economy to its former self. I would give a maximum of 150 points of the 383 points for this factor.

The health side of this equation is particularly difficult to access for there is plenty of ambiguity as to whether the situation is getting better or not. This can be exemplified by the acute difference of opinion between President Trump and Dr Fauci. In a senate testimony, Dr. Fauci horrified investors when he warned senators of the serious consequences of higher death rates if States reopened. To make matters even worse, the Who said that the virus may never go away.

While unnerving, the above statements do not take into account the progress that is being made on the health front in trying to invent vaccines, discover drug treatments and devise test procedures. Abby Cohen, advisory director at Goldman, said; “the physicians and scientists with whom I have had the opportunity to speak regularly do believe that there are probably seven or eight vaccines that look promising right now.” Moreover, the evolution of new deaths using a 7-day moving average of new daily deaths per one million of population had dropped from a high of 10.4 in the week ended April 22 to 7.35 for the week ended May15. This is where the investor's “fear of missing out” enters the equation even though the idea clashes with the reality of how long it will take to find a solution or the unintended consequences of failing. Overall the health side is not worth any more than150 points for now.

Based on the aforementioned calculations, the trading range for the S&P 500 in round numbers is 2600 to 2900. And, it is likely to last until we get a breakthrough.

Copyright © Palos Management