by James T. Tierney, Jr., CIO Concentrated US Growth, AllianceBernstein

Economic fallout from the coronavirus pandemic has battered a US retail industry already experiencing seismic change. But companies with effective, multichannel consumer models in place before the crisis will compound these advantages on the other side of it.

The US retail industry—from groceries to jewelry—has undergone major structural change over the last decade. Amazon’s dominance around product information, availability and convenience has long raised the bar on consumer expectations and continues to fundamentally shift how retailers view their store-to-customer relationships. For equity investors, select companies that have adapted well to these changes deserve a closer look.

Pandemic Store Shutdowns Reflect Legacy Problems

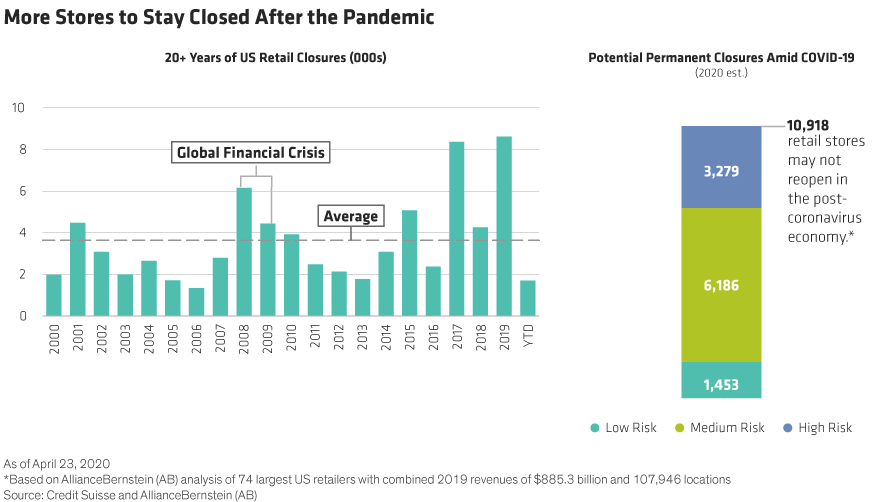

The sea change in how consumers shop has left many retailers behind. Since 2010, over 41,000 US retail locations have closed—40% more than over the prior 10 years, which included the global financial crisis of 2008–2009 (Display, left). And more stores will stay closed after the pandemic. Our analysis estimates that one in 10 of the roughly 108,000 stores run by the 74 largest retailers may never reopen in the post–COVID-19 world (Display, right). Before the crisis, this 10% permanent closure would likely have taken three years to reach.

J.C. Penney, J.Crew and Neiman Marcus are clear testaments of what happens when retailers stick to old ways. Even when they lost money, these “anchor store” retailers got by with a core model of low fixed operating costs and a steady volume of in-store customers. This legacy brick and mortar model is not ideal in the new retail environment, and flat out can’t work in a global pandemic when you’re forced to turn away shoppers at the door. By late May, J.C. Penney, Neiman Marcus and J.Crew had all sought Chapter 11 bankruptcy protection.

Digital Consumer Experience Redefines Business Models

It’s not that everyone shops on the web. The US Bureau of Labor Statistics reported that online purchases were less than 15% of total retail sales in 2019. But the shelter-in-place rules across the country pushed consumers to try online shopping, and the influence of this permanent and growing wave of ultra-connected consumers can’t be dismissed. At the very least, it requires brick-and-mortar retailers and branded manufacturers alike to rethink and modernize their business models to reach their consumers.

Retailers like Home Depot and Ulta Beauty have kept their competitive edge with a digital transformation in fulfillment operations, and customer interactions and experiences. Also, many name-brand companies such as Nike and Estée Lauder have embraced e-commerce to expand into direct-to-consumer models. This widens their distribution capacity for starters, while also supporting customer-centric innovation and product development down the road.

Retailer Fates Accelerated by the Coronavirus

COVID-19 will be a catalyst for the fates of many US retailers—winners and losers alike. We expect a huge leapfrog effect as market share shifts faster from struggling, physical-centric stores to nimble, omnichannel models. Trends that were expected to unfold over a decade by most estimates will now be compacted into just a few months, in our view.

Innovators Were Equipped for the Crisis…

Few predicted a pandemic, but retailers that made innovative improvements to address changes in the industry have been better placed to navigate the crisis. For instance, long-standing supply-chain adjustments have helped some move fast to fulfill online orders and accommodate home delivery demands. Innovative loyalty programs and social media strategies, meanwhile, have changed how these retailers engage with customers. And these moves have helped them push forward timely customer updates and gather feedback in the extended global shutdown.

Retailers built to last also prioritized investment in technology. Their shifts to cloud-based infrastructures, for instance, let their leaderships seamlessly connect with employees and, during the crisis, have ensured operational integrity in potentially chaotic work-from-home scenarios. Meanwhile, mechanization and robotics adopted in distribution centers can promote healthy employee social distancing with minimal disruption to operations and output. Most important, companies that had already adopted cross-channel distribution capabilities—including curbside pickup and home delivery— were able to maintain at least some sales volume while their physical stores yielded none.

…and Poised for Long-Term Success

As states begin to slowly ease stay-at-home restrictions, consumers are starting to venture out. No one knows how long it will take to get back to normal. But retailers who stayed ahead of the curve with omnichannel consumer models and other forward-looking strategies will continue to benefit from them well after the storm subsides, those who didn’t, won’t.

While retail earnings will not be encouraging during the shutdown, extreme dislocations frequently create a domino effect. The additional debt taken on by weaker players becomes life threatening and causes them to degrade the customer experience—exactly when they need to be enhancing it to recapture shoppers. Investors who can find retailers with healthier balance sheets and the right strategic infrastructure in place to cope with the industry’s transformation should be able to find solid sources of consistent long-term earnings growth when the recovery kicks in.

James T. Tierney, Jr. is Chief Investment Officer of Concentrated US Growth at AllianceBernstein (AB)

Anna Toshach is Senior Research Analyst, Concentrated Growth Equities at AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..