by Matthew J. Moberg, CFA, Franklin Templeton Investments

Markets hate uncertainty. In the first quarter of 2020, global markets have digested two shocks: COVID-19 and a sudden drop of more than 50% in the price of crude oil. Predictably, equity markets have not been kind to these two surprises.

As we look forward to the remainder 2020, we believe equity markets will now wrestle with the duration and severity of the coronavirus and the impact it will have on the global economy, the supply and demand outlook for oil, and governments’ reaction to these events.

Sudden shocks, steep declines and unexpected market events are unsettling and uncomfortable. They are also very normal. In my career as an investor, they have happened twice, in 1999-2000 and 2007-2008. If the decline is large and strong enough, it gets its own name, such as, in the cases mentioned above, “the dot-com bubble” and “the global financial crisis”.

Almost by definition, each one of these events needs to be sudden, uncertain and unprecedented—defined as “never done or known before.” For example, Donald Trump winning the US presidential race in 2016 was, by most accounts, a surprise; however, it was well considered, and we certainly have had surprising US presidential election results in the past. The dual shock of COVID-19 and the sudden drop in the price of oil, simultaneously, is unprecedented.

What makes humans unique within the animal kingdom, amongst many features, is our ability to gather in networks much greater than ourselves. Nations, religion, governments and the global economy are all examples of this. The world economy wants to get back to work. Workers want to get back to work. Governments want to get back to work. Therefore, I believe it’s reasonable to assume we will get back to work.

While one can argue the crisis we are in now is unprecedented, it is normal for equity markets and the global economy to experience shocks. Our team has been investing in innovation for more than 50 years, and we have a process in place that helps us remove fear, panic, individual stock bias, and which we think helps us make good decisions in times of crisis. This process is the output of managing money through multiple past unprecedented events and viewing each crisis as an opportunity to refine, improve and learn from the previous crisis. Of course, we have enacted that process during this time, and we have executed on our predetermined playbook.

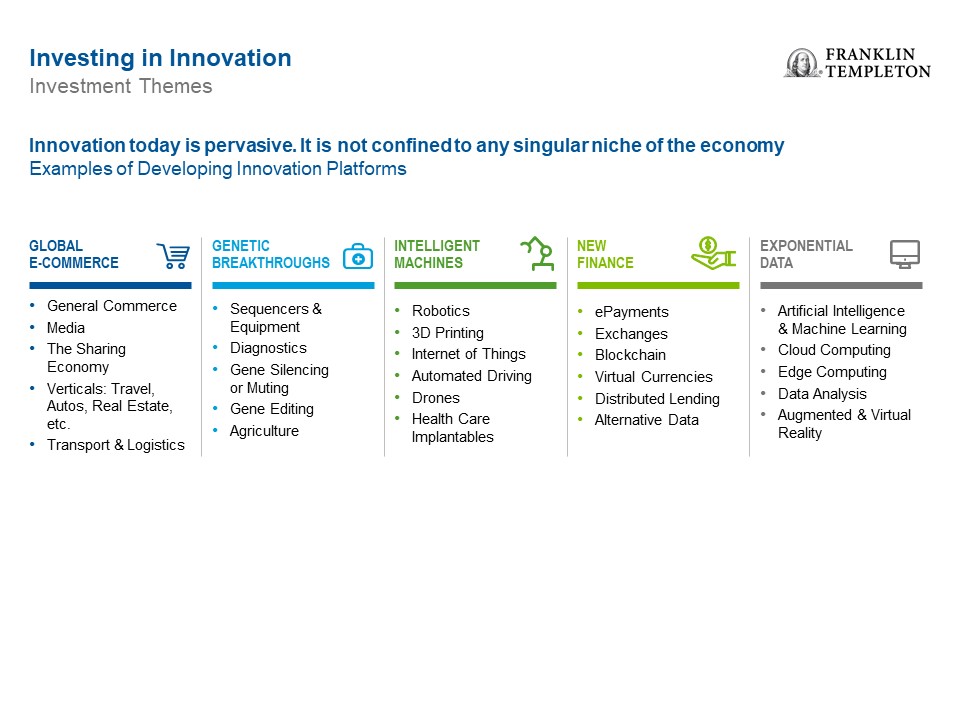

As followers of our investment philosophy know, we have organised this period of accelerating investment into five themes: disruptive commerce, genomic discovery, intelligent machines, new finance and exponential data.

In this period of crisis, we believe each one of the above themes will play a part.

Global e-commerce: We have already seen a good uptick in the usage of e-commerce as consumers avoid physical contact at stores.

Genetic breakthroughs: COVID-19 is analysed at the genetic level to test and vaccinate our population against the virus.

Intelligent machines: Automation will be leaned upon to produce and deliver goods with minimal human contact.

New finance: Payment providers will continue to reduce payment friction and physical contact in traditional commerce.

Exponential data: The reliability and speed of delivery of data has helped businesses to continue to function efficiently through video conferencing and work collaboration, while consumers are entertaining themselves, at home, with over-the-top entertainment programming, socialising and video games.

We invest in innovation. We are optimists. We live at a time of accelerating economic change due to accelerating innovation. We believe in our government and institutions and or collective ability to solve this crisis. We have new tools in our ability to fight a pandemic that we have never had in our history. Finally, we have often observed that it’s a poor investment to invest against human ingenuity. We will press forward with the belief that we will come out of this process stronger and better prepared for the future.

We understand these times are uncomfortable and stressful. All of us on the team wish you and your family safety and health during these unprecedented times.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The companies and case studies shown herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton Investments. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security. Past performance is not an indicator or a guarantee of future results.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Investments in fast-growing industries, including the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasising scientific or technological advancement or regulatory approval for new drugs and medical instruments. Small- and mid-capitalisation companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Actively managed strategies could experience losses if the investment manager’s judgement about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

This post was first published at the official blog of Franklin Templeton Investments.