Corporate bond investors should move up in credit quality in 2020.

After such a strong 2019, it’s unlikely that total returns will match the performance we’ve seen this year. Given the low level of yields today, and the high prices that have resulted in 2019’s drop in yields, income payments are likely to make up the bulk of the returns in 2020, not price appreciation.

We suggest investors reduce exposure to high-yield corporate bonds, as we see their prices at the greatest risk of falling next year, and consider moving up in credit quality in other parts of the corporate bond market as well.

2019—a banner year for corporate bond investments

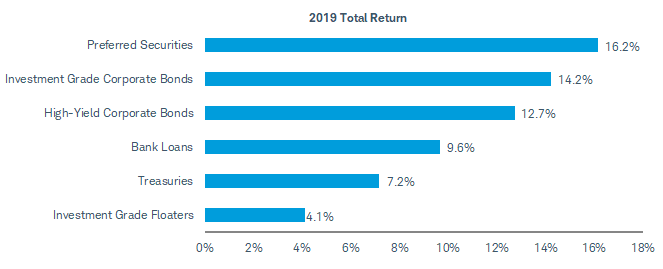

Taking risk has paid off this year. Not only has every corporate bond index we track posted positive total returns this year, but many are higher than 10%.

Strong performance for most corporate fixed income investments

Source: Bloomberg. Total returns from 12/31/2018 through 12/10/2019. Indexes represented are the Bloomberg Barclays U.S. Treasury Bond Index, Bloomberg Barclays U.S. Corporate Bond Index, Bloomberg Barclays U.S. Corporate High-Yield Bond Index, Bloomberg Barclays U.S. Floating-Rate Notes Index, ICE BofAML Fixed Rate Preferred Securities Index, and the S&P/LSTA Leveraged Loan 100 Total Return Index. Total returns assume reinvestment of interest and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no indication of future results.

The strong returns have been driven by the combination of falling Treasury yields and lower credit spreads (the relative yields that corporate bonds offer above comparable Treasuries). But we don’t expect this trend to continue. Through December 10, the 10-year Treasury yield has dropped by 84 basis points this year, from 2.68% to 1.84%. As bond prices and yields move in opposite directions, that has helped pull prices significantly higher this year. We believe intermediate- and long-term bond yields will rise modestly this year, so the tailwind of this year’s falling Treasury yield will likely turn to a headwind next year, potentially pulling prices lower.

Risks remain elevated

We see four key risks to corporate bond investments in 2020:

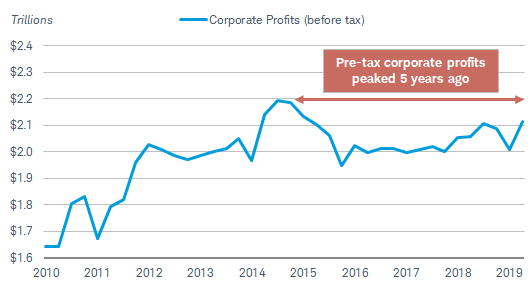

- Corporate profit growth has stalled. According to the Bureau of Economic Analysis (BEA), pre-tax corporate profits peaked at $2.2 trillion in the third quarter of 2014, and have yet to return to those levels. In other words, over the past five years, domestic corporations have been making less money each quarter than they did in 2014.

Quarterly corporate profits are below their 2014 high

Source: Bloomberg, using quarterly data as of 2Q 2019. Flow of Funds (FOF) Corporate Business Corporate Profits Before Tax with Inventory Valuation Adjustment (IVA) and Capital Consumption Adjustment (CCadj), (INCOCBCP Index).

The profit figure above provides a more robust look at corporate fundamentals compared to data from S&P 500® companies—it includes both public and private corporations of all sizes.

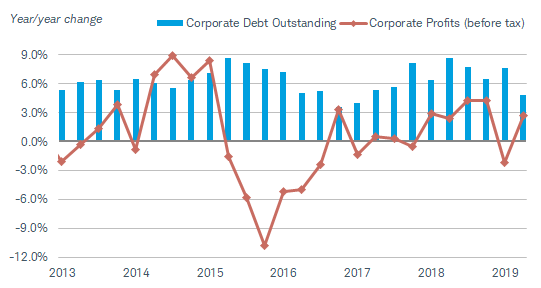

- Corporate debt continues to rise. U.S. corporations continue to issue more and more debt, taking advantage of still-low borrowing costs. The debt growth isn’t confined to one type of debt, either—it has been booming in both the investment-grade and high-yield corporate bond markets.

Since the second quarter of 2015, the year-over-year change in corporate debt outstanding has outpaced the year-over-year change in corporate profits. This trend could make it difficult for bond issuers to service their debt down the road, especially if corporate earnings come under even more pressure.

Corporate debt growth is outpacing corporate profit growth

Source: Bloomberg, using quarterly data as of 2Q 2019. FOF Corporate Business Corporate Profits Before Tax with IVA and CCadj (INCOCBCP Index) and FOF Nonfarm Nonfinancial Corp Business Credit Market Instruments Liability (CDNSCBIL Index).

- Economic growth concerns. Although we’ve seen some signs of stabilization both domestically and abroad, economic growth may continue to slow. The Institute for Supply Management (ISM) Manufacturing PMI Index remains below the key 50 level after dropping to 48.1 in November, indicating that manufacturing activity is contracting. While the non-manufacturing index is above 50, the trend is still negative. On the bright side, the JPMorgan Global Manufacturing PMI rose to 50.3 in November, after spending six months below the key 50 level.

While some of the surveys appear to be stabilizing, they’re short of signaling “all’s clear.” If economic growth continues to slow and surveys continue to have a negative tilt, investor sentiment may turn negative, credit spread may increase, resulting in lower corporate bond prices.

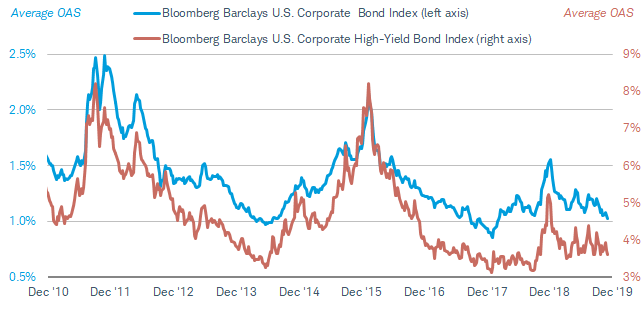

- Low relative yields. We believe it makes sense to take additional risks if you’re compensated accordingly, but today that’s not the case. Credit spreads—or the additional yield a corporate investment offers to a comparable Treasury security—remain very low.

The average option-adjusted spread (OAS) of the Bloomberg Barclays U.S. Corporate Bond Index closed at 1.02% on December 6, 2019, its lowest reading of the year. Meanwhile, the average OAS of the Bloomberg Barclays U.S. Corporate High-Yield Bond Index closed at 3.6% on the same day, only slightly higher than the 2019 low of 3.46% from this past April. In other words, the relative yields that corporate bonds offer are at or near their lowest levels of the year, and they are well below their long-term averages.

Spreads are at or near 2019 lows

Source: Bloomberg, using weekly data as of 12/6/2019. Option-adjusted spreads (OAS) are quoted as a fixed spread, or differential, over U.S. Treasury issues. OAS is a method used in calculating the relative value of a fixed income security containing an embedded option, such as a borrower's option to prepay a loan.

Given these elevated risks, we suggest investors take a more cautious approach to corporate fixed income investing in 2020. We see very little room for prices to rise next year, and coupon payments are likely to be a key driver of total returns next year. If economic growth continues to slow or corporate profits deteriorate further, the number of corporate defaults could increase, pulling corporate bond prices lower, especially in the lower-rated, riskier parts of the market.

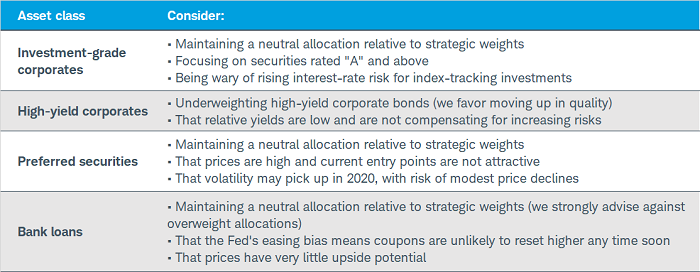

What investors should consider now

Investment-grade corporate bonds

We suggest a neutral allocation to investment-grade corporate bonds, with two caveats:

- Focus on corporate bonds with “A” ratings or better.

- Consider investments with average durations that are lower than the benchmark index.

As the amount of corporate debt outstanding has surged, so too has the number of BBB-rated corporates. Bonds with BBB ratings now make up more than half of the Bloomberg Barclays U.S. Corporate Bond Index. While that’s still considered investment grade, BBB is the lowest rung of the investing-grade rating spectrum, and just a notch above high-yield, or “junk,” territory.

Given the abundance of BBBs and slower corporate profit growth, a wave of downgrades could lead to a large number of BBB-rated bonds being downgraded to high-yield, likely leading to price declines.

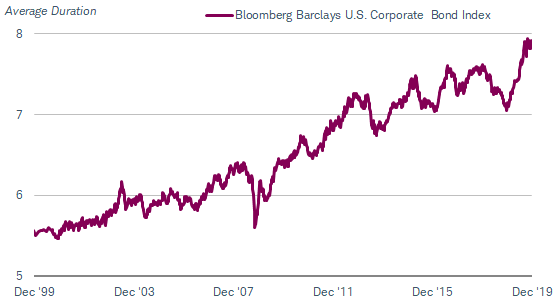

Meanwhile, the interest rate risk of the corporate bond index is now at an all-time high. The average duration, a measure of a bond’s sensitivity to interest rate movements, of the Bloomberg Barclays U.S. Corporate Bond Index closed at 7.9 on December 9, 2019—its highest reading ever. The higher the duration, the more sensitive a bond (or bond fund) is to changing yields. With a higher duration, the potential price declines for the broad index if yields do rise are larger today than in year’s past.

The average duration of the investment-grade corporate bond index has been climbing

Source: Bloomberg, using weekly data as of 12/6/2019.

This has implications for investors who invest in corporate bonds through passive, index-tracking investments like ETFs or mutual funds. You may be unknowingly be taking more credit risk (due to the large amount of BBB-rated bonds) and more interest rate risk (due to the high duration) than you may be expecting.

Investor takeaway: For those who invest in individual bonds, focus on those with A ratings or above. Also, focus more on short- or intermediate-term maturities, given our expectation of modestly higher long-term yields in 2020. For those who invest via funds, we suggest focusing on funds with higher average credit ratings than the benchmark index, as well as those with a more intermediate-term focus, for instance those with an average duration below the 7.9 average duration of the index. To help find investment options, you can search using the ETF Screener or Mutual Fund Screener, or explore funds on the ETF Select List or Mutual Fund Select List.

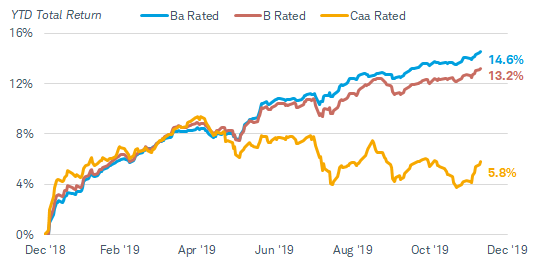

High-yield corporate bonds

We suggest investors underweight high-yield corporate bonds, instead focusing on higher-rated fixed income investments. With credit spreads as low as they are today, there’s less additional yield to serve as a cushion in case prices do fall in 2020.

One concerning trend has been the recent performance within the high-yield market. While the broad index has posted double-digit returns this year, the strong returns have been driven by the highest-rated bonds, not those with low ratings. The chart below highlights the year-to-date performance, and the divergence that began back in April. In fact, since April 30, 2019, the Caa rated bonds have lost 3.2%, compared with gains of 5.7% and 4.0%, respectively, for “Ba” and “B”rated bonds.1

Lower-rated bonds have significantly underperformed the upper tiers of high-yield lately

Source: Bloomberg. Cumulative total returns from 12/31/2018 through 12/10/2019. Returns assume reinvestment of interest and capital gains. Indices represented are the “Ba,” “B” and “Caa” sub-indexes of the Bloomberg Barclays U.S. Corporate High-Yield Bond Index. Past performance is no guarantee of future results.

We view lower-rated bonds’ underperformance as a sign that investors are shying away from the riskiest parts of the market. If concerns grow that the health of the corporate bond market is deteriorating, or that defaults may begin to pick up, the lowest tier of the market is likely to continue to underperform, and it could spread to all high-yield issues.

There are other risks within the high-yield market as well. Ratings downgrades have significantly outpaced upgrades this year at both Standard & Poor’s and Moody’s Investors Service, and the flat slope of the yield curve has generally led to poor total returns going forward. Finally, the high-yield market has shrugged off the global growth concerns lately. Historically, when manufacturing surveys have fallen like they have this year, high-yield bond prices have fallen. That hasn’t been the case this year. If there isn’t a clear turnaround in the various manufacturing surveys, we think high-yield bond prices should fall.

Investor takeaway: Reduce exposure to high-yield corporate bonds, instead focusing on higher-rated fixed income investments like investment grade corporate bonds, U.S. Treasuries, or investment grade municipal bonds.

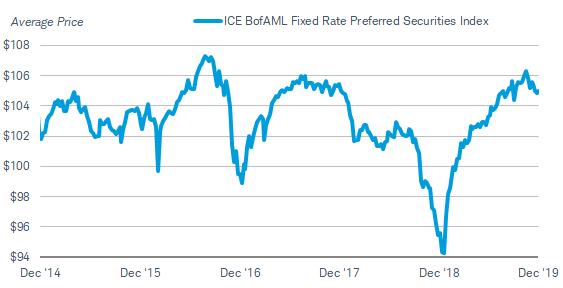

Preferred securities

Preferred securities can still make sense for income-oriented investors, but we believe there may be more attractive entry points down the road for investors looking to invest. In other words, investors can still hold preferred securities, but we would not be adding them to portfolios today given their high prices.

After falling sharply in the fourth quarter of last year, preferred prices surged in 2019. Driven by a combination of falling Treasury yields, lower credit spreads, and strong stock market returns, the average price of the ICE BofAML Fixed Rate Preferred Securities Index hit a multi-year high this past October and still remains well above its long-term average.

Preferred securities prices are at the high end of their 5-year range

Source: Bloomberg, using monthly data as of 12/9/2019. Past performance is no guarantee of future results.

A key consideration with preferred securities is that they have high interest rate risk and high credit risk. They have high interest rate risk because they have long maturities, or no maturity date at all. That’s a risk today given our expectation of modestly higher intermediate- and long-term Treasury yields next year. If that expectation comes to fruition, prices should fall modestly.

Preferreds also have high credit risk because they rank below a given issuer’s traditional debt and their coupon payments are often discretionary. Given our concerns about corporate profits, investor sentiment could sour if corporate profits or economic growth disappoints next year.

Investor takeaway: There’s very little room for preferred prices to rise, if at all, but there is a risk of price declines next year. We expect preferred securities’ income payments to be a key driver of total returns next year. Investors can still hold preferred securities because of the high income payments they offer, but make sure you have a long investing horizon and be prepared for price volatility.

Bank loans

Bank loans are niche part of the corporate bond universe. Also called senior loans or leveraged loans, they are junk-rated corporate loans that generally have floating coupon rates. The declining trend of short-term interest rates due to Federal Reserve rate cuts is one reason we’re generally cautious on bank loans, but their high prices and deteriorating covenant quality are two other areas of concern.

The average price of the S&P/LSTA Leveraged Loan 100 Index rarely gets above $100, so with a current price of $97.8, there’s not much room for upside.2 Meanwhile, bank loan investors today are likely receiving coupon yields that are roughly between 0.5% and 1.0% lower than where they are one year ago, as the three Fed rate cuts have brought down short-term interest rates. Like our outlook for most other parts of the credit market, if the economic outlook deteriorates, there’s plenty of room for bank loan prices to fall.

Investor takeaway: Proceed with caution with bank loans. More importantly, understand their risks. While they are called “senior” loans, they still carry junk ratings, are issued by firms with large amounts of debt, and their prices are very volatile. They should always be considered risky investments, and should serve as a complement to high quality, core bond holdings, not as a substitute.

1 Source: Bloomberg. Total returns from 4/30/2019 through 12/10/2019. Total returns for the “Ba,” “B” and “Caa” sub-indexes of the Bloomberg Barclays U.S. Corporate High-Yield Bond Index.

2 As of 12/10/2019