by Kevin McCreadie, AGF Management Ltd.

A 60/40 portfolio mix of stocks and bonds has served investors well over the years but may not be enough to protect them from the next big downturn in markets. Instead, what’s needed is an allocation that moves beyond these two traditional asset classes and takes cover in the growing universe of alternative investments.

That’s not to say investors should completely abandon the 60/40 concept. Stocks and bonds can still be an effective pairing for generating uncorrelated returns and they continue to provide important diversification benefits at the core of most portfolios. In fact, 2018 is the only year since 1969 that both asset classes have fallen in tandem during the same year, according to Bank of America Merrill Lynch data.

And yet, because this one occurrence happened just last year, there is cause for concern. In the past, there was much greater assurance that waning share prices would be offset by rising bond prices and vice versa—so much so, that most investors took it for granted. At the same time, it was widely agreed that the combination of stocks and bonds would provide overall returns that would adequately grow a portfolio to achieve most people’s goals over the long term.

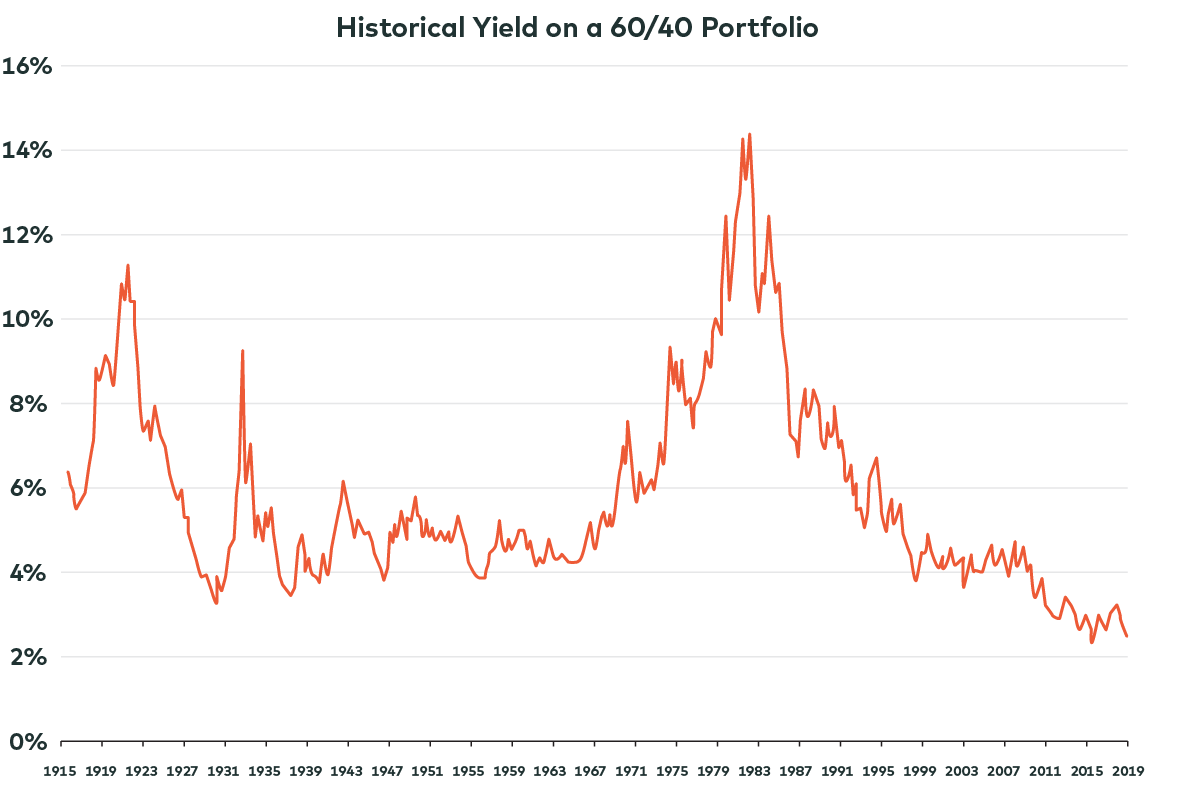

But that’s no longer the case in a market environment that is now so clearly defined by tepid economic growth and persistently low yields. Take, for example, a simple 60/40 portfolio that invests in the S&P 500 index and U.S. 10-year Treasury notes. At the end of August, it yielded just 2.4%, tied for the lowest yield on record since 1915.

Source: A Wealth of Common Sense blog, October 20, 2019

Granted, most 60/40 approaches are far more diversified than this and have the potential to net out with higher yields because of allocating to global equity markets and a variety of government and corporate bond issues from around the world. Even so, too many investors are ill-equipped to handle the growing risk of a late-cycle economy that, sooner or later, will culminate in a recession and major equity selloff.

In the past, the smart move in these instances was to hide out in bonds or go to cash and wait for the fallout to subside. During the financial crisis, for instance, investors could still earn close to 5% on U.S. short-term rates, while those who bought longer maturity government bonds earned even more and benefited from capital appreciation once central banks began to slash rates aggressively.

Today, they’d be lucky to earn a fraction of that and the risk of owning bonds has become far greater given interest rates have never been lower and have turned negative in many parts of the developed world including Europe and Japan. In other words, it may not hurt you, but also may not help you.

This is where alternative investments come in. From long/short equity strategies to real assets including infrastructure, real estate and/or commodities such as gold, investors can enhance their 60/40 portfolios through different sources of potential yield and uncorrelated returns.

In doing so, they will leave themselves in much better shape to preserve capital and still grow it in what is bound to become an increasingly volatile environment in the months ahead.

Kevin McCreadie is Chief Executive Officer and Chief Investment Officer at AGF Management Ltd. He is a regular contributor to AGF Perspectives.

The commentaries contained herein are provided as a general source of information based on information available as of November 5, 2019 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

*****

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), Highstreet Asset Management Inc. (Highstreet), AGF Investments LLC (formerly FFCM, LLC), AGF Investments America Inc. (AGFA), AGF Asset Management (Asia) Limited (AGF AM Asia) and AGF International Advisors Company Limited (AGFIA). AGFA is a registered advisor in the U.S. AGFI and Highstreet are registered as portfolio managers across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

™ The ‘AGF’ logo is a trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2019 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.