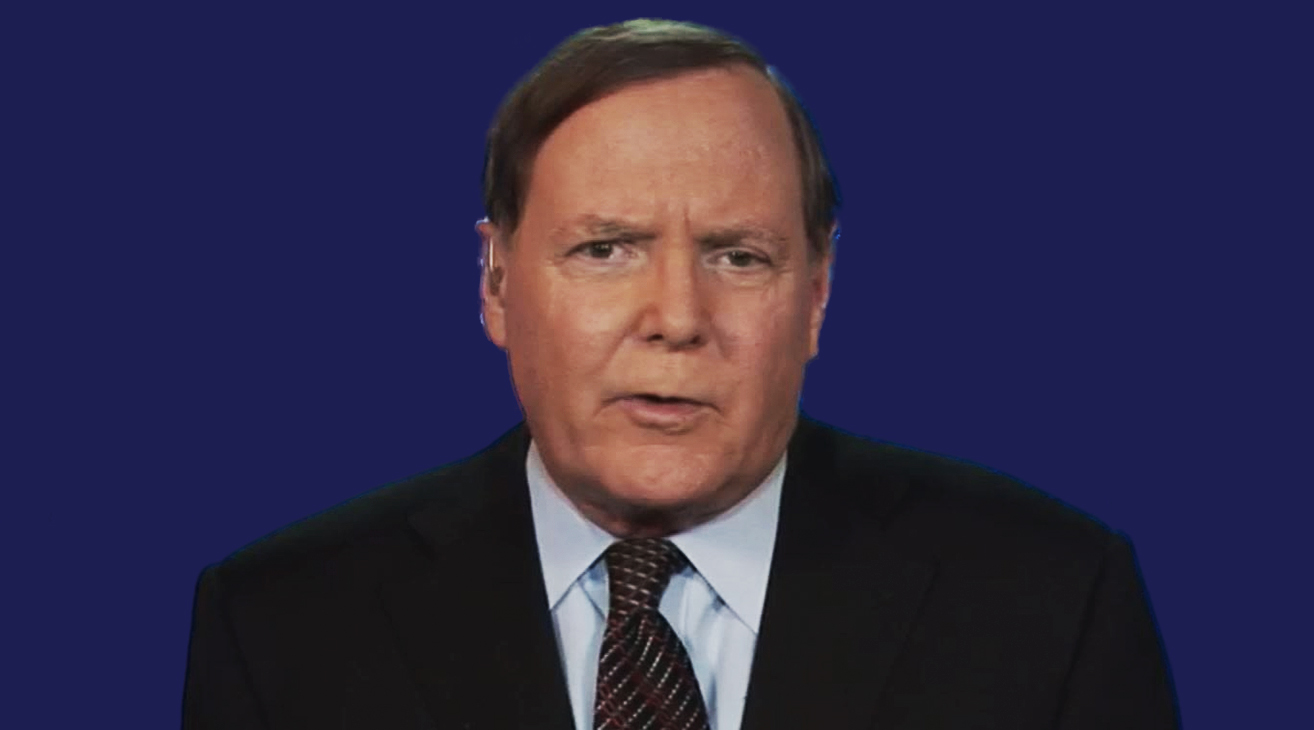

by Jeffrey Saut, Chief Investment Strategist, Saut Strategy

The fact that the equity markets are rallying in the face of this week’s negative “energy blast” is highly bullish. The S&P 500 (SPX/2968) has traveled above the 2940-2950 overhead resistance level often mentioned in these missives (its 6th attempt) and is probing the next resistance level of 2960 – 2970.

Less discomforting world tensions seem to be the driver along with this morning’s better than expected economic reports and renewed Chinese trade talk rumors.

Fed speak begins today with Williams speaking first, just as the NYSE opens. The NY Fed President has been a tad hawkish as of late. Bullard, who called for a 50 bp rate cut at the next FOMC, will do his usual stick. Kashkari, who appears to be competing with Bullard for Trump’s attention and affection, might try to out dove Bullard. Evans, who is a habitual dove, is the wild card. The big day this week is Friday:

August jobs report and Powell speaks in Zurich at 12:30 p.m. ET on “Economic Outlook and Monetary Policy.” And you can be sure that Donald “Have Tweet will Gravel” Trump will comment on both the jobs report and Powell.

Our sense is after the opening “upside pop” stocks will stall awaiting tomorrow’s employment report. And then there was this for one of Wall Street’s best:

The market continues to polarize into two groups of investors with diametrically opposing philosophies. In one camp are the “Charlie Browns”, the defensive pessimists. This group is comprised of slow, conservative money that shares a generally fatalistic outlook for the global economy. They believe in perpetually low interest rates, are convinced that a market apocalypse is always lurking just over the horizon and that safe-assets are US dollars and Treasuries.

They tend to be longer in the tooth with most of them snake bit during the tech bubble and financial crisis. They often refer to lofty P/E multiples when expressing their views on equities. They believe that the EU will break-up and hate Bitcoin. Their equities of choice are low-beta, high-yield and minimum variance. REITs, Utilities, Low-Vol indices. They gravitate towards diversified, low-cost ETFs to implement their thesis. In the second camp are the “Mavericks”, the risk-takers who thrive on going Mach 2 with their hair on fire. They are Tweet happy and devour high-velocity headline conditions.

They are fast money with no loyalty nor allegiances to long-term views, trends or trades. They’re more optimistic of a trade resolution but won’t get caught expressing that in anything longer than a three-month bet, and even that will likely be implemented through the options market. They’re hedge funds, trading accounts, millennials. They don’t care if the EU breaks up and love Bitcoin. Volatility is cocaine to this brazen heard. Info Tech, Consumer Stocks, Industrials and Consumable Commodities (Energy and Base metals)- whatever the flavor of the day.

They’re single stock jockeys, ETFs bore them 'cuz they don’t offer enough torque. Ironically, it’s the activity of the Mavericks, like yesterday, that are the bane of the existence of the Charlie Browns with the latter being much more influenced by the behavior of the former. Today is going to be another tough day for the Charlies today as yesterday’s feature of Top Gun will be on replay this morning.

I’m a self-diagnosed Charlie Brown, though I harbor more optimism as I remain far more constructive on the longer-term prospects for the global economy and equity markets given the easy and plentiful central bank liquidity (and of course the belief that Equity Risk Premiums are far more relevant than P/E multiples). So, I’ll ask you, who are you? Or, like me, are you a hybrid. Be honest with yourself.

Copyright © Saut Strategy