by Dan Roarty, AllianceBernstein

Sustainable investing is often misunderstood. Many investors think a sustainable agenda limits a portfolio to a narrow piece of the market. In fact, plenty of stocks can help investors create social benefits while generating strong returns—if you know how to find them.

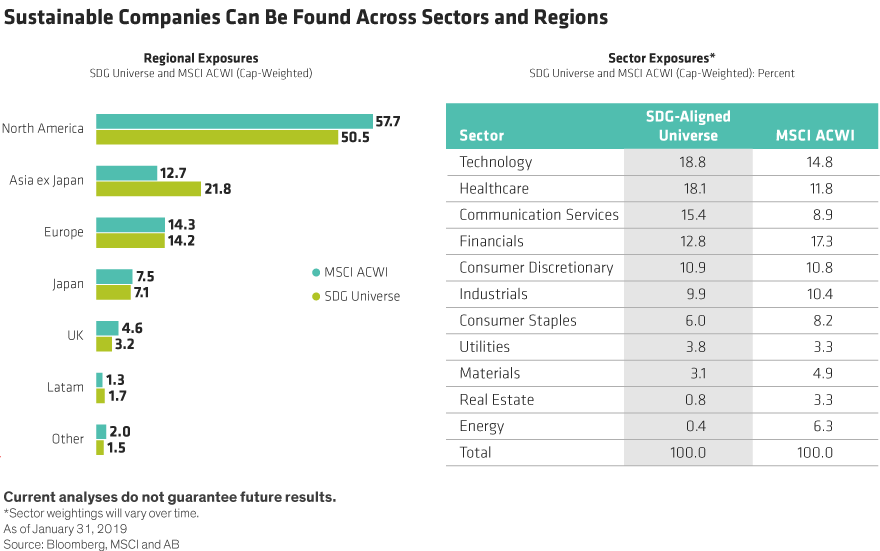

Conventional wisdom suggests that creating a sustainable equity portfolio is a restrictive exercise that involves screening out stocks and fishing in a condensed subset of the broader equity market. Our research shows the opposite: many companies across a wide range of industries and countries are in fact aligned with the United Nations Sustainable Development Goals (SDG).

We identified companies with at least US$1 billion in market capitalization that generate some portion of their revenues from the sale of SDG-aligned products and services. Identifying and researching these companies allows us to better understand the implications of sustainable investing, report portfolio and benchmark performance and alignment with the SDGs, and dispels some common misperceptions about sustainable investing.

Diversification Potential Is Greater than Perceived

Among companies that we surveyed around the world, 1,408 are aligned with the SDGs, and 976 of those are included in the MSCI ACWI. Together, these companies represent 51% of the benchmark’s market capitalization. These companies exist in all sectors and geographies (Display), which means there’s ample opportunity to construct well-diversified global or regional portfolios using a sustainable investing lens. For example, we found 418 US companies that are aligned with the SDGs, including 197 in the S&P 500 Index, representing 56% of the benchmark’s weight.

Many clients also assume that they must sacrifice financial returns to invest sustainably. We disagree.

Sustainable investing is not about passively excluding a few industries from a portfolio. It’s an active approach in which securities are selected from a large universe of companies with attractive fundamental characteristics and powerful secular drivers. What’s more, comprehensive sustainable investing involves considering additional environmental, social and governance (ESG) variables, which can help reduce risk. On the surface, then, we think there is no reason to expect that this group of companies must underperform non-sustainable strategies over time.

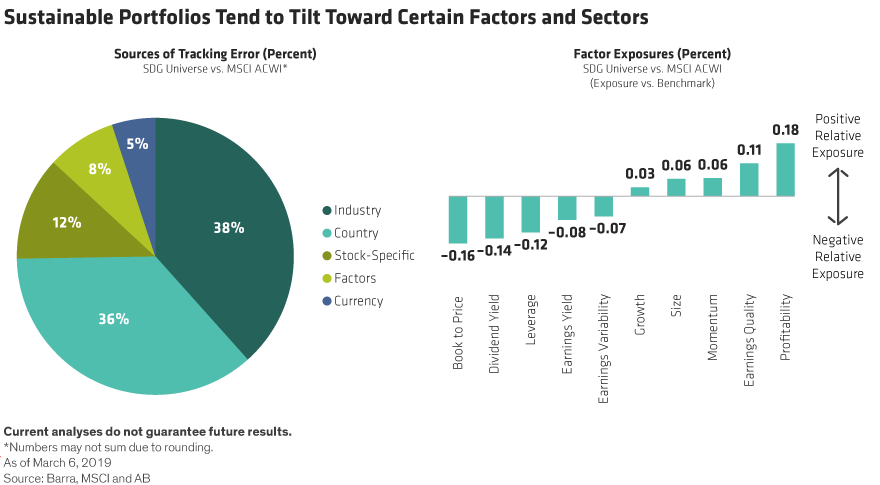

Watch Out for the Tilt

Still, sustainable investing portfolios tend to tilt toward certain industries, countries and factors (Displays below). Our research shows that sustainable strategies may have more exposure to quality growth factors, such as profitability and earnings quality. At the same time, they’re likely to be underexposed to value (cheapness), balance-sheet leverage and cyclicality. In terms of sectors, sustainable strategies tilt toward technology and healthcare and away from financials and basic materials.

When evaluating a sustainable equity portfolio, check whether the manager is actively drawing on a broad universe of SDG-aligned companies and not just the usual ESG suspects. And make sure that portfolio construction takes into account the potential factor and sector tilts, and how they might influence the pattern of returns.

Dan Roarty is Chief Investment Officer—Thematic and Sustainable Equities at AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

This post was first published at the official blog of AllianceBernstein..