by Jeffrey Saut, Chief Investment Strategist, Saut Strategy

Chapter 1 in the seminal book “The Intelligent Investor” by Benjamin Graham is titled “Investment versus Speculation,” which is defined by Jason Zweig as:

[backc url='https://sendy.advisoranalyst.com/w/J8pxsj3OgR4yxKxsA1169Q']Confusing speculation with investment, Graham warns, is always a mistake. In the 1990s that confusion led to mass destruction. Almost everyone, it seems, ran out of patience at once, and America became the Speculation Nation, populated with traders who went shooting from stock to stock like grasshoppers whizzing around in an August hay field.

He goes on to write:

People boasted that they were “right.” But the intelligent investor has no interest in being temporarily right. To reach your long-term financial goals, you must be sustainably and reliably right. The techniques that became so trendy in the 1990s – day trading, ignoring diversification, flipping hot mutual funds, following stock-picking “systems” – seemed to work. But they had no chance of prevailing in the long-run, because they failed to meet all three of Graham’s criteria for investing.

While we attempt to “call” some of the short-term wiggles in the stock market, we are much better with long-term investing and the primary trend of the stock market remains “up.” For example, last Thursday on CNBC we stated:

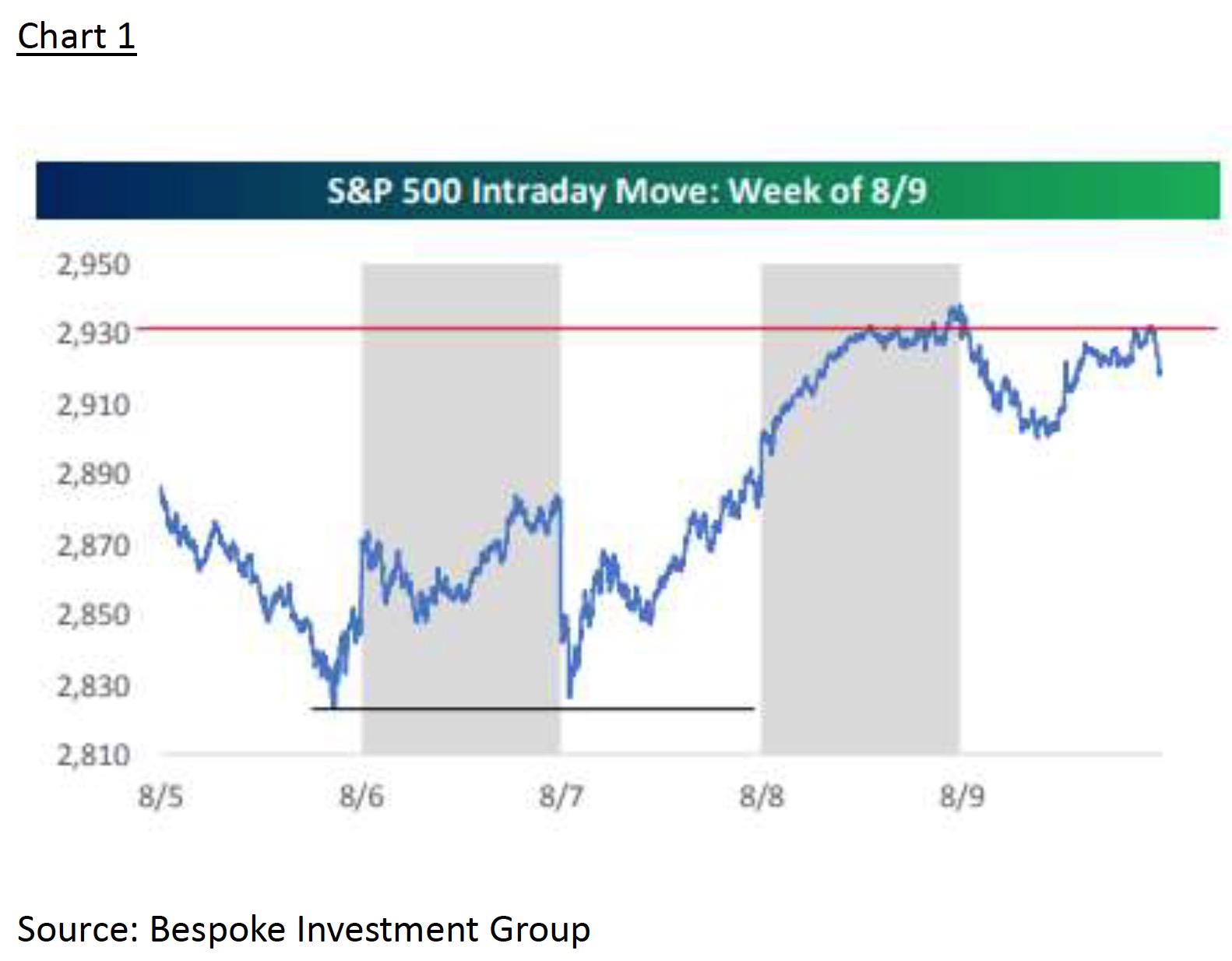

While our long/intermediate-term models did not register a cautionary signal, our short-term model did so two weeks ago, and we wrote about it. We raised a little cash but stated that any pullback should be mild and contained in the 2940 – 2960 support zone. Boy was that a bad trading call because following the Jay Powell presser, and the President’s increased tariffs on China, the equity markets fell into a selling vacuum. We said that “selling vacuum” ended last Monday with a capitulation low of ~2822 on the S&P 500 (SPX/2918.65), which turned out to be a 90% Downside Day (90% of the Upside to Downside volume came in on the downside and 90% of Points Traded also came in on the downside). In our Trading Flash Tuesday morning we said to not trust the first rally because markets usually come back down and test a capitulation low; and that is exactly what happened on Wednesday when the Dow fell ~589 but closed flat on the session. So, we think the lows are “in,” although we said on CNBC it would not surprise if the equity markets consolidated for few sessions.

Continuing with the wisdom of Benjamin Graham:

Presumably our defensive investor should obtain – at least once a year – the same kind of advice regarding changes in his portfolio as sought when his funds were first committed. Since he will have little expertness of his own on which to rely, it is essential that he entrust himself only to firms of the highest reputation; otherwise he may easily fall into incompetent or unscrupulous hands. It is important in any case, that at every such consultation he make clear to his advisor that he wishes to adhere closely to the three rules of common stock selection given earlier in the chapter. Incidentally, if his list has been competently selected in the first instance, there should be no need for frequent or numerous changes.

Those tenets are:

- There should be adequate though not excessive diversification. This might mean a minimum of ten different issues and a maximum of about thirty.

- Each company selected should be large, prominent, and conservatively financed. Indefinite as those adjectives must be, their general sense is clear. Observations on this point are added at the end of the chapter.

- Each company should have a long record of continuous dividend payments.

If this sounds familiar, it should. This is what we try to do at Capital Wealth Planning (CWP). We buy large-cap prominent blue-chip stocks with dividends and then “strategically” sell short-term out-of-the-money call options against those stocks attempting to get index like returns with about two thirds of the stock market volatility while generating a 5% to 7% income distribution for our clients. Historically, CWP gets ~90% of the upside in the stock market with only ~60/70% of the down side. For investors of my generation that are seeking reasonable returns, with diminished volatility and an income stream, CWP’s investment strategy is a great investment model.

[backc url='https://sendy.advisoranalyst.com/w/J8pxsj3OgR4yxKxsA1169Q']While last week’s early weakness was emotionally trying, it served in turning everyone bearish again. This is being reflected most of the finger-to-wallet ratios we monitor (AAII bullish sentiment collapsed from 38.4% to 21.7% while bearish sentiment leaped to 48.2% from 24.05%). Moreover, last week’s bottoming sequence was classic. We fell into a capitulation low on Monday (SPX@2822) followed by Tuesday’s sharp “throwback rally.” Then on Wednesday the SPX came back down to 2825 (chart 1) and that was it, the bottom was in and we said so.

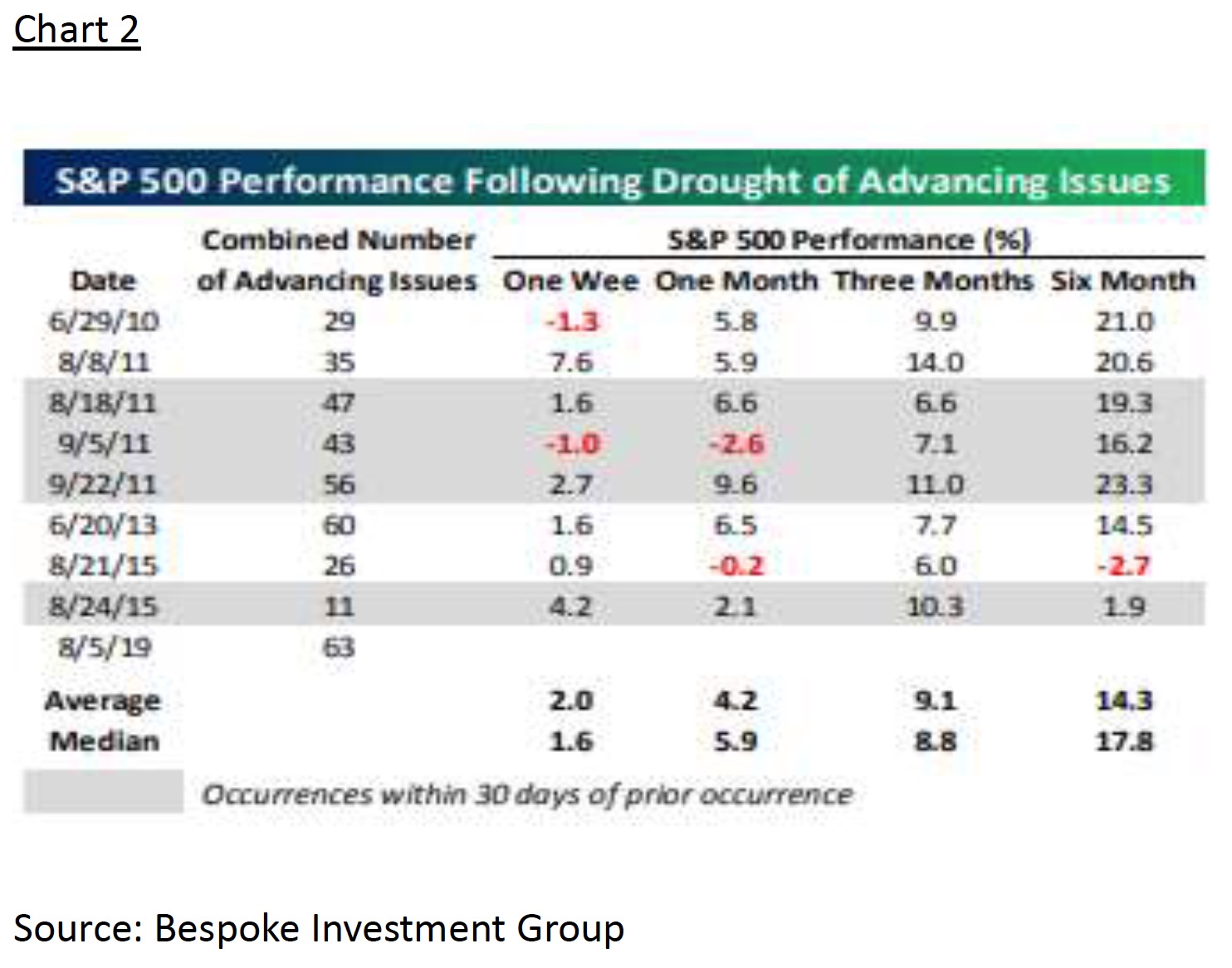

Interestingly, following previous such selling climaxes the SPX was up 8.8% on a median basis three months later and 17.8% six months later (chart 2). As our friends at the must have Bespoke Investment Group write:

The reality is that even if the long-term picture for the economy and stock market remains positive, in a world where foreign policy is changing on a daily basis, the potential for short-term disruptions exists, so keep some cash on the sidelines to take advantage of them.

The call for this week: Well, as we anticipated the downside chart gap in the SPX between 2914 and 2898 was “closed” last week, but the SPX stalled at its 50-day moving average (chart 3). Still, we think the lows are “in” and as the uber smart Tom Lee (Fundstrat) notes in a MarketWatch article titled “Tom Lee literally pleads with investors to not ignore 5 bullish signs forming in the stock market.” Those five bullish signs are:

-

Fed made its 1st rate cut and since 1971, mean 6M gain

-

The CBOE Volatility Index, known as the VIX, term structure (1M-4M) inverted, last 5 of 7 times was the bottom

-

Daily RSI fell below 30, and 6 of the last 6 saw S&P 500 gain sharply

-

3% 1-day drop is sign of panic, since 2009

-

A measure of market sentiment shows that the share of bulls less bears -26, since 1987

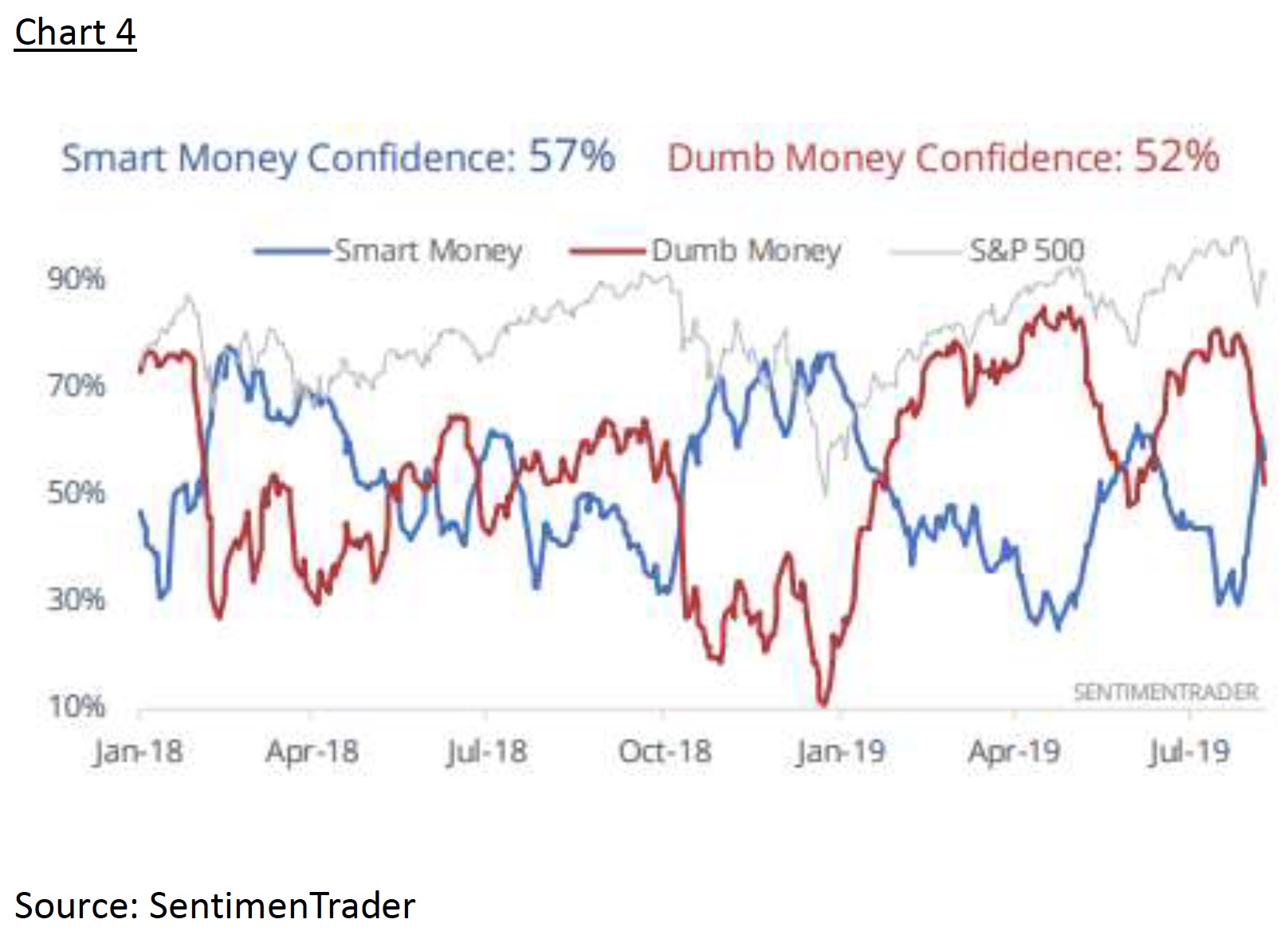

We would also note that Jason Goepfert’s (the brilliant captain of SentiTrader) Smart Money – Dumb Money chart shows that Smart Money has crossed above Dumb Money. Historically, when that has happened it has been bullish (chart 4). Our work shows that if there is any “follow on” selling it should abate in the 2840 -2850 zone basis the SPX. And this morning we are indeed getting follow on selling as DJT says China trade talks set for September might not happen and Steve Eisman says Hong Kong protests are his biggest worry with economy, a possible “black swan.” Such comments have the ESUs off some 17-points. The S&P 500 Index had an Inside Day on Friday. Traders will be sensitive to the high (2935.75) and low (2900.15). This is expiry week; traders will play for the usual manipulation to squeeze SPY call options. However, as everyone should know by now, a tweet, news bit or quote can send stocks flying or tumbling at any moment.

Investing/trading involves substantial risk. The author and Saut Strategy do not guarantee or otherwise promise as to any results that may be obtained from using this report. Past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence, including carefully reviewing any prospectus and other public filings of the issuer. These commentaries, analyses, opinions, and recommendations represent the personal and subjective views of the author, and are subject to change at any time without notice. The information provided in this report is obtained from sources which the author believes to be reliable.

Copyright © Jeffrey Saut