by Sonal Desai, Ph.D., Franklin Templeton Investments

The Federal Reserve’s (Fed’s) interest rate cut last month was unnecessary, in my view. I think the US economy is doing okay, deflation risks are overblown and looser monetary policy will increase financial market distortions. Here, however, I want to flag a deeper concern: I fear that monetary policy has lost its anchor, and the Fed lacks conviction and direction. In this piece, I discuss the reasons and the implications for investors.

Conviction on the Fed’s monetary policy framework has evaporated.

Central bankers often fear that inflation expectations might become unanchored.

I fear that monetary policy itself has become unanchored.

The Fed has offered a mishmash of justifications for its decision to cut rates at its July meeting: (1) as insurance against global trade uncertainty; (2) to boost inflation; and (3) to make the job market even hotter. With so many different reasons, the Fed can pick and choose—and ignore the hard data showing a robust economy led by strong employment and consumption.

On Target

I have argued that the Fed simply caved to market pressure. Harvard’s Robert Barro suggested it might have succumbed to political pressure.1 The two are observationally equivalent, since markets and politicians are both clamoring for lower interest rates.

You are more likely to cave in to pressure when you lack conviction in your own ideas. And, conviction on what monetary policy should try to achieve—and how—appears to have evaporated.

Inflation and bond yields have remained low even as the US economy has recovered. This has led many academics and market participants to argue that the equilibrium real interest rate (“r-star”) is now lower than it used to be;2 and that with low inflation, the Fed’s nominal interest rate will also be lower, potentially too close to the “zero lower bound,” leaving the Fed unable to cut interest rates enough to offset a recession.

Fear of the Zero Lower Bound

A companion argument, advanced by economists Olivier Blanchard and Lawrence Summers, is that monetary policy can do more than smooth the ups and downs of the cycle: it can shape long-term growth.3 Getting the economy to run hotter for longer will fuel more investment and get more people to join the labour force and gain skills; this increase in capital expenditures and human capital will increase potential growth. Allowing a prolonged recession will have the opposite impact. In economist parlance, there is a “hysteresis effect.”

This has fueled a rich debate on if and how to change the Fed’s monetary policy framework. Proposals abound: a higher inflation target; a price level target; or a nominal GDP target. The underlying consensus seems to be that (i) deflation and secular stagnation are the biggest risks, and (ii) the Fed should aim for higher inflation, possibly around 4%–5%.

The debate is valuable, in my view. As the economy evolves, economists and policymakers must strive to understand its dynamics.

The Inflation Fetish

This new inflation fetish, however, leaves me puzzled. Let’s take a step back—What do we as a society want to achieve here? And therefore, what should policymakers be aiming for?

Presumably the goal is full employment and faster increases in living standards for the largest possible number of people. As for inflation, we just don’t want it to get in the way. We want it low and stable. The Fed and other major central banks had converged on a 2% target by balancing the following considerations:

- Inflation should be low enough that it remains stable (higher inflation tends to be more volatile) and that people don’t have to think about it, so it does not distort consumption and investment decisions;

- It should not be too close to zero because in a world where some wages and prices don’t decline in nominal terms you need positive inflation to let relative prices adjust.

Over the past 20 years or so, that’s exactly what we got: consumers and businesses could pretty much ignore inflation, and we have had no evidence that low inflation caused a misallocation of resources by preventing relative prices from adjusting.

Fears of deflation are exaggerated, in my view. Neither the United States nor Europe fell into prolonged deflation even during the global recession of 2009 or the European debt crisis. Low inflation has not stopped the US economy from coming back to full employment or the eurozone from growing above potential for a four-year stretch.

In Japan—the textbook cautionary tale on the dangers of deflation—real per-capita growth between 1991 and 2018 averaged 0.9% per year—well below that of the United States and United Kingdom (1.5%), but only marginally weaker than Canada (1.2%) and France (1.1%).4 Deflation does not seem to be the greatest threat to rising living standards.

Japan: Deflation Does Not Equal Stagnation

The costs and risks of switching to a higher inflation target, on the other hand, I believe are too quickly dismissed. With inflation at 2%, it takes 10 years for prices to rise by 20%. Make the target 4%–5% and prices rise by 20% in just 4–5 years. In 10 years they are up 50%–60%, and in 14–15 years they have doubled. Now you can’t ignore inflation anymore, especially because it will probably be a lot more volatile than now. Indeed former Fed Chairman Ben Bernanke has noted that 4% might not be consistent with the Fed’s price stability mandate.5

Inflation: Careful What You Wish For

Also, to the extent that price dynamics are held down by technological progress or globalisation, boosting inflation might be neither feasible nor desirable.6

Insurance Is Not Free

But what about the risk of having interest rates too close to zero?

Well, for one thing, we discovered quantitative easing (QE), and it has worked as advertised. QE pushes private investors into riskier assets, reducing the cost of funding for a wider range of corporations and investment projects, and boosting consumer wealth through higher asset prices.

Yes, it’s better to cut rates. But if having rates close to zero is so bad, why does the Fed rush to cut them when the economy is still strong?

Those who push for lower rates and higher inflation also tend to dismiss out of hand monetary policy’s potential impact on financial stability and asset prices. This is curious. On the one hand, they argue that the risk of financial crises is greater than it used to be, and that’s one more reason to cut rates sooner rather than later. On the other hand, they refuse to acknowledge that loose monetary policy might contribute to asset bubbles.

We had loose monetary policy in the runup to the stock market bubble of the late 1990s and the housing and credit bubbles of the 2000s, but I guess that was just a coincidence. I know it’s hard to judge if asset prices are running ahead of fundamentals, but when asset prices mainly respond to expectations of Fed rate moves, shouldn’t we at least pause and reflect?

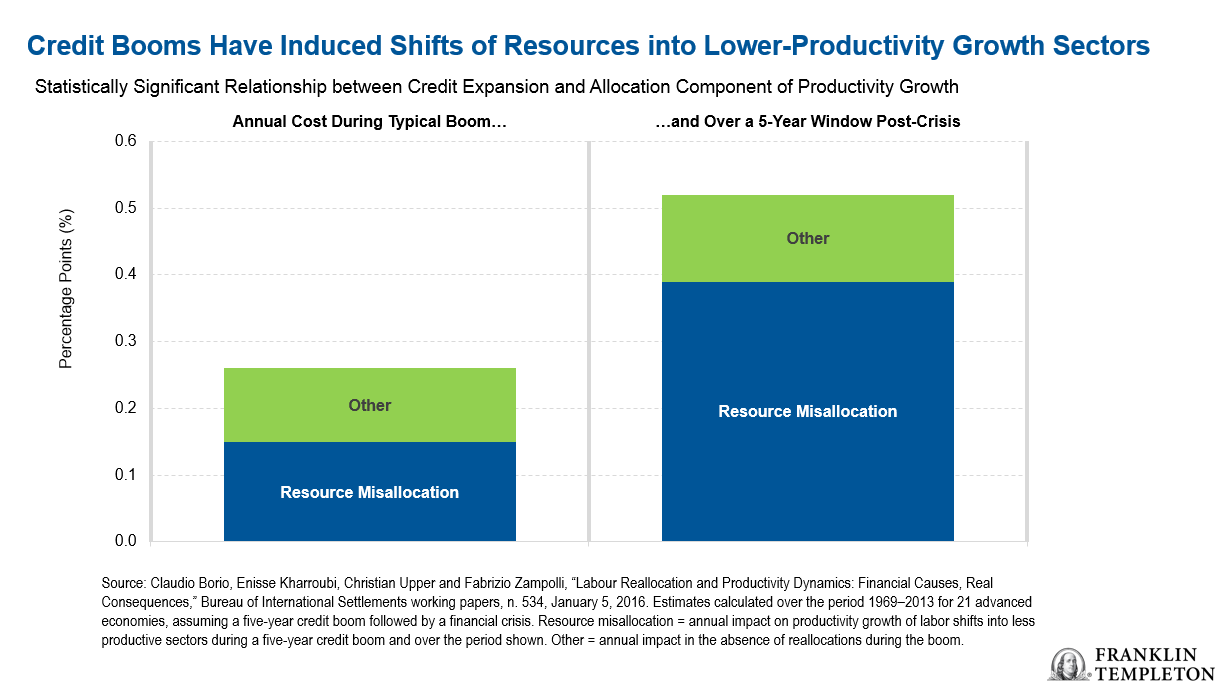

Recent Goldman Sachs research confirms that “buying insurance” with pre-emptive rate cuts causes more financial market distortions—plus wasting ammunition that later the Fed might really need. And by the way, just as a deep recession can undermine long-term growth through the hysteresis effects described above, Bank for International Settlements (BIS) research shows that long credit booms cause a misallocation of resources that reduces productivity and long term growth.7

The Other Hysteresis: Financial Booms Undermine Productivity Growth

For Investors, Fundamentals Remain the Long-Term Anchor

You know my view: I think the US economy is doing okay, deflation risks are overblown and looser monetary policy will increase financial market distortions.

But that’s not the point here. The point is that the debate I summarised above perhaps explains why monetary policy has lost its anchor and why the Fed lacks conviction and direction. Monetary policymakers are puzzled by inflation’s disappearing act; they fear a deflation they have never yet encountered; they would like to believe they can boost long-term growth, but they are not quite sure; and they don’t want to believe that monetary policy might cause financial bubbles, but deep down they must surely wonder.

If monetary policy has become unanchored, the job of investors becomes a lot more difficult. Persistent uncertainty makes it even harder. After the Fed explained that trade uncertainty was a factor in its decision to lower interest rates, US President Donald Trump (who has openly voiced his desire for lower rates) promptly announced another round of tariffs on Chinese imports. Equity markets first buckled and then recovered in the expectation that more trade uncertainty will lead to further monetary easing.

At the moment, anticipating the Fed’s ever-changing moods seems paramount. But once its bent the Fed to its will, the market will likely turn back to assessing fundamentals. Today’s Fed behaviour is shaped in large part by the economic developments of the post-financial crisis period. Current and future economic fundamentals will eventually feed back into the Fed’s behaviour and should play the greater role in driving asset prices, both directly and indirectly.

Our challenge is to keep a sober eye on fundamentals even as we gauge markets that are playing cat-and-mouse with the Fed.

Get more perspectives from Franklin Templeton delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of August 7 and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in foreign securities involve special risks, including currency fluctuations, economic instability and political developments. Investments in emerging market countries involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Such investments could experience significant price volatility in any given year.

__________________________

1. Source: Robert J. Barro, “Is Politics Getting to the Fed?,” Project Syndicate op-ed, 23 July 2019.

2. Source: This is what economists call the natural rate of interest, or the real interest rate that prevails when the economy is running at full strength. It is often referred to as “r-star” in the debate because it is denoted as r* in the relevant mathematical formulas. For a discussion on r*, see, for example, Federal Reserve Bank of San Francisco President John Williams, “The Future Fortunes of R-star: Are They Really Rising?” Speech at the Economic Club of Minnesota, 15 May 2018.

3. Source: Olivier Blanchard and Lawrence Summers, “Rethinking Stabilization Policy: Back to the Future,” Peterson Institute for International Economics, 8 October 2017.

4. Source: International Monetary Fund, World Economic Outlook Database, April 2019. Calculations based on GDP per capita at constant prices, purchasing power parity at 2011 international dollars. The year 1991 is normally identified as the beginning of Japan’s first “lost decade.”

5. Source: Ben Bernanke, “Monetary Policy in a New Era,” Peterson Institute for International Economics, 2 October 2017.

6. For example, James Stock and Mark Watson, “Slack and Cyclically Sensitive Inflation,” National Bureau of Economic Research Working Paper n. 25987, June 2019. They found that about half of the prices captured in the personal consumption expenditure deflator, the Fed’s preferred gauge of inflation, do not respond to cyclical changes in economic activity.

7. Source: Claudio Borio, Enisse Kharroubi, Christian Upper and Fabrizio Zampolli, “Labour reallocation and productivity dynamics: financial causes, real consequences,” BIS Working Papers n. 534, 5 January 2016.

This post was first published at the official blog of Franklin Templeton Investments.