by Stephen H. Dover, CFA, Franklin Templeton Investments

One of the advantages of our global presence is having the ability to consider local developments in a wider context. Our experience in different markets around the world enables us to spot emerging trends, identify potential future challenges and opportunities and make connections that hopefully lead us to better decisions.

Analyzing local developments through a global lens, and global developments through a local lens, can help us draw different conclusions from the crowd and lead us to undiscovered potential opportunities.

Over the coming months, our team of equity analysts will offer their thoughts on some markets around the world that we think are especially worthy of note.

We kick off our global tour with a look at the Canadian equity market.

While many global equity investors may overlook Canada, the country has seen some meaningful achievements this year. In the realm of sports, Canadian basketball fans watched the Toronto Raptors defeat California’s Golden State Warriors on June 13, 2019, to assume the National Basketball Association crown for the first time since entering the league in 1995.

Canada’s women’s soccer team reached the final 16 in the World Cup, and Mercer rated the coastal city of Vancouver the third-best in the world for quality of living, and the highest in North America.1

But focusing in on equity markets for the purposes of this commentary, Canada’s equity bull market passed its 10-year anniversary on March 9, 2019, and subsequently reached a new all-time high on April 23, 2019.

A Look at Canadian and US Equity Markets

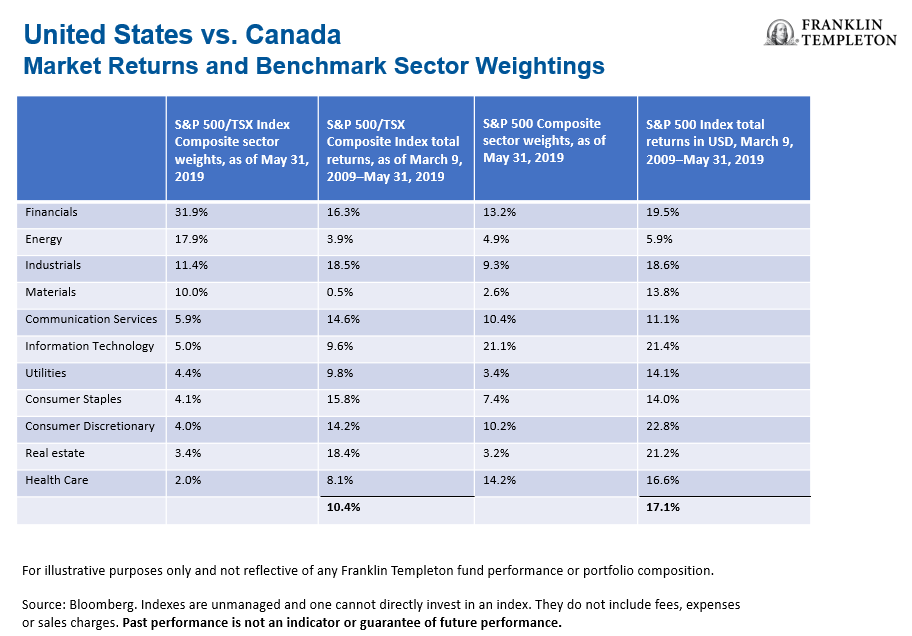

While the duration of the current equity bull market in both Canada and the United States is the same, the magnitude of each has materially differed, with the US market outpacing Canada. More specifically, the total return for the S&P 500 Index through to the end of May 2019 amounted to an annualized advance of 17.1%, or 404.0% unannualized, far exceeding the advance for the S&P/Toronto Stock Exchange (TSX) Composite Total Return Index of 10.4% annualized (10.8% annualized in CAD) or 174.7% unannualized (186.5% unannualized in CAD).2

In a 10-year span that featured low interest rates, a tepid economic expansion and a recovery in the state of global financial markets following the global financial crisis, sector returns were generally strong, but highly divergent.

The Canadian and US market returns of the past decade have differed significantly, due in part to dissimilar composition. The US equity market is relatively heavy in information technology and health care companies, while Canada is relatively heavy in energy and materials companies.

Two growth-oriented sectors, information technology and health care, both heavily weighted in the S&P 500 Index, were two of the strongest-performing sectors in the United States over the past decade. These same two sectors have much less weight in the S&P/TSX Composite and materially underperformed their US counterparts, consequently contributing relatively little to Canadian equity returns.

On the other hand, the energy and materials sectors, two value-oriented sectors that are heavily weighted in the S&P/TSX Composite, and carry much less heft in the S&P 500 Index, were two of the worst-performing sectors over the past 10 years, materially weighing on Canadian equity market returns.

Over longer periods such as 15 and 20 years, the magnitude of Canadian and US equity market returns are more similar, given outperformance by Canadian equities in the prior decade amid a global “commodity supercycle” which heavily benefitted Canada’s natural-resource orientation. The country is rich in natural resources, particularly petroleum; it’s oil reserves are the third-largest in the world. It also boasts a variety of industrial metals and is the world’s third-largest exporter of timber.

North American Trade Linkages

North American Trade Linkages

From an economic standpoint, the Canadian economy is inextricably linked to the United States. While 15% of US exports are destined for Canada, approximately 75% of Canadian exports are destined for the United States. As such, the weight of trade tensions and related uncertainty surrounding the global growth dynamic has damaged sentiment for investors in Canada.

Furthermore, specific trade restrictions imposed by China on Canada following the arrest of a senior Huawei executive in Vancouver has further impacted Canadian export activity.

However, the removal of steel and aluminum tariffs the United States had previously imposed has offered some relief. Prospects for the ratification of the new United States-Mexico-Canada Agreement (USMCA) to replace the North American Free Trade Agreement (NAFTA) in place since 1994 could offer some additional overall relief for exports, sentiment and investment.

Canadian Housing Market Concerns

Beyond trade, the dampening effects of low global energy prices and changes to domestic housing policies have contributed to a cooling economy in Canada. In the case of oil and gas, a lack of egress has led to severely discounted pricing of domestic production and a meaningful reduction in the economic contribution of Canada’s natural resource-heavy economy.

Also of focus in Canada is the domestic housing sector and its potential effects on the economy and equity markets, including the prominent Canadian commercial banks. Relatively unscathed during the global financial crisis a decade ago, the Canadian housing experience materially diverged from that of the United States.

There are concerns regarding a potentially overheated housing market in Canada, but they are not new concerns. The Canadian mortgage market differs materially than in the United States, with a tighter regulatory framework. The regulatory environment in Canada is squarely focused on adjusting taxes, mortgage qualification stress tests and other measures to target elevated debt levels, stretched affordability and potential credit deterioration.

Tighter credit standards and higher mortgage rates have contributed to some cooling in the housing market this year, including some of the frothiest cities such as Vancouver and Toronto.

Mortgages in Canada include a more conservative product offering: prepayment penalties in Canada are common, mortgage terms are typically five years or less, amortisations are typically 25 years or less, interest is not tax deductible, lenders generally have full recourse lenders, mortgage insurance is federally backed and mandated for the full mortgage amount if the loan-to-value ratio exceeds 80%.

We also would point to Canadian commercial banks, which have been the envy of the world. Accounting for more than 20% of the Canadian equity market, they have benefitted from a strong regulatory framework as well as geographic and broad business-line diversification.

Interest Rates and the Canadian Dollar

Similar to the trade dynamic between the United States and Canada, the interest-rate environment between the two countries is highly correlated. While rates generally rose through much of 2018, significant declines to date in 2019 erased much of those increases.

In July, the Bank of Canada decided to keep its key interest rate unchanged at 1.75% and hasn’t signalled any change ahead—although the central bank did downgrade its growth forecast for this year amid trade and other uncertainties.

Going forward, we believe the direction of interest rates will continue to carry enormous influence over the value of equities globally, Canada being no exception. Changes in interest rates have direct implications for the cost of capital and valuations, in addition to impacts on businesses’ economics and overall profitability.

Interest rates do have an impact on the Canadian dollar, and in response to the changing economic landscape, the Canadian dollar has responded by moving from a high of US$0.82 in early 2018 to US$0.74 in mid-2019. A weaker Canadian dollar has a direct, positive impact on many Canadian equities.

More specifically, companies with non‐Canadian dollar revenues and Canadian dollar expenses, including a disproportionate number of domestic materials and energy producers, can directly benefit.

Currency weakness also aids those Canadian companies that have US and/or other foreign operations where profits are ultimately repatriated/translated back into Canadian dollars on more favourable terms, such as the Canadian commercial banks and life insurance companies.

Our Local View

With regards to local Canadian perspective, our team at Franklin Bissett, headquartered in Calgary, Alberta, concentrates its fundamental equity efforts on applying a distinctive approach to the Canadian equity market utilizing their bottom-up style known as “GARP,” or growth at a reasonable price.

Currently, it is Franklin Bissett’s belief that equity market excesses over the past few years have in part been driven by investor exuberance regarding specific equities’ momentum and potential, rather than the true fundamentals and valuation of the underlying businesses.

While it is unpredictable what the Canadian equity market has in store over the coming five or 10 years, the team at Franklin Bissett has successfully managed portfolios with an active approach through several market regimes of strong and weak sentiment and varying sources of sector leadership and economic environments.

We would highlight that despite some uncertainties, Canada has a robust financial system, and according to the recent IMF Financial Stability Assessment Program report, it should be able to withstand severe shocks, even though there are some vulnerabilities in regard to household debt and housing market imbalances.3

While Canada has a sophisticated, developed market economy and equity market, its Franklin Bissett’s view that significant inefficiencies will likely persist, and should allow for continued investment success.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Actively managed strategies could experience losses if the investment manager’s judgement about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

____________________________________________

1. Source: Mercer “2019 Quality of Living Ranking.”

2. Source: Bloomberg. 10-year period through May 31, 2019. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

3. Source: International Monetary Fund, Canada Financial System Stability Assessment, as of June 2019.

This post was first published at the official blog of Franklin Templeton Investments.